|

|

|

Viewing the 'College' Category

June 8th, 2024 at 03:35 pm

I just happened to notice (very randomly) that DL(18)'s tuition was due this month. What!? We paid in August last year but I guess that was a special freshman due date.

What a pain. I paid the entire tuition for the school year, basically. Will get a financial aid refund in November. (Tempted to cross off the year as done and paid for, but will wait for financial aid to sort out.)

Feeling cash poor in the short run. Was feeling very balanced and then suddenly feel out of balance. I will have to ponder.

I had been meaning to share a food stamp update but wanted to wait and see if MM(20) was truly eligible. He's been dragging his feet but he finally got through the red tape.

My conclusion is that the only reason he is eligible for the food stamps is because we are uber frugal. But I will start at the beginning and then get to how it ended up.

In MM(20)'s college county, some majors are eligible for food stamps. The main criteria is that you can't live with your parents, you must have a kitchen (he would have been ineligible freshman year) and you need to cook most of your meals. MM(20) fit all these parameters.

They've been doing a big marketing push this year. It would be hard not to know about this, at this point. Was totally clueless last school year and then only found out mid-year this year.

MM(20) had told me at some point that his girlfriend was getting "food financial aid." So finding this out was a big lightbulb moment. This explains why she refuses to accept any grocery money. Obviously she knew about the food stamps. This is also probably the only reason we perservered with the red tape. Her parents clearly have a higher household income. If not for knowing she was eligible for full benefits, it would have been easier to write off that clearly MM(20) would never be eligible for food stamps.

Now that he is approved and he has his benefit amount, I'd say the truth is somewhere in the middle. They don't ask anything about assets, so that is not a factor. MM(20) will become ineligible any month he makes something like more than $2,800 (more than full-time minimum wage). They asked MM(20) for financial aid information, so they probably extrapolated our income/assets (at least a rough estimate) from that information.

I am still a little confused why the girlfriend is receiving the full food stamp benefit of $300/month. I don't know if it's because it's more 'all or nothing' if you have no parental support. Or if she was just being paid room/board at her on campus job (considered to have $0 income?).

The final answer is that MM(20)'s benefit is being pro-rated based on the support we provide him. It sounds like he will be getting $150/month food stamp benefits. This just happens to be the amount we were giving him for groceries. We reported to the state that we were "gifting" him $1,400/month (half minimum wage) for tuition/room/board/support. It sounds like if he is being gifted half minimum wage, then he gets half the food stamp benefit.

Of course, I will no longer be giving him food money (due to this benefit) and his rent is decreasing next year. So technically he will be eligible for a little more.

I already mentioned in the past that MM(20) is in the extreme minority re: low grocery spending. & MM(20)'s rent is also easily half of what it could be. It quickly became clear that he is only getting this benefit because A - he is uber frugal, and B - we give him very little support outside of tuition/rent. & C - he's also living off of his girlfriend's food stamps. It sounds like it's fairly typical for parents (at this college) to give students $2,000/month for just rent and food. That's not counting utilities, allowances for spending money, or any other financial support. Oh yeah, and that does not even count tuition! I was right to be skeptical about being eligible for food stamps. We just squeaked by because our personal situation just happened to fit inside the box.

How random is that, that the government wants to give him the amount I was giving him for food allowance? Technically, MM and his girlfriend are sharing $450/month. Even with her fancy menus, it's more than they can figure out how to spend.

MM(20) already bought up groceries for this school year (before he got the benefits), so this won't change my budget until next school year. But this will be a nice benefit for next school year. Fingers crossed, however many months he can get this benefit. (Ideally, for last 2 school years.)

Posted in

Just Thinking,

College

|

3 Comments »

April 21st, 2024 at 03:16 pm

I guess this is largely a MM(20) money update.

I thought we would go over MM's cash during winter break, but he ended up not having much of a break. I am surprised he still has any cash available, but he's been in extreme low spend mode and just stretching that $1K annual gift (using for spending money during college years). We touched base during his spring break. I think he had maybe ~$1,200 easily accessible cash. He was very *shrugs* about it, just needs it to last 3 months.

MM(20) did decide that he was probably going to cash out some or all of his I Bonds. But we decided to just wait and see what the next interest rate would be. & we left it that he will need to open a new bank account this summer (to park extra cash).

I just happened to notice two things last week:

1 - I Bond rate set for 2.97% inflation rate next round.

2 - One of our CUs is paying 5.5% interest.

The CU account is a mega interest account that was paying 4% when the average high yield interest rate was 1%. It's fallen behind in recent months, but that 5.5% is perfect for MM(20) to park his I Bond funds. The catch on this 'mega interest' account was that the cap was $5K for the mega interest.

I can't even tell you why I checked, but maybe it's just because it's been so long since either of us has kept a full $5K in these accounts... I figured I'd double check (if my memory was correct) and... The 5.50% is on the first $10K!

Note: We've already moved our own money over to take advantage of $10K @ 5.5%.

I let MM(20) know. He is cashing out his I Bond and moving most of that to his CU account. When all is said and done, he will have $10K earning 5.5%, $500 earning 7% (another CU), and $1,500 left in his checking account. Maybe only $1,000 left after a few more months of college spending. He will want to figure out a higher-balance high yield savings account at some point, but won't be necessary until he gets a job and starts piling up more money.

In other news, MM(20) has had his rental figured out for next year, for a while, but was still negotiating the cost of the bedroom he will be renting. I guess he got that sorted out and he told me it will be $808/month. He will be saving $42/month, for a much bigger room and nicer neighborhood.

Somewhat related, we need to cash out the rest of our I Bonds. I have been dragging my feet because I got used to the easy separate buckets of money. But I think I've only really been allocating this money to the kids 50/50 (in my mind) while it was doled out 50/50 into separate I Bonds. The truth is that this is a '2 in college at the same time' fund. I just needed a little time to wrap my brain around it. I am thinking about loosely earmarking $20K for future DL(18) rent expenses. & then earmarking the rest to MM(20). I would earmark all of the mega I Bond interest to MM(20). & also all future interest to MM(20), who is currently paying rent. This is very simplistic and easy to keep track of. I really only care about keeping the $20K for DL(18) if he is moving out this summer/fall (and if we are paying two years of rent for two college kids at the same time). So if we end up falling a little short, this $20K is money we can probably tap if MM(20) needs it. (At current, DL has no plans to move out.)

I wasn't sure if we would pay for MM(20)'s 5th year of college rent. We left it as a bridge to cross later. I wanted to give him ample notice if we expected him to chip in. But at the same time, wanted to give it some more time to see how things sorted out. He did his part. He's done a good job keeping rent costs down. I suppose when I tell him we are going to pay for the rent, will have to clarify that we can cover rent 'at this rent level'. (We also found out his 5th year of tuition will be free, because adding the 5th year is giving him a 4th year grant. I could just pull the 5th year of rent from his gifted college fund, if I wanted or needed to. Now that we expect he might have anything left in there).

MM(20)'s current lease ends in July and I think the new lease starts August 1? But he will be able to store his stuff there in the meantime. MM(20) expects to stay at this house his last 2 years of college. With everyone I know who rents being constantly kicked out by selling landlords... I would never presume he could actually stay there 2 years. But it would be nice if it works out. Just my past experience re: sky high real estate. It doesn't help that home sales just went from 0 to 100 overnight. But I would have laughed at the idea of counting on this rental for 2 years, regardless. We can only hope that it is that easy.

Posted in

Just Thinking,

College

|

1 Comments »

March 30th, 2024 at 03:03 am

My kids both received substantial middle class grants from our State this year, re: attending in-state public Universities.

I've tried to look this up (how to ballpark or estimate) in the past, but it's so complicated and depends on so many factors. Primarily, how many students are eligible. Because then funds are divided among eligible students.

So my mind was just blown when I figured it out. 🤯 I just had to dig a little deeper.

Side note: It appears that the kids' assets are not being counted in this formula.

There's other parts to the formula, but calculations below are just what was applicable for our personal situation.

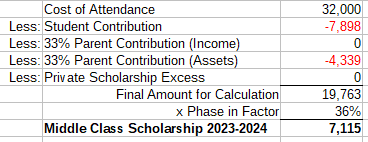

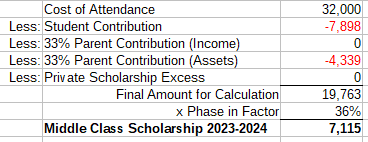

This is how the calculation went for the 2023-2024 school year.

MM(20)

Note: The cost of attendance is a ridiculous number that we do not pay. $20K is a more accurate number. $10K for tuition, $12K for housing, and maybe save $2K here at home re: less utilities and food costs. Eating is not a college expense. In this case, MM(20) spends way less on food at college than at home, so that is a cost savings for us. (& utility savings might be a few pennies on top of that.)

& all students are expected to be able to contribute the $7,898 re: part-time or summer work.

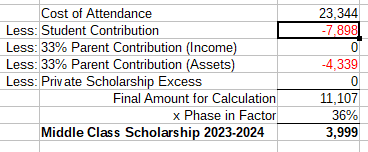

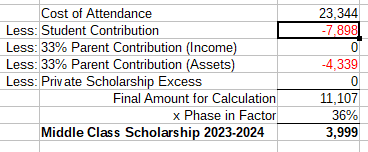

DL(18)

Note: The cost of attendance is a ridiculous number that we do not pay. We paid $8,000 tuition and DL(18) has some increased transportation costs with the daily commute to the college. The rest is food/housing allocated to 'students who live with parents', plus $3,000 misc. personal spending (nope).

I guess the key is the 'Phase In Factor' and is decided every year based on the budget. For now, the best I can presume is that the phase in factor will remain the same for 2024-2025. There is a lower 24% factor being used to estimate financial aid for 2024-2025. So that is the number the kids will get from their colleges. & then they eventually finalize this % later in the year. I am going to use 36% (same as this year) as a rough estimate of the actual dollar amount. It does not sound like the State has the budget to bump up this grant again next year. Which is completely fine with me. We are getting to a tipping point where more grant money means less college tax credits. So it's all kind of the same in the end, for us.

In the end, it looks like grant numbers will likely be the same next school year, unless CA budget numbers radically change that %. & of course, MM(20)'s grant might be a big fat $0 (if the decide he is already a senior, based on their methodology). I do not count on anything, but it's just nice to have a better idea how all of this is calculated.

I now understand that DL(18)'s grant is smaller because he is living at home. (& also because his college tacks on less fees). & I now know that it doesn't matter if either kid starts piling up assets (re: working or gifts). & I confirmed that there is no '2 in college at the same time' adjustment for this particular grant (re: our personal situation).

I also had no idea how much assets were penalizing us. I knew we were on the lower end of this income scale, so the $0 income adjustment makes sense. For the assets, we are penalized $140 for every $10K we add. I guess technically $280 (x2) while we have two kids in college. It would clearly be pointless to have less assets. That's less assets generating interest and stock market gains. & of course, if we didn't have the assets, then we'd be tapping retirement funds or taking higher interest loans, etc., to pay for college. Clearly we are better off just having *more* assets.

I keep distinguishing the middle class grants because we knew it was pointless to plan for any (need-based) financial aid re: middle middle class income and in-state public colleges (very low cost). That has gone as expected, but the middle class grants have gotten a big boost in the years since MM(20) started college. It could end up being a $40K windfall (roughly $20K per kid). & that is a really nice surprise.

Side note: MM(20) did get a nice one-year merit scholarship from his college. I've since been told that is not a thing. It was apparently a bit of a unicorn. Just to add to the, "Well that was unexpected," which sums up all of my kids' financial aid.

The next chapter: If I ever get to blogging about it. I found out in the Fall that MM(20) is probably eligible for food stamps. $300 per month! We are going to apply this weekend. Obviously should have applied sooner, but we are both in disbelief about it. Not 100% sure, but will just have to apply and see what happens. (Would have applied sooner if I knew 100% for sure that he was eligible.) These are also benefits being extended to the middle class.

Edited to add: Note to self: The new FASFA form does not ask if a student plans to live with parents. Just read somewhere it's up to the school to get that information and report it for our middle class grant? Something I will need to keep on top of when DL(18) moves out. Will want to make sure we get the extra grant dollars if we are paying for rent.

Posted in

Just Thinking,

College

|

1 Comments »

March 23rd, 2024 at 01:51 pm

I wanted to repost this because have had a lot of questions in recent years about things addressed in the past.

Our Big Picture feelings about college, per 2017 post:

https://monkeymama.savingadvice.com/2017/03/29/college_211895/

Of course, I could see how it would be interesting to update how things have shaped up, 7 years later.

We both agree that we expect the kids to work significantly during high school and college, that our own financial health comes first, and that we don't want to borrow a penny for college. We don't want them to graduate with any student loan debt. We are willing to help our kids in any way we can as long as we are within these parameters.

2024 Update: Tried to be open minded, but couldn't ignore the 'cost pennies colleges that everyone recruits from'. Both our kids ended up different State colleges, but are basically the third generation in our family to take advantage.

Our kids aren't working as much as we envisioned. One thing I don't think I said in this particular blog post was that our city has generally always been terrible on the employment front, and I of course recognize that an engineering degree might take more commitment than our business degrees did. That said, I think the pandemic is mostly what torpedoed my kids teenage working years. MH and I were very much, "You don't need a teen job around crowds of people." But also, there is an element of the kids not needing to work. MM(20) had a couple of strong working summers and has $10K+ saved up. With his grandparents helping, I feel very *shrugs* about him not working at all in 2023. DL(18) is a little further behind the curve and probably more impacted by the pandemic.

I think the point of my original post is we expected our kids to work and contribute. (Wasn't planning to buy them cars and pay for all their college expenses). But with grandparents giving them this gifted college fund and helping them, has bought them a lot of freedom not to work. I personally don't have any problem with it. I wouldn't personally just do all the work and pay for everything, but if the grandparents want to do that, more power to them.

Both my kids announced this winter that they were bored and they intended to work this school year. MM(20) wants to do all the things and so it took him 2+ years to get settled and figure out his priorities. But he knew he would have a lot of time in winter and spring quarter. I forwarded him an internship opportunity (for this summer) that pays $40/hour. If he could land that, he could make $10K in 6 weeks. Something like that. I am all for "working smarter, not harder". DL(18), I strongly encouraged to not work in the fall, to ease into college. He has thrived his first semester of college and he announced towards the end of fall semester that he was bored and could definitely work. He might not be able to find a low hours job (like an on campus job) until next fall. He did find a temp job and made about $1,300 this year already. I will feel a lot better about DL(18) once he finds a steady job and has enough savings to buy a car.

We personally have not tied up this money (re: gifted college funds) in college type funds because we don't have any incentive to. We would rather have free use of the money. We don't have a big enough income, but I do have enough tax knowledge, to not bother with 529 plans or other college savings options. To be clear, we are not paying any taxes on these investment gains. So we don't need the trade-off of extra hoops to jump through for tax breaks that we don't need.

Along the same lines, MH and I both used our "college money" for a home down payment instead. In a state where college cost pennies and housing costs are sky high, I think it seems very likely our kids will experience the same. So I don't want to be penalized for tying up their gift money for college when they more likely will use it for post-college housing. Ideally, we'd actually really like to pay it forward and save this in-law money to give them as a lump sum *after* college. I don't know if we will be able to swing it, but this is what we would like to do. & if we can't, we definitely want to do something like this for our grandkids. (I think if it was not for the in-law money, this would just be a "pay it forward to grandkids" goal).

2024 Update: DL(18) is currently on the 'living at home' plan and on track to use 100% of this college money after college. As of today, I think MM(20) might have $5K or $10K left after getting a 5-year degree. Very likely $0. He chose a much more extravagant college experience (5 hours away, in paradise). & even DL(18), who knows. The kid I thought maybe would never get more than a AA degree, he told me the other day he might want a PhD. He might find a way to use his $30K for college. I do have their gifted college funds parked in cash, while we expect to use all of the funds (MM) and while DL's plans are still so up in the air. We can talk about longer term plans for this money as longer term plans crystalize.

In 2014 we were in a position to start putting money away into taxable investment accounts again (in addition to fully funding IRAs). I guess college is the only goal at this point, besides retirement. Though I don't consider this *all* to be college money, it is certainly accessible if we need it for college. We are putting away about $7,500 per year. I think matching the in-law college money is a good place to start. It probably works out too that we will probably get there in another couple of years. At that point we may just back off and figure that $40,000/each is a phenomenal start. I think we'd probably most likely just focus on cash flowing the rest (if there is anything left to cash flow).

2024 Update: For MM(20), we've had a lot of windfalls to help with his rent. Pandemic funds and unemployment covered his first year of rent. & the in-laws have been giving us some gift money after they received an inheritance.

Our investments ended up getting to $40K and we have earmarked all of this money for college. Won't necessarily use it all, but have it earmarked for now ($20K per kid, to cover rent). I lost my job in 2018 and took a big pay cut, but also gained a work retirement plan. So we stopped adding to taxable investments (and was not able to match the gifted funds, which ended up being $30K per kid). I only added snowflakes (credit card rewards) 2018-2022. The money did get a big boost when I put it in I Bonds for much of 2022-2023. We turned $40K into $45K (while keeping the principal safe). I don't know if anything has ever come that financially easy to us. It seems there's always some obstacle or headwind, so I am really delighting being in the right place at the right time, just having this wad of cash for I Bonds when interest rates were nearing 10%.

I was able to resume (more significant) taxable investing in 2023. Our investment account just hit $10K. After saving for college, I wanted to save up $10K for MM(20)'s jaw surgery and related round of ortho. I didn't feel comfortable crossing off his college as 'done and paid for' until we had this covered. Not that it is a college expense, but it's a final expense we wanted to cover for him before he flies the nest. So I am eyeing this $10K and wondering if I should just call it. But I will wait for MM's grant to sort out his senior year (still not sure about that) and will wait for his lease to be finalized and to have real numbers. By the end of the year I should have a plan and/or be able to call it.

Edit: With the I Bond gains, the kids ended up with about $53K/each. Which yes, was a phenomenal start. That's $30K gifted funds ($1K per year, built up up over time), and $23K (our investments 2014 -2018 --> cash --> I Bonds --> back to cash). DL's money is completey untouched, as mentioned. But I have started to spend down MM's money from this $53K peak.

& to be clear, the investment account is up to $10K after completely starting over. (I can see that wasn't clear when I typed that out). 'College' money is all in cash. But we have been able to resume adding to taxable investments (more than just snowflakes) in the past year.

Since I worked my way through college, I think the idea of MH working + kids working seems easiest on some level (would be a LOT of cash that we could put towards college). But, I think the "saving ahead" is important just because you never know. Relying on future income streams is a little outside of my comfort zone. So while some part of me thinks that "cash flowing with several jobs" is really the most obvious and the easiest, we always have a Plan A + Plan B + Plan C, etc.

2024 Update: Plan A is working out pretty nicely. I mean, I am happy to have the "saved ahead" I Bond money too. But also, we are hitting some of our highest income years while our kids are in college, and so that is going pretty well. I stand by my decision not to divert large amounts of assets to college savings (or anything at all when my kids were very young). We started saving when we had the money and are mostly cash flowing with higher income during these college years.

Note: We are mostly using 'saved ahead' money to pay for MM's tuition/room/board (the more expensive college) while we have two in college at the same time.

We did also park extra money in ROTHs that we have never touched (starting when the kids were babies). I never would have put that much money in retirement otherwise, but was okay with it knowing we could use this money for college. I would have also been fine lowering retirement savings during these college years. Plan B was always, "We don't have to mega save for retirement".

Final thought: I've already said this many times before, but is worth mentioning. We planned for full sticker price (roughly $30K) for the State colleges. These college tax credits and middle class grants did not exist when I went to college and I never counted on any of this money. The grants and credits will bring the net cost of MM(20)'s degree down to about $15K and DL's degree will cost $5K (or maybe $15K if he takes 5 years). This is just a nice surprise that we did not plan for.

Also, I don't expect to be saving any more money for college after 2024. I think we will move on to other financial goals because we will be DONE.

Posted in

Just Thinking,

College

|

2 Comments »

March 11th, 2024 at 03:45 am

I've revised MM's estimated college costs, below. I also kept the old numbers (to the right), for reference.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$10,000 5th Year Tuition/Fees

-12,000 Tax credits (-10,000)

-21,000 CA middle class grants (-13,000)

- 6,000 Scholarship

---------

$13,000 Net cost ($23,000)

**I added in MM's $1K summer school class

I won't believe it until I see it, but I now believe that MM's 5th year will be entirely paid for with state funds and tax credits.

So, I just completed the kids' FASFAs for next school year (was delayed this year due to major revisions; I waited for all the kinks to work out before I bothered with it.) I logged into DL's account to make sure his GPA was reported by his high school.

I am still so confused because MM(20)'s state grant changed from '3 years' to '4 years' at some point. It was expected he would only get 3 years of grants re: college credits he went into college yet. He was already considered a sophomore when he started college (per state grant measures, but he would need a minimum of 4 college years to complete an engineering degree).

So I asked MM(20) to double check today while we had a video call. (He set up his own account; I don't have access). I also needed his college tax form, so was just taking care of business. It is still very clearly showing that he will get a middle class grant next year (Year 4). He told me that he is pretty sure that changed when he made his double major official (end of last school year). Which is *why* he is taking a 5th college year. So, wait. This means his 5th year will cost $0! If that's the reason and this is true, that is pretty sweet. I mean, he's getting a whole free year out of the deal of adding one more year of college.

I am still skeptical and will believe it when the money hits our account.

I also (at some point) crunched the numbers on a Year 5 college tax credit and it was a lot more than I expected. A full $2,000. & so I also added that to my estimate, and that will bring the net Year 5 cost down to $0.

In the end, net tuition/fees will be the same difference, if it takes 4 or 5 years.

I will have to check if MM(20) anticipates taking any more summer classes.

Posted in

Just Thinking,

College

|

0 Comments »

March 8th, 2024 at 02:41 pm

This is a Part 2 re: my last post. Realized I should have mentioned this with that post.

I am enjoying actually making interest on our cash. The 'Gifted College Fund' interest covered all of MM's college expenses during his junior year.

Interest received this school year: $950

Net Tuition Paid (after tax credits): $743

Class supplies purchased separately: $185

In the end, interest will roughly equal costs this school year.

(I actually skipped a $241 reimbursement, I think in December when I got my work bonus. So I only deducted $687 from college fund this school year.)

We didn't pull any expenses from the college fund freshman year. (We didn't intend to, but I think our net cost was $0 that year.) We pulled out $5,000 to cover Sophomore year expenses (we had less middle class grants & scholarships that year). $20,000 remains in this college fund.

I expect that MM(20) will have $0 left when he is done with college. His state grants are probably exhausted (this is still very unclear, but likely those funds will dry up). & he's added a 5th year, so will be a couple of roughly $10K years of paying full tuition. He understands that his choice to pay 5 years of rent in a high cost region, this means that he will not have any (gifted) funds left at the end. Choosing a very affordable State college still has many benefits, like MM(20) not having to work at all. Or us feeling *shrugs* about the 5th year.

Note: I have no plans to touch DL(18)'s gifted college fund, as long as he is living at home and paying roughly $1K per year tuition. If not used for college, it's his money to do whatever he wants with it.

Posted in

Just Thinking,

College

|

4 Comments »

March 6th, 2024 at 04:42 pm

The last week (er, two weeks) have been a whirlind. Mostly good things. MM(20) visited for dinner Friday night (over one week ago), we went to GMIL's 99th birthday party that Saturday, and MH got home from his trip that Sunday night. I paid off the travel credit card bill. We ended up using exactly that $3K gift money to cover the cost. (The goal was to cover a chunk of the costs. It's just gravy that it covered everything.) More details later, if I ever have any time. I had family visiting from the mid-west and MH needed to help his GMIL with a new computer, so we were in the Bay Area this past weekend.

I've got 2023-2024 college year mostly wrapped up. I mentioned (re: annual goals) that this won't be a big college expense year.

DL(20) received his state financial aid check/refund last week. So now I have a better idea the flow of things. Refunds arrive 11/1 & 3/1, roughly.

I received a $2,000 refund (spring semester) from DL's college and a $1,074 bill (spring quarter) from MM's college on the same day. I paid MM's tuition and checked off on my side bar that his third year is done and paid for.

Note: $2,000 is the net I should owe for DL's fall semester. Will just park the money in savings to cover the rest of his college expenses this calendar year. In the short run, the $2K will let me cash flow MM's tuition before I reimburse myself from various buckets. This semester thing is a lot more simple than the quarter thing.

For MM's tuition, I am cash flowing the tax credit ($833, or 1/3 tax credit). I have the benefit of reduced taxes, to pay this portion of tuition. The remaining $241 I will pull from MM's gifted college fund.

I did also cash out two of the I Bonds (end of 2023) and am able to reimburse myself monthly for MM(20)'s rent. We have never had more than a roughly 1% interest rate (or some promo deals on smaller amounts of savings) during our adulthood. I more viewed the I Bonds as an investment (that was mega interest for a while). Turned maybe $20K of savings into $22K+ for MM's college expenses (woohoo)! But now that I am cashing that out, I am really enjoying having some decent interest rates on our cash. Any incidental college expenses that MM(20) has at this point should just be covered by interest. This is also how I am funding his utilities. I am leaning towards just hiring a cleaner (with this interest money) when MM's lease ends.

In other news. Very cautiously optimistic but... It sounds like the girlfriend is bouncing back? She told me that she unexpectedly felt well for a whole 5 days and that she was traveling to visit MM(20) for a couple of days. She is doing so well that those 'couple of days' has turned into 2 weeks. MM was just telling me she extended her stay so that she could go down to LA and visit her cousin's baby or something like that. I had no idea if they found some underlying condition (had more answers), found meds that worked, or what happened. I spoke to MM(20) a couple of days ago and he told me that she is just getting better, as they said would happen. They just didn't know if it would take months or years. My recollection is that she has been down for 5 months. It sounds like she is putting this chapter behind her.

Posted in

Just Thinking,

College

|

1 Comments »

December 3rd, 2023 at 05:52 pm

Yes, the state wants to give us $11,000 for college this year. MM(20)'s fall quarter refund finally showed up. I wanted to pay his winter tuition that week, so the timing worked out perfectly.

I believe it now. It's real.

Here's an update of MM's expected college costs, with the 5th year. He did officially get his double major approved and so 5 years is the plan.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$10,000 5th Year Tuition/Fees

-10,000 Tax credits

-13,000 CA middle class grants

- 6,000 Scholarship

---------

$23,000 Net cost

**I added in MM's $1K summer school class

Of course, nothing is easy. *sigh*

The girlfriend is still very ill. I just looked back at texts and it's been 6 weeks since MM(20) first took her to the hospital and she was hospitalized. She's been in and out of the hospital this whole time and they don't know what is wrong with her. This became more apparent during Thanksgiving week when MM(20) was home and he filled us in more on what was going on (and he was probably more in the loop; the girlfriend has moved back home in our city for the meantime). I presumed she was on the upswing but I texted her about something or the other yesterday and she told me she was having a bad day and was being put on heart meds. Very short term, I am sure that they are starting to wonder if she can feasibly go back to school in January. Longer term, lord knows. 😟

Posted in

Just Thinking,

College

|

3 Comments »

October 22nd, 2023 at 02:10 am

MM(20)'s mega I Bond interest expires the end of November. Will cash out and move to his high interest savings account. It used to be 'mega interest', but is below average these days. & the cap is $5K (on what used to be mega interest). I just put it on my calendar to have him open a high yield cash account when he is home for Thanksgiving break.

This reminds me, I've seen that Chevy is starting to release Bolts that they bought back during the recall. Put in new batteries and these cars have brand new 8-year warranties. They've been flooding the market, similar to how it was when we bought the car (we bought when they were coming off lease and flooding the market.) The pricing is similar, at $15,000. The kicker is that today there is a $4,000 used EV tax credit. This could be a $11,000 car purchase, plus tax on the larger sticker price. It's a little early and I know that it's more than MM(20) wants to spend. But I thought he might be enticed by the very inexpensive fuel (which would probably mostly be free.)

I wouldn't buy one of these cars before 2024, and we'd maybe miss the boat. Why 2024? Because dealerships will be able to advance the tax credit. So no more wondering if uncooperative dealerships are going to figure out their crap. $4K off the top or we walk. & also, the new rules will be much more lax. Many instances where you can take the credit up front and not have to pay back if you are not eligible. I'd have to do homework on that. There is a 20-page IRS FAQ that I have not looked at in any great detail. But I get the jist that all is this is going to be much easier and more favorable in 2024. I still expect dealerships to be uncooperative and mostly clueless. But the up front tax credit will be make or break the deal for the 20yo. Who most definitely does not want to spend $15K on a car.

I brought it up, but MM(20) told me he doesn't want a car next school year. That's news to me! The only thing of note that has changed is that he has a bike this year. He may be finding that is more than enough, for transportation.

The other big financial update is that MM(20) has committed to a 5th college year. He was a little wishy washy about his major and changed it a couple of times. Finally decided he just wants to double major. So that will take 5 years. There's some non-academic reasons also for him wanting to take 5 years.

I can very much relate. Very different reasons, but I also had several reasons I took 5 years to finish college. So I asked MM(20) early this calendar year if he thought he would finish in 4 years. I was surprised when he said yes. At that time we told him we had both taken 5 years to finish college. I am glad we had this discussion because I want him to do it right the first time. I think he felt like he had to finish in 4 years. & so he started considering this other major when he had more time (I think he'd need 4.5 years to switch?) & then after getting two major changes approved, he just got approval to just double major in both of those majors.

Of course, I think this would have been around when he would be deciding if he wanted to do a 5th year Masters program. (Another reason I didn't just presume he'd be done in 4 years). Some of this decision is that he doesn't want to do a Masters program at all. I am surprised, but makes it an easier sell. If he's really going to be done with all his schooling in 5 years, this is a pretty good deal.

The tuition part is easy. He's got just about enough cash left in his gifted college fund to cover Years 4 & 5 (when he won't be eligible for grants any longer; no tax credit that 5th year). This is exactly what the gifted college fund is for. To give him more options.

As to housing, I have no idea. It's years away and so we will keep saving. It could be that we expect him to contribute more during that 5th year. I just don't know how that will shake out. It also could likely be moot. I have two years of rent saved up for DL(18) already. It's how it's always been with my kids. MM(20) was the one who always wanted to do 2 or 3 extra-curriculars while DL(18) wanted to do zero. MM wanted to go on all the big trips while DL didn't want any part of that. MM wants to go to school 300 miles away. DL needs a slower transition into adulthood. It might just be the ying/yang it always is. I've always been able to afford all this for MM because his brother is uninterested. & so it might just be how college shakes out too. I've got rent money saved that DL(18) might not end up using.

In the meantime, I just keep saving for these college years.

Posted in

Just Thinking,

College

|

0 Comments »

September 6th, 2023 at 02:16 pm

I discussed with MM(20) and we are just going to send him a $1K monthly allowance for rent and groceries. Just for simplicity, as we switch to monthly housing costs. I was just paying quarterly (with tuition) when he lived in the dorms.

MM(20) only spent ~$80/month on food last school year. 🙄 & he looks starved. So I am leaning on him to spend more. I don't know that he will spend more, but I am trying. I will be sending him a flat $150/month for groceries.

Why $150? Because it makes it an even $1,000 per month, with rent. & I presume that about doubling his grocery budget should be more than ample.

I saw a conversation in the parent group recently, about what to expect to pay for food (for kids living in apartments with kitchens). $400 - $600 was pretty much all that anyone recommended. 😲 I just presumed that included eating out costs, but there were comments about how "this can be done if you meal plan" and stuff like that. Still, clearly has to be some eating out costs. MM(20) never eats out, and I expect that is most of why he keeps food costs down so low.

There was even a comment how if you don't give your kids at least $500/month, it's not fair to roommates because obviously your kid would have to steal their roommates' food.

I often feel like I live on a different planet, and this is one of those moments. The only relateable comment was someone who has a $250/budget for their kid who shops at Costco. If I can get MM(20) to actually spend $150. & I know a lot of it is that he gets a lot of free food from the girlfriend, and some free food from clubs and so one. I expect $250/month would be a decent grocery budget for MM(20) if he didn't have the 'free food' factor. (They aren't eating ramen. They are eating 4-course meals. The girlfriend is quite a chef.) Not only that, but they also take turns cooking for 2 (or more), which clearly helps to reduce their food costs.

It will be interesting to see how this year goes. With less roommates and me pushing him to spend more on groceries, he may spend a little more. He doesn't have to share a kitchen and fridge with 4 other people. That should allow for more cooking and leftovers. More room for leftovers, if nothing else.

The question mark this year is utilities and other expenses. Moving from an "absolutely everything is covered with rent" situation to a "nothing is covered with rent" situation. But the utilities should be so minimal that I think I may just reimburse him twice during the school year. & once I have a year of utility data, might just roll that into a flat monthly allowance for future years.

The school had even covered cleaning supplies, so that will be a new expense this year. I don't know how much MM(20) will pay for laundry this year and how much he will just do laundry at the girlfriend's house. (Laundry was always free in the dorms). I am sure there's things we have not thought of.

I did give MM(20) his $1K college gift this year, to use towards furnishing his apartment. Seemed the best use of this money for this school year. In the end, he's found everything for free. He even had a free bed/mattress at some point (that fell through). & he found a free bike. As of this moment, he still needs a mattress. & he might need some kitchen stuff, depending on what the roommate brings.

Posted in

Just Thinking,

College

|

5 Comments »

September 6th, 2023 at 02:46 am

MM(20) had an estimated $4K state (middle class) grant per his college. I mentioned in a prior post that $4K was my "pulled out of my butt" estimate and didn't know what to make of it. His grant had been $2K his first year, then $3K. Well, it sounds like the school basically used my estimate method. Figured he might get another $1K this year.

In the meantime, MM(20) was out of town for the long weekend. I cornered him when I got home from work and had him log in to check his grant. The dollar amount went up by $4,000 this year. What the heck!?

I had read somewhere over the summer that "the dollar amount depends on the specific school." But I was second guessing this when DL(18) wound up with the $4K amount. I just presumed both the kids would get the same $4K amount. I was stunned when MM's grant came in at $7K!

MM's expected net college costs:

$42,000 Tuition/fees**

-10,000 tax credits

-13,000 CA middle class grants

- 6,000 Scholarship

---------

$13,000 Net cost

**I added in MM's $1K summer school class, so brings the grand total tuition to $42,000.

The one thing that is really unclear is if MM(20) will get any further middle class grants. The state is treating MM(20) like a senior because he started with so many AP/IB credits. For planning purposes, I presume this is all the financial aid he will get.

I suppose you never know how things will sort out with future scholarships and everything. Lord knows I was surprised this year.

At the end of the day, this grant is an extra $3,000 in MM(20)'s pocket. I was paying his tuition from his gifted college fund. With this news, he should end his junior year with $20K cash (gifted college fund), same as he has now. I think technically will be pulling out ~$800 for tuition this junior year, but he will be able to make that back (in 12 months) with higher interest rates on cash account. If there's anything left after college, this money is for him.

Edite to add: Have been told that the college will sort out grants end of October. Hopefully before we pay the next quarter. It will be hard to believe until the college deducts it from MM's tuition.

Posted in

Just Thinking,

College

|

5 Comments »

September 3rd, 2023 at 03:04 pm

Enjoying a nice bout of cooler weather. & the clouds/sunsets that come with the cooler weather.

I got some more firm college numbers for DL(18). Woohoo!

I've been following actual CSU college numbers (over the decades) and planning for $30K (sticker price) degrees for my kids.

Actual cost = $30,400 at DL's specific college. It looks like it will be closer to $32K with parking permits (over 4 years). I am considering that as part of tuition/fees, since the parking is kind of necessary to be able to commute to the college.

Up until this afternoon, that's all the info I had. $32,000 degree minus $10,000 college tax credits = $22K max I expect to pay for this degree.

It sounded likely the kids would have similar state middle class grants, but I was second guessing because I recently read it depend on the college. & for all I know, DL(18) didn't get the paperwork in. I don't know! I had this number in April? when MM applied to college, but I didn't know if I'd get this number (for DL) until after I paid for DL's first year of college. Or like 9 months later. 🙄

But I saw the topic come up in the college parent group (MM's college) today and it looked people had real numbers. What!?

DL(18) got a $4K grant! (I was able to log into his state grant account). I am so relieved that everything went through.

The best part is these grants are increasing every year. Was more like $2K MM's first year. Then $3K. Then $4K.

DL's expected net college costs:

$32,000 Tuition/fees

-10,000 tax credits

-16,000 CA middle class grants

---------

$6,000 Net cost

Probably minus some increased middle class grants in the future, which could easily net out this cost to $0.

Of course, it's not quite so simple. The tax credit thing gets complicated. If middle class grants increase any further, then the tax credits will decrease. & I mean, we won't even get the full $2,500 tax credit this first year. But I feel pretty confident saying that DL will probably pay no more than $5K for his degree (if he can finish in 4 years).

It sounds like most likely I won't get any refunds from DL's school until next year. His tuition (full sticker price) and parking permit will be $4,000 for the spring semester. Due end of December maybe? Early January? But the school will owe me this $4,000 (grant) refund, so that should be a wash. Because of this, I've checked off DL's freshman year as done and paid for. In my sidebar. The $4K cash already paid should be all I need to come up with for the next 11 months. Phew! Feeling relieved because the money drain was pretty crazy in August/September. Paid college x2, medical bills, last minute vacation and so on.

The planner in me is very happy. We plan to just cash flow DL's college expenses (with income). I didn't think it would amount to much more than $1,500 per year. But it's nice to have firm numbers and a more firm plan.

DL(18) is just living at home, so no other college expenses to figure out. I mean, he's got a bigger commute now, but he is covering those expenses.

Posted in

Just Thinking,

Picture Project,

College

|

2 Comments »

July 8th, 2023 at 01:37 pm

MM(19) got out of jury duty. Didn't have to go in, and was freed Wednesday afternoon. He bought train tickets the second he got the news, and headed to LA. The prior weekend he went re: school club and had most expenses paid for. Last weekend he visited the girlfriend, who has a job down there. The train was pretty fast and it was cheaper than gas. I gave him $40 for food. Because the GF watched our cat while we were out of town, and refuses to take money. So I told him to try to make her take the cash. & if she won't, then to take her out to eat. Or buy her groceries or whatever.

I just noticed that MH's larger mega savings account bumped up to 4%. It used to be 3.5% or something like that, when everyone else was paying 1%. But they had been slower to adjust re: recent interest rates. I moved my money out personally (it had dropped down to 2%), but I thought it might be worth MM(19) waiting it out. That surely they would adjust. I see now that they went up to 4% on April 1. That works out well for MM(19). He only has $2,000 in there right now, but he can put any summer earnings in this account.

I also noticed that MM(19) is done with 9.62% rate on I Bonds. Will bump down to ~7% for the next 6 months.

MM(19) ends the school year with $937 more than he started with.

+$445 interest (10 months)

+$202 credit card rewards

+$1,115 TA job (one quarter)

-$825 Misc. Spending**

Net = +$937

**I don't have any details re: his spending. It works out to spending ~$82.50 per month during the school year. Off the top of my head, this would be contributing gas to GF and gas re: multiple trips to LA during the year (school club), meals out (mostly when on the road), toiletries, haircuts, and any personal spending, books and school supplies, etc. Net of credit card rewards on his newer credit card (that I have no access to).

Not included above, I sent MM $800 for groceries. That works out to $80 per month. Which is ridiculous, compared to the $300/month he eats at home (in less expensive region). 🙄

I know he gets a lot of meals from the GF. If I thought literally he was only eating $80/month food, I'd be more concerned. But I am guessing he gets at least $100/month of food from his girlfriend.

We will have to have some discussions and figure out next year. Paying rent quarterly to the school (with tuition), I have just been reimbursing MM(19) grocery expenses once per month. But with the off-campus housing, I'd like to just send him a monthly allowance to cover room and board. (Because will also be paying rent every month. Just want to do one monthly reimbursement). I think $150/month might be more appropriate for groceries, but want to make sure he is spending a little more and eating enough. So we need to talk about that.

Bigger picture, MM(19) has $11,700. & that's just more liquid cash. He also has college funds and ROTH IRA. Last we talked about it, he's thinking of buying a car next summer. But he's been very wishy washy on this front. He seems hell bent on going very cheap with the car. Unfortunately, I don't think the 20yo kids' car has given him a realistic view on car expenses. It didn't need a repair for the first 4 years (when he was paying for all of the expenses). Dude, if your grandparents *and* your parents are happy to pay for your college. Take the money and buy a nicer car that will last you a very long time. We did too good of a job setting our kids' car expectations, but I didn't know they'd just be handed everything (car + college degree). I think MM(19) could easily buy a $10,000 car that will last him a very long time (if he waits until he is 21 to buy a car).

Well, I got sidetracked re: kid stuff. I just wanted to see how the school year shook out for MM(19). Before, I really had no idea how much spending money he would want/need re: college, and was tracking just to get an idea about things. At this point, I have much less access to his finances and he's clearly got enough money to cover expenses. The next chapter will be figuring out how to handle the monthly expenses next school year. I should probably just transfer him rent money for July. His first month rent must be due next week. Off campus, he's stuck with a 12-month lease.

I am checking where we are at with things. I have $11,200 I Bonds set aside for MM's junior year rent. In my mind it was $10K (original investment) and I only had 11 months of rent covered. But I am going through the math and I think I have 12 months rent covered + about $85/month to cover utilities. With the interest earned on these I Bonds. This is my big chore for next week. I need to sort out insurance with the rental company and make sure MM(19) gets his first month's rent paid. Utilities won't start to sort out for another few months.

Of course, I am still getting ~7% on these bonds, so I won't be cashing any I Bonds out soon. I will just cash flow rent and reimburse myself when the interest rate drops down (December). I'll be draining our cash down in the meantime. But mostly this is money we want to use to fund our IRAs (when the year is over). So it works out pretty well. I'll have a $6,000 chunk to cash out in December and will just move over to IRAs. In 2024, I can just pay the rent with I Bond money every month.

Even though the I Bond money is tied up for another 6 months, I am pretty happy with where we are at re: MM's college funds. I am just presuming that he will get the usual $1K college gift from in-laws (this month) and will be able to use that money to furnish his apartment. He's not going to need much and will mostly buy used. I think we can stretch that money out to furnish his apartment and also get him a very used bike. (No point spending any money on a nicer bike that will just get stolen).

Well, I started this post a bit ago. I leaned on MM(19) to call the leasing office. He needed to talk to a human because I don't think anyone plans to move in until September. Found out he needed a cashier's check for the first month rent. He just happens to be in the college town this weekend, so it worked out. He had time to go to the CU and will drop off the check this weekend.

MM will be traveling to the college town two weekend in a row. But the leasing office is closed weekends, so I don't know when he will ever get the key to his apartment. He seems very "meh" about crashing in completely empty apartment. Would rather just crash with friends in their nice furnished houses.

(Yes, this was after two weekends in a row in LA. He is alternating work trips with vacation trips. I think next weekend is just a big birthday weekend. I think he's staying at someone's fancy pants parent's house on the coast).

I put it on my calendar that I will need to start sending him rent money before the 1st of the month. July was easy with the partial month, but I guess technically will need to send him a second bigger check this month, before August 1.

Posted in

Just Thinking,

College

|

0 Comments »

April 24th, 2023 at 11:34 pm

MM(19) sorted out his housing, as I expected he probably would. He was just being a little too *chill* for my liking. While I worked on the backup plans for the backup plans. But he had a few irons in the fire and I was giving it some time before I dove in too deep. So it ended up taking very little time or mental energy on my part.

He found this rental the day after the RA position news. But then he hit a red tape brick wall with the management company. It took about 10 days but they finally let him apply. (In the interim, I had given up on this option.) He let me know Friday night that he had signed the lease.

It was the Goldilocks option, as to price. Not the most ideal situation overall. But certainly could be worse. Was otherwise considering a $500/month "job on campus" living option (that was problematic on multiple fronts) and a $1,500/month room. Ended up in the middle. He won't need a car, and it has a kitchen. So these are all pluses. I found a rental last week and then later realized it didn't even have a kitchen. So I started wondering if that might be a sacrifice (which could end up being costly re: food costs). But being able to not have a car is probably the biggest savings factor.

Would prefer to just live on campus another year, but they have very few spots for juniors/seniors. I mean like 500 spots for 10,000 students? Something like that. & they maybe also reserve some housing for transfer students.

Wait. Does this mean we are done saving for MM(19)'s college!? With this rent locked in and knowing it will be so much easier the following year (with an earlier start)?

My first instinct is that I want to keep saving for the "crap happens" factor. The obvious that comes to mind is if we do get stuck with this (whole) lease for any long period of time. If the roommate backs out for any reason. Stuff like that. In addition to all the other infinite ways that crap can happen.

When this day did come, I thought I may take a breather before circling to finish off DL(17)'s college costs. But now that I am here... I will just keep saving, for whatever kid might need it. I just want to be *done* so that we can move on to other things. I think DL(17)'s college costs are well covered. But he is also my wildcard. More likely to take longer, to drastically change plans later (finish school out of state), to drop out. I don't know.

So my first instinct is to just keep saving for whoever needs it.

Then I remembered that MM(19) has a whole other round of ortho, plus surgery. Should probably keep saving for that. It's not college, but it's one last thing before he is self sufficient. It kind of gets wrapped up in this ball of final costs (mostly college) before we are done financially supporting him.

I will ponder all this more as I formulate 2024 goals in December. If it wasn't for the whole ortho factor, I'd probably just start a "for whoever needs it" college top off fund. But I expect I will probably be leaning towards some more MM(19) savings first.

Not ready to call it yet, but getting very close!

Posted in

Just Thinking,

College

|

1 Comments »

February 22nd, 2023 at 04:11 pm

We expected the economics to be the same for our kids as it was for us. Cheap college. Completely absurd post college housing costs. We preferred to keep any "college money" for after their college years. In the end, this is even more true for my kids. They will pay less (than we did) for their college degrees. Housing has only gotten more absurd.

That said... MH had the free ride but he also just lived at home during college years. He told me he is not interested in saving MM(19)'s college fund while we pay for completely unnecessary luxury costs like housing 300 miles away. The "Far away college" was not necessary to get him the same quality degree. I am 100% on the same page.

For MM(19)'s freshman year I did not agree this was entirely fair, because MM received a (one-time) scholarship at this other college. It would have cost him the same to live at home the first year. But for this school year, I do appreciate the load off my shoulders. Phew!

We both want to leave some of this money for the kids, as long as they are choosing affordable degrees. But for MM(19), it's just not going to be *all* of it.

We've been kicking the can down the road as much as possible. Wanting to rely more on saved money when we have two kids in college at the same time. & then all this financial aid delay during this school year. Have been waiting for that to sort out.

But now it is time. We agreed to cash flow MM(19)'s rent this year. Food costs are just being carved out of our grocery budget (no new spending.) & we will pull tuition from MM's college funds.

The Gifted College Fund

This is a $1K annual gift from the in-laws, since birth. MM(19) has probably received ~$20,000. (I think one or two years might have been forgotten/skipped). This gift has grown to $30,000 over time.

I did give him the $1K gift for spending money this college year, but he just put this money in I Bonds (along with his earnings last year).

In 2020 MM(19) had a big earnings year and we put $5K of this gift into a ROTH IRA.

This leaves him with $24,300 today, that is just sitting in cash.

We paid $0 tuition last year and so we did not pull any money out from college funds.

We will pay $4,300 tuition this school year. This works out pretty well. I will draw this account down to $20,000, reimbursing ourselves for the $4,300 tuition.

I want to remember that with the ROTH IRA and the I Bond money, he technically still has $26,000 of this gift money left. & he might receive another $2,000 from the in-laws during his college years ($1,000 x 2 years).

Next Year

DL(17) will most likely live at home and go to the local State college. We will not touch his college fund. I expect to pay ~$2,000 tuition in August and ~$2,000 tuition in January.

Note: Will also get a $2,000 college tax credit; net cost is ~$2,000 for the year.

We will pull MM(19)'s tuition from his college fund. It will be $2,000 tuition in August, $2,000 tuition in November, and $2,000 tuition in February.

Note: Will also get a $2,500 college tax credit back; net cost is $3,500 for the year.

I will cash flow the tax break, and so will pull ~$1,200 from MM's college fund every quarter. I'd like to just reimburse ourselves every quarter, but will need more timely financial aid information in order to do that. With two in college at the same time, I might err on just reimbursing what we actually pay and then putting back any financial aid refunds. If it's anything like this school year was.

The above numbers presume $0 scholarships.

Unknowns

There's still a lot of unknowns re: next school year.

DL(17)'s situation is very cut and dry with the whole living at home thing.

MM(19).... Where to begin!

There is a lot that has to sort out re: housing. He's trying to get free room/board or deeply discounted room/board re: RA position or other on-campus jobs. He's trying to get on campus housing (as a backup plan.)

Financial aid is supposed to be favorable with two in college. This means nothing for DL(17) if he lives at home. For MM... I don't fully understand what this means. If our "need" is $15,000, do they give us $15,000 next year? I was going to say they've only offered us loans for negligible amounts of "need" in prior years. But I guess to be fair, the school also knew that they were giving us scholarships and they knew the state was giving us aid. In reality, "need" has been covered in past years.

MM(19) might fare better with scholarships if he does demonstrate need.

I am just preparing financially re: what I do know, and any reduction in expenses will just be gravy.

Update: I transferred the $4,300 to our checking account and paid rent for the rest of the year. I really enjoyed paying this expense with someone else's money. 😁 The rent bill just happened to match the $4,300 figure and I can pay it now. I can't pay tuition until MM(19) registers for classes.

Posted in

Just Thinking,

College

|

2 Comments »

February 15th, 2023 at 01:44 am

Received $94 bank interest for the month of January.

Received $246 I Bond interest for the month of January.

Snowflakes to Investments:

--Redeemed $36 credit card rewards (cash back) from our grocery card

--Redeemed $96 cash back on Citi card

--Redeemed $21 cash back on dining out/gas card (& grocery rewards from Q4 2022)

Other Snowflakes to Investments:

+ $7 Savings from Target Red Card (grocery purchases)

TOTAL: $160 Snowflakes to Investments

Snowball to Savings:

+$1,300 MH Income

+$ 250 MH Award Money (Script Contest)

+$1,130 College Refund

+$1,050 State Inflation Relief

-$ 700 Stereo System + backup camera (kids' car)

401k Contributions/Match:

+$563

Savings (from my paycheck):

+$ 250 to investments

+$1,000 to cash (mid-term savings)

Short-Term Savings (for non-monthly expenses within the year):

+$1,500 to cash

-$1,200 Home Insurance

-$ 360 Auto Repairs (kids' gas car)

-$ 210 Annual Movie Pass (Regal)

-$ 175 Museum Membership

TOTAL: $4,898 Deposited to Cash and Investments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Hybrid Miles Driven: 605

Fuel Costs: $16 Electricity

(assumed 50 miles & 14 KwH per full charge)

Electric (EV) Miles Driven: 1,516

Fuel Costs: $21 (home) + $46 (out)

(assumed 300 miles & 60 KwH per full charge)

Most charging (both cars) was done at home or at free chargers.

Lots of driving this month. One college trip (round trip ~650 miles), one Bay Area trip (~250 miles) and then MH traveled about 140 miles roundtrip for a San Francisco trip. He drove 70 miles and then took the train the rest of the way.

The hotel charging was expensive, $23 for a full charge. Is more in line with gas prices. But was worth it and very convenient to just charge up the car all the way, overnight. The rest of the charging expenses will decrease substantially in the future, with warmer temps and more efficient EV tires.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note: I am always lagging a month behind because any bills charged in December will be paid off January 1 and reflected in my January numbers. I charge in one month and the next month I figure out how to pay for everything (if I need to pull anything from savings). So this update reflects December spending & January savings.

I chickened out about sweeping MH's income (above $1,000) to investments. I am struggling with feeling a little "cash poor" after that big mortgage paydown. We just bought a second set of new tires (when the first were a bust). We will have fence replacement expenses soon. & while in storm/fence/tree mode, will get our trees trimmed. There's college expenses in February, and $12,000 I need to send to IRA for 2022.

MH did unexpectedly receive some Holiday pay (for the week after Christmas). I suppose some of this is moot because I didn't expect that MH would bring home much in January. That was just a nice surprise, but we are also trying to get these tires covered. With unexpected money, ideally.

It should just be a short term stress. Will add back some buffer quickly, these months that MH is working. & college expenses should be pretty minimal until August. I am going to pull some money out of college funds, for the first time. Tuition for the whole (academic) year, which will offset MM's last rent bill for the school year. & the two refunds I just received from the college will be all I need to cover tuition. Just parking the refunds until it goes back out again.

I had written off our inflation relief check as lost/stolen. Tried to call three weeks ago. Was told I had to wait until January 31st to get a replacement card. The original showed up in the mail on January 30th. Phew! That would have been so irritating to cancel/replace and then just have it show up the next day. I applied to the car stereo purchase, which was the original plan. (I don't remember if that was the original original plan, but was easy to justify the stereo upgrade knowing that this money was coming.) I suppose that works out pretty well. The rest, and MH's unexpected Holiday pay, should cover most of the tire purchase.

January was clearly a big cash boost, and I do appreciate it. MH also finally got that $250 he won a while back.

I was just updating sidebar. I am just going to call it. MM(19)'s first two years of college paid for in cash. I won't send the final 2022-2023 payments over for another few weeks, but clearly we have the cash to cover it. Extra so, if I am just applying recent college refunds and pulling from college funds. I put this *goal* more in my sidebar as a clarification. The feeling of it is *shrugs*. It's less of a goal and more just how we roll. It's also fairly official that DL(17) will be the 4th person in our household to take advantage of CSU (CA State University). This is just solidifying my *shrugs* feelings about the cost of college.

Posted in

Just Thinking,

Budgeting & Goals,

Investing,

Credit Card & Bank Rewards,

College,

Electric Vehicle (EV)

|

2 Comments »

January 12th, 2023 at 04:04 pm

DL(17) was officially accepted into the local State college. They give very high priority to local high school students. I think it only took this long because their business college is impacted. He was getting a little stressed that his less studious friends were getting immediately accepted. So I know he is relieved that it is official.

I think there's probably a 90% chance he will stay home and go to this college. Has been leaning that way as more of his friends are choosing to go to this college.

This is the only college he applied to. His first choice (was) a Bay Area community college.

With Federal tax credits and state middle class grants, we are talking $6,000 for his 4-year tuition. (Full sticker price is $32,000).

This is why we did not spend decades saving up for college. The kids also both received ~$30K from in-laws for college. I knew this would cover a 4-year degree. I've been basing this off of full sticker price (in-state). Projecting future college costs (in the past) and concluding that $30K would cover tuition. I have never counted on tax credits that come and go. I had no idea we'd get so much middle class state aid. So pretty much we had set aside the full sticker price but are not paying anything close to that.

Posted in

Just Thinking,

College

|

5 Comments »

January 2nd, 2023 at 02:16 pm

I am memorializing goals in my sidebar. I kind of like the format I used last year, so will stick with that.

Pay cash for college ✔

$10K to Savings ✔

Final tally was $11,412. The plan was to use this money to pay cash for college. At the end of 2022 we had roughly -$0- cash plus emergency funds. So that's about how it sorted out. That we had just enough to cash flow college.

$2K to Investments ✔

Funded with snowflakes.

I topped off with $100 from MH's income, to make the full $2K.

9% Income to Work Retirement Plans ✔

MH and I both contribute the minimum for 401k match. The 9% includes employer contributions.

$12,000 to IRAs 2022 ✔

Done. We won't fund until we do our taxes and the year is over. But we did end the year with an extra $12K set aside for IRAs. This is mostly thanks to annual cash gift from in-laws.

Bonus Goal that wasn't in my sidebar:

Extra to Mortgage ✔

We threw my bonus and gift money ($8,000) to the mortgage to pay down the balance to $99,999. Woohoo!

The $8,000 extra payment shaved off 1 year of payments and $4,600 interest.

Why $8,000? I did want to hit the psychological milestone of being done with six figure debt. But this also puts us down to a total of 32 years of mortgage on our current home. While my bare minimum goal is to knock that down to 30 years, the recent big chunks will allow me to put the mortgage on the back burner during these college years. I can whittle down the last two years with much smaller snowballs. I guess my bigger goal is to not (feel the need to) throw bigger chunks to the mortgage for a while. This goal was satisfying on many fronts.

This was just more of a hope or a wish, versus anything that we would have been able to achieve with our income. It wasn't on my sidebar, accordingly.

Edited to add: We ended up funding only one IRA in 2022 ($6,000). I used the other $6,000 for Invisalign for myself. It was a rather last minute decision in early 2023. I would have done this instead of the mortgage, if I had known sooner. I wanted to reflect in goals, but as I type it out, the money was saved. It was just redirected at the last minute.

Posted in

Saving,

Just Thinking,

Budgeting & Goals,

Investing,

Home Ownership,

Financial Independence by 50,

College

|

1 Comments »

December 23rd, 2022 at 02:28 pm

I transferred over a whole whopping $136 to MM(19). $78 for 30 days of groceries (???) and $58 for his one way train ticket home. His girlfriend gave him a ride back to school after Thanksgiving break.

To be fair, he charged up ~$25 on my Target card that I just paid for. (Might have included non-grocery expenses that I'd expect him to pay for.) & he told me MIL bought him some groceries but he made it sound like it was only $10 or $20. (That he didn't really need anything, the weekend she visited.)

The girlfriend is feeding him a lot. I was planning to get her a grocery gift card for Christmas. Because she never accepts money (for gas or anything.) I asked MM if her parents were paying for her groceries, wondering if that wasn't very exciting gift for her. (Though maybe I owe her parents, in that case.) But MM(19) told me that she was getting financial aid for her groceries. I share because I think MM(19) is greatly benefitting from her free food.

MM(19) is applying for a RA position. Fingers crossed! I never in a million years would have guessed one of my kids would want to be a RA. & honestly, not even really sure what his motivation is. He gets "free" room and board regardless (we are paying). His ultra frugal genes are his motivation, I guess. & I think he just wants to be more independent. Unfortunately, is going to make housing really difficult (scrambling last minute re: very impacted housing) if he doesn't get the position. But I am feeling pretty zen about it. I can be zen for the chance to save a bajillion dollars. Will see...

We did just get DL(17)'s State college application submitted. We had the nice surprise that his high school will pay for one CSU application. (They are trying to figure out what to do with extra pandemic funds.) I put $70 on the credit card but should eventually get a reimbursement for that. He is just applying to the local State college. It would have just been a check box to apply to our alma mater too (another State college) but we missed the deadline and that ship had sailed. I didn't realize that A - the local state college extended the deadline & B - few other CSUs seemed to do the same extension. DL(17) has been resisting (even visiting the college), so it's not a big loss.

Edited to add: Already received $70 reimbursement. That was fast.

Financial aid is sorted for MM(19). Phew!

I am ready to sit down and sort all things college finances for MM(19). It's plausible he could get more scholarships this year, but if he does I'd probably just give the money back to him. I am preceding with the info that I have to-date, which is probably accurate.

Net tuition for the year is $4,100. I will pull that money out of MM's gifted college funds when I pay spring quarter fees. That is about a wash with the rent that will be due.

We hadn't touched MM's money yet. But he had free tuition last year. I just hadn't touched it this year yet because financial aid was so up in the air. Now that it's sorted, I like how this year is pretty much done and paid for already. But I expect in the future I will just reimburse ourselves as we go.

I started this post a bajillion years ago but just have been slammed with work. I figured I'd circle back and at least get this posted.

MM(19) did make it home last night. Phew! He had a blast, working on the parade float. I don't know when, but when we can all sit down and look at some of his pictures... I will share a behind the scenes photo.

Posted in

Just Thinking,

College

|

0 Comments »

November 25th, 2022 at 05:14 pm

Pre-Thanksgiving was Drama Drama Drama. But the day ended up very nice and peaceful.

Long story short, hell froze over and MH agreed not to do Thanksgiving with his family. Of course his mom can't let it go, so it was a lot of drama the days prior. (I don't think he's ever missed a Thanksgiving. They have no concept that I have a family too, that MH has his own family, etc.) I think the worst of it was Wednesday, when I was blissfully out of town. If I was home, MH would have been venting to me all day.

**Edited to remove my own venting.**

I wish we could have given the Holiday to my parents, but they just aren't up to it at this point. So we decided to have a peaceful day at home. Is what all of us wanted more than anything at that point. But we had sent off MM(19) to his girlfriend's Holiday and they ended up inviting us. We felt obligated to go. Most particularly because they had for months planned a summer BBQ that we had to cancel last minute when MH had COVID. & it turns out that they usually have a bigger Thanksgiving with family but had stayed home due to medical reasons. So they really appreciated having more mouths to feed.

The girlfriend and the Dad are both really good cooks. We ate very well. They seem to be a very relaxed bunch and we really enjoyed meeting them.

I tried a new/simple cookie recipe that was amazing:

https://www.justapinch.com/recipes/dessert/cookies/butternuts.html

I am looking forward to the peaceful long weekend. Nothing planned today, though we have some appetizers to eat through (that we had bought for the in law Thanksgiving.)

This weekend will be college stuff. Have some financial stuff to go through with MM(19). & DL(17) is going to be applying to one college.

We toured the local State college a few weeks ago and were all very pleasantly surprised. It's a really nice campus. I think we've always been kind of "meh" on the local colleges, being from the Bay Area. & I mean, they didn't have any accounting programs when we moved here. I abandoned my Graduate degree with the move. Lord knows we didn't see the point of studying engineering here (with all the Bay Area schools to compare). So I booked the tour and MH and DL(17) were kind of, "Why are we here?" Because I like back up plans for my back up plans, and wanted DL(17) to know what his options are. We all ended up really liking the campus. So he may just stay at home his first year of college.

I keep trying to get him to tour my alma mater (which has an amazing accounting program) but DL(17) is really resisting. He is prickly and I honestly think he would just hate it (it's in the middle of downtown). But he wants to study accounting and I think he needs to at least set foot there and guage how he feels about it. If he viscerally hates it, I am totally fine with that. But it would be nice to know for sure. (He absolutely could not stand MM's college campus. If he didn't have such a negative visceral reaction, I'd suggest he just goes to community college down there and room with his brother. I suppose it is another community college he could look into, but I think the distance is a bit much for him.)