|

|

|

Viewing the 'College' Category

January 11th, 2026 at 01:01 am

MM(22) Nov 2025 'Gifted College Fund': $9,115 (+$5K ROTH)

MM(22) Dec 2025 'Gifted College Fund': $7,900 (+$5K ROTH)

Rent is paid through 1/31.

Nothing much to report. Will pay MM's final tuition payment in February.

& I have some extra cash set aside to cover MM's last month or so of rent in college town. Didn't have much of a plan before, but I officially told MM(22) not to worry about it. I just did some rough math and it's still crazy how we might have just enough 'gifted college money' to cover his last month of expenses. But too many reimbursements flying around and moving parts. (He just got 1/3 of reimbursements owed to him from 24-25 roommates. This was money I already gave him so he technically owes back to the college fund. Just to make this more impossible to calculate.) Will see.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I won't have another DL(20) update until I get his financial aid refund, in a couple of months.

Posted in

Just Thinking,

College

|

1 Comments »

December 3rd, 2025 at 03:48 pm

MM(22) Oct 2025 'Gifted College Fund': $13,759 (+$5K ROTH)

MM(22) Nov 2025 'Gifted College Fund': $9,115 (+$5K ROTH)

Rent is paid through 12/31.

$3,450 deducted for winter tuition.

Note: Paying full price tuition. No financial aid; middle class grants have been exhausted. (Technically $3,900 full price, but I am covering the 'tax credit' portion.)

I am itching to cross off his tuition as paid and done (Year 5) but I just paid for the winter quarter. I will probably pay for the spring quarter in February.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

DL(20) Sep 2025 'Gifted College Fund': $23,682 (+$5K ROTH)

DL(20) Nov 2025 'Gifted College Fund': $20,587 (+$5K ROTH)

$3,250 deducted for spring tuition. (Technically, $4,500 full price, but I am covering the 'tax credit' portion.)

Will received a $2,000 financial aid refund in the spring.

Recap:

*We paid Years 1 & 2 Tuition with our own money

*Year 3 (net $2,700) was paid from DL(20)'s gifted college fund

*This will leave him $22,500+, going into Year 4. The difference is interest earned on the account.

*I expect Year 4 to be more of the same.

I was just prepping for the FASFA and updating DL(20)'s current assets. He had a big income year, and so I was poking around to see if that would change his senior year financial aid. As far as I can tell, they don't count the kids' income and assets for middle class state grants. We shall see...

When double checking if DL(20)'s income or assets would lower his middle class grant next school year... I just happened to stumble upon that his 5th college year (teaching credential) would be eligible for a middle class state grant. What!? All I had heard was those expired after 4 years. So I was not expecting that!

As to the '5th year state grant' and 'the school district wants to pay for DL's teaching credential and his housing costs', these are all things I just happened to stumble across. Imagine what DL(20) might find with a little time and effort.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Side note: I am unable to fix blog formatting or comment on blogs. I tried to say Happy Birthday to Terri77.

Posted in

Just Thinking,

College

|

3 Comments »

November 4th, 2025 at 04:27 am

MM(22) Sep 2025 'Gifted College Fund': $14,897 (+$5K ROTH)

MM(22) Oct 2025 'Gifted College Fund': $13,759 (+$5K ROTH)

Rent is paid through 11/30.

🤯

I will blink, and the school year will be over. I suppose our biggest expense is rent, though school didn't start until mid-September. The rent part is about halfway done (July thru July). I pay all the bills the first of the month, so basically December rent is already taken care of (covered with my November income/expenses.) I might not transfer the money to MM(22) for a couple of weeks, but it's long gone as far as my accounting is concerned. I've moved on to December. & in December, I will be sending MM(22) his January rent money.

I told MM(22) the other day that I will be celebrating that last tuition payment. That will be in March.

Like I've said before, it's less about the actual cost of tuition (low). & more about moving on to the next chapter. But it will be nice to confirm he is *done* (after extending one year). & it's just this whole other mental load, remembering to pay tuition 3x per year. Extra so, with the quarter system. (& of course, was a lot more when sorting out constant financial aid refunds, wondering how on earth MM would find housing, etc.) The monthly rent is a little more *shrugs* as it is part of my monthly accounting cycle. & will likely just shift over to paying rent for DL(22), anyway.

Note: I would have felt *shrugs* if we paid rent x2, re: money set aside to cover college living expenses. But I can appreciate the simplicity of only having one rent payment to keep track of. The timing worked out that I will only be paying college rent for one kid at a time.

In other news, we have entirely replaced MM(22)'s $20K college fund (what we personally saved for college years). & so we will be moving on and working on replacing DL(20)'s $20K college fund. While we have not used any of DL's money, I did divert $5K into retirement in 2024. So we can start with replacing that $5K. It will be nice to have these funds when other things come up.

Posted in

Just Thinking,

College

|

0 Comments »

October 5th, 2025 at 09:28 pm

MM(22) Aug 2025 'Gifted College Fund': $16,075 (+$5K ROTH)

MM(22) Sep 2025 'Gifted College Fund': $14,897 (+$5K ROTH)

Rent is paid through 10/31.

Paying *all* of MM's college expenses out of this account. Still no idea if it will be enough to stretch through the end of the school year.

MM(22) told me he is due some money for utilities. To be reimbursed from past year roommates. But they are shuffling the deposits around and he will have to pay some for the bigger deposit (less people) for this year. Whenever he gets that refund, I will let him apply that money to rent.

I just did some quick math and it looks like we may have enough money in this account to pay rent and tuition through 6/30. It's almost absurd how down to the penny it's going to be. Like I said before, not planned whatsoever. The reason I think we can breakeven is if I count his rental deposit being returned. Unknowns: Utilities, tax breaks, course fees, etc.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

DL(20) Aug 2025 'Gifted College Fund': $21,488 (+$5K ROTH )

DL(20) Sep 2025 'Gifted College Fund': $23,682 (+$5K ROTH)

DL got his middle class grant refund from the state already. So I deposited that back into his college fund. It was 2 months earlier than we have received in the past. So I was not expecting that.

DL's net college costs Year 3: $2,700

Now that I have some real numbers...

Rough future math:

$23,000 Start of Year 4

-$3,000 Year 4

-$7,000 Year 5 (Teaching Credential) ~no financial aid expected

-----------------

$13,000 Left after Undergrad/Credential

Of course, DL might also have some summer school classes and test fees.

It sounds like the Teaching Masters program is ~$15,000. Which is an absolute no brainer from a cost/benefit standpoint. The Masters will pay off very quickly re: higher pay.

& he will probably get a couple of more $1,000 checks from MIL. This could end up being a 'down to the penny' situation. Stretching further with the Masters Degree, because he is just living at home.

I hadn't run through the math before. But it sounds like he will have just enough money for all of the above. If not, DL(20) has a lot of time to save up to cover some of the Masters classes. (He's saving ~$900/month, at the moment.)

He did ask me if he should put that $1,000 gift into his college fund this summer, when I offered it to pay for his college commute expenses. I told him it really made no difference. It will just be fattening up his cash and investment accounts. It's not like he plans to spend it.

Edited to add: I am sure I already mentioned, that I have frequently seen enticing financial incentives for teaching degrees (over the past 20+ years). Of course we will keep an eye out. Today I saw that the school district we live in will pay 80% of a credential, will provide $12,000 housing allowance (over 12 months) and a $5,000 bonus for math teachers. The catch is he'd have to teach in this school district for 3 years. Our school board friend shared this on social media. When I was digging for more details, I saw they offered the same deal last year. DL(20) is excited about that. I told him to look up what other school districts (like the one he is working for) offer.

If DL(20) can land a deal like this, he'd have $20K left after his Undergrad/Credential.

Posted in

Just Thinking,

College

|

2 Comments »

September 13th, 2025 at 07:10 pm

Crazy crazy week. But thankfully, it was all good crazy. I will break this out into three posts.

DL(20) was able to meet with an advisor in the college education deparment. Because of his work experience, he will be able to do a 1-year track for his teaching credential. The credential program is treated the same as Undergrad, with minimal fees added. DL will have to pass two tests and add a few classes to his degree. He might choose to take some summer classes so that he can keep working, but it sounds very doable.

As far as a Masters, it looks like it will be just one part-time year at his current college. While I am sure there are many other options, I don't think he will see the point. Being able to go to school close to home and his job, will be important. & the cost will also be hard to beat. I just happened to meet up with another teacher (MH's friend's wife, I only met her once before and she wasn't on my radar at all. Until MH told me we were meeting up with her the other night.) So of course I asked her about teaching and all that. She thought that his Stats major was very complimentary for teaching. & as Rob in the blogs told me, made a point how important data collection was for teachers. She felt this would look very favorable to employers.

This officially puts DL(20) on a 5-year college track. He will fit right in with the rest of the household. If he can pull it off in 5 years, he will have the distinction of earning a credential, in addition to his degree. But because of that, he is probably a little extra motivated to finish his degree in 4 years. It will likely require summer classes because he also wants to work a lot during the school year. Mostly because he likes his job, but also he has a lot to save up for. Will see how it all works out.

Note: Some topics of conversation that have come up in recent weeks: Buying a condo, marriage, supporting his future spouse, getting a Masters degree, etc. <---- These are all the things he is thinking about financially. Though I don't think he has any plans to spend much on a wedding or an engagement. He asked me the other day how much it really cost to elope. Then he saw the look on my face and said, "Not now! In a couple of years probably."

If you told me 2-3 years ago that DL(20) would be the first in our household to pursue a higher degree. What!? I lumped him in with a lot of my family who were not college people. Now in his third year of college... I think the truth was that he just wasn't a K-12 person. It was easy to presume that he would have been more well served by a community college/AA degree, like several people in my family.

This is also a kid who never wanted to take an advanced class or do a single extra-curricular activity. He was always so precious about his time and I was so grateful he was admitted into the art school. It was the only way he ever would have gotten any exposure to the arts. Because asking him to take a class after school would have been a bridge too far. Even for something he was extremely passionate about art. So... Who is this kid who wants to work and go to school and take summer classes? Clearly it has to do a lot with finding his true passion. Being older and more mature. But I also think a lot of it is just having more control over things. Having control about what he can study and how he can spend his time. I might have said already, but adulthood really suits DL.

I wanted to jot some of the college info down before I forget the new info. This means DL will probably also have a more expensive 5th college year (like his brother). I wouldn't expect any financial aid once the state grants dry up (after 4 years). But there's frequently been generous government offers for individuals to pursue teaching credentials. (MH has considered this route a few times, when they literally would have paid him a 'salary' while also paying for a credential program.) Will keep an eye out on what opportunities are available when we cross that bridge.

Posted in

Just Thinking,

College

|

3 Comments »

September 6th, 2025 at 04:54 pm

MM(22) July 2025 'College Rent Fund': $2,400

MM(22) August 2025 'College Rent Fund': $112 $0

Rent is paid through September 30th.

I reimbursed MM(22) for 6 months of utilities, so this account is pretty much exhausted. I think I will call it. There is still technically $15,112 in this account, earmarked for DL(20). Er, was earmarking $15,000 in my mind. But I have been giving interest on the entire combined account to MM(22). Because MM(22) is the only one using the money. I think it’s fair to cut MM(22) off at this point. In the name of simplicity.

Note: I am not committing to give DL this $15,000. It’s just there if he wants to transition out of the house before he graduates. Which I personally think he should. But DL and MH more lean towards saving money.

Second note: Started with $20K in this account (for MM’s college years) and currently have $19,500 in our ‘taxable investment’ account. I think it’s safe to say that we will have entirely replaced the original $20K (this fund) by the end of this calendar year. Or about 4 years after MM(22) started college.

MM(22) July 2025 'Gifted College Fund': $16,015 (+$5K ROTH)

MM(22) Aug 2025 'Gifted College Fund': $16,075 (+$5K ROTH)

+$60 interest in August

With the ‘college rent fund’ exhausted, will be tapping this fund for rent and all the college expenses going forward.

MM(22) doesn't start his 5th college year for a couple of more weeks.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

DL(20) July 2025 'Gifted College Fund': $21,607 (+$5K ROTH )

DL(20) Aug 2025 'Gifted College Fund': $21,488 (+$5K ROTH)

I ended up paying for parking fees out of this fund. This was the first year we started paying for tuition out of this fund. Figured might as well also not sweat the parking fees.

I received DL’s state grant amount/estimate and it is more than I will owe for spring tuition. We should be putting in more than we take out, for the rest of the year. But I won’t get Fall financial aid money back for a few more months.

DL(20)'s Fall semester started a couple of weeks ago.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

We are starting a new chapter where all the college expenses are being paid by the 'saved ahead' funds. I don't anticipate cash flowing any college expenses (from income) in the future. I'd still consider these our most expensive 'kid' years re: private healthcare (x4) and feeding growing boys ($$$$$). There is some major cost savings to be had (~$30,000 per year) once our kids fly the nest (healthcare, food, mortgage paid off or downsize). I feel like most my peers with college-aged kids are sweating 'college'. I am more sweating everything else. Or maybe more to the point, looking forward to the massive decrease in other young 20-something expenses. In just a few more years.

Posted in

Just Thinking,

College

|

1 Comments »

August 24th, 2025 at 04:47 pm

This was an earlier post I did estimating DL's college costs:

DL's expected net college costs:

$32,000 Tuition/fees

-10,000 tax credits

-16,000 CA middle class grants

---------

$6,000 Net cost

Probably minus some increased middle class grants in the future, which could easily net out this cost to $0.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

DL's actual net college costs (Years 1-3):

$24,686 Tuition/Fees

+ 1,100 Parking Fees

+ 0 College Laptop (paid with credit card reward)

+ 314 Orientation, books, supplies

- 7,500 Tax Credits

-11,590 CA middle class grants

---------

$7,010 Net cost

In the end, grants decreased a little bit re: political budgets and games. I believe the grants were set to drastically reduce last school year, but then were saved at the last minute. In the end, I think the grant is basically the same all 3 years for DL (probably about where MM maxed out). But his college is a lot less expensive (no outside room/board to pay) and so the amount is ~$4,000 per year. (MM received more because it's a % of total college costs). $4,000 (per year) is what I originally estimated re: DL first year grant. I would personally not count on anything next year but will see where things land.

We technically should be eligible for lower income grant this year (full $6,000 to cover tuition; this does not cover fees). But even this middle class grant number is just a first pass/estimate at this point. Nothing is set in stone. It's all clear as mud, at this point. It will be clear when the money hits my bank account.

In the end, DL(20) is probably on track to spend closer to $10,000 on his degree. What is notable is that $10K was the cost of my own college degree. Which I considered to be extremely affordable, 30 years ago. Factoring inflation, he's paying about 1/4 as much for a similar (State) degree. The full sticker price has scaled with inflation. The very low (net) cost is due to college tax credits and state middle class grants that did not exist 30 years ago.

Note: While looking up actual dollar amounts paid, I figured I would share *all* of the costs. I consider my first estimate to be a really rough estimate. 'Actual costs' include every college related expense that we paid to-date.

DL(20) is just living at home, and so these are *all* of his college costs. Commute becomes a bigger college expense in this situation, but he is paying for all of the car/commuting expenses. He was. MIL just gave me the annual $1K for the kids' gifted college funds (she forgot last year). So this was the first time I just passed on the money to DL(20). It's just enough money to cover the fuel for his college commute. The money might stretch a little farther this school year, now that he has a more fuel efficient vehicle.

Posted in

Just Thinking,

College

|

2 Comments »

August 16th, 2025 at 04:08 pm

MM(22) will end the summer with about $15,000, as I expected.

I am advising him to keep $10,000 set aside for a car replacement.

I presume that $5,000 will cover his expenses this next school year. I just looked it up and he spent $3,500 the past 12 months. Considering that he has a car now (for the last 8 months or so), I will just round up to $4,000. Realistically he will spend $4,000 this last school year. But for planning purposes we can round up and add some buffer. $5K is a nice and safe round number for planning.

I am unclear on the details, but he told me his job is extended through the fall quarter. This is surprising because his schedule is so jam packed in the Fall. He told me, "It's only 6 hours per week". Still, I wouldn't hold my breath that he keeps this job. But a few thousand extra dollars is probably good re: the 'running out of money' factor. If we are short $1,000 re: his last month of rent (July 2026), MH and I may just agree to gift that money to him. But for the most part we have closed our pocket book and are done using our own money to pay for MM(22)'s college expenses. It's possible he will have a month or two of rent to cover at the end.

There is no long-term financial planning in MM(22)'s world. He chose to take a full 3 years off of working, so this is what he is left with. Long-term financial planning will be a post-college discussion.

Edited to add: Oh yeah, and all my kids' CUs keep sending MM(22) 'pre-approvals' for $60,000 car loans. 🙄 I got another offer in my email the other day.

Second edit: MM just told me that he will be a paid research assistant for the entire school year and there was something like $17,000 in the budget to pay him. It will be interesting to see what he ends up with. Maybe I can do a 2-for-1 investing lesson when he is back in town in a couple of weeks. If he's got a year-round job (for the first time) it would be wise to start contributing some percentage to retirement. That changes the equation considerably.

Posted in

Just Thinking,

College

|

2 Comments »

August 16th, 2025 at 03:18 pm

I confirmed rent numbers with MM(22). Did some rough math and I think rent will just zero out earmarked college funds. Crazy how that works out. I am probably getting way too much credit for 'planning ahead'. We obviously have a tendency to plan ahead and erred on the side of not touching 'money saved for college' for as long as possible. But... that we will have just enough 'college' funds to cover Year 5. That is very random.

I also would have felt completely *shrugs* if MM(22) had to cover 100% of his college costs this school year (or any other year). To try to get across how this is not a, 'I planned everything down to the penny' situation. Far too many unknowns, and very little financial commitment on our part.

MM(21) gets a lot of credit for being frugal with his housing choices. His rent will increase 50% this year re: solo room. His housing choice is still frugal considering that he lives walking distance from campus (and comparing average rents).

I forgot that currently they are splitting a house 3 ways. & there was some talk of adding another roommate. Will see how it all ends up. MM has also lost roommates 6 months in, two years in a row. Things can always go either way.

MM(22) July 2025 'College Rent Fund': $2,400

Rent is paid through August 31.

MM(22) July 2025 'Gifted College Fund': $16,015 (+$5K ROTH IRA ~ unknown current value)

I pulled $3,400 out in July, to pay for Fall quarter tuition.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

It took me so long to post this...

MM(22) got me utility numbers for the first 6 months of the year. Was about $1,100. Between that and rent, his 'college rent fund' will be exhausted in August. Will be hitting the 'gifted college fund' pretty hard after that.

Posted in

Just Thinking,

College

|

3 Comments »

July 7th, 2025 at 01:07 am

I've been sorting through a few financial chores with DL(19) and have a few more financial chores to get through.

Done:

**Opened a high yield savings account

**Opened a ROTH IRA

**Opened his own credit card

For the ROTH IRA, we moved $5K over from his gifted college fund, same as his brother did during his first big income year.

For the credit card, we skipped the intermediate step of getting a student card. Our CU refused to ever increase MM(21)'s $500 limit, so it seemed to be more hassle than it is worth. The only thing DL(19) needs to be concerned about is utilization, re: high credit score and paying balance off monthly. So he will still be using my credit card for a while. I told him to just use the new card as a gas card. Until he gets a bump to his ($1,000) credit limit.

Random side note: Both kids have 780 credit scores. I noticed a few months ago that MM(21) had been 'pre-approved' for a $60,000 car loan. I showed DL(19) and he got a kick out of that (both the idea of spending that much on a vehicle at any age, much less at 21, and the 25% or whatever interest rate). It's moot because MM(21) has *no income*. Not like he could actually get any car loan.

We went into this year deciding to utilize DL(19)'s college fund (that we had not touched yet). I was over it. Paying up front the tuition due in June but not getting financial aid refunds until November. With all the political nonsense, who knows where the state grants will land. But I was already over it, before the political uncertainty.

DL(19) Year 3 'Gifted College Fund': $21,500 (+$5K ROTH IRA)

The question is: Will DL(19) get a $3,000 (financial aid) refund to put back into his college fund? This $21,500 balance is what he has left after paying his Fall 2025 tuition. He is expecting a $3,000 lower-income grant this year. Which is really more of a lower-asset grant. Our income was always below the threshold. But after spending down assets to pay for college for 4 years... Now our assets are under the threshold too.

My best estimate is that this will be a $0 net tuition year for DL(19): $8,000 tuition/fees, minus $6,000 grant, minus $2,000 tax credit.

Posted in

Just Thinking,

College

|

3 Comments »

December 1st, 2024 at 03:48 am

I completed the kids' FASFAs on Friday. I thought the beta version wasn't working because it didn't ask anything about our assets or the kids' assets. What the heck!? I quickly figured out that we don't have to report our assets because MM(19) was eligible for food stamps. That's a completely random loophole that I wasn't expecting. I had decided that this might eke out an extra $1K in grant money (for DL) next year but otherwise didn't expect much else to come from this development. But I later thought about it and remembered that we are ineligible for one state grant because our assets are just a bit above the cutoff. I now think that DL(19) might net an additional $3K - $4K re: lower-income grant.

Side note: All of this is mostly moot. I wasn't paying attention and we had been spending down some of these assets to pay for college. Holy crap, our assets yesterday (when I completed the FASFA) were $425 over the limit to receive this other grant. So basically this whole food stamp loophole thing is saving my bacon because I wasn't paying attention. I could have paid down a credit card by $426 and been eligible for this grant anyway. 🙄 I feel very saved by the bell. We've just not been that close to the limits before, so wasn't paying attention. This whole thing just gets crazier.

I spent way too much time today looking up how this and that is calculated. I just confirmed that they only count parent income and assets. I think it's pretty much guaranteed that our assets will be even smaller next year. (Barring some very unexpected windfall). But we will only be a 3-person household for DL(19)'s senior college year. That's a lower income limit, for 3. I will have to look at our income and spend some time pondering.

If putting $10K to the 401K nets an extra $3K or $5K college grant for DL's senior year... That is obviously a no brainer. But feeling a little cash poor in the moment. I probably would have to consider putting DL(19)'s college rent money into my 401K. & I suppose I don't even know what the target is. I will just have to guess what next year's numbers will be re: inflation. For reference, our salary is pretty much right at the cutoff (for lower income grant). With inflation in recent years, we are apparently on the cusp of being eligible for this lower income grant (re: both income and assets). But I do usually get a bonus and we do have investment income (in addition to our salaries). I probably need to just put my bonus to 401K and maybe my next paycheck. That would bring us below the income ceiling for DL(19)'s senior year. & then like I said, I expect we will also be below the asset ceiling. After another 12 months of spending down assets on college expenses. I mean, moving $10K from a taxable account to a 401K... That will really take care of the asset side of things.

Note: Home equity and retirement funds are not counted as 'assets' on the FASFA.

I thought this was just going to be a post about this food stamp loophole. But I guess I also discovered I could secure a lower-income grant for DL(19)'s senior college year.

Edited to add: I went through the math today. I forgot to deduct regular 401K contributions when thinking this through in my blog. & MH took an unpaid month off of work this year. So our income should easily come in below the income limit for this other grant. Bonus excepted. My bonus will likely all have to go into my 401K. Between grant money earned and taxes saved, I will probably get 100% of that money back in some form or other. Of course, I might lose other tax breaks and other grants, so it's just a lot of moving parts. I can report back with the results in about 2 years.

Posted in

Just Thinking,

College

|

0 Comments »

November 9th, 2024 at 03:47 pm

MM(21) Year 4 'Gifted College Fund': $19,150 $19,000 (+$5K ROTH IRA ~ unknown current value)

Note: I've added 1st quarter financial aid refund (expected any day now) back to this account balance. I only pull tuition from this fund, which is expected to be $0 (net) this school year.

I expect that tuition will be $9,000 next year (no grants). This means that MM(21) could probably leave college with $10,000 gift fund remaining. In addition to that ROTH IRA (funded with gift money).

The last piece is figuring out that 5th year of rent. I've got rent covered (money just sitting in cash) through end of 2025. I am probably about 6 months short.

I like the idea of pulling $5,000 out of the college fund to cover those last 6 months of rent. I also have 'college rent money' just sitting here for DL(19) that will probably go unused. & we have other buckets of money. But I think both MH and I are kind of over it after cash flowing rent expenses in earlier years when MM(21) was the only kid we had in college. We are ready to cross off MM's college as 'done and paid for' and would like to move on to other things. Even if the 'the other thing' is just paying for DL(19)'s college.

If we pull $5K out of the 'gifted college fund' for those last 6 months of rent, MM(21) will still be able to graduate college with $5K gift funds left. & he will still have that ROTH IRA.

This was mostly what I was anticipating, but I thought it was possible that MM(21) would get $0 in grants this year (wiping out his college fund by the time he graduated). So it's nice to have numbers in hand and figure out what the long term plan is.

MM(21) can do whatever he wants with any remaining funds. But I think the most obvious and practical use of that money is buying a car. (Which he may end up doing before he is done with college.)

Edited to add: The grant money has arrived in my bank account. Yay! It's really really real.

Second edit: MM(21) registered for classes and it looks like there is an extra $120 lab fee this quarter. This will bring his college fund balance down to $19K. Technically, the difference between his net tuition and the college tax credit (that we will cash flow re: lower taxes), the difference is currently $188. I will pull this $188 from his college fund, but he's earning interest and will end the month with $19K+.

DL(19) Year 2 'Gifted College Fund': $29,000

I suppose that I should also update where DL(19) is at. Not touching any college funds while he is just living at home.

I am eyeing $5K of this money to fund a 2024 ROTH (same as his brother; during his first big income year). & have been eyeing roughly $5K of this money as a car fund. This helped me to sleep at night while he relied on a 20yo car to get to school (before he could find a decent job). But also, it's sensible that a car is *the* big college expense in his situation. His biggest college expense is his commute.

It looks like I paid DL's spring tuition last November. So I will probably have his sophomore year literally done and paid for, this month. I will check it off (in my sidebar) when it is official. Though it would probably be fair to just check off that I know this school year is well covered. It's just a formality that I can't pay MM(21)'s spring tuition until March.

Posted in

Just Thinking,

College

|

1 Comments »

November 4th, 2024 at 03:54 am

I gave up on blogging October expenses, because life took a sharp turn into crazy town.

Today I appreciated the extra hour, and got caught up on some things. & Finally... MM(21) received financial aid numbers and had some time to give those to me. So I am no longer in limbo wondering if his middle class grant will be $0 this year (as originally expected).

I've been waiting for this number, to update his 5-year tuition projection.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$11,000 5th Year Tuition/Fees

-12,000 Tax credits

-23,500 CA middle class grants

- 7,500 Scholarships

---------

$10,000 Net cost

**Includes $1K for one summer school class

I believe it now! 4th year grant was awarded. Interestingly, MM only got the grant because he added a double major and a 5th year of college. So this means the 5th year will mostly pay for itself. We had no idea this would be the outcome or that he would get another $7,000 grant this year. & then when we realized, I was skeptical. Until it became more official.

My degree cost $10,000. I also took 5 years. Of course, factoring inflation, MM(21) did much better than I did. The college credits and middle class grants did not exist during my college years. He will leave college with much higher pay, and so has greatly improved on the cost/benefit, compared to my own degree (which I thought was pretty darn good re: cost/benefit).

I'll do a seperate post about MM(21)'s college fund and how much I expect he will have left after college.

Posted in

College

|

2 Comments »

September 24th, 2024 at 02:10 am

I was just double checking MM's bank account before sending him rent money for October. There was a random $500 deposit from his college that confused me for a beat, but I eventually realized that it must be a scholarship. What!? I figured maybe MM(21) didn't know about it. But he did know and just never bothered to tell me. It's a $1,500 scholarship for the year ($500 per quarter).

Talk about a nice surprise! It's all money in MM(21)'s pocket. I am depositing the $500 back into his 'gifted college fund'.

MM(21) Year 4 'Gifted College Fund': $16,750 (+$5K ROTH IRA ~ unknown current value)

Still no idea how MM(21)'s grant will sort out this year. I should have some answers in November and then I will know what net tuition costs will actually be this school year. & at that point I should have a pretty good idea about our 5-year tuition cost. I'll do an update at that time.

It was a big money day. DL(19) also got his first paycheck for first more steady job. It's the first job my kids have had that isn't just a summer or a temp job. DL(19) received a $750 check for 2 weeks of pay. & I think he's worked another 4 weeks already (the State pays monthly).

I don't know that DL(19) has ever made a big purchase. At the moment he owes me $400 for some car maintenance. Not that he borrowed the money from me. But we went in 50/50 with the cost and I was just being nice and waiting for his payday before I asked for his 50%. He told me that he wants to buy a used bike for $500-ish. This is probably his first big purchase, ever.

I guess now it will be all the things. He will need a high yield savings account (first priority is to save up for a car), I want him to apply for a credit card in his own name (now that he has income), and we will talk about saving for retirement. His employer is taking 7.5% for retirement (mandatory). DL(19) was playing with stock market type simulators when he was 10, maybe younger. I wouldn't necessarily prioritize taxable investing for a 19yo but I think he will like making his money work for him. One thing at a time, but it all needs to be addressed as the money starts to pile up.

Posted in

Just Thinking,

College

|

6 Comments »

July 29th, 2024 at 04:19 am

I hadn't realize that these middle class college grants were on the chopping block for this next school year. I was just looking up something else completely different and came across news that there was a push to cut these benefits by 90%. (Which I think is fair. I think 'very low cost and great colleges' is more than good enough.) By the time I saw this, the state budget had already passed. Nothing was cut and the benefits will again be increased this next school year. (Which I also think is fair. Talk about last minute, making it impossible to plan if you have no idea what your actual cost will be.)

I *think* this means my last tuition estimates were spot on. But I will hold off until it's official. Until all the red tape is sorted and the money starts to show up in my bank account.

I went through MM(20)'s rental application some weeks ago. Fingers crossed! I hadn't really thought about it before, but as I thought to rent logistics, I can see it's going to be a pain making sure that 3 roommates get their rent in time. He's already largely moved his stuff over but will technically have no lease for 10 days. He is using the same property management company as last time, so this whole process is much smoother than last year. He's planning to move into a much nicer townhome (moving up from a small apartment). It's very close to campus (closer than the "on campus" apartments were) and so MM(20) is intent on living without a car for another year or two.

I will do an update on where we are at with those costs, but will wait until it is official. Because he sorted out a couple of big rental messes last year, I am just letting it go and letting MM(20) figure it out. But I think it's incredibly stressful he doesn't have the lease signed yet. He just told me the new lease should be for August 2nd.

Edited to add: I am still waiting for that to be finalized, so that I can do an update on his rent for the last 2 years. So that I can at least do a projection. In the short run, not even sure if the 3rd roommate will work out or if they will just split everything 3 ways.

Second edit: Never got around to posting this. Some of it was because I expected an update any day. But MM(21) hasn't been home most of the month. So I have not seen him for more than 5 minutes. & I don't know any other details other than the lease is signed, re: original plan. (I have no idea where things landed re: drama). I am going to roll with the info I have and do some projections re: where we are at with college money.

MM(21) has $20K in his gifted college fund. Tuition is roughly $20K for the last 2 years. But we will get $4,500 in tax breaks and he will likely get another $7K+ grant this year. (Still not certain if that will be $0 or $7K.) It's plausible that MM(21) will still have ~$11K left in his college fund, at the end of Year 5. Note: I've only touch this fund to pay for his tuition.

It's Year 5 rent that I didn't have much of a plan for, and left it with MM(21) - last year - to circle back later. For now, I think we will cover the Year 5 rent. A lot of it of course depended on where he ended up for the last 2 years. I've got $13,000 set aside for MM's rent specifically. In addition, will presume another $2K of interest (over 2 years). This will cover 18 months of rent.

I've got 6 months of rent to figure out how to cover. Roughly $5,000. Because of the grant, I am eyeing MM(21)'s gifted college fund. It's precisely what that money is there for. $5K will buy him the difference that I don't have 'already saved' for his 5th year of rent. If I pull $5K out for rent, he may still end college with $6,000 (gifted funds).

If the math went another way, I'd have no problem telling MM(21) he needs to start chipping in towards expenses, etc. But it sounds like he might be able to squeak by.

I am so very close to crossing off MM(21)'s college as 'done and paid for'. But I won't be certain until this final year state grant sorts out. I am hesitating because it was initially supposed to be $0. I won't fully believe it until the money hits my bank account.

Another Edit: I know, I know. But I didn't feel it was worth a new blog entry. MM(21) just told me his new deposit amount on the townhouse ($750). I decided to just pull that from his 'gifted college fund'. Making a note about it because I don't care for his blase attitude about picking up his despot check from the old rental. If he ever gets that money back, I will put it back in his college fund. Trying to shift the financial pressure to him.

I can see it's more interesting to just update the kids' college fund balances when I do these posts. Will start to see MM(21)'s balance dwindling down more these last couple of years.

MM(21) Year 4 'Gifted College Fund': $16,150 (+$5K ROTH IRA ~ unknown current value)

Note: We have pulled $11,865 from these funds to cover first 3 years of tuition, one summer class, one expensive class fee, and a rental deposit. I am also probably due a $2,500 financial aid refund (will deposit back into this fund, when received). MM(21) will likely end his senior year with the $20K he started with. Financial aid is just incredibly slow to sort out. I will probably pay for the first two quarters before I start to get final numbers or refunds. So this account will be a yo yo in the meantime.

Clarification: It was $20K when I started this post, but then I paid Fall tuition & took out that $750 rental deposit. Tuition/grant/tax credit/interest will probably be a wash this school year. Rental deposit should also be returned eventually.

DL(19) Year 2 'Gifted College Fund': $28,700

Note: No plans to touch DL(19)'s college fund, as long as he is living at home and receiving significant state grants.

Posted in

Just Thinking,

College

|

0 Comments »

June 8th, 2024 at 04:35 pm

I just happened to notice (very randomly) that DL(18)'s tuition was due this month. What!? We paid in August last year but I guess that was a special freshman due date.

What a pain. I paid the entire tuition for the school year, basically. Will get a financial aid refund in November. (Tempted to cross off the year as done and paid for, but will wait for financial aid to sort out.)

Feeling cash poor in the short run. Was feeling very balanced and then suddenly feel out of balance. I will have to ponder.

I had been meaning to share a food stamp update but wanted to wait and see if MM(20) was truly eligible. He's been dragging his feet but he finally got through the red tape.

My conclusion is that the only reason he is eligible for the food stamps is because we are uber frugal. But I will start at the beginning and then get to how it ended up.

In MM(20)'s college county, some majors are eligible for food stamps. The main criteria is that you can't live with your parents, you must have a kitchen (he would have been ineligible freshman year) and you need to cook most of your meals. MM(20) fit all these parameters.

They've been doing a big marketing push this year. It would be hard not to know about this, at this point. Was totally clueless last school year and then only found out mid-year this year.

MM(20) had told me at some point that his girlfriend was getting "food financial aid." So finding this out was a big lightbulb moment. This explains why she refuses to accept any grocery money. Obviously she knew about the food stamps. This is also probably the only reason we perservered with the red tape. Her parents clearly have a higher household income. If not for knowing she was eligible for full benefits, it would have been easier to write off that clearly MM(20) would never be eligible for food stamps.

Now that he is approved and he has his benefit amount, I'd say the truth is somewhere in the middle. They don't ask anything about assets, so that is not a factor. MM(20) will become ineligible any month he makes something like more than $2,800 (more than full-time minimum wage). They asked MM(20) for financial aid information, so they probably extrapolated our income/assets (at least a rough estimate) from that information.

I am still a little confused why the girlfriend is receiving the full food stamp benefit of $300/month. I don't know if it's because it's more 'all or nothing' if you have no parental support. Or if she was just being paid room/board at her on campus job (considered to have $0 income?).

The final answer is that MM(20)'s benefit is being pro-rated based on the support we provide him. It sounds like he will be getting $150/month food stamp benefits. This just happens to be the amount we were giving him for groceries. We reported to the state that we were "gifting" him $1,400/month (half minimum wage) for tuition/room/board/support. It sounds like if he is being gifted half minimum wage, then he gets half the food stamp benefit.

Of course, I will no longer be giving him food money (due to this benefit) and his rent is decreasing next year. So technically he will be eligible for a little more.

I already mentioned in the past that MM(20) is in the extreme minority re: low grocery spending. & MM(20)'s rent is also easily half of what it could be. It quickly became clear that he is only getting this benefit because A - he is uber frugal, and B - we give him very little support outside of tuition/rent. & C - he's also living off of his girlfriend's food stamps. It sounds like it's fairly typical for parents (at this college) to give students $2,000/month for just rent and food. That's not counting utilities, allowances for spending money, or any other financial support. Oh yeah, and that does not even count tuition! I was right to be skeptical about being eligible for food stamps. We just squeaked by because our personal situation just happened to fit inside the box.

How random is that, that the government wants to give him the amount I was giving him for food allowance? Technically, MM and his girlfriend are sharing $450/month. Even with her fancy menus, it's more than they can figure out how to spend.

MM(20) already bought up groceries for this school year (before he got the benefits), so this won't change my budget until next school year. But this will be a nice benefit for next school year. Fingers crossed, however many months he can get this benefit. (Ideally, for last 2 school years.)

Posted in

Just Thinking,

College

|

3 Comments »

April 21st, 2024 at 04:16 pm

I guess this is largely a MM(20) money update.

I thought we would go over MM's cash during winter break, but he ended up not having much of a break. I am surprised he still has any cash available, but he's been in extreme low spend mode and just stretching that $1K annual gift (using for spending money during college years). We touched base during his spring break. I think he had maybe ~$1,200 easily accessible cash. He was very *shrugs* about it, just needs it to last 3 months.

MM(20) did decide that he was probably going to cash out some or all of his I Bonds. But we decided to just wait and see what the next interest rate would be. & we left it that he will need to open a new bank account this summer (to park extra cash).

I just happened to notice two things last week:

1 - I Bond rate set for 2.97% inflation rate next round.

2 - One of our CUs is paying 5.5% interest.

The CU account is a mega interest account that was paying 4% when the average high yield interest rate was 1%. It's fallen behind in recent months, but that 5.5% is perfect for MM(20) to park his I Bond funds. The catch on this 'mega interest' account was that the cap was $5K for the mega interest.

I can't even tell you why I checked, but maybe it's just because it's been so long since either of us has kept a full $5K in these accounts... I figured I'd double check (if my memory was correct) and... The 5.50% is on the first $10K!

Note: We've already moved our own money over to take advantage of $10K @ 5.5%.

I let MM(20) know. He is cashing out his I Bond and moving most of that to his CU account. When all is said and done, he will have $10K earning 5.5%, $500 earning 7% (another CU), and $1,500 left in his checking account. Maybe only $1,000 left after a few more months of college spending. He will want to figure out a higher-balance high yield savings account at some point, but won't be necessary until he gets a job and starts piling up more money.

In other news, MM(20) has had his rental figured out for next year, for a while, but was still negotiating the cost of the bedroom he will be renting. I guess he got that sorted out and he told me it will be $808/month. He will be saving $42/month, for a much bigger room and nicer neighborhood.

Somewhat related, we need to cash out the rest of our I Bonds. I have been dragging my feet because I got used to the easy separate buckets of money. But I think I've only really been allocating this money to the kids 50/50 (in my mind) while it was doled out 50/50 into separate I Bonds. The truth is that this is a '2 in college at the same time' fund. I just needed a little time to wrap my brain around it. I am thinking about loosely earmarking $20K for future DL(18) rent expenses. & then earmarking the rest to MM(20). I would earmark all of the mega I Bond interest to MM(20). & also all future interest to MM(20), who is currently paying rent. This is very simplistic and easy to keep track of. I really only care about keeping the $20K for DL(18) if he is moving out this summer/fall (and if we are paying two years of rent for two college kids at the same time). So if we end up falling a little short, this $20K is money we can probably tap if MM(20) needs it. (At current, DL has no plans to move out.)

I wasn't sure if we would pay for MM(20)'s 5th year of college rent. We left it as a bridge to cross later. I wanted to give him ample notice if we expected him to chip in. But at the same time, wanted to give it some more time to see how things sorted out. He did his part. He's done a good job keeping rent costs down. I suppose when I tell him we are going to pay for the rent, will have to clarify that we can cover rent 'at this rent level'. (We also found out his 5th year of tuition will be free, because adding the 5th year is giving him a 4th year grant. I could just pull the 5th year of rent from his gifted college fund, if I wanted or needed to. Now that we expect he might have anything left in there).

MM(20)'s current lease ends in July and I think the new lease starts August 1? But he will be able to store his stuff there in the meantime. MM(20) expects to stay at this house his last 2 years of college. With everyone I know who rents being constantly kicked out by selling landlords... I would never presume he could actually stay there 2 years. But it would be nice if it works out. Just my past experience re: sky high real estate. It doesn't help that home sales just went from 0 to 100 overnight. But I would have laughed at the idea of counting on this rental for 2 years, regardless. We can only hope that it is that easy.

Posted in

Just Thinking,

College

|

1 Comments »

March 30th, 2024 at 03:03 am

My kids both received substantial middle class grants from our State this year, re: attending in-state public Universities.

I've tried to look this up (how to ballpark or estimate) in the past, but it's so complicated and depends on so many factors. Primarily, how many students are eligible. Because then funds are divided among eligible students.

So my mind was just blown when I figured it out. 🤯 I just had to dig a little deeper.

Side note: It appears that the kids' assets are not being counted in this formula.

There's other parts to the formula, but calculations below are just what was applicable for our personal situation.

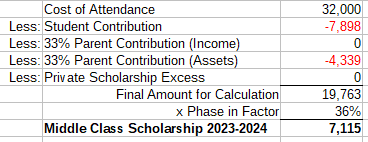

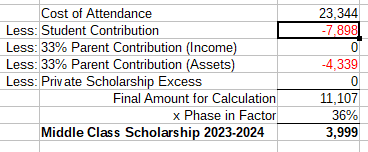

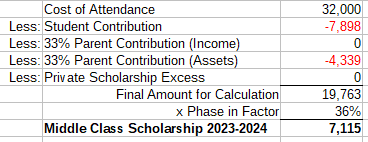

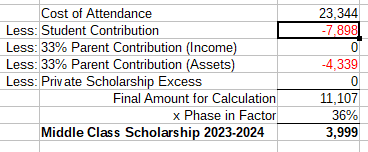

This is how the calculation went for the 2023-2024 school year.

MM(20)

Note: The cost of attendance is a ridiculous number that we do not pay. $20K is a more accurate number. $10K for tuition, $12K for housing, and maybe save $2K here at home re: less utilities and food costs. Eating is not a college expense. In this case, MM(20) spends way less on food at college than at home, so that is a cost savings for us. (& utility savings might be a few pennies on top of that.)

& all students are expected to be able to contribute the $7,898 re: part-time or summer work.

DL(18)

Note: The cost of attendance is a ridiculous number that we do not pay. We paid $8,000 tuition and DL(18) has some increased transportation costs with the daily commute to the college. The rest is food/housing allocated to 'students who live with parents', plus $3,000 misc. personal spending (nope).

I guess the key is the 'Phase In Factor' and is decided every year based on the budget. For now, the best I can presume is that the phase in factor will remain the same for 2024-2025. There is a lower 24% factor being used to estimate financial aid for 2024-2025. So that is the number the kids will get from their colleges. & then they eventually finalize this % later in the year. I am going to use 36% (same as this year) as a rough estimate of the actual dollar amount. It does not sound like the State has the budget to bump up this grant again next year. Which is completely fine with me. We are getting to a tipping point where more grant money means less college tax credits. So it's all kind of the same in the end, for us.

In the end, it looks like grant numbers will likely be the same next school year, unless CA budget numbers radically change that %. & of course, MM(20)'s grant might be a big fat $0 (if the decide he is already a senior, based on their methodology). I do not count on anything, but it's just nice to have a better idea how all of this is calculated.

I now understand that DL(18)'s grant is smaller because he is living at home. (& also because his college tacks on less fees). & I now know that it doesn't matter if either kid starts piling up assets (re: working or gifts). & I confirmed that there is no '2 in college at the same time' adjustment for this particular grant (re: our personal situation).

I also had no idea how much assets were penalizing us. I knew we were on the lower end of this income scale, so the $0 income adjustment makes sense. For the assets, we are penalized $140 for every $10K we add. I guess technically $280 (x2) while we have two kids in college. It would clearly be pointless to have less assets. That's less assets generating interest and stock market gains. & of course, if we didn't have the assets, then we'd be tapping retirement funds or taking higher interest loans, etc., to pay for college. Clearly we are better off just having *more* assets.

I keep distinguishing the middle class grants because we knew it was pointless to plan for any (need-based) financial aid re: middle middle class income and in-state public colleges (very low cost). That has gone as expected, but the middle class grants have gotten a big boost in the years since MM(20) started college. It could end up being a $40K windfall (roughly $20K per kid). & that is a really nice surprise.

Side note: MM(20) did get a nice one-year merit scholarship from his college. I've since been told that is not a thing. It was apparently a bit of a unicorn. Just to add to the, "Well that was unexpected," which sums up all of my kids' financial aid.

The next chapter: If I ever get to blogging about it. I found out in the Fall that MM(20) is probably eligible for food stamps. $300 per month! We are going to apply this weekend. Obviously should have applied sooner, but we are both in disbelief about it. Not 100% sure, but will just have to apply and see what happens. (Would have applied sooner if I knew 100% for sure that he was eligible.) These are also benefits being extended to the middle class.

Edited to add: Note to self: The new FASFA form does not ask if a student plans to live with parents. Just read somewhere it's up to the school to get that information and report it for our middle class grant? Something I will need to keep on top of when DL(18) moves out. Will want to make sure we get the extra grant dollars if we are paying for rent.

Posted in

Just Thinking,

College

|

1 Comments »

March 23rd, 2024 at 01:51 pm

I wanted to repost this because have had a lot of questions in recent years about things addressed in the past.

Our Big Picture feelings about college, per 2017 post:

https://monkeymama.savingadvice.com/2017/03/29/college_211895/

Of course, I could see how it would be interesting to update how things have shaped up, 7 years later.

We both agree that we expect the kids to work significantly during high school and college, that our own financial health comes first, and that we don't want to borrow a penny for college. We don't want them to graduate with any student loan debt. We are willing to help our kids in any way we can as long as we are within these parameters.

2024 Update: Tried to be open minded, but couldn't ignore the 'cost pennies colleges that everyone recruits from'. Both our kids ended up different State colleges, but are basically the third generation in our family to take advantage.

Our kids aren't working as much as we envisioned. One thing I don't think I said in this particular blog post was that our city has generally always been terrible on the employment front, and I of course recognize that an engineering degree might take more commitment than our business degrees did. That said, I think the pandemic is mostly what torpedoed my kids teenage working years. MH and I were very much, "You don't need a teen job around crowds of people." But also, there is an element of the kids not needing to work. MM(20) had a couple of strong working summers and has $10K+ saved up. With his grandparents helping, I feel very *shrugs* about him not working at all in 2023. DL(18) is a little further behind the curve and probably more impacted by the pandemic.

I think the point of my original post is we expected our kids to work and contribute. (Wasn't planning to buy them cars and pay for all their college expenses). But with grandparents giving them this gifted college fund and helping them, has bought them a lot of freedom not to work. I personally don't have any problem with it. I wouldn't personally just do all the work and pay for everything, but if the grandparents want to do that, more power to them.

Both my kids announced this winter that they were bored and they intended to work this school year. MM(20) wants to do all the things and so it took him 2+ years to get settled and figure out his priorities. But he knew he would have a lot of time in winter and spring quarter. I forwarded him an internship opportunity (for this summer) that pays $40/hour. If he could land that, he could make $10K in 6 weeks. Something like that. I am all for "working smarter, not harder". DL(18), I strongly encouraged to not work in the fall, to ease into college. He has thrived his first semester of college and he announced towards the end of fall semester that he was bored and could definitely work. He might not be able to find a low hours job (like an on campus job) until next fall. He did find a temp job and made about $1,300 this year already. I will feel a lot better about DL(18) once he finds a steady job and has enough savings to buy a car.

We personally have not tied up this money (re: gifted college funds) in college type funds because we don't have any incentive to. We would rather have free use of the money. We don't have a big enough income, but I do have enough tax knowledge, to not bother with 529 plans or other college savings options. To be clear, we are not paying any taxes on these investment gains. So we don't need the trade-off of extra hoops to jump through for tax breaks that we don't need.

Along the same lines, MH and I both used our "college money" for a home down payment instead. In a state where college cost pennies and housing costs are sky high, I think it seems very likely our kids will experience the same. So I don't want to be penalized for tying up their gift money for college when they more likely will use it for post-college housing. Ideally, we'd actually really like to pay it forward and save this in-law money to give them as a lump sum *after* college. I don't know if we will be able to swing it, but this is what we would like to do. & if we can't, we definitely want to do something like this for our grandkids. (I think if it was not for the in-law money, this would just be a "pay it forward to grandkids" goal).

2024 Update: DL(18) is currently on the 'living at home' plan and on track to use 100% of this college money after college. As of today, I think MM(20) might have $5K or $10K left after getting a 5-year degree. Very likely $0. He chose a much more extravagant college experience (5 hours away, in paradise). & even DL(18), who knows. The kid I thought maybe would never get more than a AA degree, he told me the other day he might want a PhD. He might find a way to use his $30K for college. I do have their gifted college funds parked in cash, while we expect to use all of the funds (MM) and while DL's plans are still so up in the air. We can talk about longer term plans for this money as longer term plans crystalize.

In 2014 we were in a position to start putting money away into taxable investment accounts again (in addition to fully funding IRAs). I guess college is the only goal at this point, besides retirement. Though I don't consider this *all* to be college money, it is certainly accessible if we need it for college. We are putting away about $7,500 per year. I think matching the in-law college money is a good place to start. It probably works out too that we will probably get there in another couple of years. At that point we may just back off and figure that $40,000/each is a phenomenal start. I think we'd probably most likely just focus on cash flowing the rest (if there is anything left to cash flow).

2024 Update: For MM(20), we've had a lot of windfalls to help with his rent. Pandemic funds and unemployment covered his first year of rent. & the in-laws have been giving us some gift money after they received an inheritance.

Our investments ended up getting to $40K and we have earmarked all of this money for college. Won't necessarily use it all, but have it earmarked for now ($20K per kid, to cover rent). I lost my job in 2018 and took a big pay cut, but also gained a work retirement plan. So we stopped adding to taxable investments (and was not able to match the gifted funds, which ended up being $30K per kid). I only added snowflakes (credit card rewards) 2018-2022. The money did get a big boost when I put it in I Bonds for much of 2022-2023. We turned $40K into $45K (while keeping the principal safe). I don't know if anything has ever come that financially easy to us. It seems there's always some obstacle or headwind, so I am really delighting being in the right place at the right time, just having this wad of cash for I Bonds when interest rates were nearing 10%.

I was able to resume (more significant) taxable investing in 2023. Our investment account just hit $10K. After saving for college, I wanted to save up $10K for MM(20)'s jaw surgery and related round of ortho. I didn't feel comfortable crossing off his college as 'done and paid for' until we had this covered. Not that it is a college expense, but it's a final expense we wanted to cover for him before he flies the nest. So I am eyeing this $10K and wondering if I should just call it. But I will wait for MM's grant to sort out his senior year (still not sure about that) and will wait for his lease to be finalized and to have real numbers. By the end of the year I should have a plan and/or be able to call it.

Edit: With the I Bond gains, the kids ended up with about $53K/each. Which yes, was a phenomenal start. That's $30K gifted funds ($1K per year, built up up over time), and $23K (our investments 2014 -2018 --> cash --> I Bonds --> back to cash). DL's money is completey untouched, as mentioned. But I have started to spend down MM's money from this $53K peak.

& to be clear, the investment account is up to $10K after completely starting over. (I can see that wasn't clear when I typed that out). 'College' money is all in cash. But we have been able to resume adding to taxable investments (more than just snowflakes) in the past year.

Since I worked my way through college, I think the idea of MH working + kids working seems easiest on some level (would be a LOT of cash that we could put towards college). But, I think the "saving ahead" is important just because you never know. Relying on future income streams is a little outside of my comfort zone. So while some part of me thinks that "cash flowing with several jobs" is really the most obvious and the easiest, we always have a Plan A + Plan B + Plan C, etc.

2024 Update: Plan A is working out pretty nicely. I mean, I am happy to have the "saved ahead" I Bond money too. But also, we are hitting some of our highest income years while our kids are in college, and so that is going pretty well. I stand by my decision not to divert large amounts of assets to college savings (or anything at all when my kids were very young). We started saving when we had the money and are mostly cash flowing with higher income during these college years.

Note: We are mostly using 'saved ahead' money to pay for MM's tuition/room/board (the more expensive college) while we have two in college at the same time.

We did also park extra money in ROTHs that we have never touched (starting when the kids were babies). I never would have put that much money in retirement otherwise, but was okay with it knowing we could use this money for college. I would have also been fine lowering retirement savings during these college years. Plan B was always, "We don't have to mega save for retirement".

Final thought: I've already said this many times before, but is worth mentioning. We planned for full sticker price (roughly $30K) for the State colleges. These college tax credits and middle class grants did not exist when I went to college and I never counted on any of this money. The grants and credits will bring the net cost of MM(20)'s degree down to about $15K and DL's degree will cost $5K (or maybe $15K if he takes 5 years). This is just a nice surprise that we did not plan for.

Also, I don't expect to be saving any more money for college after 2024. I think we will move on to other financial goals because we will be DONE.

Posted in

Just Thinking,

College

|

2 Comments »

March 11th, 2024 at 03:45 am

I've revised MM's estimated college costs, below. I also kept the old numbers (to the right), for reference.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$10,000 5th Year Tuition/Fees

-12,000 Tax credits (-10,000)

-21,000 CA middle class grants (-13,000)

- 6,000 Scholarship

---------

$13,000 Net cost ($23,000)

**I added in MM's $1K summer school class

I won't believe it until I see it, but I now believe that MM's 5th year will be entirely paid for with state funds and tax credits.

So, I just completed the kids' FASFAs for next school year (was delayed this year due to major revisions; I waited for all the kinks to work out before I bothered with it.) I logged into DL's account to make sure his GPA was reported by his high school.

I am still so confused because MM(20)'s state grant changed from '3 years' to '4 years' at some point. It was expected he would only get 3 years of grants re: college credits he went into college yet. He was already considered a sophomore when he started college (per state grant measures, but he would need a minimum of 4 college years to complete an engineering degree).

So I asked MM(20) to double check today while we had a video call. (He set up his own account; I don't have access). I also needed his college tax form, so was just taking care of business. It is still very clearly showing that he will get a middle class grant next year (Year 4). He told me that he is pretty sure that changed when he made his double major official (end of last school year). Which is *why* he is taking a 5th college year. So, wait. This means his 5th year will cost $0! If that's the reason and this is true, that is pretty sweet. I mean, he's getting a whole free year out of the deal of adding one more year of college.

I am still skeptical and will believe it when the money hits our account.

I also (at some point) crunched the numbers on a Year 5 college tax credit and it was a lot more than I expected. A full $2,000. & so I also added that to my estimate, and that will bring the net Year 5 cost down to $0.

In the end, net tuition/fees will be the same difference, if it takes 4 or 5 years.

I will have to check if MM(20) anticipates taking any more summer classes.

Posted in

Just Thinking,

College

|

0 Comments »

March 8th, 2024 at 02:41 pm

This is a Part 2 re: my last post. Realized I should have mentioned this with that post.

I am enjoying actually making interest on our cash. The 'Gifted College Fund' interest covered all of MM's college expenses during his junior year.

Interest received this school year: $950

Net Tuition Paid (after tax credits): $743

Class supplies purchased separately: $185

In the end, interest will roughly equal costs this school year.

(I actually skipped a $241 reimbursement, I think in December when I got my work bonus. So I only deducted $687 from college fund this school year.)

We didn't pull any expenses from the college fund freshman year. (We didn't intend to, but I think our net cost was $0 that year.) We pulled out $5,000 to cover Sophomore year expenses (we had less middle class grants & scholarships that year). $20,000 remains in this college fund.

I expect that MM(20) will have $0 left when he is done with college. His state grants are probably exhausted (this is still very unclear, but likely those funds will dry up). & he's added a 5th year, so will be a couple of roughly $10K years of paying full tuition. He understands that his choice to pay 5 years of rent in a high cost region, this means that he will not have any (gifted) funds left at the end. Choosing a very affordable State college still has many benefits, like MM(20) not having to work at all. Or us feeling *shrugs* about the 5th year.

Note: I have no plans to touch DL(18)'s gifted college fund, as long as he is living at home and paying roughly $1K per year tuition. If not used for college, it's his money to do whatever he wants with it.

Posted in

Just Thinking,

College

|

4 Comments »

March 6th, 2024 at 04:42 pm

The last week (er, two weeks) have been a whirlind. Mostly good things. MM(20) visited for dinner Friday night (over one week ago), we went to GMIL's 99th birthday party that Saturday, and MH got home from his trip that Sunday night. I paid off the travel credit card bill. We ended up using exactly that $3K gift money to cover the cost. (The goal was to cover a chunk of the costs. It's just gravy that it covered everything.) More details later, if I ever have any time. I had family visiting from the mid-west and MH needed to help his GMIL with a new computer, so we were in the Bay Area this past weekend.

I've got 2023-2024 college year mostly wrapped up. I mentioned (re: annual goals) that this won't be a big college expense year.

DL(20) received his state financial aid check/refund last week. So now I have a better idea the flow of things. Refunds arrive 11/1 & 3/1, roughly.

I received a $2,000 refund (spring semester) from DL's college and a $1,074 bill (spring quarter) from MM's college on the same day. I paid MM's tuition and checked off on my side bar that his third year is done and paid for.

Note: $2,000 is the net I should owe for DL's fall semester. Will just park the money in savings to cover the rest of his college expenses this calendar year. In the short run, the $2K will let me cash flow MM's tuition before I reimburse myself from various buckets. This semester thing is a lot more simple than the quarter thing.

For MM's tuition, I am cash flowing the tax credit ($833, or 1/3 tax credit). I have the benefit of reduced taxes, to pay this portion of tuition. The remaining $241 I will pull from MM's gifted college fund.

I did also cash out two of the I Bonds (end of 2023) and am able to reimburse myself monthly for MM(20)'s rent. We have never had more than a roughly 1% interest rate (or some promo deals on smaller amounts of savings) during our adulthood. I more viewed the I Bonds as an investment (that was mega interest for a while). Turned maybe $20K of savings into $22K+ for MM's college expenses (woohoo)! But now that I am cashing that out, I am really enjoying having some decent interest rates on our cash. Any incidental college expenses that MM(20) has at this point should just be covered by interest. This is also how I am funding his utilities. I am leaning towards just hiring a cleaner (with this interest money) when MM's lease ends.

In other news. Very cautiously optimistic but... It sounds like the girlfriend is bouncing back? She told me that she unexpectedly felt well for a whole 5 days and that she was traveling to visit MM(20) for a couple of days. She is doing so well that those 'couple of days' has turned into 2 weeks. MM was just telling me she extended her stay so that she could go down to LA and visit her cousin's baby or something like that. I had no idea if they found some underlying condition (had more answers), found meds that worked, or what happened. I spoke to MM(20) a couple of days ago and he told me that she is just getting better, as they said would happen. They just didn't know if it would take months or years. My recollection is that she has been down for 5 months. It sounds like she is putting this chapter behind her.

Posted in

Just Thinking,

College

|

1 Comments »

December 3rd, 2023 at 05:52 pm

Yes, the state wants to give us $11,000 for college this year. MM(20)'s fall quarter refund finally showed up. I wanted to pay his winter tuition that week, so the timing worked out perfectly.

I believe it now. It's real.

Here's an update of MM's expected college costs, with the 5th year. He did officially get his double major approved and so 5 years is the plan.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$10,000 5th Year Tuition/Fees

-10,000 Tax credits

-13,000 CA middle class grants

- 6,000 Scholarship

---------

$23,000 Net cost

**I added in MM's $1K summer school class

Of course, nothing is easy. *sigh*

The girlfriend is still very ill. I just looked back at texts and it's been 6 weeks since MM(20) first took her to the hospital and she was hospitalized. She's been in and out of the hospital this whole time and they don't know what is wrong with her. This became more apparent during Thanksgiving week when MM(20) was home and he filled us in more on what was going on (and he was probably more in the loop; the girlfriend has moved back home in our city for the meantime). I presumed she was on the upswing but I texted her about something or the other yesterday and she told me she was having a bad day and was being put on heart meds. Very short term, I am sure that they are starting to wonder if she can feasibly go back to school in January. Longer term, lord knows. 😟

Posted in

Just Thinking,

College

|

3 Comments »

October 22nd, 2023 at 03:10 am

MM(20)'s mega I Bond interest expires the end of November. Will cash out and move to his high interest savings account. It used to be 'mega interest', but is below average these days. & the cap is $5K (on what used to be mega interest). I just put it on my calendar to have him open a high yield cash account when he is home for Thanksgiving break.

This reminds me, I've seen that Chevy is starting to release Bolts that they bought back during the recall. Put in new batteries and these cars have brand new 8-year warranties. They've been flooding the market, similar to how it was when we bought the car (we bought when they were coming off lease and flooding the market.) The pricing is similar, at $15,000. The kicker is that today there is a $4,000 used EV tax credit. This could be a $11,000 car purchase, plus tax on the larger sticker price. It's a little early and I know that it's more than MM(20) wants to spend. But I thought he might be enticed by the very inexpensive fuel (which would probably mostly be free.)

I wouldn't buy one of these cars before 2024, and we'd maybe miss the boat. Why 2024? Because dealerships will be able to advance the tax credit. So no more wondering if uncooperative dealerships are going to figure out their crap. $4K off the top or we walk. & also, the new rules will be much more lax. Many instances where you can take the credit up front and not have to pay back if you are not eligible. I'd have to do homework on that. There is a 20-page IRS FAQ that I have not looked at in any great detail. But I get the jist that all is this is going to be much easier and more favorable in 2024. I still expect dealerships to be uncooperative and mostly clueless. But the up front tax credit will be make or break the deal for the 20yo. Who most definitely does not want to spend $15K on a car.

I brought it up, but MM(20) told me he doesn't want a car next school year. That's news to me! The only thing of note that has changed is that he has a bike this year. He may be finding that is more than enough, for transportation.