|

|

|

Viewing the 'Taxes' Category

April 17th, 2023 at 02:01 pm

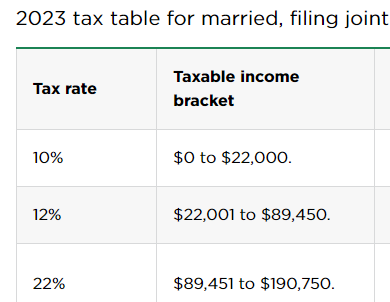

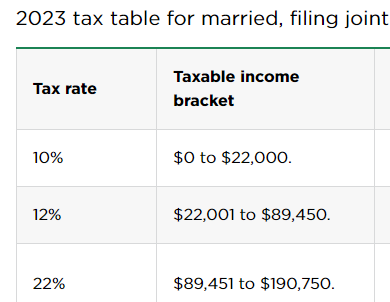

I was so pleasantly surprised how low overall our taxes were last year (with MH working full year, with my raise and bonus, etc.) that I never noticed that we had graduated out of the 12% tax rate. 😵 Which also means... No more 0% tax on investments.

Which means... I need some time wrap my brain around that and actually think about taxes when it comes to investments. We've been spoiled for so long.

I went back and looked more closely because I thought maybe it was just the investments (I sold a lot of investments last year). In the end, taxable income was $89K and that only included about $3K of investment income. The rest is pretty simple. Mostly just salaries and the standard deduction. (Though we will obviously have a lot more bank interest in 2023.) With our (more than 3%) raises this year, we are clearly in a new tax bracket. 22%.

It's going to get nasty with the I Bonds. Tax-free if used for "college tuition". Not going to be tax-free re: our very low tuition costs. So that's one more tax thing I will have to think about and plan around. I had wanted to use the I Bond money for college rent. But it might make the most sense to just consider the I Bonds our emergency fund, so that we can then tap more accessible cash (without any tax consequences).

I will also have to reconsider utilizing my work 401K. If we are really close re: hitting the next tax bracket and losing 0%-tax investment space. It might be worth throwing a few thousand dollars into a 401K if it gets us back to tax-free investments. Will just have to see how the year shakes out.

Another note to self:

First ~$13K of earned income is tax-free for the kids. Have been having them claim exempt. In the end, MM(19) made $6,000 in 2022. What I didn't think about was that only $5,200 of CA wages are exempt (single standard deduction). MM(19) ended up owing $3 to California. I suppose he can continue to claim exempt for Federal. (Can do so if prior year and current year are both $0 tax years). But technically is no longer able to claim exempt (California) because he paid $3 tax for 2022. Will have to keep an eye on that. DL(17) is more likely to just work something like 15 hours per week year round, so he will probably start piling up the dough pretty quickly. Will have to have him submit a separate California W4.

I appreciated that we realized this without a big tax bill to pay!

Posted in

Just Thinking,

Taxes

|

5 Comments »

March 8th, 2023 at 02:17 pm

For the Used EV credit, the IRS states very clearly that you need to get a signed statement from the dealership that includes certain information. Purchase needs to be from a licensed dealership or something like that, can not be a private party purchase for the used EV credit.

The two dealerships my in-laws went through had never heard of the credit. They had no idea about the $25K cap but were happy to haggle once my in-laws pointed it out. (I mean, they had to walk out to get their attention, but obviously they aren't paying $25,001+ if it will cost them a $4,000 tax credit. The dealership got the point that they weren't going to budge.)

Now that they have the car, the dealership refuses to provide this tax information. I don't know if it's worth fighting in the moment. They should eventually figure it out and it may be easier to ask for this information at the end of the year. Let other people fight this battle?

They are supposed to provide documentation at time of sale *and* also to the IRS. I am less concerned about the latter. As long as we have the documentation, is really all that is important.

I had been thinking that it would be pretty enticing to buy a hybrid and to get this credit, for MM(19). Something like my car, that I saved my whole life working up to and is very luxurious. A car like that is $16,000 right now and would only be $12,000 with the used EV credit. MM(19) has the cash for that and it would last him a very long time. Though he has a very cheap heart and might want to go more used. The used EV Credit will swing the pendulum substantially towards an electric hybrid. I wouldn't have recommended before, given the uncertainty of long-term situation (how long he will be renting, etc.). I think without a charger at his residence, the full EV would be much easier/better for his situation. But is also more expensive. (Easier to charge out and about, with the fast chargers.) I just don't see how you'd ever charge a hybrid, in contrast. But if you can save $4,000... I've seen a lot of people say over the years they only drive in gas mode or EV mode, and it doesn't seem to matter much either way.

But... This whole idea is off the table until the dealerships straighten up. I would refuse to purchase if they had no idea what I was talking about and couldn't provide a tax document.

I figured I'd share as a warning, if you are considering the used EV credit. Heck, this also has to be an issue with the new EV credit. This is a dealership that sells brand new EVs. So they have to be giving new EV buyers the same runaround when it comes to providing tax documentation. If not, they would have any clue what we were talking about.

Posted in

Just Thinking,

Taxes,

Electric Vehicle (EV)

|

2 Comments »

December 30th, 2022 at 02:57 pm

For the first time ever, looks like we will just be taking the standard deduction for our taxes. It's about $26,000.

Last year we itemized $34,000. The obvious difference is that we had $9K in medical bills last year and has ~$0 this year (miracle of miracles.) $9K was extreme, but $0 is a miracle. Both were very extreme years compared to our average. Usually we hit our $3K deductible.

{Knock on wood. The year isn't over so won't celebrate coming in under medical deductible until January 1. But any medical bills that pop up this week will be 2023 expenses to figure out.}

In the future, will have less than $4K mortgage interest (woohoo!). That's an itemized deduction that is dropping rapidly. Property taxes and charity. That's about it.

State/local taxes are the opposite of what most presume. Our State income tax system is progressive, we've paid ~$0 during the years we have had kids under 18. (Lord knows I've done tax returns for regressively taxed states, where every dollar earned is taxed, in contrast.) Property taxes can not rise more than 2% every year (Prop 13).

Medical is most of what we deduct. Health insurance premiums ($$$$$$) + medical/dental/ortho expenses. We had the usual expenses, but just no deductible and nothing extra this year. No orthodontist, no wisdom teeth, no other medical procedures.

I was making a note to get charity/donations in before 12/31. Particularly re: the $1,000 in law gift. They gift us $1,000 every year to forward on to charities. I decided that it's probably better to push that off to 2023 and to bunch deductions.

The bigger thing I will have to consider bunching is property taxes. I have just been paying once a year for simplicity. Which I really really like. Less to keep track and use brain power for. But, interest rates were also nothing the years I have done this. With interest rates bumping up and being able to financially benefit from bunching deductions, I will have to ponder. Taxes aren't due again until December, and so I can make a well informed decision at that time. If I want to delay the second installment until 2024.

The whole point of bunching deduction is that if you would consistently come in under the standard deduction, you could at least bunch some deductions every other year and itemize (more than the standard deduction). Being so on the cusp, we might just be more likely to itemize in 2023. If we have an average medical year. So it's beneficial to push off deductions to next year.

I expect I will have a few years where I ponder the hassle of bunching tax deductions and give some extra brain power to that. But I expect inflation to outpace our deductions. I think that will happen quickly, in the next few years.

Edited to add: Will still itemize for California, but that doesn't really mean anything.

Posted in

Just Thinking,

Taxes

|

0 Comments »

January 9th, 2022 at 03:42 pm

Feeling productive today. Got our taxes mostly done. Is generally how I handle it. Just get everything entered and then double check that tax forms match my records, as those forms come in. Try to file before February.

I really miss the professional work software and how much time it saved me. I've just been throwing tax projections into last year's software and then mentally tweaking what I know is different for the next year. It's not great but it's the most cost effective (and fast) way I can figure out how to do tax projections.

I had to share because when throwing all my numbers into tax software I was coming up with some large tax due at first. Was kind of ignoring and figuring it would sort out as I entered more data. Oh yeah, that extra $6K in medical expenses this year, ended up putting us massively over the standard deduction. That did help.

Towards the end though I still had $2,000 shown due. At the very end it was $2,001. Did I mess thing up that bad? Nope, I figured it out pretty quickly. That last $2,000 was college tax credits. Did I literally get our taxes down to the penny? Er, down to $1?! Holy cow!

I told MH to give me a gold star. 😁

In the end, I refined a couple of more deductions and so the taxes went down a bit. The only estimate that remains is I threw in some investment dividends as 'taxable' and I know a lot of that will sort out to non-taxable (qualified dividends at 0% tax rate). So that's the one thing I have to wait for to finalize. Should get investment tax forms in 1-2 weeks.

Posted in

Just Thinking,

Taxes

|

1 Comments »

April 15th, 2020 at 08:20 pm

The IRS updated their website. You can now check on your stimulus "economic impact payment" status. & you can also provide your direct deposit information if you didn't have a "direct deposit refund" on your filed 2018 or 2019 tax returns.

Text is https://www.irs.gov/coronavirus/get-my-payment and Link is https://www.irs.gov/coronavirus/get-my-payment

The website just went live today and so it may be better to check back later.

You will get a confirmation once you go through the process. Or you will get a message stating "Payment Status Not Available" with a link to information on eligibility rules. (To clarify: You will get the "Status Not Available" message if your income is too high to collect the stimulus payment, or if you are otherwise ineligible). If you don't receive any sort of confirmation, you will need to try again. (I was apparently too slow my first time through, but that will probably be a common problem today. The second time I tried I got a confirmation message).

Edited to add: After one day of the new site "Get My Payment" website being up, there is now a FAQ page that answers a lot of questions:

Text is https://www.irs.gov/coronavirus/economic-impact-payment-information-center and Link is https://www.irs.gov/coronavirus/economic-impact-payment-info...

Posted in

Just Thinking,

Taxes

|

0 Comments »

April 10th, 2020 at 11:31 pm

The IRS updated their website:

Text is https://www.irs.gov/coronavirus/economic-impact-payments and Link is https://www.irs.gov/coronavirus/economic-impact-payments

The IRS has created a new website that allows non-filers to request the stimulus (economic impact) payments. Just go to the link above and you will see more info.

Individuals receiving social security benefits are not required to use this new tool to receive their payments. That said, you'd want to check it out if you have dependents and receive social security benefits (and haven't filed tax returns for 2018 or 2019). This is the only way you can let the IRS know that you have eligible dependents, in this situation.

The IRS also announced that a website for taxpayers to enter direct deposit information, and a website to check the status of your stimulus payment, will be available next week.

They also have a reminder (on the link above) to update your address (the usual channels) if the IRS doesn't have your most current address.

Posted in

Just Thinking,

Taxes

|

1 Comments »

April 3rd, 2020 at 05:36 am

I am absolutely exhausted (work week from hell). So if this is gibberish, I will fix it later.

The U.S. tax stimulus will be $1,200 per adult and $500 per dependent child (under age 17). There is also an income cutoff for receiving these payments. (Just google it, it's all over the news).

Edited to add: The definition of "adult" is mostly someone who is not a dependent. So your college kids are not going to receive the $1,200 and you will not receive $500 for them.

As pointed out to me in my last blog post, you get to keep this stimulus. It sorts out when you file your 2020 tax return if you are owed a bigger stimulus amount (if your income changed, you had a new baby, etc.). But if you were overpaid based on income/dependent changes, you won't have to pay anything back.

Tax Planning Point: They will base these stimulus payments based on your 2019 tax return if it was filed. Based on 2018 if you did not file your 2019 tax return yet. If you had a big jump in income in 2019 and haven't filed yet, you might want to take your time. Not sure how much that helps if it takes 20 weeks to mail out checks. But, I have seen this advice thrown around. I suppose it could be wise to file an extension and not file your tax return until you get your stimulus if that's the case.

The wish of the legislature was to get these checks out in 2 weeks. 🙄 This sounds pretty pie-in-the-sky to me. But I know firsthand the IRS is severely understaffed, and also that many of their workers were sent home. But anyway, I just saw a headline on CNN that the IRS said they need 20 weeks to get checks out. Yes, 20 weeks!

IRS put up a site with some FAQs that I will put at the end of this post. Last I looked (a few days ago) it was mostly, "Check back later for details". In that FAQ they said that if for any reason you didn't file a tax return in '18 or '19, for example if you only had social security income and had no requirement to file, they will set up a simple online process to file a "basic" tax return just to provide the information to get your stimulus check.

Oh yeah, and if you had a direct deposit refund in 2018 or 2019, they will use that information to direct the deposit into your bank account. Direct deposit stimulus payments are expected to be done around April 15th. So if you had a tax refund and chose direct deposit, you might get your stimulus payment in about two weeks. (It's the remaining checks that will take several weeks to process. It will take them 5 weeks to be able to print out the first stimulus checks). On the IRS FAQ they also mentioned setting up some kind of an online form for taxpayers to provide their direct deposit information for a quicker stimulus payment. Details to follow later...

I ended up taking a tax/COVID class yesterday. The tax professionals were pushing back hard. The IRS expecting every fixed-income retired adult to figure out how to request their stimulus?... Tax professionals were insisting there must be a way to cross reference social security records, at the least.

In the end, the IRS has already caved. The IRS will also issue stimulus payments based on social security records. There will still be people who don't file tax returns for various reasons and will have the chance to request their stimulus with some sort of online process, but at least this captures a chunk of the lower income/older population who isn't going to have a lot of help with this stuff in isolation. (& now that I am reading the updated website, they don't have any mention of how you request stimulus in other situations, so it seems to be just changing every day at this point. Who knows).

Economic impact payments: What you need to know

Text is https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know and Link is https://www.irs.gov/newsroom/economic-impact-payments-what-y...

Social Security Recipient Update:

Text is https://home.treasury.gov/news/press-releases/sm967 and Link is https://home.treasury.gov/news/press-releases/sm967

Some Americans could wait 20 weeks to receive stimulus checks, IRS tells House Democrats

Text is https://www.cnn.com/2020/04/02/politics/stimulus-20-weeks-irs/index.html and Link is https://www.cnn.com/2020/04/02/politics/stimulus-20-weeks-ir...

One final tax thing: IRS has extended tax deadlines from April 15th to July 15th. You will have to check to see if your state has followed suit. There was a lot of back and forth, "What about this and that and this?" Estimate payments, IRA contributions, etc. At this point, it's all extended to July 15th.

Edited to Add: As of April 9th, I see they extended pretty much EVERYTHING, including (June 15th) second quarter estimate deadline. Also finally caved on 3/15 business tax deadlines.

Posted in

Just Thinking,

Taxes

|

12 Comments »

February 2nd, 2018 at 01:42 pm

**MH saw some noise cancelling headphones on Amazon for 90% off. He figured what the heck. In the end I guess it was a pricing mistake because they canceled the order.

**MH is still looking for the right blu ray player for the TV we bought 9 months ago. In the end he saw another "too good to be true" deal for $25. I guess this was at Walmart. In the store it didn't show the advertised price (85% off) and they seemed to think he was crazy when he inquired, but it rang up for $25.

He hadn't picked one up before because he was being crazy picky. I got the sense this had everything he wanted, but maybe also willing to settle a bit in the interim because nothing to lose at that price. In the end, it seemed to have some problems and they were out of stock by then (couldn't exchange) but he diagnosed that he needed a better cable and it seems fine now.

So I thought he was 0 for 2, but maybe this one will work out. He is going to give it some time.

**My cell phone is almost 4 years old and I was targeting all along to replace this spring (at the 4 year mark). Given work uncertainty, I asked MH yesterday to keep an eye out. I told him I probably rather get used to a new phone before I am more seriously job searching. & I'd rather buy a phone while I have a (high paying) job. So he will start looking around for me.

My phone is mostly fine but has admittedly been wonky for about 18 months. It is not secure as I am sure it is no longer receiving updates, so that is my main concern. It turns off randomly at times (but I don't use enough for it to matter). MH saved it from a "black screen of death" about a year ago. I know his tech skills have helped me to keep it the 4 years that everyone else seems to think is crazy and impossible. But even MH has been nagging me a bit as he knows I no longer receive security updates. I was dead set on 4 years because I had paid $400 for it. I can be okay with 3 years and 10 months.

-----------------------------------------------------------------------------

I usually file taxes early, before I have tax forms. Because I don't need the tax forms. But I peruse the tax forms as they come in and make sure they agree to my records.

In the end, my mortgage company reported that I paid more interest than I did. ??? It's the only tax form mistake I ever recall catching. I double checked their website and their monthly interest amounts (2017) matched mine, so I will ignore the tax form. It was in my favor so I won't worry about it. If it went the other way I would make sure that they correct it.

I plan to file taxes today. Our software at work hadn't been updated yet. I talked to the person in charge of that yesterday and she seemed confused, but we finally decided she was out Friday and hadn't followed up on our weekly updates. (They should get done regardless, but she usually makes sure that they are done). She got it updated ASAP when she realized we couldn't file *any* tax returns yet. It was a hectic day/week, so will just press the "send" button when I get to work today. I knew I had all sorts of tax forms in the mail (in route or sitting in mail box) and figured I better check those first.

I did well with harvesting tax gains for kids. I always strategically harvest tax gains at 0% tax rate. But this year I squeaked by with harvesting tax gains and not even having to file a tax return for them. I don't know how realistic that goal is as their investments grow, but works for now.

Posted in

Just Thinking,

Taxes

|

0 Comments »

January 16th, 2018 at 01:53 pm

Was shocked to get a raise this year. Just seemed unlikely given economics of employer. (Was a bit of a niche market that just happened to fared very well during the recession, but now we have an aging/retiring client base). There is still a weird dynamic where I am youngest in office but have surpassed some of my elders, and so have been the only one to get raises over many years. Ever since I realized this, I've not taken raises for granted. I was legitimately shocked this year.

Well, that's easy! I can take care of everything I wanted to in 2018 budget/spending plan without worrying about it.

--Health insurance went up $65/month

(Where the vast majority of my raises have gone since having kids. This year was a small increase in the grand scheme of things.)

--MM wanted to attend third weekly gymnastics class offered this year. We told him we have better things to do than to drive him over there 3 times a week (yikes!) But, that we could discuss after my work review. I am more open to it now; will have some extra funds. Will still have to find some reasonable balance.

--I wanted to bump up our short-term savings. Expenses like insurance (life, disability) are creeping up. Most especially since I turned 40. (Maybe some "leaping up" in that case). This gives us more breathing room in the budget because we use short-term savings for one-off expenses. It's a hard balancing act because if we save money we want to leave it there, and I think psychologically it might work well being a little tight. But it's starting to get a little out of balance and is stressful at the end of the year when I really haven't saved enough for all this stuff.

This breaks out to:

$5,500 property taxes

$4,300 insurance (various)

$2,000 vacation

$1,500 car maintenance

$1,200 Dental

$2,300 Misc.

The extra $1,200 to Misc. = some breathing room. Phew!

When I plugged my new salary into a paycheck calculator I came up with +$280 monthly income with a $250 monthly raise. I presumed that was because of the new tax tables. Anyway, I will do some tax projections today and figure out what to do. I barely withhold any taxes from my monthly paycheck, because I get a OT check every year that's taxed like a bonus. So while it would probably be wise to adjust my withholding with the extra windfall, I also don't see the point of letting the government hold my money all year. It may be that I just decide to put the entire difference ($80/month?) into investments. That is money I can put into tax withholding if my job situation changes.

But I will do a tax projection, make sure I am paying in enough state tax, etc. Once I figure out how much I need for taxes, I can finalize my 2018 goals.

I may just leave sidebar goals as is because they are very aggressive. Not really entirely sure I can or even want to make these goals, but aiming high seems to work well for us.

Maybe I am weird, but the more money we make the harder I find it to save 20% or 30% for long-term. I think that's probably because of taxes. But is probably also the longer we have gone without any BIG expenses. When I am not replacing cars, paying for braces (x2), funding teen drivers, and doing maintenance on a 20-year-old home, it's much easier to lock up 30% of income in retirement and other long-term funds.

Tax Notes:

--Our taxes will remain unchanged with the new tax laws. Our "taxable income" will increase substantially because we lose all of our exemptions. Which probably doesn't bode well for the long run. (For the short run, like just a couple of years, this increase is offset by child tax credits)

--That said, MH's small income is getting taxed at 15% instead of 30%. If we are shifting to a two full-time income, then the timing works out pretty well. As long as we have kids, I still pay "almost nothing" as to taxes on my income. Which is why the high tax rate on an additional few thousand dollars has been so jarring.

--Accordingly, we will probably drop the 401k contributions. We've only done for tax reasons, which annoys me, because increasing cash flow would be the motivation for this job. Will build up taxable investments instead of adding to 401k, which just makes more sense given our financial situation.

It depends how my tax projections go today. Not 100% decided, but I like that I feel less tied to the 401k.

--Will stick with the Traditional IRAs (as much as we can; MH is being phased out). Taxes are complex, and we need the Traditional IRAs to increase our itemized deductions and to lower our taxes. I believe last I calculated was a 24% savings for every dollar we put in Traditional IRA, because it increases our itemized deductions the more we can decrease AGI. So that is why. I will check today now that I have some better salary estimates to plug in. Oh, and we have to do the Traditional IRAs to keep our taxable investments tax-free. Between those two points, I don't see any ROTH contributions in our near future.

Edited to add: It was probably a bigger second income which was much more palate-able with the new tax law. Which is just interesting timing for us. I can't re-create that 15% tax rate with current income situation, so I am guessing that was a more long-term/higher income tax projection.

I ran numbers today and we save 32% for every dollar we put into 401k+Traditional IRA. Looks like we will stick with the 401k. (It's the loss of 0% investment tax rate that is tripping me up).

Federal tax withholding is surprisingly better than I remembered (withholding enough from salary to cover all taxes for year, even with lower withholding rates). But I have to send +$40/month to the state, a 50% increase. This leaves $40-ish per month for investments. I will just round up to $50.

Posted in

Just Thinking,

Taxes,

Daily Expense Challenge

|

2 Comments »

July 20th, 2017 at 07:50 pm

Today I harvested some tax gains. Is a strategy to keep "taxable" investments tax-free.

In the process, I just converted to admiral shares and way lower expense ratios. In theory, I'd generally just immediately buy back what I sold; selling solely to lock in 0% tax rate on those gains. But in the end I decided to move funds over in the process and to be a little more efficient.

For myself, technically any long-term capital gains are tax-free for Federal. But... That's not entirely true because bumping up our AGI (even just a couple of thousand dollars) wreaks all sorts of havoc on the rest of our taxes. It decreases what we can put in tax-deductible IRAs and reduces our medical expense deduction, etc. But, whatever. It's not like it's going to get better than a 0% tax rate. (I mostly expect our income and taxes to be much higher in the future).

Since we've mostly been able to shelter our investments in retirement funds, this is the first time that I've had a tax-free gain to harvest. At about $3,000 for long-term gains and I figured I could live with that. (I probably wouldn't want to add much more to our tax return. We are already on track to maybe have 10% more wage income than last year).

For the kids, I have been selling off funds frequently to the same end, though I got a bit of a break the past two years. But for today, MM was at a good selling point. $1,000 investment income is tax-free for them. $1,500 is just some very minimal state tax. I might have timed it well enough that they are more in the $1k range and won't owe any state taxes.

Note to self:

$1,000 investment income is the sweet spot for kids. No requirement to file a tax return at this investment income level.

If you have no idea what I am talking about, here is a link that explains:

Text is https://www.bogleheads.org/wiki/Tax_gain_harvesting and Link is https://www.bogleheads.org/wiki/Tax_gain_harvesting

I guess this came to front of mind because my dad *finally* sold some mutual funds that he had wanted to sell a few years back. He's waited for tax reasons, and I guess given my tax perspective I have no idea what he has been waiting for. !! I mean, Obamacare was the reason the last two years, but now in 2017 I would have sold January 1. Not sure how long 0% investment tax rate will be around and am glad he finally took advantage.

As for the kids' "college" money, it's conservatively invested (balanced fund) and I have an equal amount in cash (our cash savings/emergency fund). So I feel that I Can shoulder any short-term market fluctuations. It seems way too premature to do anything with that. Kids start college in 4 & 6 years. Keeping in mind that we used our own "college money" for a home down payment instead of college. (College is still super cheap here and housing is only more insane now than it was then). This really could be money that remains untouched for 10+ years. So for now, we have no plans to cash out any college money or to shift to a more conservative allocation. We may set aside more new money in cash, as college becomes more imminent.

Posted in

Just Thinking,

Investing,

Taxes,

College

|

0 Comments »

January 22nd, 2017 at 03:30 pm

Finished our taxes yesterday.

I have the financial records to complete taxes on January 1, generally, but was waiting for investment 1099s (the only info I can't calculate on my own). I got an e-mail that those were ready on Friday.

I also haven't seen a pay stub for MH in months (got locked out of his online account) so will just wait to file until we get his W-2. I otherwise probably wouldn't even wait for the W-2. I expect I know his gross pay within a few pennies or a dollar, but would rather it all match 100%. We do not withhold any income taxes from his check, so that is some of why I don't really need his pay stubs. As long as the direct deposits are what I would expect them to be.

{I am totally fine with filing taxes before I have W-2s or 1099s, when I have any financial records whatsoever. It's just that I am flying pretty blind with MH's income}.

With MH working all year, we bumped up our "taxable income" from $46,000 to $48,000. We are still nowhere near the next tax bracket of 25%.

But, MH's income is being taxed around 30%. Taxes are complex.

In the end, we'd owe $1,400 if we did ROTH IRAs, or we get $1,000 back if we do Traditional IRAs. Total tax savings of $2,400. We can't max out the Traditional IRAs because of MH's work retirement plan. But rounding a bit, we can put $5,000 into his Traditional IRAs and $500 into his ROTH. I will hold off funding those until I get his W-2 and finalize everything. I already knew I could max out my Traditional IRA and did fund that already. We will do the Traditional IRAs and will invest the tax savings, per sidebar goals. (I expect for 2017 that MH won't be able to put nearly as much into Traditional IRA).

When I get the 1k refund I will just throw it at our investments. Not entirely sure how I will come up with the other $1,400. I think I will probably just fund that part when I get my OT check.

When we first started doing this it was like "$2,500 tax refund" for Traditional IRA or "no taxes due" for ROTH contributions. I did it this way because we were really in "flip a coin" territory, and I did want to just invest the difference. I'd say we are still somewhat in "flip a coin" territory, but also I am just covering MH's income taxes from my paycheck. I will just leave it be, for now. I expect everything to change, tax-wise, anyway. So we can re-evaluate from there. For now, this works, and still gives us some room to go either way.

Posted in

Just Thinking,

Taxes

|

4 Comments »

January 29th, 2016 at 02:06 pm

I did complete our taxes. I don't really need any tax forms except some investment information. But I wasn't thinking that I didn't have dh's W2 from which I needed his employer Tax ID for e-file. So I thought that would hold us up for a while.

In the end I poked around online and found his W2.

Yes, our taxes are very simple. (I don't need W2s because neither of has any benefits, and even if we did I could figure it out from our pay stubs. I don't need any tax forms except for "qualified dividends"; is the only info I don't seem to have on my own).

-----------------------------------------------------

We did save $2,500 doing Traditional IRAs instead of ROTHs. I will get a $1,500 tax refund that (I will invest) and already moved $1,000 over from savings to investments. The deal is if we do the Traditional IRAs then we invest the tax savings.

Edited to add: And I just noticed we already got tax refund. So will move the other $1,500 over to investments today.

-----------------------------------------------------

For 2016 goals I just copy and pasted 2015 as a starting point. I didn't have enough information otherwise to form goals yet.

In the end I got a small cost of living raise, which just covers cost of living increases for this year (our utilities all seemed to go up suddenly and our HOA fees went up for the first time ever). So I will keep my salary goals the same. Which are the goals in my sidebar.

As to dh, he went back to work this week, post long winter break. The last thing we really want or need is more long-term retirement funds. But it is the most efficient thing to do. I Was surprised when I ran a tax projection and his income is being taxed at 30%. Yeesh! Thankfully he does have a 401k that he is already eligible for. We discussed it a while ago before I knew the taxes would be so bad and dh was leaning more towards the 401k. I was more trying to talk him out of it. After running the tax projection dh didn't want to talk about it because he is getting some MRI results next week. He just can't think "future" until he knows where his health stands. So we will enjoy his first full paycheck for the year and figure it out after that. Historically we always delay taxes and I expect that is what we will do, even if we haven't had the formal "let's do the 401k" discussion yet. I don't see either of us throwing 30% of his income down the drain. We had abandoned ROTH contributions around the 20% marginal tax mark.

We are also still very much in the 15% tax bracket; nowhere near the 25% tax bracket. But taxes aren't exactly simple. They can be pretty whacked.

What we miss more than anything is the liquidity of dh working and this doesn't do much to resolve that. But... Our parents are in a generous stage and so this is helping us to just suck it up and fund the 401k. We might get some cash gifts this year to fund more "Early retirement" funds. If we do the 401k and we hang onto some taxable investments (gifts) then that takes away from the potential mortgage avalanche. The big picture is more important to us.

Posted in

Just Thinking,

Budgeting & Goals,

Taxes

|

2 Comments »

February 9th, 2014 at 04:28 pm

**We made it to our 3 San Francisco days of events. I thought we were driving to San Jose twice more this month, but dh seemed to think we would combine trips. Will see. It will be a lot to celebrate his folks' anniversary and his Grandma's birthday on one weekend day. Two weeks might be better for me, though more driving. (I was thinking of skipping the birthday, anyway).

THEN we will probably be on low-spend mode until May.

**It's funny because I really thought SIL (more means) would want to do an extravagant party for the in-laws' 40th anniversary.

But, since they are moving into their $1 million+ home this month? Dh has yet to talk to her about this anniversary at all (  ), but we got the message loud and clear. They aren't planning to spend a penny. ), but we got the message loud and clear. They aren't planning to spend a penny.

{I am rolling my eyes that dh has yet to speak to his sister about it - rolling them at him}.

I suppose it works out. I was trying to set aside $1k - $2k of money that in-laws gave us, in case it was a big dinner party out kind of thing. BUT, I have failed miserably given how 2013 was, and so it is what it is. I doubt we will spend a penny. Dh and I will offer to take them out to dinner. I just can't imagine them letting us pay.

Dh is working on a video, but has been struggling with his own family. I think it's easier to do for other families - maybe being more removed from the subject? I am sure he is also being too hard on himself.

---------------------------------------------------

**I finished our taxes. Being organized and having a simple tax situation (& having really nice professional software), it was not a time consuming endeavor. Maybe one hour, max, to gather information and file all of our tax returns. I harvested some tax gains for the kids, which means having to file for them when they sell mutual funds.

I always aim for breakeven, but my withholding and deductions have been pretty sporadic in recent years.

I did adjust my withholding in 2013 because our medical deductions are more limited with Obamacare AND our mortgage interest went down significantly (with latest refinance). About $6,000 less deductions than last year, from those two things. Plus income went up a bit, etc.

In the end, I did good. $30 net refund. (Er, I think I just got lucky).

The big question for me is what to do about our IRA contributions. *sigh* I am squarely in "flip a coin" territory with this.

Tax rate has gone up from negative (less than 0%), up to 23%, in the years since we have had kids. So, the ROTH is officially no longer a "no-brainer."

25% is a strong tipping point for me. One reason is because in the past we took a larger deduction up front and then converted ROTHs in lower income years. I am also in the middle of converting my parents' ROTHs (early retirement/no income years). All this to say that it is not a simple situation with a simple answer. (It could be a MUCH better tax savings decision to skip the ROTH for now).

I think the long and the short of it is that even at 23%, it's a lot of money to throw away in the hope that the tax code and our circumstances work out to our favor in the long run. $11,000 x 23% = $2,530 tax savings. Which is certainly no small beans, to me. This would boost our savings rate significantly. ($2500 is like 3% of my income - we'd just turn around and invest the tax savings).

That said, we don't have to decide until next April. At which point we will have more information. If we can easily cash flow the ROTHs at that point, we may just to do so. If not, we can do the Tradiitonal IRA, or do 5/50.

For 2013, I had already committed to doing the ROTHs. Kind of glad about that. Because if I thought to check before I filed, I might have changed my mind. We got our ROTH balance to six figures already, so I think we will do fine whatever we decide. (Those ROTHs will be no small beans when we reach retirement age, even if we stop contributing to them).

Posted in

Just Thinking,

Living on One-Income,

Taxes

|

3 Comments »

January 19th, 2013 at 09:34 pm

I am quite sure the average person is quite ignorant about all the taxes they pay.

I know I personally have a very strong edge with all my tax knowledge (income tax, payroll tax, etc.).

BUT, I don't always pay attention to every tax I pay. Some of the smaller stuff is easy to ignore.

SO, while I am tracking our sales tax this year and monitoring that I am also starting to look at all the taxes that we pay.

So, I have more tax observations, and I found a simple way to save some taxes!

**We share cell phone service with my parents, who live in another city. While looking at our cell taxes, I found that our city has some of the highest cell phone taxes in the region. Which is not to say there is much we can do, because my parents live in one of the most expensive cities in the world. Odds are, their tax is even higher.

So I looked it up. Best I can tell, our cell phone tax rate is 7%. I have *no idea* how it is figured, since it comes out to about 3% of our total cell charges. BUT I found that San Jose has a cell phone tax rate of 5%.

Worth a shot, so I changed the mailing address to my folks' address. Totally on the up and up as our usage runs very 50/50. It's a toss up which city the taxes should be billed too. We have apparently been paying more tax than we need to, for several years. {I initially did not want to change it all over to their name, but realized that all I had to do was change the billing address. Easy peasy! Will see if this makes a difference...}.

**I am also seeing another layer of it being impossible to compare apples to apples sometimes when discussing these things online.**

Other utility billing observations:

**Our landline is also subject to the 7% tax, but it cost pennies. In fact, all of our landline taxes (lots of Federal taxes) are negated out because they run about $2 per month, and we get a $2 credit per month for getting online bills. So, I'll consider it a "no tax."

**Our internet is subject to -0- taxes. No fees. No taxes. I found this one surprising. I didn't know "high speed internet" was tax-free.

Clearly it's in how they bill it. I am sure they could lower the "bill" and add some fees. This is one of our higher utility bills. All the fees are obviously included in the rate. But still, I like the no tax part!

**Water/City Charges. $0 Tax.

I appreciate this because their charges are kind of insane and completely out of our control. For reference, the metered water portion of our bill was $3 last month. The rest is a flat fee, and we pay a TON for water in this city. Glad I don't have to pay taxes on top of fees I can't control at all.

**County Sewer Charges

It's a flat fee and I don't have the bill handy. I don't think the taxes really matter - they will charge what they charge and I have no control over it. But I will look it up later.

**Gas and electric is interesting. We use the regional private PG&E for gas and the local city utility for electric. The general impression is that our electric is dirt cheap because of this. Hard to say (I'd have to compare rates), but the city charges us a heck of a lot of FEES. I think our lower electric bill is mostly due to the energy efficiency of our home. As most people even locally guess we pay about 3 times what we do in winter, etc. {My parents seem to think they'd have a much lower bill here than their PG&E Electric, but I am not so sure - excepting a more modern and energy efficient home}.

PG&E GAS: 7.5% utility tax. Basically no charges and fees. We barely use any gas and so the tax is negligible. We literally pay on average $20/month. We have gas heat (furnace, hot water, gas stove, etc.).

City Electric: 7.5% utility tax. Plus this and that fee. They literally add $18/month just plain flat fees, to our bill. Our last bill (December) was $55 for electricity usage and $25 for fees and taxes. Lovely!!

So though I always kind of feel like our electricity conservation isn't as stellar as our gas conservation, I suppose that really isn't quite fair. Electric costs more anyway, and the fees and the taxes add up. This utility tax is calculated based on all the usage AND the fees. So, double ouch.

So today I have far more knowledge than I had yesterday. & I might have even saved a couple of bucks in the process.

Posted in

Just Thinking,

Taxes

|

8 Comments »

January 11th, 2013 at 02:51 am

My overall feeling is that we don't pay a lot of sales tax. It's a tax that is easy to avoid with lifestyle choices.

SO, I am putting my feelings to the test. I don't know if I will have the patience to track this all year, or if it will get too tedious.

This is what I got so far:

Our sales tax just went up to 8% on 1/1.

I was pleased to see that our grocery bill was literally $0 sales tax. That is about what I expected - but seems like this or that or the other is always taxed. Obviously this was an all-food run.

(I think at Target dh also picked up some tape. I just lump most the household type spending with "groceries.").

This is all good, since grocery spending is the bulk of our retail spending.

We will see how the year progresses...

Posted in

Just Thinking,

Taxes

|

3 Comments »

January 8th, 2013 at 11:00 pm

IRS announced today that they will accept e-files on January 30th. They will accept paper returns prior, but will not process them before January 30th.

The following forms will not be processed until late February or March (see list on link):

Text is www.irs.gov/uac/Newsroom/List-of-IRS-forms-that-1040-filers-can-begin-filing-in-late-February-or-into-March-2013 and Link is www.irs.gov/uac/Newsroom/List-of-IRS-forms-that-1040-filers-...

Most the items on the list are not common forms. I give the IRS credit for not delaying more forms. But maybe since the tax changes were not too different from last year...

Posted in

Taxes

|

2 Comments »

January 2nd, 2013 at 07:03 pm

I have extremely mixed feelings about the tax bill that just passed in Congress. I will note the changes at the end of this post, for inquiring minds who want a quick summary.

My feelings are a little bit of "Holy heck, our taxes would have been insane" without these tax extensions. On the flip side, the tax extensions are expected to add $4 trillion to the deficit over the next decade. My ire goes to why these tax cuts were ever put in the first place (during times of high spending/war, etc.). This can be seen as very political, but to me it just is what it is. We certainly wouldn't run our household in this way financially - it is totally insane.

I think a lot of it is fine temporarily with the economy in the toilet, but not sure why so much of this is being made more permanent.

As to Congress? Seriously? Like you couldn't have figured this out 30 days ago? 2 weeks ago? Life has been rendered beyond complicated for me in the tax field. I feel more sorry for software developers and the IRS, though.

I am so relieved AMT is patched and we saved that $500. Not that I have strong opposition to paying another $500 in taxes. But I Really thought Congress was going to pay lip service to middle class tax cuts while letting stealth taxes like AMT run rampant. As they have been for a long time. The fact it was going to affect us was not a good sign for the lower middle class. I am more relieved that they made a permanent patch, indexed to inflation. This should have been done about 15 years ago...

-----------------------------------------------------

I ran some tax projections today. We are still at owing about $1,000; is what I projected early in 2012. Final number was highly dependent on medical bills for the year, which ended up as low as could be.

I ran tax projections for next year, but our software has not been updated for the very recent tax law changes. So, I refigured what it will be. Interesting to note, our taxes would have gone up $2500 this year without recent tax law changes. Add in $1500 for the payroll tax holiday ending. That is no small sum, to me. 5% of our income would have gone to increased taxes. Ouch! Dodged a bullet, for sure. We'd survive, but not sure how most people would handle it. Which is why I have so many mixed feelings... (ETA: I think more to the point - our Federal income taxes would have about *doubled* with that $2500 increase. Ouch! I think that is what bothered me more than anything. I'll agree our taxes are too low and should go up, but no matter how you slice it, it is going to be painful when it comes to pass).

Since the payroll tax holiday expires, and my withholdings are probably due for a change due to less medical deductions allowed in 2013 (Obamacare tax increase) and lower mortgage rates, I refigured my paycheck at a few different exemption levels. Decided to move my allowances down from 12 to 10. I also increased my state withholding by $20 per month.

The net effect of all this is to decrease my paycheck by $230 per month. But would have me at about breakeven for our taxes *this year.* Which means we will still owe a little next year with all the reduced deductions - is fine.

Our health insurance also went up about $75/month. So we are down about $300/month between this and taxes. I had set aside the payroll tax holiday and refinance "monthly savings" to our savings account last year, but will lose that $300/month.

This leaves my savings goals mostly as is:

--$1200/month to short-term savings. I was thinking of upping this to $1300 for property tax increases, but that will only be half the year, and I have run out of savings room anyway. Paying more income taxes and owing less later will help with just keeping our savings at $1200/month. All this money is spent within the year (mostly various insurances and taxes)

--$400/month to mid-term savings.

--Max out ROTHs, of course

--Overtime saved for China

--Extra mortgage payments will have to be snowflaked and come from other income sources. I think $4k is still very possible. Dh's folks seem very generous of late. It is also not every year that we will be saving a large sum for an overseas trip. More like "once every decade or two." So still gives us wiggle room for ever rising health insurance and ability to prepay more to the mortgage in future years, all else being equal.

--Raise? Perhaps, but doubt it will be much if anything. If so, I will put it to the ROTHs. We have been doing about $800/month. $900/month is a better clip for the new contribution limits. (It doesn't matter for this year, since I already advanced the additional $1000, but will help for next year, and is probably where any raise should go).

-----------------------------------------------------

**I harvested some capital gains in the kids' accounts this year, since the stock market kept going up, up and up. Basically, first $1900 or so of investment income is tax-free for them, annually. I was also unsure if this would still be true for 2013 (0% capital gains rate for them, and us, in 2012).

We don't bother with the complications of 529s and such, because hell would freeze over before we actually were eligible for any financial aid, and because it is pretty darn simple at this stage in the game to keep their earnings tax-free. Our strategy can always be re-evaluated as money grows and actually starts hitting kiddie tax limits. For now, I sell high and reset the cost basis of their mutual funds. This is the first time I have ever had any motivation to do so (in about 10 years).

I checked today and they were well under the limit. They both had about $1,100 in investment income for 2012. I was checking to be sure, when projecting our taxes.

------------------------------------------------------

**Did you hear that California now has highest income tax bracket in the U.S. 13.3%? Ouch! A huge tax increase just went into effect on higher incomes. Thing is we already totally gouge the rich. I don't intend to ever be *that* rich, so we are okay. Our effective income tax rate for 2012 was less than 1% of my salary.

It's such a progressive tax state, that I don't have many complaints at our income level. I was thinking of tracking our sales taxes this year, out of curiosity. I don't think we pay that much because we don't consume that much. But I am curious to see real numbers. I may only have the energy to track for a month. Might be pretty tedious.

Obviously this is more painful with big purchases. So not that it never affects us - but less likely to affect us much on a day-to-day basis.

The ugliest taxes we pay are probably gasoline taxes. I should probably track those too.

----------------------------------------------------

Recent Federal tax changes of note:

--Top rate 39.6% (up from 35%) for individuals making $400k+ and married households with $450k+ income.

--Payroll tax holiday is gone - Social security tax goes up from 4.2% to 6.2%, starting January 1.

--AMT patch made permanent, indexed to inflation, starting 2012.

--The maximum capital gains tax will rise from 15% to 20% for individuals taxed at the 39.6% rates ($400k+ income, as noted above)

--The itemized deduction phase-out is reinstated, and personal exemption phase-out will be reinstated, but with different AGI starting thresholds (adjusted for inflation): $300,000 for married filing joint, and $250,000 for single.

--The estate tax will continue to provide an inflation-adjusted $5 million exemption (effectively $10 million for married couples) but will be applied at a higher 40% rate (up from 35% in 2012).

--The $1,000 Child Tax Credit will be extended through 2017.

The following is for 2013 only:

--No taxes on discharge of debt (e.g. foreclosure) for primary residence.

--Mortgage insurance premiums treated as deductible interest.

--college tuition deductions

--favorable business write-offs for equipment purchases, extended one year

Posted in

Just Thinking,

Budgeting & Goals,

Taxes

|

12 Comments »

March 30th, 2012 at 12:24 am

**Is it weird that I am bummed that first mortgage payment is not due for another month?

I think I am just itchy to make first payment and to see how extra principal payments are handled. The CU website does not have a space to enter "extra principal" with payment, and I am not keen to revert to a paper and check method (I do have paper coupons). I think I will just make the paymnet and send an e-mail about the principal application. I can't be the only one online who wants to just pay it at the wesbite, without a paper check.

Anyway, it's probably best to replenish savings with next paycheck. April 16th should bring me some serious cash inflow. Or not. I need to wait for my overtime to be 100% sure how much I want to put to the mortgage, anyway.

**I am thinking a lot more about tax gain harvesting. I share in case you are not aware that the long term capital gains tax rate is 0% for "15% or lower" income tax brackets. {Expires this year? Maybe not expiring with all this election stuff?} I've got too many tax shelters to bother with taxable investments, so it doesn't mean much to me, but am thinking about it in term of kids' UGMAs and my folks (who have no income at the moment, but lots of investments). Regardless, I was also thinking this was an easy scheme to skirt around the kiddie tax. To harvest gains. If the stock market stays up like this... I googled a bit and apparently this is quite common. I just hadn't thought about it before. Will need to think about it more as the stock market performs well and their balances grow.

**So much of marketing is getting you to pay more for very similar products. (Or, allowing you to pay much less, if it means you wouldn't buy it otherwise - i.e. senior and student discounts. Better to sell at lower prices than not all, to certain demographics).

Funny experience today. Dh met me for lunch. I had $7 cash in my wallet, and wasn't so interested in eating out, as I just wanted a break from craziness at work (but no time for the usual drive home). So we go to the Wendy's across the street, and I just look at the Dollar Menu and get some junior bacon cheeseburger thing. & some value fries. Dh orders the Baconator! It came out to like $7. Neither of us eat there very much at all (once every couple of years?). I am a BK gal and he likes Carls Jr. So, we sit down to eat and dh looks at his very small burger, and looks at mine, and says, "What is the difference??" I said, "It looks like it has a thicker patty?" He didn't believe me, but I thought it looked very slightly more substantial. Though otherwise it was pretty identical. So he tells me, "I paid $4 for this thing!" I just had to laugh because though it was a perfect size for me, there was no way that little burger was going to hold him until dinner. He was thinking big giant Carls Jr. type burger, know what I mean?

So he did complain about it - they told him it had a "premium bun" (looked identical?), more bacon, extra cheese, and a bigger patty.

Pfffft...

I am sure all fast food chains have similarly priced type items. We just happened to order the budget-priced and the cadillac-priced version of the same thing. No discernable difference. We were both business majors (he majored in marketing), so there is nothing surprising about this. But I just thought it was funny. My dh was not amused!

Ah, I love the dollar menu!

I actually just noticed the other day that the BK shakes were almost $4 as well. I was thinking of getting one. I looked at the price and thought, "Like hell!" Their little fudge sundaes are $1. I figured the difference was negligible there, too.

Posted in

Just Thinking,

Investing,

Taxes,

College

|

2 Comments »

February 28th, 2012 at 06:24 pm

As promised. I read something stupid so I will pass along something with some facts in it.

Few Wealthy Farmers Owe Estate Taxes, Report Says

Text is http://www.nytimes.com/2005/07/10/politics/10tax.html and Link is http://www.nytimes.com/2005/07/10/politics/10tax.html

It's an old article, but it's the best I can find right now.

For reference, when I was about 25 and had an income of about $50,000, we implemented estate planning in our house. Life insurance, and living trusts. The cost? Dirt cheap.

If you have a million dollars + in net worth, you generally have the sense to do the most basic of estate planning.

I will give you that if the estate tax reverts to $1 million exemption again, this could become more of a problem in the *long run.* But it seems extremely unlikely that things will go back that way. There are a lot more important things regarding taxes to address and worry about in the here and now.

& why the masses are worried about a tax that only affects 1% (at most) of the population, I will never know. It reads: "Those poor rich millionaires." Yeah, my heart is bleeding...

To be honest, the estate tax doesn't collect that much to begin with. So, if the obliterated it tomorrow or not, I could tell you I really couldn't give a flip. But the misinformation out there just makes me roll my eyes. I'd be pleased if I saw an article that said, "The estate tax does not bring in any real revenue for the government - it just makes lawyers and accountants rich." Now that is a statement I can agree with! So, no, I am not in love with the estate tax. But, I just don't see that it's really hurting anyone. So, meh.

Anyway, this is one myth that just won't die!

Posted in

Just Thinking,

Taxes

|

4 Comments »

August 17th, 2011 at 07:46 pm

Text is http://mauledagain.blogspot.com/ and Link is http://mauledagain.blogspot.com/

Unfortunately, I can't link the blog post I wanted to - specifically. So, scroll down to August 1.

August 1 - Tax Complexity: Why?

"It is no secret that I find the complexity of the Internal Revenue Code to be unjustified, oppressive, counter-productive economically, and the consequence of politicians creating new provisions rather than expanding existing ones, because the former is more advantageous to incumbents concerned about the source of their next campaign funding dollar."

"The Portfolio analyzes tax provisions that pump money into economically distressed areas, an approach that began in the 1990s as Congress chose to ignore direct grants that constitute spending and decided to use tax breaks that are, in effect, spending, though the beneficiaries of these provisions and their Congressional prot�g�s refuse to treat them as spending and thus consider any reduction or elimination of these tax breaks to be tax increases rather than spending cuts."

-----------------------------------------------------

Since everyone was talking about that little tax piece from Warren Buffet (Stop Coddling the Uber Rich?) - I thought I would share this as additional reading (after reading some of the discussions around the web this week).

Yeah - there is a lot of big words - and maybe some tax stuff you never heard about - but it makes a big point.

Posted in

Just Thinking,

Taxes

|

0 Comments »

March 16th, 2011 at 03:36 pm

**Pay Day Today. I actually usually forget it is pay day and am surprised to get a check. I remembered because I had some other checks to deposit. Asked dh to just run them to the bank (had some cash, too), since I can easily scan my paycheck. So, became front of mind. BEfore this scanning thing, I just held all deposits to pay day.

The credit card is due the 31st, as is the mortgage. I will probably set the credit card to pay once my paycheck is deposited. Since I am adding extra principal to the mortgage - I will just pay it last minute. See if we can drum up more principal in 2 weeks time. It has a 2-week grace period, so no biggie. With no extra principal, I always pay it the 30th. But, I will likely pay it later with the extra principal factor. I'll decide exactly what to pay around the 31st, anyway.

Anyway, with 2 weeks before any bills due, no wonder I forget it is pay day. I just figured out this month with raise, tax cut and piano lessons, that I can pay everything on the 1st, transfer everything to savings, ROTHS, etc., and then nothing else to worry about until the end of the month (mortgage & big credit card). I like the simplicity. It doesn't always work out so easily...

-----------------------------------------------------

I had awesome news for a tax client. Couldn't have planned it better if I tried.

$50k taxable income? How much was his tax?

Um, $350???

That is an effective tax rate of 0.8%.

Is a low income tax client that came into some money. So, all he had was investment income - taxed at 0%. Tiny bit of tax on social security and disability. A whole $350 on that.

I sent him on his way and figured it was right, but couldn't wrap my brain around it. I had forgotten (or not known?) that capital gains rates were 0% up to the 15% tax bracket. I knew for 10% tax bracket. But not 15% tax bracket (up to $68k tax-free income for married couples).

I told him to enjoy it while it lasts - maybe 2 more years. I said "Welcome to being wealthy - the wealthy get all the tax breaks."

Not very many people can manage that kind of scenario (no income but loads of investment income). BUT, some can.

Posted in

Just Thinking,

Taxes

|

0 Comments »

February 18th, 2011 at 05:41 pm

I subscribed to this IRS e-mail a while ago. I believe they send daily tax tips.

I subscribe because the tax code is so immense and complex, there are many areas I never see at my job. So, I find it good to have a refresher - of any kind.

This is also why I like answering people's tax questions. On the less complex side, anyway. The more I practice, the more likely some of this stuff is off the top of my head when clients ask. Helps me to keep on top of the never-ending changes to the tax code.

Anyway, today's topic I knew some of you would find interesting:

----------------------------------------------------

"Ten Important Facts About Capital Gains and Losses

Did you know that almost everything you own and use for personal or investment purposes is a capital asset? Capital assets include a home, household furnishings and stocks and bonds held in a personal account. When a capital asset is sold, the difference between the amount you paid for the asset and the amount you sold it for is a capital gain or capital loss.

Here are ten facts from the IRS about gains and losses and how they can affect your Federal income tax return.

1. Almost everything you own and use for personal purposes, pleasure or investment is a capital asset.

2. When you sell a capital asset, the difference between the amount you sell it for and your basis � which is usually what you paid for it � is a capital gain or a capital loss.

3. You must report all capital gains.

4. You may deduct capital losses only on investment property, not on property held for personal use.

5. Capital gains and losses are classified as long-term or short-term, depending on how long you hold the property before you sell it. If you hold it more than one year, your capital gain or loss is long-term. If you hold it one year or less, your capital gain or loss is short-term.

6. If you have long-term gains in excess of your long-term losses, you have a net capital gain to the extent your net long-term capital gain is more than your net short-term capital loss, if any.

7. The tax rates that apply to net capital gain are generally lower than the tax rates that apply to other income. For 2010, the maximum capital gains rate for most people is 15%. For lower-income individuals, the rate may be 0% on some or all of the net capital gain. Special types of net capital gain can be taxed at 25% or 28%.

8. If your capital losses exceed your capital gains, the excess can be deducted on your tax return and used to reduce other income, such as wages, up to an annual limit of $3,000, or $1,500 if you are married filing separately.

9. If your total net capital loss is more than the yearly limit on capital loss deductions, you can carry over the unused part to the next year and treat it as if you incurred it in that next year.

10. Capital gains and losses are reported on Schedule D, Capital Gains and Losses, and then transferred to line 13 of Form 1040.

For more information about reporting capital gains and losses, see the Schedule D instructions, Publication 550, Investment Income and Expenses or Publication 17, Your Federal Income Tax. All forms and publications are available at http://www.irs.gov or by calling 800-TAX-FORM (800-829-3676). "

Courtesy of the IRS.

Text is http://www.irs.gov/newsroom/content/0,,id=104608,00.html and Link is http://www.irs.gov/newsroom/content/0,,id=104608,00.html

--------------------------------------------------

That's the long and the short of it. Now you are a capital gain/loss expert.

I always joke that the simple rule is if you make money, report it. If you lose money, you can't deduct that.  That is the rule when it comes to personal assets, hobbies, etc. That theme runs through the entire tax code though (passive losses, etc.)

Anyway, because of that, most people don't realize their cars, etc. are a capital asset. Since you rarely make money on these type assets, it wouldn't occur to you that you would have to report any gain. But technically, you would, if you ever had the luck to make money off those type assets.

Posted in

Taxes

|

0 Comments »

December 21st, 2010 at 04:34 pm

California increased their individual tax rates/exemptions in 2009/2010.

This affected us substantially. Our annual income taxes went from about $600 to $1600. Ouch. However, these were also the years of the "making work pay" credit, so it kind of evened out.

Anyway, I initially saw taxes were going down (state) for 2011 and decided to leave as is for future tax increases.

THEN, I remembered how the state is issuing IOUs and delaying refunds, etc., etc., etc. I decided to *screw that* and change my withholding back. I would prefer to owe at the end of the year.

This will increase my paycheck by $80 per month.

Payroll tax holiday will buy me about $130 per month.

My Federal seems dead on, as is, so I will keep that withholding the same. Means I found another $210 per month, total.

That's $2520 per year. Piano lessons is $1k per year, each child. The rest will go to savings for next year's piano lessons. The payroll tax holiday is only a one year deal. I think if I start LM later in the year, and STATE tax rates stay low another year, I can fund 2 years of lessons.

It is also looking more likely we will max out our ROTHs next year. Maxing the ROTHs (from income/consistently) and affording piano lessons have been in my long range goals for many years. I thought all this medical/surgery stuff, 2 years in a row, would set us back much further.

2011 looks promising!

(I know, I know - how long until the state increases taxes again? Maybe this June with the budget? Likely! But I will enjoy in the interim. I am also presuming I bounce back quickly from surgery! Hoping for the best...).

Posted in

Just Thinking,

Taxes

|

1 Comments »

December 10th, 2010 at 05:54 pm

I think this sums it up pretty good:

Why the Tax Compromise is a Mistake

Text is http://mauledagain.blogspot.com/ and Link is http://mauledagain.blogspot.com/

------------------------------------------------

My head is spinning at work.

It's hard to remember all the "one-time" absurd tax laws for the state to generate revenue. My boss about gave me a heart attack when he said NO SAFE HARBOR for Cali income tax this year. Turns out he was wrong. (I thought he knew something I didn't and freaked me out a bit - that is only true if your income tops $1 million).

I've got clients calling me about this health care credit (For small employers with low-wage employees, who provide health insurance). It's so convuluted, no one qualifies. But I have to stare at it a couple of hours to tell them they don't qualify.

I am reading about the IRS lack of guidance on carryover basis for Estates in 2010. No Estate Tax in 2010. Sounds great, right? No. No stepped-up basis for inherited assets. I just read that this form (to allocate basis) is due April 15th, for people who passed in 2010 with larger estates, though the IRS has not issued any guidance on a number of issues, and has not even provided the form.

It's December 10 and AMT is not patched though it has been promised to be (for 2010).

The government wants to pass a social security tax holiday that is too late to implement for January.

People all the time tell me that accountants must support all this crap because it means job security. I think the line from "job security" to "it's practically impossible to do my job" was crossed when Bush took office. But, it's just gotten worse since Obama took office. I actually contribute to my profession's political action committee because I know they support SIMPLIFYING all this mess. It's honestly the main reason I contribute.

California is a mess because they can't justify to match all the tax breaks at the Federal level. I have to give California that. Though it is a huge PITA for tax payers and tax professionals, at least they don't blindly play along with tax legislature they can't afford. For me, there are 3 tax systems. Fed, AMT, and California. That's 3 times the work compared to a decade ago (when AMT was more rare and California mostly conformed to Federal law).

2011 will be a fun year, indeed!

Posted in

Just Thinking,

Taxes

|

3 Comments »

October 15th, 2010 at 02:47 pm

**It's official that 2011 IRA Contribution Limits will remain unchanged for 2011. (Our tax research company calculates the changes every September - I just remembered to look). IRS will make an announcement in the next couple of weeks, probably.

For whatever reason, they didn't calculate 401k limits this year. I presume the $16,500 max will stay the same (my educated guess).

Posted in

Just Thinking,

Taxes

|

2 Comments »

February 13th, 2010 at 04:17 pm

Is it absurd that I feel like I am filing insanely late? I usually have my taxes done before January 31, and file sometime around Feb. 1.

But, life has gotten in the way, and this is my first opportunity to sit down and finalize everything.

I will hold off pushing "send" since I think that I have more charity receipts laying around.

I also need to open a regular IRA to roll my work retirement into. My boss is closing the plan. I just have no idea what I want to invest in. Ugh. But if I open a regular IRA with $1080, this got my taxes down to $0. ($800 refund Feds; $800 due to state). & makes our retirement contributions about 17% for the year. Woohoo. I am contributing for 2009 to get the immediate tax break. That, and I don't need a tax break for 2010 - I have medical bills galore for that...

So, I will just file my taxes with that figure, and pretty much means I should just open a Vanguard fund - since I can invest as little as $1k. I can always change my mind and roll things around, later. I think it's time for me to open a Vanguard account!

I will probably invest this money a tad more conservatively, which I suppose makes sense, since it gets taxed on the back end. LEt all the aggressive stuff be in the ROTHs? Since it shouldn't be taxed again? Will have to ponder it. This will put our ROTHs and regular IRAs at about 50/50. It's been that way for a while, but I haven't had any control over my work retirement before. So, now I have to think about it all a lot harder. It's overwhelming to suddenly be in charge of such a large chunk of change!

----------------------------------------

I've got to whip out the kids' returns now. I think part of the reason I like the UGMA accounts for them, is they are well under any taxable limit for now, and I can easily report their (non-taxable) dividends on my tax return.

BUT, their balances grew enough in 2009 that I was able to move them over to some mutual funds with bigger minimums. So, sold their old funds, and triggered capital gains or losses. Not sure which - I haven't looked. Probably losses, after the storm of 2008. So, now I have to file 2 more tax returns. Ugh!

Note to self: Don't trade their mutual funds willy nilly!

I actually just put them in some "Retirement fund" that gets more conservative with time. Putting the target date when they turn 18, or something along those lines. So, I don't foresee a lot of trading anyway.

I think I didn't want to be reponsible for messing up their investments. I just set it to "easy." It's one thing to mess up my own retirement, but their mutual funds are about 99% funded by gifts. I am just playing those safe!

Anyway, all our investments are tax-deferred, or in cash. Their taxes are more complicated. Lucky them!

-----------------------------------------

In other news, we got the house back to ourselves!  It was kind of nice yesterday. It was kind of nice yesterday.

I figured I would work all morning and go check on them at lunch. Considering the last few days, I am sure they will be fine. Though the kids would probably love a trip to the drop-in daycare place, all the same. May do that for dh. I think the gameplan is to try not to expect much of anything from him for 2 more weeks. Next week will be easy with the kids gone. I told him the week after I would drop off BM at before-school daycare to give him a break in the mornings. But, at the 6 week mark, I won't be so nice. I think it is crossing the line to our usual "he is not a morning person" thing. Whereas, I can't work near the overtime if I am getting kids ready and busing them to school, etc. So, I told him I would do everything until his doctor appointment March 1, and then he is going to have to start getting BM to school. He always gripes about it anyway, so I think at this point he is just milking it. But if he is supposed to take it easy for 6 weeks. I won't be so nice once March rolls around and work gets extra crazy!

Posted in

Just Thinking,

Taxes

|

0 Comments »

February 10th, 2010 at 01:16 am

This article came to my inbox today.

Myths about federal taxes

Text is http://www.mercurynews.com/business/ci_14358598?nclick_check=1 and Link is http://www.mercurynews.com/business/ci_14358598?nclick_check...

Was a good one, though this barely scrapes the tip of the iceberg.

Posted in

Taxes

|

1 Comments »

April 11th, 2008 at 03:29 pm

Well, I have made clear that our taxes have been pretty low since we have had kids. Of course, I ran across an old post on the forums when I was searching for some old forgotten topic where someone had assumed I was playing a game with the IRS. I had just never seen that reply before, and it was quite ancient to reply too...

I have to say, no games. Which I have said before. But I Wanted to clarify. I am a W-2 employee. I withhold plenty. On average I owe $0 and get a refund of $0 for tax day. I usually run pretty breakeven. (Owe a few hundred fed, get a few hundred back from state. How it usually goes).

So yes I wanted to illustrate again how living on one income we get to keep a big chunk of our paycheck. & why a second income doesn't always sound terribly lucrative.

Of course, this whole topic reminds me there should be much more tax education in schools. MUCH more. I think people could make much more informed financial decisions if they understood the tax ramifications.