|

|

|

|

You are viewing: Main Page

|

|

October 25th, 2024 at 02:47 pm

October 20

NSD

$0 Movies

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I am trying to keep on top of things, I think just because it's been a crazy year. & maybe also in Fall cleaning mode. If August /September hadn't been so crazy, I would have been okay just chilling on the weekends during random super busy weeks.

Last weekend I didn't get through all my weekend chores but I think I pushed off a few things to the week and got them done. Which is how this weekend is going. I got a lot less rest this weekend but did manage a small nap both days.

The life balance is not terrible. I would give up my October spending tracking (sharing here) if it was too much. It is very time consuming to jot down a blog post every day. I am kind of surprised I made it this far. Will see what this week has in store.

Today I unclogged my sink and the kids' shower. I did a lot of laundry. Feeling more caught up re: new towels, new clothes, etc. I washed a new blanket that I bought some weeks ago. As I type this out... I was unloading the cat food and I think I got distracted and just left half the cat food in the box. I will go take care of that now. (DL got home in the middle of that, and was very chatty.)

{Yup, totally forgot what I was doing mid box-unpacking.}

I am not going to return anything. Apparently I just have to blog about my spending and I everything I order will magically fit well. I don't know yet if MH will keep the pants.

Edited to add: Will return one pair of pants for MH. He did like one of them and I will try to exchange the other.

MH has been working all weekend at his (unpaid) side job. He had free press access to a convention and it wasn't all 'work'. He seemed less star struck than the last one he went to. (This is why he asked me to cook a couple of meals.) Tonight MH is enjoying a 'free' movie on his unlimited pass. I doubt I have encomassed all his free movies in my blog. But when he leaves for a night movie he tells me. He also often goes to the movies after work. It's something like $20/month for his movie pass and he takes full advantage.

DL(19) pretty much ate all the food (I expected some leftovers) and so I don't know what I am going to eat for lunch on Monday. Right now I am undecided re: deli sandwich (from home) or a fast food run.

Posted in

Just Thinking

|

0 Comments »

October 24th, 2024 at 03:52 am

October 19

$40 Groceries

$30 Donation

$15 Target

$10 Car Wash

$9 Movies

$9 Comedy Show

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

MH had asked me to pick up a bell pepper at the grocery store, and to cook two meals. I decided to make sloppy joes & potatoes for dinner tonight, and will make chow mein on Tuesday. I picked up noodles, veggies, hamburger buns, and milk. Milk was also a request from MH. It's a new thing. No one in my house really drinks milk, but now suddenly DL(19) is really into milk. I think initially he was hoping to bulk up a bit. (LOL. I just can only laugh. Good luck at that. With these genes?) So that's new and that is expensive. His initial motivation was to add calories but now he just really likes drinking milk.

Oh yeah, and salmon was on sale for roughly half off. That was unexpected. I will probably make for lunch Sunday. MH doesn't like fish, so that didn't really help re: the couple of meals he requested that I make for the family. But DL(19) will love the fish treat.

& I picked up strawberries because they were on sale.

MH told me he could push off a big grocery store run until mid-week, if I got him that pepper. (He tossed a pepper this week because it had a bug in it.)

While out, I decided to get my car washed. It seemed a little excessive when I decided to run it through, but there was some streaks of bird poop on my car. In the end, the water seemed very dirty and maybe it was well needed. I'd have to look up when my last car wash was. Not particularly necessary in our non-snow climate. We mostly just wash when we do a lot of out-of-town trips (when the cars get really dirty on longer drives) but I rarely drive the hybrid out of town.

I did a donation (per sidebar goal) when I saw someone from my more distant past had passed away. It was a 'donation in lieu of flowers' thing.

While out, I ran to Target for some drano. They had the kind that cuts through hair, which is why our sinks clog. All they had were smaller bottles but I bought a second one presuming the kids' bathroom would need it.

MH went out to a comedy show that was way past my bedtime. 11pm? Apparently he also bought a movie or some movies.

& DL(19) got his paycheck. It was $1,500 for a full month. He is planning to buy a bike and a computer. I put it on my calendar to help him open a high yield savings account (where he can park more than just $500) in November. Right now he's about where he has peaked in the past ($3,000 cash).

Edited to add: DL ate all of the meat and potatoes. When I asked MH if he had put the food away or if DL had just eaten it all, he told me he thought I put it away. He also complained about not enough potatoes. I told him he was preaching to the choir. 😁 But yeah, I was expecting some leftovers. It's good I got the salmon for an extra meal.

Posted in

Just Thinking

|

0 Comments »

October 21st, 2024 at 02:32 pm

October 18

NSD

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I didn't take the time to write anything down Friday. So it seems like it was a blur. I did work late with new employee.

New employee showed up a whole 9 days in a row. So that's something! Everyone I hire is a personal and medical disaster. It's hard to come by employees who actually show up. Off the top of my head, this is employee #8? After 7 disasters? I wouldn't consider my last assistant quite on the same scale of disaster. But... She far surpassed her PTO this year re: several deaths in the family and a lot of sick days. I suppose it's relative. It just seemed a little more low key than everyone else. I don't remember her being hospitalized. & I realize that sounds insane as I type it out (that several deaths was 'low key'). But I am used to Level 11 crazy.

Our admin assistant who has been on attendance probation for... 10 months? (We tried to get ahead of it because it never ends well. We failed spectacularly. Hindsight 20/20, should have given the final warning sooner and moved on.) She had a good performance review this week. As my employer and another manager dreamed bigger re: her recent more consistent attendance, I had to burst their bubble. I said, "Guys, it's flu season. Let's see how the next few months go." Admin assistant called in sick the next day.

Side note: I have no doubt she was sick. There's no question that any of this is real. It's just a lot.

Overall, I am impressed with new employee and feeling optimistic. It's the first time we have hired someone more experienced for this position. Which was a strategy re: lack of time to hire and train. I already see that paying off.

MH asked me to go to the grocery store and cook dinner a couple of nights. I think next week will be a little easier. No need to hold new employee's hand until 5 or 6pm. But it will be a big week and I am covering for MH too. Easier than last week, but still hectic. It will be another big training week.

I just checked the credit cards because I don't remember anything about Friday (spending). I suppose that's because it was a no spend day.

Posted in

Just Thinking

|

0 Comments »

October 20th, 2024 at 02:27 pm

October 17

$13 Groceries

$23 Dinner Out of Town (MH)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Today was a little more relaxed than the last couple of days.

I thawed some meat in the morning and realized we didn't have any bread I like, or anything to go with hamburger meat. (MH had told me my bread was "out" at the store). I am glad I even noticed. I picked up some soft breakfast food and bread at the store.

I got out of work early enough that I had the energy to cook, empty the dishwasher, and do a load of dishes. MH will appreciate it because my spaghetti/meat dinner was a 4-pot affair. (DL and I like different types of pasta. & then I cooked up some leftover meat into hamburger patties. That was pan #4.) There's also still 9 containers of tupperware sitting out. If I wanted to be really nice I would do another load of just tupperware.

MH is out of town at a movie premier re: a movie he worked on. He drove and spent $23 on dinner. This was all the spending I anticipated; nothing else popped up.

Posted in

Uncategorized

|

2 Comments »

October 20th, 2024 at 02:57 am

October 15 & 16

$4 Walgreens

$1 Soda

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Crazy days...

Tuesday I went to two Walgreens, to buy some straws. There's one Walgreens by my home and one by my work. The one by my home doesn't seem to have what I am looking for, most the time any more. No straws there. I stopped by the other one and found one box of straws. It was hard to find, but I found it. I was going to buy two boxes, which would have been excessive. I already had an extra box at work (I didn't realize). So it worked out.

This is another ortho expense. They shaved down my teeth. Not sure if the straws help, but using in case it does keep the soda more away from my teeth while my teeth are re-calcifying or whatever it is teeth do.

Note: I very rarely go to the store. So this month is just crazy. I seem to just be running out of everything.

Wednesday I went into work later and grabbed a fountain soda on the way in.

I don't know that I'd even have the time to write this down (it's past my bedtime and I have some things I want to get done outside of work). But my work file won't back up and I am trying to get that backed up after the 1 hour of work I brought home turned into 4 hours. It's done but I don't think I will be able to back it up. I am ready to give up.

I got home so late Tuesday (MH was working late) that I didn't make dinner. I did offer to make pancakes but DL(19) didn't want them. Thursday may be the same, just scrounging for food in the fridge and cupboards.

I just checked the credit card and confirmed that MH is in 'too busy to spend money' mode.

I sent MM(21) $800 for rent. Not sure if that really counts because I don't have to figure this out from our budget. I have an investment account I pull rent money out of. MH and I both got paid today and there's just too much money in the account. I don't usually pay MM(21) his rent this early but it's random that MH and I both got paid on the same day.

Oh yeah, and we had rain today! I woke up to a beautiful rainbow spanning across the sky. The sky has put on some spectacular shows this week.

Photo credit: A neighbor

Posted in

Just Thinking

|

0 Comments »

October 18th, 2024 at 02:11 am

October 14

$6 Fast Food Lunch

$52 Target

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I didn't plan well. Just noticed the cat food was getting low. I should have added that to recent Target order. So I did yet another Target order.

For lunch I just wanted to get out of the office and have a treat.

My shoes arrived and they actually fit. Yay!

When I got home, I mentioned to MH that we should go for a walk. We tend to walk most days when it is not too extreme hot/cold or when there isn't smoke. It sounds like the smoke might move in this week, so will take what we can get.

I hadn't even thought of it but once we got outside I told MH the comet was very visible around the same time the day before. A little after sunset. I can see why the comet was so bright from our neighborhood. There is nothing to the west of us. But unfortunately they put in a school (in recent years) with very bright lights. We didn't see the comet at first, though venus was spectacular. We walked a couple of blocks past the street lights and we thought we saw the comet. So we walked down a dark bike path (not very far) and then got a better view.

The moon was very bright and I wasn't really expecting to see anything. The commet was amazing! We will probably go out and try to see it again.

Edited to add: Tried again Friday (before the moon rise) but we could not see the comet. It's fading quickly as it gets farther from the sun.

Posted in

Just Thinking

|

2 Comments »

October 17th, 2024 at 02:50 pm

October 13

$131 Groceries

$105 Kohls

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

It's going to be a long week. I expect I will be in the office for 5 days. & the new employee likes to work a later schedule. I gave up working past 5:00 (now that she's getting more settled) but 5:00 still seems crazy late. I know I will be exhausted.

MH has a very busy week re: second job (unpaid). I presume I will be trying to make dinner some nights. I am not going to be particularly organized or prepared. I wouldn't be surprised if I ran to the store some mornings. I will have to at least plan ahead that much if I don't want to go to the grocery store at 6pm.

MH is going to the grocery store today. I put black beans on the grocery list and figured I'd re-try that (black bean wraps). It will give me food for the work week.

I was going to make spaghetti today for lunch, but that was before we ate out. I will eat my dinner leftovers (if DL doesn't beat me to it). The spaghetti will be a quick/easy weeknight dinner. None of this probably helps MH but I told him I'd make sure DL was fed. I could also just order a pizza (which is something else MH doesn't care for). That's a good option for later in the week when I expect to be more tired.

I will tend to some chores today. Mostly lots of laundry.

I ended up doing a Kohl's order because the pants I buy were only $15. I ordered a couple of pairs and was trying to add a couple of bath towels so that I could get free shipping. (The towels I keep in the guest bath are falling apart, I noticed today.) This doubled the amount of shipping, don't ask me how. MH just happened to walk in at that moment. I had forwarded him my Kohl's cash (some weeks ago) because he was going to buy some pants. So when he walked in I told him I was spending the Kohl's cash. We added some mens pants to the shopping cart. I told him I would return them if they didn't work for him. He'd rather buy in person. But he really needed pants. So it's possible this will make both our lives easier. But I do also expect to return some of this order. I buy the same pants over and over, but the sizing is usually a little bit off. I figured odds are I will return one of the pants I ordered for myself.

Posted in

Just Thinking

|

3 Comments »

October 17th, 2024 at 03:42 am

October 12

$73 Dinner Out

$700 Yard Cleanup

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

When I was pregnant with DL(19), I hired a gardener that brought much peace to our life. I just couldn't do it any more. Two kids + a full-time job + exhaustion (not enough sleep), etc., etc. Our gardener was amazing for the first 15 years or so (I feel very blessed about that) but really started dropping the ball after that.

We finally let him go and hired someone else. The new guy has been a little flakey but the bar is very low at this point. & I didn't read too much into it when he didn't show up last Saturday on 100F+ degree day. I don't know if he would have communicated with us but MH followed up and he said he would come today. Which seemed a very obvious thing, to wait a week when it would be 25 degrees cooler. He did show up promptly today and it was a big job. & has also shown up regularly to maintain the yard (where the bar had gotten very low). The front yard needed work but was passable. The back yard was looking like a jungle in some places.

Now that the yard is cleaned up, next on my list is to get the gutters cleaned. There wasn't access on the side of the house where a tree was growing and a shrub was blocking access to the side of the house. I had a tree guy cut the shrub back last year and we still had access to the side (and the water shut off) but wasn't sure a big guy with a ladder and a power washer could squeeze through there, or how much the 'tree' or whatever was blocking things. It's all cleaned up now so I will schedule a gutter cleaning. I just checked the last guy I hired was still working. He charged pennies to clear 2 stories of gutters and power wash the entire house.

MH told me early in the day maybe we should just go out to eat. He thought I would want to for some reason? I said, "No thanks." It was a, "I thought that's what you would want" thing and I responded, "Why would I want that?" I think the fridge is full but MH often guages better re: voracious teenager. I pretty much slept all day and did nothing. I just needed to recover from a long week.

I woke up around 5:00 and just felt "ugh" about food. I did have some shoes to return at the mall and thought if we did that I could get at least one productive thing done Saturday. & we could find somewhere to eat in that area. We had a leisurely dinner which ended up being more expensive because we ordered an appetizer and dessert.

Edited to add: My inclination was to get through our gift cards (that we seem to never use) but I couldn't find any. Checked my blog and I guess we actually got through all of our restaurant gift cards?

Posted in

Just Thinking

|

0 Comments »

October 15th, 2024 at 03:54 am

October 11

$66 Shoes (Moi)

$10 Parking

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Not entirely sure if my spending will count today. I just happened to receive a targeted ad for shoes that looked cute. It was in a brand that carries wide sizes. A Kohl's ad? My big/wide feet are very hard to shop for. I was annoyed they didn't even carry wide sizes of this shoe but I looked around and they were cheaper on Zappos. I guess I have my credit card saved on that account, so it was a couple of clicks to order. (I usually like the extra pain point of having to go dig out my credit card when I make an online purchase). Anyway, there's probably a 90% chance I will return them. In general, I'd say that more dressy type shoes are always too narrow and tight. Which is why I don't think I have any. Certainly nothing comfortable.

These shoes were a little dressy. I have two years to find shoes to wear to my son's wedding. & yes, I better start looking now. If the shoes are cute at all (in person) and fit, I would be very happy with the targeted ad. If not, I will just return them.

Today was a chaotic day. I started out feeling more optimistic but everything I touched was a mess. It was a frustrating work day. When I opened up the fridge to grab dinner, a small plastic to-go container of salad dressing fell out and splattered everywhere. That was DL(19)'s fault and he cleaned most of it up. I told him that pretty much summed up my day. I did end up doing a load of laundry because my clothes were splattered with dressing. (It looked 10x worse than it was. Thankfully it cleaned up quickly. Though I am not confident we found all of it.)

MH went to a film festival. I would have gone if it wasn't so chaotic this week. I recall falling asleep at this festival multiple times in the past. & that's when it is not an exhausting week. He got 63 free miles at a downtown car charger (which is a few miles from our home). I presume he had to pay for parking but I didn't see that show up on any credit cards.

Okay, so I asked MH about that. The 63 free miles was just what he had left to top off the car. (No out of town trips in recent weeks; his commute is only 3 miles each way). They were doing 'event parking' for a flat rate of $10 cash up front. Which he thought was BS because there was no event at the big arena (he had checked because then they charge $20 and he would have parked on the street in that case). So he was annoyed but at least he got some fuel for that $10.

The downtown free charging (city parking garages) was supposed to go away some months ago. But the wheels of bureaucracy move slow.

Posted in

Just Thinking,

Electric Vehicle (EV)

|

0 Comments »

October 13th, 2024 at 06:38 pm

October 9

$47 Groceries

$27 Haircut (MH)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

MH & I both went to the grocery store today. I picked up some cheese and deli meat (as planned). MH picked up some bread, milk, and other odds and ends.

Temps dropped down by 10 degrees and I didn't even turn on the A/C upstairs on this day. Woohoo!

Both MH and DL got haircuts this week (DL paid for his haircut). MH was annoyed because he received a targeted ad online and went for the '$13' haircut. When he went in they said that was for Nevada only and they wouldn't honor it. I was surprised he didn't push it (he generally would) but he just complained to me about it. I told him that I once went in stupidly with a coupon for another place (similar name) and they honored it (which seemed really unnecessary). It evens out.

-------------------------------------------------------------------------------------------------------------------

October 10

$6 Lunch Out

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I was dreading today. Had an ortho appointment in the morning and presumed they might remove the metal brackets from my teeth. Which is no big deal but of course they had to put one on my one sensitive tooth. That is the one I am dreading. In the end, it was irritating because they did not take them off. They gave me 90 more days of invisalign and I should be done at my next visit. Woohoo! But they don't know 100% and wanted to keep the rubberband brackets on 'just in case'. It's a good indication not to get too excited about it. But if all goes well, I will be done right on schedule (exactly 20 months).

And... The rest of the day was training new employee, who is an extreme extrovert. No matter her personality, it just sounded exhausting. I am happy to report that the day overall went very well and there was nothing to dread. Felt very positive at the end of the day.

The ortho appointment caused much chaos. I planned to just run home and pack lunch after the 9am appointment, and was planning for it to possibly run long (if they started scraping brackets off my teeth). In the end it was a quick appointment and I quickly figured out a better logistical plan. I usually switch the invisalign trays before bed so they don't bother me. Starting a new tray at 9am meant I was going to want a softer lunch. I decided to just grab a fast food burger. Which would just take time out of my work day. So I finally figured out if I just worked from home for an hour I could re-charge my car and knock out some work in peace. Then I wouldn't have to take a break to drive into work *and* a break to go run for fast food. I was able to just grab some lunch on my way in. The day ended up working pretty well and it was nice to break up the day.

Posted in

Just Thinking

|

1 Comments »

October 11th, 2024 at 01:01 pm

October 8

$9 Groceries

$41 Amazon

$81 Target (Groceries)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I ran to the store and got some breakfast food for the week.

One limitation I have right now is that I can only eat softer foods (re: invisalign). So I am not eating the usual things or what we have around the house.

I did some laundry and thought that I could throw some laundry detergent on the Target cart and probably get up to that $35 minimum for shipping odd things. I mentioned to MH and he told me he had already filled up the cart. He added some Halloween candy, deoderant and a few groceries. So I just submitted the order. The laundry detergent wasn't urgent. Then I thought about it and thought I had something else more in my cart than just soap. I finally realized one of the items was no longer in the shopping cart (and so wasn't ordered). I briefly pondered canceling the order and re-submitting. But decided to just do a second order of laundry detergent. MH told me my other item (lip balm) had been out of stock. But it appeared to be in stock when I did the second order. I won't hold my breath. Will just consider it lucky if it actually is in stock and shows up.

I am thinking of running to the grocery store for some deli meat on Wednesday. I think I will just literally make ahead a cheese sandwich and then grab some deli meat. Trying to think of something easy to fill up my lunches while I am stuck at work more.

I did also make some corn salsa for the work week. I consider it more of a salad. MH had bought ingredients for me around the 1st of the month but I forgot. Just happened to notice a pepper and a lime in the fridge and that reminded me. Got around to that Tuesday night (barely). It's a newer recipe that I have been making a lot. A Chipotle copy cat. Never had the original but have been told this version is much better. I will take that to work for the rest of the week.

I guess MH bought some electronic cables (for something or other) some days ago. It didn't ship until later and so I am just seeing it now. He also purchased a movie and a phone case for a new phone he bought last month.

In good money news, DL(19) told us today that he probably didn't want to go to camp next summer. He's had some time to think about it and be more realistic. I'd like to keep the tradition, going to the woods every summer, but can go a much more frugal route. & I think the kids will really enjoy it, when we figure out this new tradition. I've got a long time to cancel my reservation. Will give it some time to be sure.

Posted in

Just Thinking

|

0 Comments »

October 9th, 2024 at 02:08 pm

October 6

$14 Movies

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

MH & I went out to the movies. The $14 was just for my ticket, I suppose. I don't go to the movies much and usually MH racks up enough rewards to cover my handful of tickets.

We got a free car charge at the movie theater. It was mostly enough to cover the roundtrip fuel to the farther away theater, but we probably eked out a few extra free miles.

---------------------------------------------------------------------------------------------------------------------

October 7

$1 Soda

**103F Degrees**

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I thought I was going to report a NSD. Then I remembered that I grabbed a soda in the drive thru this morning. I don't like/drink coffee and Dr. Pepper settles my stomach. So if I feel a little "meh" or need an extra umph, soda is my drink of choice.

I expect there will be some extra eating out and soda the next few weeks, re: extra work and extra time in office. I will have to abandon my work-from-home days for a while. Which is just more energy (that I don't expect to have) to figure out food for work, etc. Will see how it goes. Of course, the flip side of that is we always spend less money (overall) when we are busier with work.

As of right now, the forecast for Tuesday is 99F degrees. 🙄 Hoping for some normalcy after that.

Oh yeah, and I spoke too soon about DL(19). He ended up eating out with friends on both Sunday and Monday.

Posted in

Just Thinking,

Electric Vehicle (EV)

|

0 Comments »

October 8th, 2024 at 02:04 am

October 5

$88 Groceries

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I asked MH if he thought these groceries would last the whole week. I was shocked when he said yes. I mean, he expects to pick up a couple of things mid-week, but all meals have been planned for with this grocery run.

I wouldn't be surprised if we had three $150 runs (the last 3 weeks of the month). I threw some things in the Target cart but needed $35 minimum to ship. MH didn't have anything to order at Target. So that's just sitting there. Off the top of my head, soap and something else I don't remember. That might be another $35+ at some point. I just throw most household purchases in the 'grocery' category. If it's bought at the grocery store, I just call it groceries.

MM(21) has his food stamps, and so I am re-jiggering the budget. I have the grocery/household budget currently set to $800/month. It's my best guess. It's more of an annual average, but there is always some +/- during individual months. This budget would be much higher in a month that MM(21) is home, but I don't know that he will move back home again.

What surprises me is how little DL(19) is eating out. Will see if he loosens up a bit when he gets more paychecks. I encouraged him some weeks ago to eat out more and around the same time he had lunch with a friend and had a very good experience. He was saying it was very good socially, in addition to mixing things up a little more from his packed lunches. & getting more (well needed) calories. And then he packed his lunch every day after that (for school/work).

Anyway, there is an expectation that the food budget should go down and DL(19) will shoulder a little more of his food costs. & I mean just normal teenager stuff. Not that I expect him to pay for his food, but I expected more 'normal teenage stuff'. Admittedly, DL(19) is probably spending less than ever right now because he is so busy with school and work. But I expected him to be eating some more convenience meals during his busy work week.

Posted in

Just Thinking

|

0 Comments »

October 8th, 2024 at 01:56 am

October 4

$4 Breakfast

$48 Dinner

$45 Movies

$1 Audible

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

It looked cloudy outside at some point and I wondered how on earth October + clouds = 100F+ degree weather. I guess it was only 96F degrees. Got some reprieve. Still forecasting 3 more 100F+ days.

I bought breakfast, as expected.

MH got a small COLA raise today. I did some quick math and comes out to another $50/month during months he is working.

We probably should have ate through the food piling up in our fridge. It felt irresponsible and wasteful re: might have to throw some food away. But we both had a "meh" day. & we were very indecisive about it. It's not even that we were feeling lazy and wanted to eat out. It's that we both felt "meh" and had no idea what we wanted to do. & we also had an extra $50 to spend, which might be why I suggested eating out. MH worried there was no room in the fridge for leftovers if he cooked dinner. We decided to task DL(19) to clear out the fridge (some) while we went out to dinner. With the plan to eat through more of the fridge on Saturday.

Our complicated feelings about eating out generally have nothing to do with money. We keep thinking it sounds nice to have the money to eat more. But then when we do we often don't enjoy it (prefer the home cooking) and then it's a thousand extra calories for the same stuff we'd just eat at home. In the end, I am happy to report that we had a very good meal that would have been difficult to recreate at home. We were happy with the splurge.

At dinner, MH told me he had signed up for some Audible deal, for just $1/month. I think most of the time he just gets audio books from the library. The $1 deal is for 3 months.

Oh yeah, and I noticed MH bought some movies. I usually don't ask him about his movie purchases. But since I am sharing, I asked and he told me that he bought some Hitchcock movies.

Posted in

Just Thinking

|

0 Comments »

October 5th, 2024 at 03:00 pm

October 3

$9 Groceries

$6 Fast Food

$0 Movies

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I didn't see where the weather landed today (101 or 102 probably), but the forecast just keeps adding more 100F+ days. Last I saw, through Monday.

Okay, so I guess it was 103F again, and that was an all-time October record. Thank you Google.

Today it was sick spending. I felt like crap and was feeling very particular about food. So I grabbed some groceries in the morning (for breakfast) and got a fast food burger for lunch. I had planned ahead black bean wraps for the week, but the thought of those makes me want to puke. So I told DL(19) to please eat those. I thought of that after he ate all the rest of the food I bought within a couple of hours of me getting home this morning. So much for that.

I will probably buy breakfast on the way to work tomorrow, unless I wake up feeling 100%.

MH went to the movies after work. He used his unlimited movie pass.

Oh yeah, and I taught DL(19) how to address an envelope today. He did not have a clue. His employer requested some paperwork. Which is a whole thing because it's a state job and everything about this is weird and tedious. Thankfully he was able to update his address online. They had a typo in the street name, but the mail was still making its way here. He's just never had any reason to mail anything before.

Posted in

Just Thinking

|

3 Comments »

October 4th, 2024 at 02:49 am

October 2

NSD

**103F Degrees**

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

MM(21) was really dragging his feet transferring money from his savings to his checking account. But I saw today that he transferred $1,800 over. Probably leaves him with $1,000-ish that he will insist can last him through the school year (after he pays for that engagement ring). I need to check in with him about getting his rental deposit back. I haven't seen that show up in his account yet.

I looked up MM's college town weather out of curiosity and it is just as hot. Ugh! His region largely doesn't have A/C. He's always lived on upper levels without A/C, but school starts in late September and the region is not that hot (close to the coast). He's having a rough week, I am sure.

MH went to a free advance movie screening. I attempted to attend one with him some months ago. Maybe the first time since 2020? It's gone very far downhill. They were just sticking to the smaller theaters which only leaves the first couple of rows. Maybe 20? seats and you have to get there many hours early to snag that. The rest is reserved for press. But MH got his first press pass today! Re: his producer "job" that does not pay. He would be happily paid in press tickets. So this was a nice treat. I don't think it was anything particularly exciting, but he will always say yes if it means more press tickets in the future.

Posted in

Just Thinking

|

5 Comments »

October 2nd, 2024 at 12:07 am

October 1

$ 7 Patreon (MH)

$105 Groceries

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Ugh! The other shoe dropped. Had major work drama in May. I think that some of my coworkers thought I was being overly dramatic but I knew my assistant would likely quit after that. She gave her very short notice today. (What is up with these very short notices??) At least when awesome admin left (her spouse gave no notice; they moved out of state for his new job) at least she stayed on and worked as much as possible. She's a people pleaser and probably helped smooth the transition more than she should have. In this case, I was too shocked to really process that I will have to train someone from zero. What a mess. The way she told me, it just really threw me for a loop. Though otherwise not completely surprised.

A very rare work break (in addition to plans to pass off a lot of my work to this employee) just became a big mountain to climb. Which would be less of a big deal if it wasn't constant mountains.

Blogging relaxes me, and is appreciated today. But I am also now more skeptical about my badwith this month. I realized today when I looked for an old "expenses tracking" post (to copy and paste) that I gave up the last October tracking I tried because MH's grandfather passed away. I just gave up mid-month. That doesn't make me feel too warm and fuzzy.

In other news, we put away the grocery credit card for the year. We maxed out our rewards on that card.

The weather is absurd. 102F degrees forecasted for tomorrow. The plus side is that we are done with summer rates. Instead of paying $0.35 per kWh during peak peak times (which we mostly try to avoid) we get to pay just $0.16 for non-summer peak hours. Which will probably still equate to an absurd electric bill because we aren't usually running the A/C in October. But it will be a little more reasonable and less sweltering in the house.

I did buy some ice cream (Saturday?) when I saw the weather forecast. I am going to go turn off my brain and eat some ice cream.

Note: Labeling this as 'Daily Expense Challenge so that it's easy to find in the future, but I am not considering this a 'challenge' and don't have a goal to limit spending. Just sharing more minutiae about where we are at these days.

Posted in

Just Thinking,

Daily Expense Challenge

|

8 Comments »

October 1st, 2024 at 02:32 pm

I was thinking about detailing daily expenses in October. It's always a good way to dive back into blogging. I looked back and I guess it's a common month for my to share more expense details.

Last week I would have said that where my head is at is that we are relaxing more financially and trying to find a new balance.

Then I paid all the October bills. *Sigh* & was informed of another massive health insurance increase for 2025. No idea how we survived 1000% health insurance increase early on during one-income years. (Roundabout financing with our mortgage; is the obvious reason we still have a mortgage.) But the plan this time around is to just hold on for another few years. At least we will be dropping from 4-person coverage to 2-person coverage. Just need to hang on in the meantime.

On the flip side of that coin, our net worth is up $100K for the year. I find it hard to sweat the small stuff during recent stock market years. It's 5 years in a row of $100K gains. (Health insurance is not "small stuff" but pretty much everything else is small.)

I am also concerned about the long term future and the inevitable "what goes up must come down." But like the health insurance, if we can just hang on for a couple of more years, our expenses should overall reduce drastically after that. Re: kids grown, mortgage paid off, etc. I think it's just so close that we can taste it. & is a lot of our relaxing.

Anyway, I can delve into my feelings and how all over the place they are, as I share daily tracking. I do think it would be wise to rein things in a bit for October.

I pay all the bills the first of every month. I've got everything paid except the *big* credit card bill. Waiting for my paycheck to hit today. Then I will get that paid off. (The rest of our paychecks during the month generally go to savings/investments. My second paycheck and all of MH's paychecks.) It's a rare 3-paycheck month for MH. Rare, because of all the months he usually has off of work (re: seasonal job). But we have some home maintenance planned this month, paid for in cash. His extra paycheck will cover that. (That bill is not paid yet because the work has not happened yet.)

I don't have any plans to spend money today. I think MH is going grocery shopping.

I don't know if I have the bandwith to track all month in my blog. Will see how it goes.

Posted in

Just Thinking

|

1 Comments »

September 24th, 2024 at 01:10 am

I was just double checking MM's bank account before sending him rent money for October. There was a random $500 deposit from his college that confused me for a beat, but I eventually realized that it must be a scholarship. What!? I figured maybe MM(21) didn't know about it. But he did know and just never bothered to tell me. It's a $1,500 scholarship for the year ($500 per quarter).

Talk about a nice surprise! It's all money in MM(21)'s pocket. I am depositing the $500 back into his 'gifted college fund'.

MM(21) Year 4 'Gifted College Fund': $16,750 (+$5K ROTH IRA ~ unknown current value)

Still no idea how MM(21)'s grant will sort out this year. I should have some answers in November and then I will know what net tuition costs will actually be this school year. & at that point I should have a pretty good idea about our 5-year tuition cost. I'll do an update at that time.

It was a big money day. DL(19) also got his first paycheck for first more steady job. It's the first job my kids have had that isn't just a summer or a temp job. DL(19) received a $750 check for 2 weeks of pay. & I think he's worked another 4 weeks already (the State pays monthly).

I don't know that DL(19) has ever made a big purchase. At the moment he owes me $400 for some car maintenance. Not that he borrowed the money from me. But we went in 50/50 with the cost and I was just being nice and waiting for his payday before I asked for his 50%. He told me that he wants to buy a used bike for $500-ish. This is probably his first big purchase, ever.

I guess now it will be all the things. He will need a high yield savings account (first priority is to save up for a car), I want him to apply for a credit card in his own name (now that he has income), and we will talk about saving for retirement. His employer is taking 7.5% for retirement (mandatory). DL(19) was playing with stock market type simulators when he was 10, maybe younger. I wouldn't necessarily prioritize taxable investing for a 19yo but I think he will like making his money work for him. One thing at a time, but it all needs to be addressed as the money starts to pile up.

Posted in

Just Thinking,

College

|

6 Comments »

August 24th, 2024 at 02:21 pm

MM(21) cash: I think he's down to about $11,000 cash. $1,750 in his checking account, but $1,200 of that is earmarked for an engagement ring.

The engagement topic has come up more. It sounds like the engagement is planned for any day now. But the wedding will be an 'after college' thing.

MM(21) has been insisting that he doesn't need any money. & has been pinching his pennies. Never ended up pulling any money from savings (last school year). But we will have to sit down before school starts and make sure he has enough cash for the next school year. Or at least the first half of the school year. On the flip side of the coin, he is much more spendy during summer months. He did a big trip a few weeks ago. This week he has been going out almost every night, socializing with college friends. Restaurants, bars, that kind of thing. He's very, "Like hell I would spend money," at school, so it's good to see him relaxing and enjoying a little more.

The past school year MM(21) received a $1,000 gift from the in-laws (annual college gift) and $500 interest. Expenses were $680. This means that he was able to save $820, which is about what he will be spending on an engagement ring. (They are going 50/50 on the ring, so he only has to come up with half the cost.)

Note: I cover tuition/fees, rent, utilities, medical/dental and a grocery allowance. The $680 he spent was for everything else. It included $250 automobile expenses. Just had him pay towards some of the car repairs during summer months when he was using the car more. I no longer have access to his credit card, so I don't know how much he has spent on fuel (probably some) or what else he spends his money on.

I've been giving him his 'gifted college money' (during college years) for 'college spending'. But MIL has been inconsistent. Ideally he should be getting a check any day and it might last him for the next school year. But if MIL forgets for a while, MM(21) will need to transfer some funds out of his savings account.

Engagement ring side note: The topic came up at work because a co worker's young sister just got engaged and we were talking about MM(21)'s engagement plans. My employer has a 8 figure net worth (family money) and married very young. He mentioned that a couple of our employees (who don't work in the office) he felt were delaying engagements re: cost of ring. & we joked about the diamond industry recommendation to spend X months of salary on a ring. 🙄 I don't remember the number, but my boss revealed (to everyone) that he spent a whole whopping $300? on an engagement ring. He had bought it at a pawn shop. (He's a decade younger than I, so this was around 2005. For reference). I chimed in that my ring didn't cost any more than that.

It's funny because my inclination is to say that we were 18/19 and weren't going to spend any more on a ring. But that's not true at all. If I actually stop to think about it. MH had the free college ride and was working his butt off to save up for a Bay Area home (he started saving in high school). He had thousands of dollars, in addition to no immediate expenses. I would have considered it a red flag if he spent any more on a ring. I am sure everyone else just wrote it off that both my boss and my husband were "very young and broke" but the truth is the both of them could have bought much more expensive rings (with cash) if that was something they actually valued. & of course, we are talking about people who don't do debt. Clearly people justify spending a lot more, putting engagement rings on credit.

Edited to add: MM(21) bought the ring this week. I don't know if he plans to propose this week in town or if he plans to propose at college town. He's moving back next weekend.

Posted in

Just Thinking

|

6 Comments »

August 15th, 2024 at 02:11 pm

MIL was trying to outlast my kids, but she gave up. We took over the camp account and I put down a $100 deposit for next summer. We did let one cabin go. It's now freed up for a younger family.

It was 55F degrees on the beach day. I tried to talk some of the kids out of it (we needed two cars to get them all to the beach), but they wouldn't hear of it. They had grand sand castle plans (pictured above). I thought the picture was a good symbol of my kids' unwillingness to outgrow family camp.

MH and I had been planning a day trip to Napa. At some point MH mentioned it would be fun to take MM wine tasting for his 21st birthday. We went wine tasting at a castle and then did a hike through the redwood forest behind the castle. & we had an extravagant dinner.

The original plan was to go to the culinary school for lunch or dinner. I didn't get the reservations in time. It's on our list this year to go back at some point (just MH and I).

Other goings on...

MH went to Indiana for a film convention. He had a blast. He just told me that he is pretty certain he won't go back to Ohio in the Fall (as originally planned). It sounds like more of this movie stuff is getting pushed into next year. It's a relief financially, but it's more money next year just being tied up for this movie stuff.

MH got a job as a producer for a local cable show. As it always is, he's not getting paid for this. But it sounds like there will be some money making opportunities and they do want to pay him in the future if they can. Not holding my breath, but it's a good opportunity re: networking and experience.

MH's movie is coming along nicely. Slowly but surely.

DL(19) got a job! He's been looking for 3 years... He's had a couple of sketchy temp jobs, but has wanted something more year round and permanent. I think considering that he gave up and just applied to anything and everything (was willing to work full-time hours this summer to get his foot in the door, though he has no need or desire to work that much). Considering the more desperate and wide net he cast, I think this job could work out pretty well. It is a state job and he will be making $$$$$. I will share more details if it works out.

It's been absurdly hot and so I have just been in survival mode. There is nothing productive happening in this heat.

Work/school is ramping back up during the next two weeks. With both MH and DL(19) returning to work. MM(21) doesn't start school for a while but I think he is moving back to college in a couple of weeks.

Posted in

Just Thinking

|

0 Comments »

July 29th, 2024 at 03:19 am

I hadn't realize that these middle class college grants were on the chopping block for this next school year. I was just looking up something else completely different and came across news that there was a push to cut these benefits by 90%. (Which I think is fair. I think 'very low cost and great colleges' is more than good enough.) By the time I saw this, the state budget had already passed. Nothing was cut and the benefits will again be increased this next school year. (Which I also think is fair. Talk about last minute, making it impossible to plan if you have no idea what your actual cost will be.)

I *think* this means my last tuition estimates were spot on. But I will hold off until it's official. Until all the red tape is sorted and the money starts to show up in my bank account.

I went through MM(20)'s rental application some weeks ago. Fingers crossed! I hadn't really thought about it before, but as I thought to rent logistics, I can see it's going to be a pain making sure that 3 roommates get their rent in time. He's already largely moved his stuff over but will technically have no lease for 10 days. He is using the same property management company as last time, so this whole process is much smoother than last year. He's planning to move into a much nicer townhome (moving up from a small apartment). It's very close to campus (closer than the "on campus" apartments were) and so MM(20) is intent on living without a car for another year or two.

I will do an update on where we are at with those costs, but will wait until it is official. Because he sorted out a couple of big rental messes last year, I am just letting it go and letting MM(20) figure it out. But I think it's incredibly stressful he doesn't have the lease signed yet. He just told me the new lease should be for August 2nd.

Edited to add: I am still waiting for that to be finalized, so that I can do an update on his rent for the last 2 years. So that I can at least do a projection. In the short run, not even sure if the 3rd roommate will work out or if they will just split everything 3 ways.

Second edit: Never got around to posting this. Some of it was because I expected an update any day. But MM(21) hasn't been home most of the month. So I have not seen him for more than 5 minutes. & I don't know any other details other than the lease is signed, re: original plan. (I have no idea where things landed re: drama). I am going to roll with the info I have and do some projections re: where we are at with college money.

MM(21) has $20K in his gifted college fund. Tuition is roughly $20K for the last 2 years. But we will get $4,500 in tax breaks and he will likely get another $7K+ grant this year. (Still not certain if that will be $0 or $7K.) It's plausible that MM(21) will still have ~$11K left in his college fund, at the end of Year 5. Note: I've only touch this fund to pay for his tuition.

It's Year 5 rent that I didn't have much of a plan for, and left it with MM(21) - last year - to circle back later. For now, I think we will cover the Year 5 rent. A lot of it of course depended on where he ended up for the last 2 years. I've got $13,000 set aside for MM's rent specifically. In addition, will presume another $2K of interest (over 2 years). This will cover 18 months of rent.

I've got 6 months of rent to figure out how to cover. Roughly $5,000. Because of the grant, I am eyeing MM(21)'s gifted college fund. It's precisely what that money is there for. $5K will buy him the difference that I don't have 'already saved' for his 5th year of rent. If I pull $5K out for rent, he may still end college with $6,000 (gifted funds).

If the math went another way, I'd have no problem telling MM(21) he needs to start chipping in towards expenses, etc. But it sounds like he might be able to squeak by.

I am so very close to crossing off MM(21)'s college as 'done and paid for'. But I won't be certain until this final year state grant sorts out. I am hesitating because it was initially supposed to be $0. I won't fully believe it until the money hits my bank account.

Another Edit: I know, I know. But I didn't feel it was worth a new blog entry. MM(21) just told me his new deposit amount on the townhouse ($750). I decided to just pull that from his 'gifted college fund'. Making a note about it because I don't care for his blase attitude about picking up his despot check from the old rental. If he ever gets that money back, I will put it back in his college fund. Trying to shift the financial pressure to him.

I can see it's more interesting to just update the kids' college fund balances when I do these posts. Will start to see MM(21)'s balance dwindling down more these last couple of years.

MM(21) Year 4 'Gifted College Fund': $16,150 (+$5K ROTH IRA ~ unknown current value)

Note: We have pulled $11,865 from these funds to cover first 3 years of tuition, one summer class, one expensive class fee, and a rental deposit. I am also probably due a $2,500 financial aid refund (will deposit back into this fund, when received). MM(21) will likely end his senior year with the $20K he started with. Financial aid is just incredibly slow to sort out. I will probably pay for the first two quarters before I start to get final numbers or refunds. So this account will be a yo yo in the meantime.

Clarification: It was $20K when I started this post, but then I paid Fall tuition & took out that $750 rental deposit. Tuition/grant/tax credit/interest will probably be a wash this school year. Rental deposit should also be returned eventually.

DL(19) Year 2 'Gifted College Fund': $28,700

Note: No plans to touch DL(19)'s college fund, as long as he is living at home and receiving significant state grants.

Posted in

Just Thinking,

College

|

0 Comments »

June 23rd, 2024 at 03:37 am

I am finally setting my next bigger picture retirement goal. It's been 3 years since we hit our $500K retirement goal. I drafted this post in January (have been slow to publish) and so I'd say we took a 2.5 year breather re: retirement goals. Wanted to let the stock market rebound, let college sort out, etc. Real estate is still a mess. I suppose we've decided that part is moot until we decide where we want to settle.

A lot of my "meh" feelings about it has been the markets. At current, the smaller homes in our neighborhood are selling for the same price as our larger home. (This renders downsizing completely useless. In addition to this, our property taxes and utilities would increase. I would have been okay with that to pocket $200K, but makes no financial sense in the moment.) I think that doubling our last retirement goal in 5 years was doable, but it was just kind of depressing while the market was down. & of course, the housing thing was a compounding factor because if we can't cash out $200K to throw at retirement then that's $200K more we need to come up with.

In the meantime, we mostly figured out college for both our kids. Still some financial unknowns but I think it's about 90% more clear than it was 2 years ago.

Ideally, I'd like to put less emphasis on retirement savings. But the reality is it's just not efficient to lower retirement contributions. After pondering for a couple of years and going more with the flow, I can see we won't change much. Will continue to contribute to work retirement plans up to the match and will continue to max out IRAs. Not sure how successful we will be with increasing IRA limits and two in college, but will keep trying.

That said, our $500K retirement goal (by 45) was a big stretch goal. We are going to continue to hit things pretty hard, but... I am no longer interested in the stretch goal being the priority.

Note: Age 45 goal was 6x salary

So our new goal will be more realistic:

$1 Mil in retirement accounts by age 52.

This presumes 6 years and a 7% rate of return.

I do think that 'thinking it' is 90% of the battle, and I think is some of why I wrestled with setting a more conservative goal. In the end, I am just setting both the realistic goal and the stretch goal. The stretch goal is to hit $1 Mil by age 50. The stretch goal is a stretch goal, but I do think it is possible. I am doing my part to write it down and believe in it. Mostly, I have other priorities and don't want to sacrifice too much for the stretch goal.

Along the same lines, I don't know how I will feel about catch up contributions when we turn 50. My gut feeling is "meh". The whole point of making retirement *the* priority in our 20s/30s is that we don't want to spend our 50s catching up. But if I really think about it, I am less of a fan of our retirement work plans and have no plans to ever max out. I do prefer self directed IRAs and I can see taking advantage of catch up space. Which is just another $1K per year, each. Once our kids fly the nest, I am sure that will be fine.

Other than that, our bigger plan is just to work less. Our expenses should drop considerably when our kids fly the nest. & so that may be a situation where we could max out everything (and do all the catch up contributions). But the bigger plan in our 50s is to work less. Not to save more. More likely will be cutting back work hours and lowering retirement contributions.

We turn 50 in 2026. That will probably be a bit of a transition year where we pay the last of the college expenses.

Posted in

Just Thinking,

Investing,

Financial Independence by 50

|

0 Comments »

June 8th, 2024 at 03:35 pm

I just happened to notice (very randomly) that DL(18)'s tuition was due this month. What!? We paid in August last year but I guess that was a special freshman due date.

What a pain. I paid the entire tuition for the school year, basically. Will get a financial aid refund in November. (Tempted to cross off the year as done and paid for, but will wait for financial aid to sort out.)

Feeling cash poor in the short run. Was feeling very balanced and then suddenly feel out of balance. I will have to ponder.

I had been meaning to share a food stamp update but wanted to wait and see if MM(20) was truly eligible. He's been dragging his feet but he finally got through the red tape.

My conclusion is that the only reason he is eligible for the food stamps is because we are uber frugal. But I will start at the beginning and then get to how it ended up.

In MM(20)'s college county, some majors are eligible for food stamps. The main criteria is that you can't live with your parents, you must have a kitchen (he would have been ineligible freshman year) and you need to cook most of your meals. MM(20) fit all these parameters.

They've been doing a big marketing push this year. It would be hard not to know about this, at this point. Was totally clueless last school year and then only found out mid-year this year.

MM(20) had told me at some point that his girlfriend was getting "food financial aid." So finding this out was a big lightbulb moment. This explains why she refuses to accept any grocery money. Obviously she knew about the food stamps. This is also probably the only reason we perservered with the red tape. Her parents clearly have a higher household income. If not for knowing she was eligible for full benefits, it would have been easier to write off that clearly MM(20) would never be eligible for food stamps.

Now that he is approved and he has his benefit amount, I'd say the truth is somewhere in the middle. They don't ask anything about assets, so that is not a factor. MM(20) will become ineligible any month he makes something like more than $2,800 (more than full-time minimum wage). They asked MM(20) for financial aid information, so they probably extrapolated our income/assets (at least a rough estimate) from that information.

I am still a little confused why the girlfriend is receiving the full food stamp benefit of $300/month. I don't know if it's because it's more 'all or nothing' if you have no parental support. Or if she was just being paid room/board at her on campus job (considered to have $0 income?).

The final answer is that MM(20)'s benefit is being pro-rated based on the support we provide him. It sounds like he will be getting $150/month food stamp benefits. This just happens to be the amount we were giving him for groceries. We reported to the state that we were "gifting" him $1,400/month (half minimum wage) for tuition/room/board/support. It sounds like if he is being gifted half minimum wage, then he gets half the food stamp benefit.

Of course, I will no longer be giving him food money (due to this benefit) and his rent is decreasing next year. So technically he will be eligible for a little more.

I already mentioned in the past that MM(20) is in the extreme minority re: low grocery spending. & MM(20)'s rent is also easily half of what it could be. It quickly became clear that he is only getting this benefit because A - he is uber frugal, and B - we give him very little support outside of tuition/rent. & C - he's also living off of his girlfriend's food stamps. It sounds like it's fairly typical for parents (at this college) to give students $2,000/month for just rent and food. That's not counting utilities, allowances for spending money, or any other financial support. Oh yeah, and that does not even count tuition! I was right to be skeptical about being eligible for food stamps. We just squeaked by because our personal situation just happened to fit inside the box.

How random is that, that the government wants to give him the amount I was giving him for food allowance? Technically, MM and his girlfriend are sharing $450/month. Even with her fancy menus, it's more than they can figure out how to spend.

MM(20) already bought up groceries for this school year (before he got the benefits), so this won't change my budget until next school year. But this will be a nice benefit for next school year. Fingers crossed, however many months he can get this benefit. (Ideally, for last 2 school years.)

Posted in

Just Thinking,

College

|

3 Comments »

May 30th, 2024 at 01:23 pm

🤪

This pretty much sums up life right now. There's an element of "no idea where to begin," every time I have some peace and inclination to blog.

I have mixed feelings about work. At least I am not juggling craziness on top of the busy season. But I don't know why everything has to implode every May 1. It feels like I can never catch a break on the work front.

We had to reschedule a few times, but finally circled back to that last hike we did. I wanted to try it out with hiking boots. With stretching and proper shoes, it was easy peasy.

We left home on 8am Saturday and we were shocked how crowded it was already. But because it was cooler and early enough, we did get the river bank to ourselves. We hiked down to a swimming hole that had been more crowded on our last afternoon hike.

This last one just happens to be called a monkey flower.

I wanted to note the time. We might try 7:30 next time. Just to play it safe. I don't know if the holiday weekend was a factor.

When trying to figure out the archaic payment system last time, I saw that the library had stake (lol) state park passes to borrow. I couldn't really find details about that either (like how long we could borrow the pass) and so I just reserved a park pass and tried it out. It probably took about 10 days to get a pass. We can borrow for 3 weeks, same as books. I will just plan to keep a pass checked out all summer because the kids will also use.

Money stuff has been pretty quiet but won't be quiet for long. Just got a $2,000 MRI bill. College expenses are just a 'second half of the year' thing. At this point I guess, while most of MM(20)'s college savings are being pulled from other savings buckets. & I think for DL(18) the timing worked out that I get a refund of first semester financial aid around the time the second semester is due.

I expect MH and I have been way too relaxed and spending way too much money. We have both been frittering money away on smaller things, which has never been our thing. But that MRI bill is stressing me out and now I am realizing that college will be a big money outflow the second half of the year. I've already told MH we will have to rein it in this summer when he is off work. He is well aware of excess spending. He seems kind of down on movie travel plans this year and has already seemed to decide he rather relax more and enjoy some smaller spending, and is willing to let go of some of the larger spending plans. It's different, but it's interesting we both subconscionsly seem to have ended up in the same place.

It just so happens that we have not had any 'big' expenses the first 4 months of the year. (Other than travel plans, paid for with gift money). I pulled money from savings the first time (this year) in May, when I purchased a new cell phone. I expect this is why MH and I have been more relaxed about money.

I need to add taxes to our expense tracking. I have not bothered during these ~$0 tax years with kids. But even just the payroll taxes, we are probably making $40K more than when I first took this job in 2018. It's now $950/month payroll taxes. & our income taxes will be about the same when kids are done with college (though we aren't paying much in the interim). Payroll and income taxes will suddenly become our two largest expenses.

When looking how much we are in the black the past few months, I can see it's exaggerated without the taxes reducing income. It's time to start tracking taxes and mentally preparing for when that is our #1 expense. I may have also just left these off (payroll taxes specifically) so that I didn't have a heart attack during lowest one-income years. But it's 22 years later now and things change.

Posted in

Just Thinking,

Picture Project

|

2 Comments »

April 21st, 2024 at 03:16 pm

I guess this is largely a MM(20) money update.

I thought we would go over MM's cash during winter break, but he ended up not having much of a break. I am surprised he still has any cash available, but he's been in extreme low spend mode and just stretching that $1K annual gift (using for spending money during college years). We touched base during his spring break. I think he had maybe ~$1,200 easily accessible cash. He was very *shrugs* about it, just needs it to last 3 months.

MM(20) did decide that he was probably going to cash out some or all of his I Bonds. But we decided to just wait and see what the next interest rate would be. & we left it that he will need to open a new bank account this summer (to park extra cash).

I just happened to notice two things last week:

1 - I Bond rate set for 2.97% inflation rate next round.

2 - One of our CUs is paying 5.5% interest.

The CU account is a mega interest account that was paying 4% when the average high yield interest rate was 1%. It's fallen behind in recent months, but that 5.5% is perfect for MM(20) to park his I Bond funds. The catch on this 'mega interest' account was that the cap was $5K for the mega interest.

I can't even tell you why I checked, but maybe it's just because it's been so long since either of us has kept a full $5K in these accounts... I figured I'd double check (if my memory was correct) and... The 5.50% is on the first $10K!

Note: We've already moved our own money over to take advantage of $10K @ 5.5%.

I let MM(20) know. He is cashing out his I Bond and moving most of that to his CU account. When all is said and done, he will have $10K earning 5.5%, $500 earning 7% (another CU), and $1,500 left in his checking account. Maybe only $1,000 left after a few more months of college spending. He will want to figure out a higher-balance high yield savings account at some point, but won't be necessary until he gets a job and starts piling up more money.

In other news, MM(20) has had his rental figured out for next year, for a while, but was still negotiating the cost of the bedroom he will be renting. I guess he got that sorted out and he told me it will be $808/month. He will be saving $42/month, for a much bigger room and nicer neighborhood.

Somewhat related, we need to cash out the rest of our I Bonds. I have been dragging my feet because I got used to the easy separate buckets of money. But I think I've only really been allocating this money to the kids 50/50 (in my mind) while it was doled out 50/50 into separate I Bonds. The truth is that this is a '2 in college at the same time' fund. I just needed a little time to wrap my brain around it. I am thinking about loosely earmarking $20K for future DL(18) rent expenses. & then earmarking the rest to MM(20). I would earmark all of the mega I Bond interest to MM(20). & also all future interest to MM(20), who is currently paying rent. This is very simplistic and easy to keep track of. I really only care about keeping the $20K for DL(18) if he is moving out this summer/fall (and if we are paying two years of rent for two college kids at the same time). So if we end up falling a little short, this $20K is money we can probably tap if MM(20) needs it. (At current, DL has no plans to move out.)

I wasn't sure if we would pay for MM(20)'s 5th year of college rent. We left it as a bridge to cross later. I wanted to give him ample notice if we expected him to chip in. But at the same time, wanted to give it some more time to see how things sorted out. He did his part. He's done a good job keeping rent costs down. I suppose when I tell him we are going to pay for the rent, will have to clarify that we can cover rent 'at this rent level'. (We also found out his 5th year of tuition will be free, because adding the 5th year is giving him a 4th year grant. I could just pull the 5th year of rent from his gifted college fund, if I wanted or needed to. Now that we expect he might have anything left in there).

MM(20)'s current lease ends in July and I think the new lease starts August 1? But he will be able to store his stuff there in the meantime. MM(20) expects to stay at this house his last 2 years of college. With everyone I know who rents being constantly kicked out by selling landlords... I would never presume he could actually stay there 2 years. But it would be nice if it works out. Just my past experience re: sky high real estate. It doesn't help that home sales just went from 0 to 100 overnight. But I would have laughed at the idea of counting on this rental for 2 years, regardless. We can only hope that it is that easy.

Posted in

Just Thinking,

College

|

1 Comments »

April 19th, 2024 at 03:26 pm

We did the traditional ‘after busy season time off and hike’. But this time was a little different. For the first time in 7? years I didn’t just look up the easiest hike I could find. I mean, the hike was labeled “easy”, I guess because of not a *lot* of elevation gain. But after about a mile uphill, it did kick my butt. MH’s job is way more physical and he seemed less bothered by it. But he very heartily disagreed with the “easy” assessment. It was a 4 mile hike with a lot of uphill. And… It was just perfect. It is exactly what I needed. I like that it was a bit more of a challenge, while being relatively easy. & I probably would not have been up to that during several years of recent ‘survival mode'.

This morning I bought some hiking shoes, which should help. I’d like to go back and redo with some better footwear. & I am over this “once per year” hike schedule. I’ve decided that at a minimum we need to be doing a hike at least once every month.

We do really need to take more advantage while our fuel costs pennies. Not sure how long that will last. Thinking to hitting more Bay Area and Tahoe hikes. Last year I realized that we had extra freedom with MH done with the whole 'driving the kids to school' thing. In addition to that, I do work from home one day per week. I'd like to maybe once or twice a month hit an afternoon hike. If it's easier for me to leave at 2 or 3. I think we left closer to 3:00 for this hike and I was surprised how empty the parking lot was (both before and after our hike). I expected more of an 'after work' crowd.

Here are some pictures from our hike yesterday. This is only 30 minutes from our house.

I’ve done a good mix of relaxing and crossing things off my to do list, this week off work. I feel I have both the physical and the mental energy to get things done. While my time has skewed maybe 80% - 90% towards just relaxing. It’s been a good balance.

In other news... I was not supposed to know this but MM(20) is engagement ring shopping. MH and I got engaged when we were both 19, which was weird in our day. Have got a lot of questions why we bothered to get engaged if we didn't plan to get married until after college. (& it was just plain weird to get married in our early 20s). I presumed that MM(20) and his girlfriend are not in any rush. They are certainly taking their sweet time. I am not surprised at all that they plan to eventually get married. But it is a big surprise that they are ring shopping.

The only reason I know is because the GF is going halvsies on the ring and she gave a chunk of money to MM(20). I thought it was rent/utility related. I am just trying to figure out how much I owe the kid for utilities. So I asked him about it. He got really uncomfortable and I thought, "Ugh, I don't want to know." So I started to tell him, nevermind. But by the time I changed course, he had already admitted it was for an engagement ring.

What!?

Kudos to the girlfriend for getting MM to buy a $1,200 ring! (This is what I presume, re: her $600 contribution). She thinks it's cute that he is an extreme cheapskate. It is not cute, and it will get old. So I am relieved he can at least spend money on important things. Not that I think a ring is important. But you know, people first. Then money, then things. It's the "people first" part that I think he's wise to oblige.

Admittedly, there could be a YOLO aspect re: girlfriend's recent health problems. I presume they won't get married until after college, but who knows. The girlfriend is *amazing* and a very welcome addition to the family.

Posted in

Just Thinking,

Picture Project,

Vacation Lifestyle

|

2 Comments »

March 30th, 2024 at 03:03 am

My kids both received substantial middle class grants from our State this year, re: attending in-state public Universities.

I've tried to look this up (how to ballpark or estimate) in the past, but it's so complicated and depends on so many factors. Primarily, how many students are eligible. Because then funds are divided among eligible students.

So my mind was just blown when I figured it out. 🤯 I just had to dig a little deeper.

Side note: It appears that the kids' assets are not being counted in this formula.

There's other parts to the formula, but calculations below are just what was applicable for our personal situation.

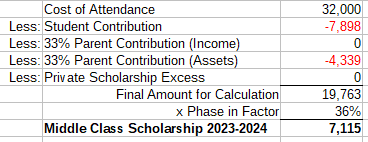

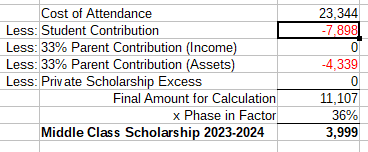

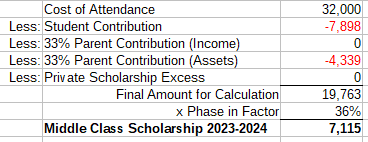

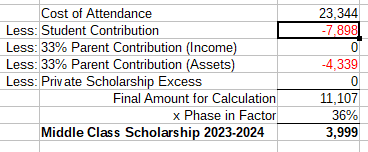

This is how the calculation went for the 2023-2024 school year.

MM(20)

Note: The cost of attendance is a ridiculous number that we do not pay. $20K is a more accurate number. $10K for tuition, $12K for housing, and maybe save $2K here at home re: less utilities and food costs. Eating is not a college expense. In this case, MM(20) spends way less on food at college than at home, so that is a cost savings for us. (& utility savings might be a few pennies on top of that.)

& all students are expected to be able to contribute the $7,898 re: part-time or summer work.

DL(18)

Note: The cost of attendance is a ridiculous number that we do not pay. We paid $8,000 tuition and DL(18) has some increased transportation costs with the daily commute to the college. The rest is food/housing allocated to 'students who live with parents', plus $3,000 misc. personal spending (nope).

I guess the key is the 'Phase In Factor' and is decided every year based on the budget. For now, the best I can presume is that the phase in factor will remain the same for 2024-2025. There is a lower 24% factor being used to estimate financial aid for 2024-2025. So that is the number the kids will get from their colleges. & then they eventually finalize this % later in the year. I am going to use 36% (same as this year) as a rough estimate of the actual dollar amount. It does not sound like the State has the budget to bump up this grant again next year. Which is completely fine with me. We are getting to a tipping point where more grant money means less college tax credits. So it's all kind of the same in the end, for us.

In the end, it looks like grant numbers will likely be the same next school year, unless CA budget numbers radically change that %. & of course, MM(20)'s grant might be a big fat $0 (if the decide he is already a senior, based on their methodology). I do not count on anything, but it's just nice to have a better idea how all of this is calculated.

I now understand that DL(18)'s grant is smaller because he is living at home. (& also because his college tacks on less fees). & I now know that it doesn't matter if either kid starts piling up assets (re: working or gifts). & I confirmed that there is no '2 in college at the same time' adjustment for this particular grant (re: our personal situation).