My kids both received substantial middle class grants from our State this year, re: attending in-state public Universities.

I've tried to look this up (how to ballpark or estimate) in the past, but it's so complicated and depends on so many factors. Primarily, how many students are eligible. Because then funds are divided among eligible students.

So my mind was just blown when I figured it out. 🤯 I just had to dig a little deeper.

Side note: It appears that the kids' assets are not being counted in this formula.

There's other parts to the formula, but calculations below are just what was applicable for our personal situation.

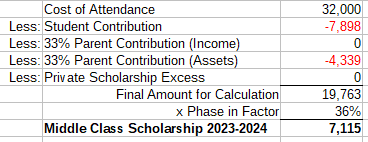

This is how the calculation went for the 2023-2024 school year.

MM(20)

Note: The cost of attendance is a ridiculous number that we do not pay. $20K is a more accurate number. $10K for tuition, $12K for housing, and maybe save $2K here at home re: less utilities and food costs. Eating is not a college expense. In this case, MM(20) spends way less on food at college than at home, so that is a cost savings for us. (& utility savings might be a few pennies on top of that.)

& all students are expected to be able to contribute the $7,898 re: part-time or summer work.

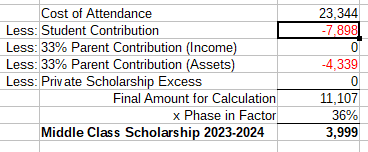

DL(18)

Note: The cost of attendance is a ridiculous number that we do not pay. We paid $8,000 tuition and DL(18) has some increased transportation costs with the daily commute to the college. The rest is food/housing allocated to 'students who live with parents', plus $3,000 misc. personal spending (nope).

I guess the key is the 'Phase In Factor' and is decided every year based on the budget. For now, the best I can presume is that the phase in factor will remain the same for 2024-2025. There is a lower 24% factor being used to estimate financial aid for 2024-2025. So that is the number the kids will get from their colleges. & then they eventually finalize this % later in the year. I am going to use 36% (same as this year) as a rough estimate of the actual dollar amount. It does not sound like the State has the budget to bump up this grant again next year. Which is completely fine with me. We are getting to a tipping point where more grant money means less college tax credits. So it's all kind of the same in the end, for us.

In the end, it looks like grant numbers will likely be the same next school year, unless CA budget numbers radically change that %. & of course, MM(20)'s grant might be a big fat $0 (if the decide he is already a senior, based on their methodology). I do not count on anything, but it's just nice to have a better idea how all of this is calculated.

I now understand that DL(18)'s grant is smaller because he is living at home. (& also because his college tacks on less fees). & I now know that it doesn't matter if either kid starts piling up assets (re: working or gifts). & I confirmed that there is no '2 in college at the same time' adjustment for this particular grant (re: our personal situation).

I also had no idea how much assets were penalizing us. I knew we were on the lower end of this income scale, so the $0 income adjustment makes sense. For the assets, we are penalized $140 for every $10K we add. I guess technically $280 (x2) while we have two kids in college. It would clearly be pointless to have less assets. That's less assets generating interest and stock market gains. & of course, if we didn't have the assets, then we'd be tapping retirement funds or taking higher interest loans, etc., to pay for college. Clearly we are better off just having *more* assets.

I keep distinguishing the middle class grants because we knew it was pointless to plan for any (need-based) financial aid re: middle middle class income and in-state public colleges (very low cost). That has gone as expected, but the middle class grants have gotten a big boost in the years since MM(20) started college. It could end up being a $40K windfall (roughly $20K per kid). & that is a really nice surprise.

Side note: MM(20) did get a nice one-year merit scholarship from his college. I've since been told that is not a thing. It was apparently a bit of a unicorn. Just to add to the, "Well that was unexpected," which sums up all of my kids' financial aid.

The next chapter: If I ever get to blogging about it. I found out in the Fall that MM(20) is probably eligible for food stamps. $300 per month! We are going to apply this weekend. Obviously should have applied sooner, but we are both in disbelief about it. Not 100% sure, but will just have to apply and see what happens. (Would have applied sooner if I knew 100% for sure that he was eligible.) These are also benefits being extended to the middle class.

Edited to add: Note to self: The new FASFA form does not ask if a student plans to live with parents. Just read somewhere it's up to the school to get that information and report it for our middle class grant? Something I will need to keep on top of when DL(18) moves out. Will want to make sure we get the extra grant dollars if we are paying for rent.

March 30th, 2024 at 05:41 pm 1711820491