|

|

|

|

You are viewing: Main Page

|

|

February 16th, 2026 at 05:50 pm

My cat didn't make it.

It's never easy but this one is really hard. It was so completely out of left field. He had so much energy and life when we dropped him off. His liver numbers never improved. Within 24 hours he went from 'appearing very healthy' to 'it's time to put him out of his misery'.

He was 14.

Hell froze over and life relented. In what world do I get to grieve my cat in peace for 3 whole days or process *any* grief. What!? Life has not let up during my 40s. It feels like such an incredible luxury to just sit with my feelings. I haven't had any time or space to grieve anything the last decade. It's always on to the next emergency, before I can process anything. While it's not fun, I recognize that it's very healthy (to actually grieve) and it's a luxury I have not had in a very long time.

I took a nap Friday around 4pm. I had some peaceful time where I felt I should rip off the band aid and tend to a few things. Let his primary vet know. & I transferred money from savings to pay off the vet bill. I could not even begin to imagine having to think about this financially for another X months or years. I thought, "I will transfer the money now but clearly can't do much until Tuesday." Ally is pretty fast to transfer and my CU always gives me funds 1-2 days early. But *never* have I been able to set up a transfer around 4pm and get the money in my account in a couple of hours. Not even if I set up the transfer at 7am. So I took my nap. Woke up and saw my paycheck hit my bank account already (4 days early re: weekend and holiday). & the Ally transfer I had just started was there. What!? Felt like divine intervention. I told MH it was a small thing. I expect the grief to still be very fresh on Tuesday. I could have handled making the credit card payment on Tuesday and being done with it. But the money part is done and life moves on. & I appreciate closing that chapter.

We talked about running away to Pismo Beach. There was one room left (at our forever hotel, the only place I would stay) and the cost was within the realm of reason somehow. Even with the Holiday weekend (it hasn't been reasonable on the weekends, in recent years). I told MH I would see how I felt after my nap. I actually felt pretty terrible after my nap and changed my mind. Looked up a few hotels closer to home (that didn't involve 10 hours in the car, roundtrip). Things are pretty booked up for the holidays, and expensive in prime destinations. I told MH, "You know what? I like sleeping in my own bed, and saving a bajillion dollars."

We did go to the coast for the day (Saturday) and I think it was a perfect 'denial stage' activity.

My cat had a big personality. I know it will be very quiet, and that part will be hard. But it helps as we share the infinite memories of all his quirks and antics. 💞

Posted in

Just Thinking

|

7 Comments »

February 12th, 2026 at 04:37 pm

I got a fog picture.

The light is a street lamp. It just looked cool in the fog but I was surprised you can't even see the street lamp (the rest of it) in the picture. & then it just looked cool with the tree and the dirty car windshield.

It's been a weird couple of months of extreme fog. Including a white knuckle drive home from San Francisco a few weekends back, with the thickest fog I've probably ever driven through.

In other news, I am really enjoying the $500 chair. The fancier/electric powered chair will take some time to get used to. I think at the end of the day I prefer being able to manually adjust how I am sitting.

I suppose it might be a spendy furniture year. On MH's birthday, the mechanism broke (recliner) on his movie theater seating. In the middle chair that he uses the most. I am not sure if this will be a 'we just were looking at reclining loveseats and should just buy that' thing, if we will buy something similar (theater seating), or if it will be an easy fix. This could easily go the way of the 2025 theme of we just need to fix or replace the mechanism. It could end up being a small thing. Things to figure out later. Just living with it for now.

I doubt we'd buy new theater seating because our longer term plan is to just have a short throw projector, and to not have a dedicated movie theater room. Not that we necessarily have long term use for a reclining love seat. But it would be a little less specific and easier to hand down or pass on.

January was very spendy. But we were able to save about $2,300+ (I updated sidebar) re: December windfalls. There were no big bills left to pay in January. January spending (Credit card charges) will sort out in February. Don't expect to be saving much in February, accordingly.

I expect February (Feb charges paid in March) to be a lot more quiet and frugal. & it's a short month. Will see.

My office moved last week and it seemed to go pretty smooth. I think my only real complaint is the crowded parking lot. It looked larger and more spacious, initially. But anyway, the last couple of smaller office buildings I have been in, they both probably had 20 spots for 5 people. I just feel like it's infinitely more likely to get into some kind of fender bender in the parking lot. & it's hard to see much when backing out of spaces re: dense mass of cars.

What's great and exciting about this move is I think I will be saving an hour a week on commuting. What!? I had started out with an estimate of 10 minutes a day, or 40 minutes a week. & was happy to put up with any downsides of the move (mostly, losing the beautiful grounds) in exchange for more time. But then I saved 20 minutes on Monday. I now think that the time savings will be more substantial. We just moved about a mile up the street. But the new office is right by the freeway, which is what I am more used to. (I am spoiled, always having otherwise lived or worked right next to a freeway entrance). The worst of the old commute was the long 2.5-mile slog to the freeway in afternoon traffic. My 30-minute drive would turn into a 45-minute drive home, just because of that stretch of city street. Anyway, now it's more of a 25-minute commute both ways.

It will be a month or two of sorting out infinite address changes (we have ~30 entities we get mail for). But I am viewing this move as the last big hurdle of a very trying few months. Phew!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

HA!

This week has been a week from hell. Many things going on, but the latest is that my cat is in the Kitty ICU. Should find out more what is going on today.

The only thing I know for sure is $$$$$$. Not thrilled about that. But also definitely an appreciation through trying times like these that we are not normal. That we can *Shrugs* when random $10K bills fall out of the sky.

It could be we have run out of luck with him eating plastic around the house. He's acting like he is poisoined, so we got grilled a lot about anything he might have gotten into. Haven't figured it out yet and could be something more serious and underlying. But I do feel like it's a miracle I have never had to take him to the vet re: all the weird and random stuff he eats. Heck, this is the first ER vet visit I've ever had for a pet.

Oh yeah, and MH is a big sofite. Logically, he's pushed back in the past, at the idea of spending this kind of money on a cat. But he folded like a wet noodle when the rubber hit the road. Heck, do I have to be the voice of reason?? He actually had a strong reaction to the DNR question. I was just, "Wait, what!?" We have a 14yo old man cat.

The vet called him spicy because 4 people had to hold him down to draw his blood. It sounded like an excorcism happening on the other side of the wall. That's my demon cat. Anyway, the vets all seem to think the odds are in his favor. He's not acting like a 14yo cat in an ICU. So all of this was kind of a no brainer. Also, I'd like him to not turn into a demon cat at home. Our vet did give us a $500 option to treat him at home. I don't think the ER would have agreed that was doable. So it might all be for the best. My nerves are far less shot, knowing he is in the best hands.

Posted in

Just Thinking

|

4 Comments »

February 4th, 2026 at 02:21 pm

I received MM(22)'s college tax form and confirmed that they treated his summer income as a 'tuition reduction'. Which is not doing us any favors. Would have been tax-free to him if they just treated it like income. It was technically wages, that I of course let him keep (and did not apply against his tuition).

I thought this seemed to be the case when they paid him in one lump sum, the same way they refund financial aid. On the plus side, MM wasn't planning to do any ROTH IRA contributions** and it seemed obvious enough to me (after he was paid), so I was mentally prepared to pay another $900 tax ($4,500 x 20% tax credit lost). Was just waiting to see how they reported on tax forms.

**I believe he has $0 'wages' this year so would not be able to do an IRA contribution if he wanted to.

& literally, he would have paid $0 tax on that money if it was reported as wages. The weirdest W-2 I have ever seen was the quarter he worked as a TA for the college. The only box completed on his W-2 was 'taxable wages'. Not subject to FICA or any other taxes. His income is well below the standard deduction.

I also just happened to get our investment 1099s (a couple of weeks ago, when I received the tuition tax form). Which is the only reason I can't finalize our tax return on January 1. I've got everything else dialed down the last day of the year. But I don't know what's a qualified dividend or not. That's the only tax form I really need.

So our taxes are pretty much done. At some point I will sit down and make sure all of our tax forms match my records.

I thought we did really good in January (savings) but it will all end up going to taxes and IRA contributions, probably.

I double checked if we literally could contribute $0 to tax deductible IRAs, how that landed. We can do $1,120. I will do that, to save $336 (30%). That's a no brainer.

Mostly I wanted to make a note to myself to remember to do the IRA contributions.

Posted in

Just Thinking,

Taxes

|

2 Comments »

January 11th, 2026 at 04:23 pm

I did a 2026 tax projection and so was able to finalize my net pay and 2026 goals.

My entire raise will go to taxes and healthcare. 😒 I had wanted to eke out some extra money from bigger raise, to cover expected tax increases in near future. I couldn't cover any of that, so I made a note in my budget spreadsheet. I need to come up with an extra $400/month (taxes) at some point in the near future. The obvious solution is to just move it over from the grocery budget, when I am no longer feeding kids. I wanted to get ahead of that curve, but I don't think it's going to happen.

Pay cash for college

Just one more tuition payment left for MM(22). & then there will be one...

$10K to Savings

The Usual

$7,500 to Investments

I am only going to be able to save ~$5,000 from my paycheck and credit card rewards. But there's always other snowballs (like MH's income) and snowflakes. So I will try to be a little more aggressive on this goal this year. It should also be easier, having less college expenses.

$1,500 to mortgage

This is the amount we need to pay to keep on our '$10K per year paydown' trajectory. This number is going to drop down for a couple of years (as regular principal payments increase).

We've been pretty set on not tying up any more money into the mortgage (than this) while we have two kids in college. & I think we are leaning more towards a 'mortgage payoff' fund at this point. (Piling up money to pay off eventually, with one final lump sum.) I was just doing the math if we front loaded this goal. It would save us a whole whopping $50. There's many reasons for the 'mortgage payoff' fund but definitely there's just not a lot of interest to be saved with pre-payments at this point, with low-balance/low-interest mortgage.

9% Income to Work Retirement Plans

MH and I both contribute the minimum for 401k match. The 9% includes employer contributions.

$0 to IRAs 2026

**Stretch Goal = $17,200 (MAX) to IRAs**

Hitting Coast mode, while strangely not getting as much tax benefit from (smaller) retirement contributions. Which I personally think is *amazing* and makes it easier to cut back on retirement contributions.

Leaving the stretch goal for the 'unexpected money' factor.

& to be clear, I consider MH's income to be a snowball. So the snowballs I need for other goals are very expected. The stretch goal is more about if money just falls from the sky.

SUMMARY

This is also an odd year where we may have some major expense decreases mid-year, with a college graduate. (e.g. a significant reduction in healthcare and food costs.) We may shift these amounts to building up investments, and bumping up goals. Will see how the year goes.

Edited to add: It's going to be a weird year of flux. Since I started this post, I now think we will be a 4-person household early in the year. I don't anticipate the extra houseguest to change our goals or numbers.

Posted in

Just Thinking,

Budgeting & Goals

|

1 Comments »

January 11th, 2026 at 01:01 am

MM(22) Nov 2025 'Gifted College Fund': $9,115 (+$5K ROTH)

MM(22) Dec 2025 'Gifted College Fund': $7,900 (+$5K ROTH)

Rent is paid through 1/31.

Nothing much to report. Will pay MM's final tuition payment in February.

& I have some extra cash set aside to cover MM's last month or so of rent in college town. Didn't have much of a plan before, but I officially told MM(22) not to worry about it. I just did some rough math and it's still crazy how we might have just enough 'gifted college money' to cover his last month of expenses. But too many reimbursements flying around and moving parts. (He just got 1/3 of reimbursements owed to him from 24-25 roommates. This was money I already gave him so he technically owes back to the college fund. Just to make this more impossible to calculate.) Will see.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I won't have another DL(20) update until I get his financial aid refund, in a couple of months.

Posted in

Just Thinking,

College

|

1 Comments »

January 10th, 2026 at 08:34 pm

O.M.G.

Disaster company sale did not go through last Friday. 😭 I just couldn't even with that.

Of course the final chapter of disaster company was a total disaster.

The buyers planned to pay cash. But they don't understand how money works? I was fed juicy tidbits from multiple people along the way. The whole thing is just bonkers.

I was still optimistic we could make this work. I think in most cases this would be a major red flag or just wasn't going to happen. But I felt like it would work out, eventually. Given the details.

So last Friday they told us the wire had been sent, but it never came through. & then they kind of went radio silent as they scrambled to figure out their crap.

I guess they came up with an acceptable down payment on Thursday. So I get this call in the afternoon that they need the wire info because they are heading to the bank. What!? (This was after almost a week of crickets. My employer is just trying to leave us off the roller coaster, like that is really possible. & the buyers were also pretty quiet while they scrambled.) So that was very out of the blue. I got the wire paperwork and it all looked good. Surely the bank agrees the money is there, and they got all the account info correct. But it was after 2pm when they called me. So I knew this would be a Friday thing.

When the wire money wasn't there by noon Friday (they thought it was sent) I was really losing my mind. I. can't. even. with. this.

The wire did eventually came through. I later told my employer, "You know, you never told me the amount we are accepting." LOL. For all I know, he demanded $500K and they only sent $400K. (While he was trying to leave us off the roller coaster ride, he hadn't told me anything about the new agreement. I had just seen the paperwork at some point while they were negotiating.) They had sent the agreed amount.

I have so much work to do to wrap this up. The week delay and distracted week of limbo is not helping things. But I am so happy how ongoing operations, payroll, and employee issues are no longer my problem. Instead of doing 50 + 15 employee's payroll every week, I will just be doing our company (15 employees). & I think our payroll is a lot simpler (mostly salaried) and will be easier to get my assistant independent on.

I don't know why. everything. has. to. be. a. roller. coaster. 2026 definitely is starting off with the exact same vibe of 2025. (When I didn't even blog for 2 months, because everything was so crazy).

Current mood: Exhausted and numb. I think I am mostly in disbelief. & the reality quickly set in as we jumped directly from that roller coaster to all the nitty gritty of moving things over.

On the home front, there's also a lot of big things going on. The most dramatic is that DL(20)'s girlfriend will be moving here soon. She needs a place to land on her feet. I expect she will live here for a while and that I will have to cosign her lease. I am kind of, whatever. If just minding my own business creates this much drama, what if I actually did something wild and crazy? 🤷🏻♀️ What difference does it make at this point? I think cosigning a lease (so that she can get on her own two feet) is actually pretty boring and would have zero impact on our finances. The stakes seem pretty low re: dirt cheap housing in our lower cost region (compared to any frame of reference I have). & with two young 20-somethings that could use an apartment (if she abandons it). I will give it some thought and won't rush into anything. But it sounds pretty boring, in the grand scheme of things.

I am really proud of both DL and his girlfriend. They both have very good heads on their shoulders. I very much relate to her situation. She has no debt. When it came to my own lack of debt, this was always viewed through a middle class lense as a big accomplishment. No, you don't understand. I couldn't have afforded one penny of debt. The interest rates are usurious when you are 20 and on your own financially. Being in a mega high cost city, I couldn't have personally afforded $100/month for a car loan or a credit card payment. There was just no money to entertain debt. I personally view it as a good thing that the GF is not going to college. She felt like she didn't have a choice. But she easily could have made the choice to go deep into debt for a degree. Or she could have chosen the debt spiral (re: payday loans, car loans, credit cards, etc.) simply because she didn't know any better.

Her timeline is speeding up because wages are so much higher and labor laws are so much better in our state. I think she will be able to save money. & then she can go the free community college route, once she establishes her residency. The smallest kindness will change the course of her life significantly for the better.

I just remembered the other day that we were encouaraging my niece (who also graduates college this year) to move up here. It's going to be a year of flux, on the household front. Might have a household size of 3-6. I think 6 is unlikely, but the offer is out there. Both the niece and MM graduate this summer.

DL(20) did tell me that his plan is to live at home for 2.5 more (college) years. Piling up the money. He is such a mini-me of his father.

This reminds me... One of MM(22)'s roommates last year was *drama* and had a falling out with their parents before they signed the lease? Their GF's parents came through and agreed to pay their rent *and* co-sign a second $4K-$5K/month property. (You know, because they already had a college kid living in another house.) I remember at the time saying, "it must be nice!" So I feel like life has come full circle as I consider pretty much doing the same thing. Just 18 months later. Well, let's be clear. I did not offer to pay the rent. It's just a similar thing. For one $1,600/lease. This is more my pay grade.

Edited to clarify: In college town, cosignors have to cosign for the entire property. I presume it will be the same for this 1-bedroom apartment though it will be split 2-3 ways.

Posted in

Just Thinking

|

2 Comments »

January 7th, 2026 at 04:10 am

This is what I started to write re: 2026 Financial Goals.

I am trying to minimize IRA contributions. But I think we will need to contribute $5K to IRAs, in order to avoid the next tax bracket (22%). Which feels pretty steep after paying ~$0 taxes for two decades. & also factoring how complicated taxes are and how this means an effective tax rate of 35%+.

I ended up preparing our 2025 tax return this week (state software isn't ready but I have good IRS numbers). And... Our income level means we lose the ability to deduct Traditional IRA contributions. What!? So anyway, this is pointless and I have to plan ahead re: larger 401K contributions instead (if I want to reduce MAGI, or if I want to lower our taxable income.)

It gets even more weird. I just reduced income by $10K (in tax software) to get a sense of what our effective tax rate is (trying to figure out if I should up 401K contributions to manage taxes) and our effective tax rate (on just this $10K) is only 22% for Federal. 😮 I was envisioning more like 40%, given how wonky our effective tax rate was for every extra dollar of income, when we had more tax breaks. That's crazy! I've never just paid a flat tax rate without losing all sorts of other deductions because we had more income.

It's good because it no longer sounds horrifying to skip Traditional IRAs.

A - I can't deduct those contributions anyway.

B - A 22% tax hit is pretty small (compared to years past). If we are used to 25%+ tax hits when we were in the 10% or 12% tax bracket. & now 22% just means 22%.

After all that, I don't have any reason to contribute any money to IRAs. It was a windy road to get here (as I noticed more and more tax consequences of higher income), but I feel a lot more confident about dialing down retirement contributions.

The other piece of this equation is that we are no longer subject to 0% long term capital gains tax. Which is some of why lowering our income (with retirement contributions) used to lower our tax rate so dramatically.

There will have to be more thought and planning re: tax efficiency in the future. For example, I never gave a flip about tax efficient mutual funds, when our investment tax rate was 0%. It's a topic I might have a wee bit more interest in now.

Edited to add: I got state tax software/update so was able to run through state numbers. Definitely feeling the middle class squeeze here. The tax rate moves pretty quickly from 4% to 9.30%. Our marginal tax rate will be 8% for state, this year. Bringing our total marginal tax rate to 30% (22% + 8%). It will be a very simple tax calculation when it comes to my bonus this year. (30% is kind of *shrugs* because that's the true marginal rate we were used to already. It's been ~30% for a long time. Just was a lot more complicated re: losing other tax breaks when we had extra dollars.) Which is why I used my tax software for rough estimates (after losing professional work tax software). Our taxes in 2026 can easily be done with some rough napkin math, in contrast. There's not 5 different tax deductions/credits/rates/phase-outs interacting with each other.

Posted in

Just Thinking,

Taxes

|

3 Comments »

January 7th, 2026 at 04:07 am

Pay cash for college ✔

Just one more tuition payment left for MM(22). Crazy!

$10K to Savings ✔

Final tally was $13,185.

Saved at the last minute, by a cash gift. Which made up for a wild spending year.

$7,500 to Investments ✔➕

Final tally: $7,900

Was able to surpass the stretch goal with my bonus.

$1,700 to mortgage ✔

Mortgage goal is non-negotiable. I will not have a mortgage for more than 30 years on this house (while healthy and well employed).

9% Income to Work Retirement Plans ✔

MH and I both contribute the minimum for 401k match. The 9% includes employer contributions.

$6,000 to IRAs 2025❓

Decided to pass on this goal. $0 to IRAs.

I put 30% to retirement last year, and wanted to focus on other goals. This decision was before the cash gift. But I think it's important to stay the course.

We contributed 20% average (to retirement) during 2024/2025. This is probably the #1 reason we are putting IRAs on ignore. Will contribute $0. The other reason I suppose is because we hit a big retirement milestone. & the stock market is high. I am sure there's many reasons. I'd be more inclined to take advantage if we could get in some cheaper buys.

The twist: Just noticed that we are about $7,000 into the 22% tax bracket for 2025. Ouch! When our taxes were otherwise ~$0, our effective tax rate was 25%+ (on IRA contributions). Because taxes are complicated. So I can only imagine that we are talking about paying 35%+ for every dollar we don't put into retirement (with the 10% tax bump). I guess this goal is on hold and I will very likely put at least $6K to our IRAs if we get a third of that money back. I am really trying to back off retirement contributions but it's just not happening. This is the flip side of efficiency and all those years I pointed out my friends and coworkers with 2x or even 3x our household income were netting the same. I am feeling the middle class squeeze. The cost of spending more is... A 33% tax penalty? Maybe I just need to let it go. I have 4 months to ponder.

Edited to add: Then I ran tax projections and I think it will be a $0 IRA year. But I will just leave this as a question mark until April 15th.

SUMMARY

Retirement goals will start to decrease as we enter financial independence 'coast' mode. The 'saving for retirement' part is over and now it's about letting that money compound. & with that, we can start to enjoy our money more. I don't see the point on keeping the petal to the metal for the next 10 or 15 years. We are starting pre-retirement and enjoying our money.

2026 Goals

TBD

I need to run tax projections and figure out what my actual net paycheck will be. From there, I can set my taxable investment goal.

Bigger Picture

The bigger picture is that we are probably going to move our longer term savings % down from 30% to 20%. We've personally never felt comfortable putting less than 30% to savings/investments. We are starting to experiment with 20%, which I am well aware is still higher than average. But for us, it feels very lax.

It's probably more precise to say that we are moving retirement savings down from 20% to 10%. Will see how the rest shakes out.

Posted in

Just Thinking,

Budgeting & Goals

|

1 Comments »

January 3rd, 2026 at 03:16 pm

Our net worth increased by $115K in 2025. This works out to $14K retirement contributions & a $96K increase in stocks. Cash/investments down $5,000 (re: college costs). Mortgage was paid down by $10K. Home values remain steady.

Re: my sidebar big picture goal, the goal has been surpassed. Still have two more years to reach goal so will leave it there. Will see how future stock market fluctuations shake out. It's my 'financial independence' goal, which doesn't mean anything until my kids are done with college and our mortgage is paid off (only then can we live comfortably on a lot less.) So that's one more reason to let the next two years shake out before evaluating progress on this goal.

I suppose if the 'financial independence' goal is surpassed, there's really no need to track any further. Future net worth gains should be about 99% stock market and real estate gains. It would not be necessary to add to our investments. But I will make an estimate of where I expect things to land in 2026. There's just no specific goal that would need to be hit.

Historically, we had a goal to increase net worth by $60K per year. & of course, I'd expect this number to go down if we are no longer aggressively saving for retirement.

Estimate Net Worth Change for 2026:

Mortgage: Paydown $10,000 <---Regular payments + $1,500

Retirement: Contribute $14,000 <---Minimum for employer match

Investment Gains: $30,000 <---Investments doing the hard work for us

TOTAL INCREASE: $54,000

Our net worth changes never look anything like our estimate (it's rare any asset class actually has an average year). But, I go through this exercise just to make sure my goal is realistic and doable. Or in this case, just to see what we can expect this year.

I am just presuming that other savings/investing and college spending will mostly be a wash.

Note: Current net worth is $1.4 Mil. Enough to give us a $1 Mil nest egg and paid-for home.

Edited to add: I just noticed that if we cashed out everything but retirement and $30K emergency fund, we could pay off our mortgage. So tempting! It's not going to happen because I have college bills to pay and some of this money technically belongs to my kids. It just makes me wonder how much longer until we just write the check and move on from mortgage life. It might be in 2-3 years.

& to be clear, no way on earth we'd have $1 Mil, if we paid off our mortgage sooner. It's been a financial/strategic decision to keep to this point. & you can also argue that keeping the mortgage longer helped us to not borrow money for college (or for anything else). But as we hit our financial independence goal and the final college stretch... There is no longer any reason to have a mortgage.

Posted in

Just Thinking,

Financial Independence by 50

|

1 Comments »

January 2nd, 2026 at 03:20 am

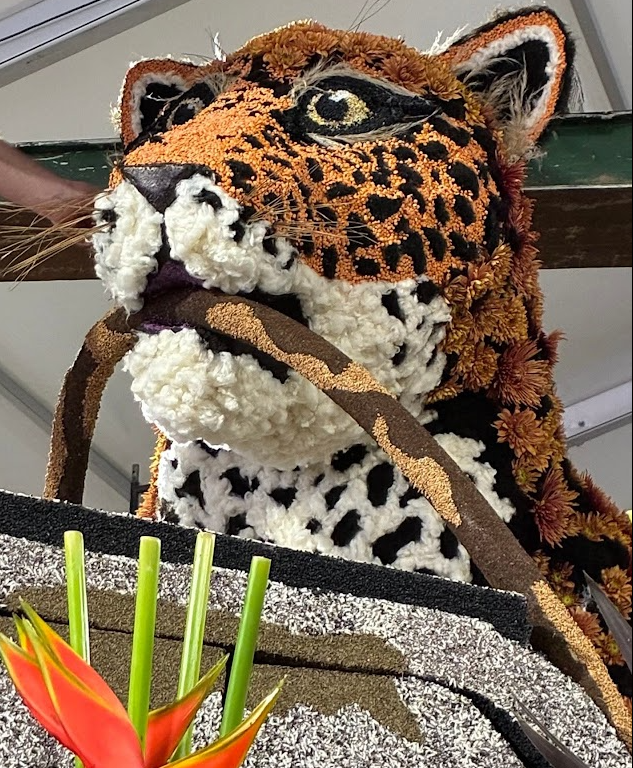

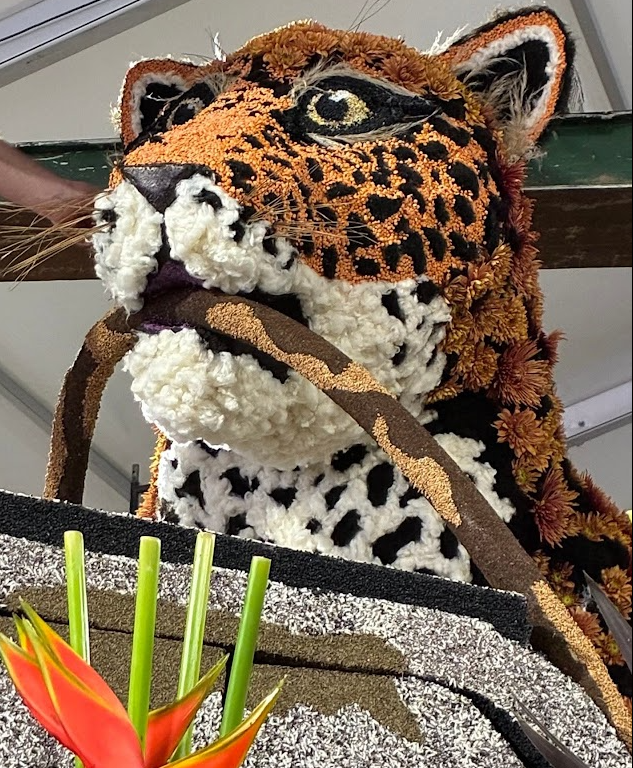

I just saw that the final judging video was posted on the YouTube channel. It shows a lot of the details.

You can copy and paste the link:

https://youtu.be/2AHWPHzncww?si=3dBnxI40zR1tn0kx

Posted in

Just Thinking

|

3 Comments »

January 2nd, 2026 at 12:39 am

One more sleep until my Christmas dreams come true... 😁

On 12/31, disaster company got served with a lawsuit. 🙄 We knew it was coming and I expect they probably heard about the company sale and wanted to slip this through. It was just icing on the cake of a trying week. But we had a heads up (some months ago) and everyone seems pretty *Shrugs* about it. We will be financially responsible for anything of this nature pre-2026. It was a disgruntled employee. (& to be clear, doesn't matter when served. The complaint is a pre-2026 complaint.)

Today is also the last day before DL(22)'s girlfriend flies home. The trip was a success. I took them out to dinner last night. I was nervous if she would like it here and could see living here. Because if not, who knows where they end up. (She is unhappy in her current situation.) So I took them out to dinner in the 'this seems to open up a lot of conversation' vein. She looked horrified when DL(20) brought up she had a plan to move here this summer. But it answered my question and I told her that was not unexpected. I think she was horrified that DL told us any of this, because it was more the seed of an idea. But DL(20) was already hoping for this possibility (at some point). & a couple of his friends want to hook her up with housing and a job.

MM(22) is inside the rose float again this year, on parade day, for his college. I worry if he got any sleep last night, in the cold and the rain. They sleep in the float, they have to stay near for whatever reasons. I mean, most likely so the parade will go off without a hitch (no MIA float operators) but also probably in case of emergency and if they need to move floats for any reason. & I am worried about him because he was sick. He might be able to sleep most of today. He can't afford to miss any classes because it's a new quarter on Monday. Last year there was a much bigger gap between Jan 1 and classes starting. & he had to stay with the float for 4 days? Meaning, he can't go back to his college for a few more days. The schedule will have to be a little different this year, with the time crunch.

Oh yeah, and their float won the grand prize! It's the first time they have won, after 75 years of participating. So that is pretty exciting! It's been a rough year of infinite mechanical problems that he was involved with. I swear he told us 3 or 4 times (some months ago) that he would be over the hump. But they ended up having several engine problems. It just seemed to never end. But the engine worked well enough for judging and getting through the start of the parade. I suppose that's the most important part.

If I have one word for 2025, it's that it was EXHAUSTING. I am so exhausted.

The tenor of the year changed a bit. It was a little less constant dire news and a lot less '10 bad things happening all at once.' Because of the tone change, and some really good things that happened, I think 2025 is going to stand out as an overall good year (head and shoulders above the rest of my 40s). But... Man it was an exhausting year, and it started out pretty rough. Most of the rest of my 40s is a blur of, "I don't have time to deal with and process *any* of this." I'd say that 2025 was less overwhelming, overall. It was a weird no-cost Murphy year. It felt like the problems were non-stop but on the money front it was one of our lower years as far as unexpected expenses and emergency spending. It's crazy how many bigger things happened that were $0-$50 fixes. The perfect example is I thought my cat was dying (he was very sickly and lethargic) and it turns out he was just eating plastic. He loves plastic, but it seems to be getting worse with age. So what stressed me out very much was an easy fix. (I realized when he puked up some plastic before I took him to the vet.) I feel like this sums up 2025 pretty well. It captures the stress and drama of all the things that ended up being "nothing" or cheap fixes.

Some pretty amazing things happened in 2025.

**We hit some long-term/big financial goals and ended the year with a lot of good money news.

**MH got his movie made and out into the world.

**DL(20) figured out what he wants to do with his life. & he found his person. Both are major life wins.

**Our 25th Anniversary trip was pretty amazing.

I am feeling very hopeful about 2026.

On the work front, trying very hard re: everything we can actually control. So excited to lose a chunk of workload (eventually) if this company sale goes through. We also replaced a $20/hour employee with two $60K+ employees. *Fingers crossed*

I still know that we have some very trying years in our nearer future, re: aging parents. 2025 was a pretty good year on that front, and I am just overall feeling in a more hopeful space. So it's weighing less on my mind. But practically, we are well aware we have some very difficult years ahead of us, sooner rather than later.

2023 & 2024 were a lot more difficult, in contrast. You don't expect to have a significantly easier year when you have two parents going through mental declines. But 2025 was a weirdly peaceful/easy year on this front.

Looking ahead to 2026:

**MM(22) graduates college! That's pretty exciting and feels along the same lines of recent retirement savings accomplishments. Watching the work of the last 20+ years come to fruition.

**MH is making another movie. This has the potential to be very stressful. But it's the big thing that is in the works for 2026. More on this later.

MH got some good news on the movie front today. We found out that MM's float won a big award. & I am hoping that tomorrow is a really good news day re: selling that company. So I'd say that 2026 is off to a strong start.

Posted in

Just Thinking

|

1 Comments »

December 30th, 2025 at 03:30 pm

Counting down the days until we get this company sold, at work.

Did their last payroll last night, which is the biggest time suck and always ends up being an after hours thing as to timing. I mean, I hope the sale goes through and I am done with that part. That will be the most immediate and obvious improvement on the work front.

It will most definitely get worse before it gets better. But it will be so worth it.

One thing I didn't mention is that on top of the rest of the work chaos right now, we are also moving offices. Seriously. It's the busiest work week of the year (for me) but I made time yesterday to select my new office. There's a funky office (the biggest in the suite) that has some sort of truss blocking a chunk of the window. My employer was pressuring me heavily to take this office. It's the biggest one, and would definitely have more of a living room feel. It needs some bookshelves and a couch. I thought I might watch some TV to get some design ideas (big offices seem to feature prominently in TV shows). But going in person, the trusses blocking the window, would drive me crazy. & I'd prefer smaller and more cozier, anyway. Anyway, it might sound nice to be offered the biggest office. But I can see the truth was I had next to last priority. With how other people had to sit here or there for other reasons. There is a tree right outside the window so maybe I can bird watch as much as I did before. & if I got the weird office, I'd survive. I just have nowhere to go but down. My employer has been incredibly picky because of the beautiful grounds we have now and the empty lot sitting next to our windows that give us unobstructed views of nature and the sky. He told me at some point most views were just of other walls (like it was at my last company).

While I will miss the grounds, this should overall be a good change.

Going back to this company we are selling. I have some stories to share about that! But waiting for everything to be finalized.

On the home front... We did the chair shopping. I made the time some how. Tried to hit the sales. My $500 chair purchase turned into $1,900. 😁 Not sure how I feel about it. We had very mixed feelings going into it. For the most part we have never bought furniture, or just went cheap when we did. We were both very much, "Let's by a step higher" as to quality. But... On the flip side of the coin this is just a temp solution and the bar is very low. So we weren't too commited either way.

I should back up. The 'nicer' living room furniture we bought in 2012 really turned out to be crap. The chair has springs sticking out all over the place. I am tired of my family acting like this is totally normal and fine. Even before the cash gift, I told MH I am replacing that stupid chair with my bonus. It's been on my radar for a while but just haven't gotten around to it. The other chair isn't necessary. We saved it from the dumpster when my sister was going to toss it 25+ years ago. (I'd consider it a very nice chair, at that time.) I mostly hate that chair at this point but my mom likes it. We mostly kept it for my mom. Who hasn't been to our house in 5+ years. It's time to move on.

So we went shopping with one or two chairs in mind. Why 2 chairs? Because the couch is mostly useless crap. But it's currently DL(20)'s bed. That's a whole thing, that should be temporary at this point.

We ended up at La-Z-Boy and I misread a number on a chair. Thought it was $900. Sat down and said, "I'll take it!" (as I sank into chair heaven). Didn't realize it was $1,910. So I quickly backtracked. The whole thing ended up feeling like buying a car. They take their chairs very seriously. (The paperwork took forever). Did we succeed in elevating our furniture quality? I think yes. We ended up spotting a chair 60% off, on clearance. It was a floor model. We took it. & the $500 chairs (more what I had envisioned buying) were such a huge step up, we bought one too. So that in the here and now we can both have some nice and comfy chairs. I don't even think we will fight over the premium chair too much (given that MH and I seem to veg out on our own time). But it's nice to have 2 comfortable chairs if we want to watch TV together in the main living area of our house. The chair I got, also had to be a 'take what we got' situation in order to get free delivery (which we haggled). They one they had in stock just happened to be the one I liked and saw in person (the fabric). There's just no matching or thought to color. I suppose both of the chairs are grey-ish.

I like to think that the flip side of the coin of saving a bajillion dollars on furniture over the years (the house is mostly filled with hand-me-downs). The flip side is that it might be fun to do some furniture shopping with more thought to colors and schemes and what we would actually like long term. When we buy our next home. If our net worth is $2 Mil+, I can just see buying what we like. & searching out more quality. Admittedly, there's some element of not really having use for anything 'nice' during the last 20+ kid and pet years.

Our new chairs arrive next week.

Edited to add: Oh yeah. After stopping at one store, it was obvious we'd buy 2 chairs. I forgot that MH and I have polar opposite furniture tastes. He liked everything I hated, and vice versa. So I went into that second store expecting we'd just buy two chairs. I'd say we both agreed on the $1,400 chair (which is electric and customizable). & I'd say he hates the $500 chair I bought and thinks it's a waste of money. I figure, worst case, the kids can have a nice La-Z-Boy in a few years. Or it might be nice in a spare/guest bedroom, to rock a future grandchild in. Who knows... All I know is I liked it and it was 10 times better than what we have right now.

Would have probably just bought the $500 chair, with my bonus (and probably could have customized the fabric. Free delivery was the limitation on that part of the purchase.) But the second chair was definitely 'gift money' spending. Would not have bought, without a chunk of tax-free money falling from the sky.

Posted in

Just Thinking

|

3 Comments »

December 27th, 2025 at 05:00 pm

I have a good idea where things will land this month.

Pay cash for college ✔

Just one more tuition payment left for MM(22). Crazy!

$10K to Savings ✔

Final tally was $15,100.

Saved at the last minute, by a cash gift. Which made up for a wild spending year.

Note: I do not count money we deducted from our savings account to pay for college. This '$10K per year' is pretty much what we need to save to keep afloat and cover college costs. Ideally is for longer-term savings but haven't made any forward progress with two kids in college. Just treading water. The exception is this $10K gift we decided to keep in cash.

$7,500 to Investments ✔➕

Final tally: $7,500

Was able to hit the stretch goal with my bonus.

$1,700 to mortgage ✔

Mortgage goal is non-negotiable. I will not have a mortgage for more than 30 years on this house (while healthy and well employed). I moved this money over from cash last month.

9% Income to Work Retirement Plans ✔

MH and I both contribute the minimum for 401k match. The 9% includes employer contributions.

$6,000 to IRAs 2025 ❌

Decided to pass on this goal. $0 to IRAs. (Will probably put 1% of our income to IRAs, when I do our taxes. Just to put us at a full 10% to retirement. But that will be an April decision.)

I put 30% to retirement last year, and wanted to focus on other goals. This decision was before the cash gift. But I think it's important to stay the course.

We contributed 20% average (to retirement) during 2024/2025. This is probably the #1 reason we are putting IRAs on ignore. Will contribute $0. The other reason I suppose is because we hit a big retirement milestone. & the stock market is high. I am sure there's many reasons. I'd be more inclined to take advantage if we could get in some cheaper buys.

SUMMARY

My last few posts are the summary. Nothing more to add.

Retirement goals will start to decrease as we enter financial independence 'coast' mode. The 'saving for retirement' part is over and now it's about letting that money compound. & with that, we can start to enjoy our money more. I don't see the point on keeping the petal to the metal for the next 10 or 15 years. We are starting pre-retirement and enjoying our money.

2026 Goals

2026 goals will likely be mostly the same. I suppose I will evaluate what I want to do with taxable investments, if we set our IRA goal to $0. I will keep an IRA stretch goal to max out ($17,200). Something to ponder if we end up with unexpected money.

I've always had raises January 1, so it's just a sensible time to set financial goals for the year. 2026 will be a little different, with a kid finishing college mid-year. There will be some financial re-jiggering once he gets a job and is more self sufficient.

I need to do a 2026 tax projection before I can figure out what my actual net salary will be in 2026. From there, can start working through monthly savings and investment amounts. Things to figure out in January.

Posted in

Just Thinking,

Budgeting & Goals

|

0 Comments »

December 27th, 2025 at 04:55 pm

It was a very good money week.

I mentioned my work bonus. This is how it shook out:

Taxes: $4,900

401K: $600

Taxable Investments: $2,500

Car Repair $1,000 (we already paid for the other half)

Savings $2,000

Me: $1,000

I know, I know. A 'chunk' did go to taxes. But I don't think any of that tax was for my salary the rest of the year. That's just all the taxes (including FICA) that came along with the bonus. I did a tax calculation and this literally is the tax I owe on the bonus. I expect $0 back at tax time.

I will hit our taxable investment stretch goal, with the bonus.

The $2,000 to savings is probably mostly earmarked for MM's last couple of months of college rent. It feels good to have a plan for that. (Other than just pulling from DL's 'college rent' money).

The 'me' thing is new. I've never pondered any mine/yours in our marriage. But after a year (or two) of paying college x2 and supporting my husband's movie. 😒 I am just over it. I had an emotional conversation with MH about this in 2024 and the next day a surprise $1,000 check showed up in the mail. From my parents! That's the thing, it's MH's parents who are generous. It's not like I am going to be, 'I am going to take some of that for myself.' & it's further complicated by my favorite things being library books and hikes (free stuff). So this check shows up out of nowhere and I tell MH I am keeping it for myself. & he says, "Obviously". (If I didn't say it, he was going to.) So I haven't spent the 2024 $1,000 and lord knows how long until I spend this $1,000. But I think it's somewhat symbolic and it's important. In the meantime, I didn't deny myself anything in 2025. So... It may be this ends up being a 'saving for a bigger purchase' fund. I don't know how it will work in combination of me already getting in the habit of just buying whatever I want (within reason).

I'd like to carve out more spending from future bonuses. Not just for myself, but for the household. But this wasn't the year. Though I later remembered that I really want to replace a piece of furniture (~$500) that is broken. We will do that. (We will save more money by the time we pick out and pay for a new chair.)

Our cash will be up $3,500 over where we started last January 1. I felt a lot better about that. That we are starting on more solid cash footing.

Then...

I got a bigger raise than I was expecting. What!? To be fair, I asked, due to a specific set of (random) circumstances. So it wasn't a total surprise. I got the feeling it might have already been in the works, given the response when I asked. But the whole thing was all very last minute.

Per usual, I am just grateful when any raise covers health insurance increases and taxes. I expect to have a $6,000 tax increase in the next couple of years. I am hoping to eke out $400/month from the raise and will just keep in cash for the short run. Longer run, I will just reduce this amount as it starts going to taxes. (The rest will go to health insurance, as most raises have while supporting a household of 4.)

We usually work more and spend less the first 5 months of the year. So I expect cash will start to pile up quickly.

Then...

We received a $10,000 cash gift.

🤯

My in-laws have been pretty generous with cash gifts in recent years. Probably a combo of RMDs (that they have no intention of ever spending) and an inheritance.

At the end of last year, MIL sprung on us that we would not get a gift at all. She was skittish about end-of-life care, and I don't know what their pension situation is when FIL passes. I think it was wise for them to back off on the gifts. & I got a big work bonus last year (with promises of future big bonuses) and so I thought the timing just kind of worked. You can't beat a tax-free gift! But I was quickly filling in the void with my own compensation.

So imagine my complete shock when MIL handed us a $10,000 gift over the weekend. What!?

We had already parsed out my bonus and given up on IRAs in 2025. & I think it's wise to stay the course. We have just been treading water on 'barely dipping into our emergency savings' for the last few years. After we put a bigger gift mostly to our mortgage (3 or 4 years ago).

I know the one thing we can do to make our lives easier right now, is to just park this money in cash. After five college years and being a little too aggressive with the mortgage... We literaly have $0 cash saved for anything other than an emergency fund. I will probably consider the $10K to be a start on a home maintenance/home down payment fund. & if the gifts resume or my bonuses do continue to get bigger over time, it may be wise for us to just start a mortgage payoff fund. Keeping it in cash is wise because we will likely buy our next home with a mortgage, and briefly own two homes. & we'd want to put 20% down (~$100K) even for a very temporary mortgage. (Crap happens; I wouldn't want to be stuck with anything too crazy.) I also think that investing in some home maintenance is more wise than throwing every penny at the mortgage. If nothing else, I foresee an A/C replacement in our nearer future.

Note: I have no idea if we will pay off this mortgage before we sell the house. Which is all the more reason to start on a 'mortgage payoff' fund and keep things more liquid in the interim.

Anyway, consider my mind blown. I really was not 'expecting' any of this. I was hoping for a nice bonus year but wasn't confident about it.

Oh yeah, and I forgot that I sent $1,000 of the gift (10%) to the credit card. I knew we'd have a little extra spending this month. I decided with my bonus to not worry about it, if we had a couple of 5-person meals out. (DL's girlfriend is visiting from out of town and staying with us for two weeks.) I'd otherwise more specifically plan for meals out with less people. $1,000 was more than we spent, and so some of that will just funnel back into our savings. But I'd say it served its purpose, even if we didn't spend a lot of it. I didn't want to stress about money during a spendier month.

Posted in

Just Thinking

|

1 Comments »

December 21st, 2025 at 04:40 pm

We are within striking distance of our financial independence goal. Probably technically there, with our assets right now. But expecting to spend down some of these asstes on the next ~2.5 years of college expenses.

Our FI numbers is also completely meaningless while we still have kids to support and a mortgage. But it's exciting to be so close to the finish line.

Most of our motivation is a scarcity mindset, which I think is a good thing when I look at how well our parents and grandparents (and us) have thrived through a lot of adversity. I chose age 50 for this goal because our parents really struggled to find work in their 50s. Their age, coupled with very challenging economic times.

My motivation has very little to do with retirement. I always worked with people who happily worked (because they wanted to) well into their 80s or even 90s. I have no desire to work full-time that long (and to be clear, the 90-somethings worked very minimally and seasonally), but I don't personally have an end date in mind as far as continuing to use my mind and make money. Shifting to part-time work does appeal to me. But it's also hard to believe that I would feel the same time crunch when my nest is empty. & I just happen to be in the middle of several big changes at work that should make my work life a lot easier. Fingers crossed! I also just don't know how realistic part-time work will be. Just one more thing to start pondering more in another few years.

As we near the end of everything we have been working for... I know we can survive the rest of our lives without paid work. I am starting to think about raising the bar a bit. Our 'normal' is the shoestring. Putting myself through college, saving for a home down payment in San Francisco. We jumped pretty quickly from that to the 'not planned' one-income thing for over a decade. I envisioned more of the same as we got our kids through college, but then it turned into some 'wild spending' years. It feels wild, compared to our norm. I just did some math and the $9K vacation overage, I covered about $2K with credit card bonuses and an unexpected gift. That extra $7K (net) we pulled from our income... Felt wild but it was only 5% of our income this year. I am telling myself more that it's okay to spend 5% of our income. & maybe it was never okay before. But it is now.

I did get my bonus. I decided to let retirement go, for this year. We will just do the 9% minimum for match. Might add 1% to keep us honest (per my sidebar). In my sidebar, I point out we never did less than 10%. I can keep that a bare minimum goal.

Even if we haven't crossed the FI finish line yet, our 50s will be more about working just enough to pay our bills. Saving for retirement is no longer necessary. & of course, we can always work more and save more. If we want to, and is how it's going to be the next few years. Until I actually turn 50, until my kids find their own footing.

While I can give up some financial efficiency (I think at the end of the day we have the income to be less efficient. Something we didn't have in the past). While I can give some of that up, I am not going to give up the employer match (free money). & it keeps us close to the 10% minimum goal.

Oh yeah, we both turn 50 next year. For some point of reference. & because we had a 30% retirement last year, we will only do 10% this year. The two years will average out. You can consider it we started coasting at age 49, but I am more focused on the average over the last couple of years. The coasting really starts next year.

It will take us some time to wrap our minds around retirement no longer being our biggest financial priority.

MH kept pointing out we turn 50 next year, because he has a January birthday. So it's very soon for him. I am just, "What!? I am not even 49 yet." It sounds so far away. My birthday is at the end of the year. So it's why I haven't personally thought about it much but it's very in my face right now.

Posted in

Just Thinking,

Financial Independence by 50

|

6 Comments »

December 21st, 2025 at 03:46 pm

We had an unexpected $500 expense come up in November. That's when I knew that I give up on 2025 goals.

I had already re-evaluated goal progress when paying for our big anniversary trip. While I felt it was silly to be stingey for our 25th, re: the big picture, I also didn't have any real plan to pay for this. I didn't want to touch longer term funds. I decided at the time (when paying for the trip) that we were still on track for:

**9% to retirement (minimum for match)

**Mortgage goal (done)

**Investment goal

I pondered IRAs more as we ended up with $2,500 in unexpected expenses at the end of the year. & the $500 was purely optional but we decided to go ahead with that. It was an opportunity that came up.

I completely give up on IRAs this year, other than the 'we have until April' factor.

I was surprised when I re-evaluated goals again (looking closer at the goals) at how realistic our goals were this year. I had left 'maxing out' as a stretch goal (re: unexpected money).

We spent about $9K over our modest vacation budget, this year. It was very one-off. We may or may not fail on our $6K IRA goal. (I am waiting for my bonus to sort out, in addition to the 'we have until April' factor.) I think we did pretty good considering excessive, one-off spending.

Reasons I am not stressed:

**Last I looked, our net worth was up $100K for the year.

**We are still living well below our means.

(This is very obvious because if I deduct 'college expenses paid with money someone else saved up for my kids' from our net this year, we are still somehow in the black. Just barely, but somehow still in the black, with income exceeding expenses. That's crazy to me! But we had a really good income year.)

Pain points:

**Cash is tight (this is somewhat moot while we have healthy investment levels; still have some money loosely earmarked for college that I am not sure we will use for college).

**I want to make more forward progress on taxable investments. It might just be this has to wait until kids are done with college. I like that we are at least mostly replacing the money we are spending on college. But I want to make more forward progress, while contributing less to retirement. It might just be an 'in our 50s' thing when we have higher income and lower expenses (re: empty nest and being older).

I was pondering my bonus (I saw a potential estimate) and was surprised how conservative I was with my tax planning this year. I paid in taxes presuming I wasn't going to put anything to IRAs. What!? I think it was me trying to lessen the pain a bit, re: massive tax increases when kids are done with college. (Which for the long run is very *shrugs* and fair. But in the short run, I will still have some mega kid expenses and it will be painful.)

I am so relieved I played the tax planning so conservative. If I do get a bonus (likely) I won't need to pay a chunk to taxes.

The other reason the pendulum swings: I put something like 120% of my bonus last year to 401K. (All of my bonus, plus moved some of my savings over to 401K). It was a '30% to retirement' year. So if we just do 10% to retirement this year, it will even out. Still hitting a 20% average.

Other posts if I ever get to them... Work and home life are both a little extra right now.

I really and truly started this as a 'I give up' (Crazy year!) post and was surprised in the end how sensible my financial planning was earlier this year. I think setting seperate stretch goals was a lot of that. A general mindset of dialing things down. I wanted to dial down savings and I think we achieved that.

Posted in

Just Thinking,

Budgeting & Goals

|

2 Comments »

December 13th, 2025 at 04:12 pm

RESTAURANTS:

------------

$100 Seasons 52

$ 50 Cracker Barrel (small balance left)

$ 20 x 1 Jamba Juice (Just found this one, from 2018!! Before I was tracking?)

$ 15 x 1 Jamba Juice

$ 10 x 1 Jamba Juice

REGIFT:

---------

$ 25 DoorDash

$ 50 Car Wash

$100 Trader Joes

Note: Edited over time to remove used gift cards. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I think we've got most of the birthday/Christmas haul.

In the past this was more keeping track of credit card rewards. But at this point in time, it's just gifts. It's still helpful to keep track of.

We don't use DoorDash (the cost is ridiculous; is moot because we don't do takeout or eat out much) and while I could probably find use for a small Trader Joe's gift card it's too out of the way to figure out how to get through $100.

MM(22) likes shopping at Trader Joe's so it will be a nice Christmas gift for him. I just googled and it's 4-miles from his college home. So it makes a lot of sense why he would frequent that store, now that he has a car.

I will give the DoorDash gift card to my assistant. I was going to buy her a Starbucks gift card, otherwise.

Note to self: I need to ask for Noah's Bagels gift card next year. I only recently discovered this chain. The bagels are some of the best food I have ever eaten in my life. So it's a nice gift card. The one standing wish list item I have is jamba juice, because like heck I am paying $8 for a smoothie. But it's a nice treat during hot summer months. Anyway, the weather is super wonky right now (cold) and I also discovered $2 hot cocoa at this bagel shop. This is keeping me sane, because I am not a coffee drinker. Though for the most part I'd probably more use a bagel gift card for bagels. & I am not opposed to spending $2 on a drink. In either case, I discovered a new food place. A very economical food place, in the grand scheme of things.

Posted in

Just Thinking

|

4 Comments »

December 7th, 2025 at 07:58 pm

November ended up being crazy. My Dad fell and broke a bone almost a year to the day he had a similar accident. Last year he broke his hip (a very minor fracture, he walked ~2 miles home afterwards). This time he landed on his arm and broke his arm. Anyway, he fell on his leg and his arm, just before I arrived at their house. We tried again re: getting some estate stuff taking care of (on a week day). Didn't think too much about it, but his wrist was swelling a lot by dinner time and I insisted I should take him for an X-ray before I went home (that he shouldn't be driving). That was the Monday before Thanksgiving. I thought it was possible he'd end up in a wheelchair and I'd have to stay all week. ER said nothing was broken, but then later they found the fracture on a follow up X-ray. I guess that happens.

Last year he just didn't see a step (while out for a walk). This time he misjudged and thought he was on the bottom step of a ladder. & he's had more broken bones than I remember, because he is very active and a daredevil. The worst injuries have always been the 'I was just standing and I fell' accidents (even 40 years ago).

I usually take Thanksgiving week off because I can't take any time off again for some months. Definitely no December time off. I recalled last (2024) Thanksgiving week being the 'least relaxing week off ever'. But I don't remember the details. I didn't feel the same way this time, but it was definitely a chore week. I had a mammogram, spent the day taking care of my parents (it was exhausting, running wheelchairs back and forth because my mom wanted to go to the hospital with my Dad.) Got college financial aid done (which went pretty quick because they didn't change it this year and I only have one kid left applying for financial aid.) & then DL(20) tortured me with some house cleaning (my least favorite thing). My next post... & I know I am forgetting something really chore-y, but I think that sums it up pretty well.

Work...

I feel like it would be a miracle if the employees under me (2) ever showed up for a whole week. Everyone's always in the hospital, it's always something. It's never particularly relented (over 7 years). I brought this over from my last job, so I don't think that changing jobs would actually change anything. But on top of that, it was a Level 11 sick year for the entire office, in 2024. So... I had to take a few deep breaths. I thought about it and decided what is in my control is my own health. & that's going as well as can be. Apparently stress works well for me. I've got super immunity at this point. I mean, I am constantly exposed and I never get sick (knock on wood). I am doing the best with what I can actually control (and it's paying off more than I would expect it to.) So I took some deep breaths and decided (end of 2024) to give it two more years. Until DL(20) was done with college. If work can't relent during 9 whole years... It might be time to try something different. & when kids are done with college, we will be entering a 'just need to work enough to pay current expenses' period. I can consider more options at that time.

I didn't say this out loud to anyone but MH. But it's crazy to me how just thinking it is 90% of the battle. I think for one, my employer is well aware. Not only am I exhausted because I am constantly covering from MIA employees. But then there is the constant emotional drain. Because it is non-stop, and usually it's something terrible. My employer definitely is entering a different period in his life (ready for more simplicity and not working as much) and he's also probably in 'let's try something different' mode. Because clearly this is not sustainable. Nothing else is working. So let's try something else. So he told me early in the year he wanted to hire an executive assistant. To make his life easier, and my life easier. Seriously, why didn't I think of that? He also told me that we are dumping one of our companies (that is a total disaster). I didn't even know that was on the table. If they put up with it for this long... That wasn't even on my radar, but that sounds like the best change ever. At least the workload would decrease substantially. & it's just a very chaotic situation. Definitely some interesting financial tidbids to share about that, if I ever have the time.

Fast forward through the year and... We are in contract to sell that company. Fingers crossed! Nothing I would want more for Christmas. I am well aware it will get worse before it gets better. It's going to be an onslaught of work to get this wrapped up. But I welcome it.

I put up with all of this because this is basically my dream job. Without this one company, it is much more my dream job. It's like being able to get rid of one really needy and chaotic client. & what remains is a lot more chill.

Just before Thanksgiving, our new executive admin had surgery. So, she fits right in. 🙄 The only other really difficult thing is that my employer made an impulsive hire (someone's relative) about a year ago,. *Sigh* I think if it was anyone else, it would have been resolved a lot sooner. & my employer even told us at some point, "She's not my relative." But whether he admits it or not, he was way too nice and patient with that situation. Which was a big ask after a long string of chaotic/sickly no-show employees. Then our servers were down for a half a week. So the week before Thanksgiving, I really had 2.5 weeks of work to get done (making up for lost computer time, in addition to trying to get all my 11/30 deadlines done so I could take that week off). On Monday (two Mondays before Thanksgiving) the nepotism employee was sicker than a dog, and asked me if she could leave early. I asked my employer the next day who was in charge of her. He said no one. Because you know, her boss was out recovering from surgery. I rolled my eyes as I had been her prior superior and she was asking me if she should come into work sick. This turned into hours of my days asking my employer if he did want her to come in sick, long talks about if we should fire her, how we should fire her, what our strategy is to replace her, etc., etc. All this stuff that should no longer be my problem, but of course it is.

Last week was absurd, because we are hiring (nepotism hire was let go), still dealing with IT issues, etc. I was well aware it would get a lot worse before it got better, re: company sale. So I am dealing with that now. Oh yeah, and executive assistant can't even drive, post surgery. My assistant doesn't have a car. Just one more 'you have to go to be kidding me' thing. I usually have 3 people to send on errands.

Will see what 2026 brings. We are really trying. Will see what happens.

Looking through my camera roll. This was a photo I took and at the time I didn't think the picture did this sunset justice. Probably more red and purple in the sky. But looking back some days later, I'd say the picture got the point across. Kind of looks like a painting.

I mentioned my work week was a wee bit crazy. Oh yeah, and MH's car was in the shop. (I completely forgot about all that extra crazy.) It was my birthday and I got cannolis at work. (My assistant asked someone else in the office to run and get cannolis. That was nice.) The next day I was eating a leftover cannoli and someone gave me a gyoza. (Another favorite of mine.) I texted MH that I'd be a little late to pick him up for work. I sent him this picture and told him this was my lunch. I just thought it was funny. I had given up and decided to eat (my real lunch) when I got home. MH only works until 1:00.

Edited to add: I remember now. Was catching up on my continuing education during my 'week off' and also was trying to squeeze in a class in between work and dealing with car issues. That was the other chore-y part to my Thanksgiving week. I am feeling better as I remember that it wasn't just work last week. I think work would have been a lot more manageable without everything else in the mix.

Second edit: I also got a new home computer set up during my break. Yeah, I had a few chores to do. My last computer was bought 8? years ago for an entirely different purpose. Now I do use it more for work. It is so much faster. I used the Windows 11 update as an excuse to go new, but I probably should have done this a while ago. It was a $500 mini desktop computer. There was talk of getting a laptop (and just plugging it into my monitor) if I might be traveling more back and forth, to help my parents in the near future. Nothing planned but it has to happen if my Dad needs to go anywhere. So there was some back and forth on that, but we decided the mini PC probably made more sense. Last time I stayed a few days with my mom, I just brough everything with me (mini PC, monitor, mouse, keyboard). I could just plug in the PC into my Dad's desktop setup.

Posted in

Just Thinking

|

1 Comments »

December 3rd, 2025 at 03:48 pm

MM(22) Oct 2025 'Gifted College Fund': $13,759 (+$5K ROTH)

MM(22) Nov 2025 'Gifted College Fund': $9,115 (+$5K ROTH)

Rent is paid through 12/31.

$3,450 deducted for winter tuition.

Note: Paying full price tuition. No financial aid; middle class grants have been exhausted. (Technically $3,900 full price, but I am covering the 'tax credit' portion.)

I am itching to cross off his tuition as paid and done (Year 5) but I just paid for the winter quarter. I will probably pay for the spring quarter in February.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

DL(20) Sep 2025 'Gifted College Fund': $23,682 (+$5K ROTH)

DL(20) Nov 2025 'Gifted College Fund': $20,587 (+$5K ROTH)

$3,250 deducted for spring tuition. (Technically, $4,500 full price, but I am covering the 'tax credit' portion.)

Will received a $2,000 financial aid refund in the spring.

Recap:

*We paid Years 1 & 2 Tuition with our own money

*Year 3 (net $2,700) was paid from DL(20)'s gifted college fund

*This will leave him $22,500+, going into Year 4. The difference is interest earned on the account.

*I expect Year 4 to be more of the same.

I was just prepping for the FASFA and updating DL(20)'s current assets. He had a big income year, and so I was poking around to see if that would change his senior year financial aid. As far as I can tell, they don't count the kids' income and assets for middle class state grants. We shall see...

When double checking if DL(20)'s income or assets would lower his middle class grant next school year... I just happened to stumble upon that his 5th college year (teaching credential) would be eligible for a middle class state grant. What!? All I had heard was those expired after 4 years. So I was not expecting that!

As to the '5th year state grant' and 'the school district wants to pay for DL's teaching credential and his housing costs', these are all things I just happened to stumble across. Imagine what DL(20) might find with a little time and effort.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Side note: I am unable to fix blog formatting or comment on blogs. I tried to say Happy Birthday to Terri77.

Posted in

Just Thinking,

College

|

3 Comments »

November 5th, 2025 at 04:21 pm

Seen at an EVGo charger near my parents' house: A self driving Chevy Bolt.

I just noticed it looked like a Waymo, and so I took a picture of it.

It was my second day off work, trying to make progress with helping my parents with legal things. We didn't get anywhere, but it was actually a very pleasant visit. With my mom's very slow mental decline and recent health problems, it's usually not pleasant. So I considered it a successful trip.

Posted in

Just Thinking

|

1 Comments »

November 4th, 2025 at 03:34 pm

This one was technically MH's photo. He has more zoom on his camera. & he might have just been focused on the bird, but I like the way the photo came out.

Oh yeah, and we saw a Great Blue Heron. A little too far away to get a useful photo or a really good look at it. It was an unexpected surprise at the end of our walk.

Posted in

Just Thinking,

Picture Project

|

4 Comments »

November 4th, 2025 at 03:28 pm

I did take pictures through the end of the month, but then time got away from me. Today I am going out of town and tomorrow I have an 8-hour class. So I don't expect much down time this week.

My takeaway is that sharing a photo is a much smaller time commitment than blogging. & it was also enjoyable, so I will infuse my blog with more photos. Once a week is probably more realistic, though I don't have any reason to stick to that.

Oh yeah, and October 2025 was the most calm month I remember in the past 8 years. Phew!!

We did go to a local college arboretum this past weekend. I think it's a 4 mile loop when you walk the whole way through. We usually go in the spring, but figured we'd go during a different season.

$0 spent. Sometimes we also get lucky and get a free car charge. But no suck luck this time. Which means we probably spent about $1 on electric fuel. It was a bit of a drive.

& then this website wouldn't support all my pictures in one post, so I broke this out into two posts.

Posted in

Just Thinking,

Picture Project

|

3 Comments »

November 4th, 2025 at 04:27 am

MM(22) Sep 2025 'Gifted College Fund': $14,897 (+$5K ROTH)

MM(22) Oct 2025 'Gifted College Fund': $13,759 (+$5K ROTH)

Rent is paid through 11/30.

🤯

I will blink, and the school year will be over. I suppose our biggest expense is rent, though school didn't start until mid-September. The rent part is about halfway done (July thru July). I pay all the bills the first of the month, so basically December rent is already taken care of (covered with my November income/expenses.) I might not transfer the money to MM(22) for a couple of weeks, but it's long gone as far as my accounting is concerned. I've moved on to December. & in December, I will be sending MM(22) his January rent money.

I told MM(22) the other day that I will be celebrating that last tuition payment. That will be in March.

Like I've said before, it's less about the actual cost of tuition (low). & more about moving on to the next chapter. But it will be nice to confirm he is *done* (after extending one year). & it's just this whole other mental load, remembering to pay tuition 3x per year. Extra so, with the quarter system. (& of course, was a lot more when sorting out constant financial aid refunds, wondering how on earth MM would find housing, etc.) The monthly rent is a little more *shrugs* as it is part of my monthly accounting cycle. & will likely just shift over to paying rent for DL(22), anyway.

Note: I would have felt *shrugs* if we paid rent x2, re: money set aside to cover college living expenses. But I can appreciate the simplicity of only having one rent payment to keep track of. The timing worked out that I will only be paying college rent for one kid at a time.

In other news, we have entirely replaced MM(22)'s $20K college fund (what we personally saved for college years). & so we will be moving on and working on replacing DL(20)'s $20K college fund. While we have not used any of DL's money, I did divert $5K into retirement in 2024. So we can start with replacing that $5K. It will be nice to have these funds when other things come up.

Posted in

Just Thinking,

College

|

0 Comments »

October 31st, 2025 at 12:09 am

Oct 25

I did not take a single picture on Saturday. So I pulled this one from Friday.

I developed a sudden intolerance to avocado in recent years. 😭 A couple of years after developing a banana intolerance. Apparently these are related.

Anyway, my employer buys lunch every Friday. I quickly realized that most sushi has avocado. *sigh* But I finally found something I like on this particular menu. Mango sushi. It's a vegetarian sushi with fried sweet potatoes. Yum.

Oct 26

Sunset picture on Sunday night. Picture taken through a windshield (with some window reflection).

More eating out... I went through a drive thru.