|

|

|

Viewing the 'Just Thinking' Category

May 22nd, 2023 at 02:28 pm

We went to a local college arboretum last weekend. The pictures don't do it justice but I've never seen such vibrant poppies anywhere else.

As to everything else, I wouldn't know where to begin. I touched on some of it in my monthly wrap up.

Work is a spiraling vortex of insanity.

My employee is leaving me. 😭😭😭

This is forseeable because she has wanted to move out of state and have babies, probably the entire time she has worked at this job. (I brought her over from my last job). But after all the talks about giving as much heads up as possible... Basically got a one-week notice because she gave notice on my week off. But her husband wanted to give *zero* notice, and so here we are. & overall, just sad, because I have worked with her for 10 years and she is an amazing human. 😭 She is moving out of state.

Of course, most of my burnout is just the "everything out of my control is completely absurd" factor. But because this was foreseeable I hired our last two admin assistants with this in mind. It's paying off for me right now. We promoted an employee to fill her position. So patting myself on the back a bit. Phew! It's adding to the chaos though, because we are training two positions now. But is probably the only reason I am not totally freaking out.

The "planning ahead" is helping my sanity, but what a week! On Monday we tried to offer the open admin assistant position to a candidate and ended up rescinding the offer. (It got weird, and I think we dodged a bullet). If that's not enough drama for one day, my boss ended up firing someone. I think it will be a good change for the long term, but it's just very chaotic right now.

May has been very quiet on the home front. June will be busy, in contrast. Picking up MM(19) from college, annual camp trip, etc. DL(17) high school graduation.

DL(17) got a job. The job market is rough and he has been looking for a year. I am not even sure if MM(19) will be able to get an internship this summer. As a freshman? Easy peasy. But now everyone is pulling back hiring. & for reference, I just put up an entry level job ad and got 200 applications in a few days. I told DL(17) I wouldn't hold my breath about it being easier when he turns 18.

So DL(17) was feeling desperate and he applied at the summer camp we go to every year. They were the only employer to ever call him back. & he got the job! It sounds like it was close though. They went from severely understaffed to, "I am not sure there's enough room in the boys' dorm for one more person."

I don't know if he will make it all summer. I don't expect him to be mentally healthy enough to live in a dorm all summer. (He's moody enough at home, and is very noise sensitive. This is with 3 bedrooms entirely to himself; sharing 2600 square feet with two other people). But we can help, with the EV. It's $4 fuel for the 200 miles roundtrip. If we have to rescue him on his breaks, will support him as much as we can. & while I am skeptical, I am proud of him for giving it a try.

I was just focusing on his mental health and the tight living quarters. I expect he'd also be homesick. It's going to be rough.

DL will mostly be paid in room and board, which is not the most useful. That, and $2,400. The rough math is that it probably works out to $6 per hour. (I am not sure how many hours he will be expected to work.) Of course, if we have any food savings, I will give that money to him. The $2,400 will cover his car expenses for a year and will give him some spending money. It's sufficient for his needs.

I haven't been sweating it because when he applied for jobs in person no one wanted to deal with work permits. (He won't need a work permit after high school, even though he will be 17 for a while). & It should be easier when he turns 18 this summer. I figured worst case, he could get a campus job in the fall. I think that will be more his speed, working something like 10 hours a week year round.

Posted in

Just Thinking,

Picture Project

|

3 Comments »

May 21st, 2023 at 01:56 pm

Take 'one size fits all' financial advice with a grain of salt.

Probably the #1 question I get about credit card churning is "Doesn't that destroy your credit score?" ~ that we close the cards when we are done using them.

It does absolutely nothing to our credit score. It appears that 90%+ of our credit score is just always having paid on time. & utilization otherwise seems to be the only thing that has any bearing on our credit score. If I apply for 3 new credit cards tomorrow (new inquiries) and close most of my old cards tomorrow, my score might(?) drop from 840 to 830? This doesn't mean anything. & honestly, I've never even noticed a 10 point drop. But admittedly, I am not staring at my credit score or worrying about it. (I watch my credit score, but I don't look at it every single day).

Also, it doesn't matter if your score is 750 or 850. You get the same exact results either way. 750+ is basically a perfect credit score. Life is exhausting enough as is. No need to spin your wheels on things that don't matter.

I've literally had an average one year of 'open credit' and a 800+ credit score at the same time. When we last refied our mortgage. *shrugs*

Note: Good credit stays on your credit report for 10 years. This is the *how* you can have all new credit and still have a very strong credit score.

The equation obviously changes if you are just starting out, trying to build up a low score, etc.

Well, you would think. This is the point of this post.

I opened a new card for DL(17) a bit ago. MM(19) was able to get his own credit card and I have way too many credit cards. So I closed the card that I had opened for MM(19) to use during his high school years. I think *5* credit cards is more than enough to keep track of, and I just no longer had any use for this card.

I was cautious and did wait until MM(19) was able to get his own credit card with a decent credit limit.

MM's credit score has been 770-780 since he applied for his own credit card when he turned 18. Before that I had added him as an authorized user on my Target card and on the card I got soley for him to use.

This ended up being genius because I never keep cards open long term. Just keep them open if I am still using them. I put him on the Target card for convenience, but it just also happens to be the oldest credit card that I have. 10+ years! Also, the card I got specifically for MM(19) wasn't showing up on his credit report when he turned 18. But the Target card was. When I realized, I added DL(17) to the Target card too, to give him a credit boost.

When MM turned 19 he applied for a new credit card. I believe they only gave him a $1,000 credit limit and I didn't find that to be too practical. But between the $500 limit credit card & the $1,000 limit credit card... I told him if he charged anything large like auto insurance, to just pay off immediately. That utilization can hit your credit score pretty hard if you aren't careful.

Interestingly, I was trying to refresh my memory and his credit card is showing a $3,500 limit, on his credit report. !! If that's correct... Phew! I've been waiting for this "credit card companies are insane" to kick in so that it's more useful for him. He can now charge up anything and everything without fretting about the utilization. It's just much more convenient and useful. But this is insane. That they are giving a kid with $5,000 annual income a $3,500 credit limit. ??? It took a little bit of time, but I guess we found the point where it gets insane.

I will have to ask him if he had noticed the credit increase, or confirm with him if that is correct.

So, where was I? MM(19) started with a 770-780 credit score. After he got his own credit cards and had a workable credit limit, I shut down the card I had gotten for him to use during high school year. I did not anticipate him using credit in the near future.

And... His credit score dropped from 780 to 770. & then the next month it went back up to 777.

There you have it. I was surprised and irritated by the caution I took waiting to close this account that no one was using. 🙄 Even for the very young credit, the card closing didn't amount to a hill of beans.

Full disclosure: MM has 100% on time payment history, 5% credit usage, 3 credit card accounts, 5 year average credit age and 1 inquiry. (He has 2 credit cards + is still the authorized user on my Target card).

The only advice he is being given is to change his mix of credit. It's the only thing he can do to improve his score at this point (per credit karma). Adding an installment loan. I really don't see the point of doing 8%+ student loans (plus 1% up front fee). It's moot because wouldn't touch these scammy loan servicers with a 10 foot pole. Before interest rates rose significantly, I more considered these loans on the level of payday loans. Who knew they could get any less appealing, but the high interest rates aren't helping. & for a car loan, he's probably going to need a co-signor because of his income. Meh. I'd rather loan him money at very low interest rates if he does need a loan. But I don't anticipate him *needing* to borrow any money.

Like us, he will probably add an installment loan when he gets a mortgage.

Edited to add: I confirmed with MM(19) that his credit limit (on the one card) is now $3,500. He hadn't noticed.

Second edit: Re-reading this post, one point to add to clarity. MM applied for his own student card when he turned 18. & then when he was 19 and had a job, I had him apply for a regular Chase rewards credit card. So that is why he has two cards. The student card still only has a $500 limit and is far less useful. He can probably just convert it to a regular rewards card (with our CU) at some point when he has more income.

Posted in

Just Thinking,

Credit Card & Bank Rewards

|

0 Comments »

May 15th, 2023 at 02:13 pm

Received $124 bank interest

Received $304 I Bond interest

Snowflakes to Investments:

--Redeemed $43 credit card rewards (cash back) from our grocery card

--Redeemed $142 cash back on Citi card

--Redeemed $11 cash back on dining out/gas card

Other Snowflakes to Investments:

+ $8 Savings from Target Red Card (grocery purchases)

TOTAL: $204 Snowflakes to Investments

401k Contributions/Match:

+$935

Snowball to Savings/Investments:

+$1,300 MH Income

Savings (from my paycheck):

+$ 250 to investments

+$1,000 to cash (mid-term savings)

-$ 697 Medical Expenses

-$ 230 Furniture

-$ 200 Household Purchases

Pulled from mid-term savings:

-$2,935 Ortho Deposit

-$ 911 Income Tax Due for 2022

Short-Term Savings (for non-monthly expenses within the year):

+$1,500 to cash

-$ 500 Life Insurance

-$ 450 Hybrid Insurance

-$ 440 EV Insurance

-$ 300 LA Weekend (show tickets)

-$ 248 DMV Renewal (EV)

-$ 150 Dentist (MM)

TOTAL: -$1,444 Net pulled from Cash

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Hybrid Miles Driven: 543

Fuel Costs: $15 Electricity

(assumed 50 miles & 14 KwH per full charge)

Was a lower miles month because I had some time off work.

Electric (EV) Miles Driven: 2,111

Fuel Costs: $22 (home) & $60 (out)

(assumed 300 miles & 60 KwH per full charge)

Most charging (both cars) was done at home or at free chargers. (Except for LA trip).

We did 120 miles of free charging this month. We got 40 free miles at the San Francisco museum and MH got 80 free miles at his parents' house (40 miles x 2 visits).

It was 3 separate Bay Area trips this month, plus a Bay Area stop on our way down to LA. Thus, the 2,000+ miles on the EV.

The biggie was our LA trip. Off the top of my head, that ended up being 950 miles. We spent $60 electric fuel on that trip. We got a free overnight charge at the in-laws house Day 1 and a free hotel charge on the last night (in LA). It was ~$20 to charge overnight at the mid point hotel. Not cheap, but very convenient (about the same cost as gas). We saved about $60 with not having to buy gas. Overall, for the LA trip we just stopped when we ate or took pit stops. It was no less convenient than a gas car in that regard, but probably more thought and planning.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note: I am always lagging a month behind because any bills charged in March will be paid off April 1 and reflected in my April numbers. I charge in one month and the next month I figure out how to pay for everything (if I need to pull anything from savings). So this update reflects March spending & April savings.

Whew! That felt like a "death by a thousand cuts" month. I am surprised we ended up that much in the black. But, just a lot of bills were due. & starting to pile up the medical bills for 2023.

Edit: Okay, so I started this post before the credit card was stressing me out. Decided to just pay off the ortho bill. Could have paid it in May. Was ~$1,500 in the black before that. Revised statement: I am surprised I am not more in the red after paying all those bills.

I bond interest was bumped up with new $10K purchase early this year. (When new rates were announced, I decided not to buy any more I Bonds at this time.) I still have 2 months of mega interest before most my bonds drop back down to 7%.

The big news is that I decided to do invisalign. I had wanted to do a separate post about it but not sure I will ever get to it. Even after 5 years of braces & major jaw surgery, I still appear to be the worst case of the household. For the most part I presumed I wouldn't be eligible for invisalign and thought braces would be cheaper. In the end, I am eligible and it cost the same either way. But I would have paid more for invisalign. I felt very, "Shut up and take my money!" as they really explained it to me. I just got the invisaligns this week and so far it is 10 times easier than braces.

For the most part, I know logically I should get this done while we live in this neighborhood. My kids' ortho is *amazing*. But so much trauma around my last round of ortho, that I didn't think I'd be able to do it. But I am very intuitive and it's just time. I expected the whole thing to be very terrible, even if it is "time". & then everything about the whole process has been so easy. I am grateful for the 30 years of technological advance.

I decided to use my 2022 ROTH IRA funds to pay for the ortho. Investing in myself and future in another way, for this year. Off the top of my head, this leaves our 2022 retirement contribution rate at 14%. I can live with that. I initially thought I'd divert $3K from retirement and cash flow the rest. But with the $6K price tag (the most I expected it to be) I decided to just pull from "retirement" funds.

The furniture and household stuff is just residual from my "nesting mode" in March.

May is going to be much worse. I have a lot of big cash expenses this month, will pay off the rest of the invisalign, etc. Trying to get things taken care of, but everything we fix seems to just bring up more problems. That just seems to be the wavelength we are on.

Posted in

Just Thinking,

Budgeting & Goals,

Investing,

Credit Card & Bank Rewards,

Electric Vehicle (EV)

|

0 Comments »

April 25th, 2023 at 12:34 am

MM(19) sorted out his housing, as I expected he probably would. He was just being a little too *chill* for my liking. While I worked on the backup plans for the backup plans. But he had a few irons in the fire and I was giving it some time before I dove in too deep. So it ended up taking very little time or mental energy on my part.

He found this rental the day after the RA position news. But then he hit a red tape brick wall with the management company. It took about 10 days but they finally let him apply. (In the interim, I had given up on this option.) He let me know Friday night that he had signed the lease.

It was the Goldilocks option, as to price. Not the most ideal situation overall. But certainly could be worse. Was otherwise considering a $500/month "job on campus" living option (that was problematic on multiple fronts) and a $1,500/month room. Ended up in the middle. He won't need a car, and it has a kitchen. So these are all pluses. I found a rental last week and then later realized it didn't even have a kitchen. So I started wondering if that might be a sacrifice (which could end up being costly re: food costs). But being able to not have a car is probably the biggest savings factor.

Would prefer to just live on campus another year, but they have very few spots for juniors/seniors. I mean like 500 spots for 10,000 students? Something like that. & they maybe also reserve some housing for transfer students.

Wait. Does this mean we are done saving for MM(19)'s college!? With this rent locked in and knowing it will be so much easier the following year (with an earlier start)?

My first instinct is that I want to keep saving for the "crap happens" factor. The obvious that comes to mind is if we do get stuck with this (whole) lease for any long period of time. If the roommate backs out for any reason. Stuff like that. In addition to all the other infinite ways that crap can happen.

When this day did come, I thought I may take a breather before circling to finish off DL(17)'s college costs. But now that I am here... I will just keep saving, for whatever kid might need it. I just want to be *done* so that we can move on to other things. I think DL(17)'s college costs are well covered. But he is also my wildcard. More likely to take longer, to drastically change plans later (finish school out of state), to drop out. I don't know.

So my first instinct is to just keep saving for whoever needs it.

Then I remembered that MM(19) has a whole other round of ortho, plus surgery. Should probably keep saving for that. It's not college, but it's one last thing before he is self sufficient. It kind of gets wrapped up in this ball of final costs (mostly college) before we are done financially supporting him.

I will ponder all this more as I formulate 2024 goals in December. If it wasn't for the whole ortho factor, I'd probably just start a "for whoever needs it" college top off fund. But I expect I will probably be leaning towards some more MM(19) savings first.

Not ready to call it yet, but getting very close!

Posted in

Just Thinking,

College

|

1 Comments »

April 23rd, 2023 at 04:45 pm

I had a week off work with absolutely nothing planned. My expectations were pretty low (that it would be peaceful). It ended up being a mix of some peaceful days and some challenging days. & a bomb was dropped on me re: work. Ugh. Another post for another day.

I did make it to my other happy place (above). This was a neighborhood in San Francisco, where my friend lived during our college years. Another little slice of paradise.

I hadn't even realized until my week off, but... MH could take some time off with me! What a difference it makes, to not have to wait until 4:00 until the kids are chauffered. It was a "the kid has a driver license" benefit I hadn't realized. So we did do one day in San Francisco. We went to an art museum, ate at a fancy restaurant with a beach view (enjoyed watching the kite surfers) and went for a sunset hike.

We had bought a more premium museum membership in 2020, to help out the museum during the pandemic. & figured we'd maybe get more use out of that during these college years (expecting to be more frugal/pinched). The premium membership has reciprocal membership with other museums. This was the first time we had used our local museum membership for free admittance to another museum. But I don't expect much the rest of this year. We have too many plans already for this year.

I expect the whole "kid driver license" thing is why we have had so many weekend trips already this year. It's just easier to say yes to things. I hadn't really thought about it before, but clearly we are enjoying the extra freedom.

Posted in

Just Thinking,

Picture Project,

Vacation Lifestyle

|

3 Comments »

April 18th, 2023 at 03:01 pm

I had fallen behind on keeping track of fuel costs in Quicken. So I finally went back and got that (2022) all cleaned up. Which wasn't a big chore because I have done a good job keeping track in my blog. But I wanted to re-calculate monthly numbers in terms of how the electric bill sorted out every month. Like my monthly blog estimates, it's all just a rough estimate. But I keep track of car fuel costs versus home electricity costs.

I realized that I don't think I've ever added up all the free miles we get in a year. But I expect that 2022 was particularly unusual. I found a free charger by the animal shelter (had a few free 100 mile charges) and then we were surprised with free fuel *twice* when driving MM(19) to or from college. That was 1,000 miles of free charge. The rest were free charges here and there.

Grand Total = 1,660 free miles in 2022

That really was without trying very hard. We just stumbled upon 1,000 of those free miles.

For point of reference, I have numbers from 2017 (our last gas car year) versus 2022:

2017

$870 minivan gas ~ 3,000 miles

$1,341 gas sipper gas ~ 14,000 miles

$2,211 Total Fuel Costs 2017

2022

$297 Hybrid fuel ~ 8,176 miles

$346 EV fuel ~ 12,200 miles

$503 Other Fuel Costs (Rental gas & kids' car gas)

$1,146 Total Fuel Costs 2022

$1,065 fuel savings 2017 versus 2022. I'll take it!

Of course, with rising gas prices and other factors, our overall savings is much more substantial than this.

2022 was a weird year in that I paid that $156 fuel for the gas rental car. & we also paid for gas on the kids' car for at least 8 months of the year. (We just didn't pay for the gas when MM was home during summer months, and after DL got his license at the end of the year). That's $500 in fuel costs that I do not expect to pay in 2023. Or $1,500 savings in a more average year.

& of course, we replaced our 14yo minivan with the hybrid, when I doubled my commute. Rough math is that my commute is 9,000 miles per year and would have cost $1,800 gas in the minivan. With the EV, I mostly only drive the hybrid for my commute. (Any extra driving would probably be on gas, so I take the EV as much as possible in those instances, keeping our household driving mostly electric.) & of course, I only drove the hybrid 8,000 miles in 2022 because it was in the shop for the last 6 weeks of the year. Anyway, this is an additional $1,000 per year gas savings.

Posted in

Just Thinking,

Electric Vehicle (EV)

|

1 Comments »

April 17th, 2023 at 03:01 pm

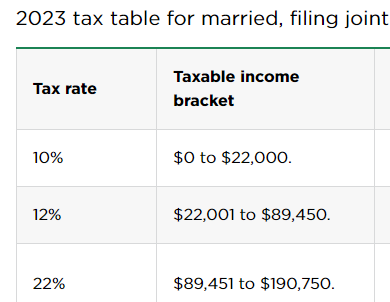

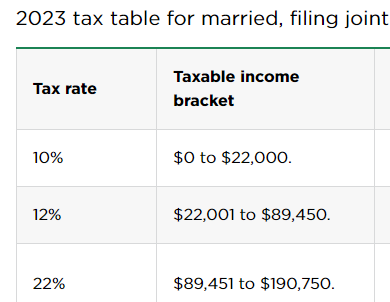

I was so pleasantly surprised how low overall our taxes were last year (with MH working full year, with my raise and bonus, etc.) that I never noticed that we had graduated out of the 12% tax rate. 😵 Which also means... No more 0% tax on investments.

Which means... I need some time wrap my brain around that and actually think about taxes when it comes to investments. We've been spoiled for so long.

I went back and looked more closely because I thought maybe it was just the investments (I sold a lot of investments last year). In the end, taxable income was $89K and that only included about $3K of investment income. The rest is pretty simple. Mostly just salaries and the standard deduction. (Though we will obviously have a lot more bank interest in 2023.) With our (more than 3%) raises this year, we are clearly in a new tax bracket. 22%.

It's going to get nasty with the I Bonds. Tax-free if used for "college tuition". Not going to be tax-free re: our very low tuition costs. So that's one more tax thing I will have to think about and plan around. I had wanted to use the I Bond money for college rent. But it might make the most sense to just consider the I Bonds our emergency fund, so that we can then tap more accessible cash (without any tax consequences).

I will also have to reconsider utilizing my work 401K. If we are really close re: hitting the next tax bracket and losing 0%-tax investment space. It might be worth throwing a few thousand dollars into a 401K if it gets us back to tax-free investments. Will just have to see how the year shakes out.

Another note to self:

First ~$13K of earned income is tax-free for the kids. Have been having them claim exempt. In the end, MM(19) made $6,000 in 2022. What I didn't think about was that only $5,200 of CA wages are exempt (single standard deduction). MM(19) ended up owing $3 to California. I suppose he can continue to claim exempt for Federal. (Can do so if prior year and current year are both $0 tax years). But technically is no longer able to claim exempt (California) because he paid $3 tax for 2022. Will have to keep an eye on that. DL(17) is more likely to just work something like 15 hours per week year round, so he will probably start piling up the dough pretty quickly. Will have to have him submit a separate California W4.

I appreciated that we realized this without a big tax bill to pay!

Posted in

Just Thinking,

Taxes

|

5 Comments »

April 15th, 2023 at 03:06 pm

Received $116 bank interest

Received $246 I Bond interest

Snowflakes to Investments:

--Redeemed $49 credit card rewards (cash back) from our grocery card

--Redeemed $68 cash back on Citi card

--Redeemed $3 cash back on dining out/gas card

Other Snowflakes to Investments:

+ $6 Savings from Target Red Card (grocery purchases)

TOTAL: $126 Snowflakes to Investments

401k Contributions/Match:

+$955

Snowball to Savings/Investments:

+$1,500 MH Income

Savings (from my paycheck):

+$ 250 to investments

+$1,000 to cash (mid-term savings)

-$ 315 Misc. Big Purchases

-$2,300 College Tuition

-$1,000 Tree Trimming

Short-Term Savings (for non-monthly expenses within the year):

+$1,500 to cash

-$ 524 Car Maintenance (Hybrid)

-$ 330 Dentist (x2)

-$ 275 San Francisco Weekend

-$ 263 DMV Renewal (Hybrid)

-$ 78 Pest Control

-$ 42 Backup Battery (VOIP)

TOTAL: $566 Deposited to Cash and Investments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Hybrid Miles Driven: 812

Fuel Costs: $20 Electricity

(assumed 50 miles & 14 KwH per full charge)

Electric (EV) Miles Driven: 716

Fuel Costs: $10 (home) + $2 (out)

(assumed 300 miles & 60 KwH per full charge)

Most charging (both cars) was done at home or at free chargers.

We did 85 miles of free charging this month.

We did one Bay Area trip. 40 free miles of charging (in-laws' new charger) and $2 charging at a fast charger. That would have been unnecessary but we left for a test drive and to show the in-laws some things with their new car and didn't want to leave the garage door open. We have a plastic cord passthrough that we put under our garage door when we charge outside and so I have since bought a couple of more. Will plan to keep one in MH's car and will give one to the in-laws.

I suppose we gave the in-laws ~100 miles of charge when they drove up here for St Patty's Day. I will just consider that a gift. It's not our driving. But I will have to ponder how I want to account for that, because I don't want it to skew our electric utility (financial tracking). I'll probably carve out that 100 miles (x kWh rate) as a gift. Or longer term maybe it will just even out.

We did also go to a show downtown and got 45 free miles.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note: I am always lagging a month behind because any bills charged in February will be paid off March 1 and reflected in my March numbers. I charge in one month and the next month I figure out how to pay for everything (if I need to pull anything from savings). So this update reflects February spending & March savings.

The big expense was trimming several trees in our yard. Mostly we have one bigger tree and then there is our neighbor's monster tree. Long overdue to trim that back. We paid very little last time. Person I found this round was more expensive, but I think they did a *lot* more work. I think last time was more "get that tree off my tree" while this guy trimmed everything back to the fence line, including the entire height of neighbor monster tree. It should last a little bit longer.

I am in nesting mode. Does this happen when your kids turn 18? I couldn't tell you why. Maybe some combo of having some breather and also feeling flush financially. Maybe also emerging from a long winter. It's just a little deja vu to the pregnancy nesting.

We did our last free timeshare stay in February? Who knows... MIL has been wishy washy about everything financial, and that is now extending to their timeshares. At first they told us we could not use for our LA trip this month because they had canceled everything. But now they want to extend a year. We were so happy they were wrapping up this timeshare mess (do not want to inherit) and so are not thrilled that they are prolonging. MH has been very clear about his feelings, but they insist they aren't keeping it for us. (Lord knows what the actual truth is.) It's moot for April LA trip because we already made plans. If not for all this, we would have stayed at the usual free place and done some extra driving. But we had already wrapped our minds around staying closer to our destination and paying for the hotel. & because we don't want to encourage them and had very little notice, I expect we will go over our vacation budget this year. Just mentioning because just one more thing on the $$$$ side. (We don't have any big plans, but it all adds up a lot faster when you have to pay for every hotel stay.)

I did not sweep any of MH's income to investments this month. Hear me out. My goal is (was) to sweep everything above $1K per month (MH income) into investments. When I received MH's last check of the month I was preparing to sweep $500 into investments. Cash is at $7,000 (projected 4/30, after big expenses. This does not include emergency funds or funds earmarked for college). It was stressing me out more at the beginning of the year (after big mortgage paydown) when cutting it close. But having $7,000 left after some major expenses... Things are progressing nicely and I am happy to resume bulking up investments.

But... I am pondering a big expense and getting a quote in April. Will see how that shakes out before I start committing bigger dollars to long-term investments. Happy to say that investments are increasing rapidly, regardless. It took me one year to invest $2K (with snowflakes). It's going much faster with the $250/month we are contributing from my paycheck, plus snowflakes.

2023 is going to be an expensive year.

Posted in

Just Thinking,

Budgeting & Goals,

Investing,

Credit Card & Bank Rewards,

Electric Vehicle (EV)

|

1 Comments »

March 22nd, 2023 at 03:59 pm

March is determined to be absurd. In January I refused to believe that January set the tone for 2023. That we were going to have another *crazy* year (after the last several crazy years). But I give up at this point.

My newest employee has been out sick 3 times already this year (once for a whole week) and had her third emergency this week. This work jinx clearly remains (this is everyone who works for me). My other employee was hospitalized last weekend. It's just how it always is. We just had a few months of peace before newest employee's life went to heck. I am very burned out, between busy year end stuff and all this constant covering for employees.

My kids are exhausting. I thought it was supposed to be easier with adult (or almost adult) kids. 😁 MM(19) got jury duty so I helped him to get that postponed. I had to do a double take because I was sure when I saw the envelope that it was MH or I. & of course, still no idea MM's housing situation. Might be scrambling next week to figure it out. This is the big crazy stressful thing and I will be happy to move past this. The rest of his college years should be pretty easy once we find him a place to live. DL(17) has never been my *easy* child, but I do appreciate how much simpler it will be with him going to college close to home.

We had postponed St Patty's Day dinner to this weekend, when MM is home for spring break. DL(17) just informed us that the marathon he was planning to do is this weekend. !! So MH was supposed to talk to his parents about that. Hopefully we can just bring them the corned beef and they can host. The marathon is in their city. It's the first I heard of it. But... I am used to MM(19) being the easy child and taking care of stuff. Time is flying, the school year is almost over. This is what DL(17) is doing for his senior project. Now that he mentions it, yeah, it had to be coming up fast. It just wasn't on my radar.

Plus we just have a bajillion other things going on.

Last weekend I did move some money out of our mega high interest bank. It's been at 3% - 3.5% during lower interest years but is no longer competitive. I expect they will eventually bump up rates but I don't care enough to wait around or keep the account open indefinitely. For now I moved most of the money back to Ally (4.0%) and will happily close the other bank account if they don't bump up rates in the next few months. Will give it a little time, but would mostly be happy to have less banks to keep track of.

MM(19) is coming home for spring break next week. It's basically a repeat of his last spring break. Taxes, dental cleaning, internship interviews, etc. A real chore week. He's got some money piling up not earning anything and so I will recommend that he open up an Ally account. Or maybe he would just be happy to put some cash at Fidelity. Will give him some options to consider. He still has some Ally account (with a $0 balance, that I asked them to close some years ago). It's been a nightmare to get some of his minor accounts moved over (Fidelity was very difficult, but it's done.) So is some of why I want to tend to this while he is on break. In case Ally makes it difficult.

MM(19) has $3,000+ that should be earning some interest.

I had a comment about interest on my last post. I bought more I Bonds earlier this year, so interest should continue to bump up. & waiting another month to see what 12-month I Bond interest is compared to other options. I have another $20,000 I can dump into I Bonds.

I had a good declutter streak last weekend. Listed some odds and ends on Craigslist and they were gone within 24 hours. Also have a charity coming by for a pickup. I missed the last pickup. I have accumulated two bags of stuff. All of the above had been set aside at some point. I just hadn't gotten around to the last step of disposal.

MH shipped some books to some family that was struggling and that misses the ability to buy books. $37 to ship a pile of books he got for free. Some part of me is, "Meh, that's what the library is for." Lord knows no one ever bought me any books. Which is probably why I am more than happy to just utilize the library and not clutter up my home. (Is just how I am used to reading books.) But with all the free scholastic books we got when our kids were little, I also don't mind paying it forward. I mean, ask me again how often this happens. (I expect MH had a little sticker shock at the post office.) In the meantime, I am happy to have that pile of books gone. I took some to work for my coworkers to sift through and MH shipped the rest. (MH had gotten all the books for free because they were "damaged." 90% of them had no visible damage, or nothing anyone would care about.)

Posted in

Just Thinking

|

2 Comments »

March 8th, 2023 at 02:17 pm

For the Used EV credit, the IRS states very clearly that you need to get a signed statement from the dealership that includes certain information. Purchase needs to be from a licensed dealership or something like that, can not be a private party purchase for the used EV credit.

The two dealerships my in-laws went through had never heard of the credit. They had no idea about the $25K cap but were happy to haggle once my in-laws pointed it out. (I mean, they had to walk out to get their attention, but obviously they aren't paying $25,001+ if it will cost them a $4,000 tax credit. The dealership got the point that they weren't going to budge.)

Now that they have the car, the dealership refuses to provide this tax information. I don't know if it's worth fighting in the moment. They should eventually figure it out and it may be easier to ask for this information at the end of the year. Let other people fight this battle?

They are supposed to provide documentation at time of sale *and* also to the IRS. I am less concerned about the latter. As long as we have the documentation, is really all that is important.

I had been thinking that it would be pretty enticing to buy a hybrid and to get this credit, for MM(19). Something like my car, that I saved my whole life working up to and is very luxurious. A car like that is $16,000 right now and would only be $12,000 with the used EV credit. MM(19) has the cash for that and it would last him a very long time. Though he has a very cheap heart and might want to go more used. The used EV Credit will swing the pendulum substantially towards an electric hybrid. I wouldn't have recommended before, given the uncertainty of long-term situation (how long he will be renting, etc.). I think without a charger at his residence, the full EV would be much easier/better for his situation. But is also more expensive. (Easier to charge out and about, with the fast chargers.) I just don't see how you'd ever charge a hybrid, in contrast. But if you can save $4,000... I've seen a lot of people say over the years they only drive in gas mode or EV mode, and it doesn't seem to matter much either way.

But... This whole idea is off the table until the dealerships straighten up. I would refuse to purchase if they had no idea what I was talking about and couldn't provide a tax document.

I figured I'd share as a warning, if you are considering the used EV credit. Heck, this also has to be an issue with the new EV credit. This is a dealership that sells brand new EVs. So they have to be giving new EV buyers the same runaround when it comes to providing tax documentation. If not, they would have any clue what we were talking about.

Posted in

Just Thinking,

Taxes,

Electric Vehicle (EV)

|

2 Comments »

February 26th, 2023 at 03:26 pm

First car deal ended up falling through for the in-laws. Probably for the best. We hadn't realized that they were still working through 2020 recalls and don't know when they would have got the new battery. MH and I were feeling a little bad about not doing our homework on that. We just presumed they were further along.

I really didn't know why they needed MH and was hoping they'd just go pick up a car if we found one. MH did find a car with only 8,000 miles but it had two owners already. I think the whole third owner thing disqualified it from the used EV tax credit. I could have done some homework to be sure. But... It's moot at this point.

On Friday MH found a 2019 model with 39,000 miles. MH's parents loved it and went to pick it up. Phew!

The mileage is really N/A because the car had an EV battery replacement last year and has a new 8-year warranty with the recall and battery replacement. The car was apparently like-new (in person) and they were very happy with it.

Full price: $24,000

Net $5,000 used EV tax credit and utility rebate = $19,000 net cost.

*Still* the most expensive EV purchased by anyone I know.

I didn't notice until later, but this model didn't have the power liftgate. But they did get the wireless charging (for phone/devices) and so have that one upgrade over our 2017 model.

They are getting their car charger installed today. They are also the only other EV drivers I know that are hoity toity enough to get a charger installed. It's really not necessary. But in this case, a lot of the *why* is because FIL is slowing down and will be unable to get gas for MIL at some point. The appeal is just being able to charge at home. (I guess MIL refuses to pump her own gas. Now she won't have to.)

{We are hoity toity and very much enjoy the luxury of faster charging at home.}

I don't think we were much of the reason for this purchase. I am sure it helped that they were envious of our car and we have only raved about it. But... If you are frugal and want an EV, what else is there? There's cheaper EVs but they have other issues like much less range and battery degradation. If you want a 300-mile range and want a car that will last 15+ years, there's nothing else in our price range. I do also think they are willing to make the leap from gas car to EV because so many in the family do drive EVs. We are not the early adopters in this family.

{May I be so brave and open to change when I am 80 years old! 100% I needed that hybrid baby step before I was ready to take the leap. I have a lot of respect for anyone who just makes the big leap.}

This is a very big perk for us because now we have free charging at their house. I've been so focused on hoping that MH doesn't have to drive down there another weekend and wonder how long until they finally get a car and stop yanking MH around... It's only as I type this out that I am, "Oh yeah! Free charging for us!" Which will probably be a wash if we give them free charging in return. But will clearly be very convenient if we can just charge somewhere that we already are. I see a lot of MH helping his parents in the near future, and the charging situation will make it logistically a lot easier.

Posted in

Just Thinking,

Electric Vehicle (EV)

|

1 Comments »

February 22nd, 2023 at 04:11 pm

We expected the economics to be the same for our kids as it was for us. Cheap college. Completely absurd post college housing costs. We preferred to keep any "college money" for after their college years. In the end, this is even more true for my kids. They will pay less (than we did) for their college degrees. Housing has only gotten more absurd.

That said... MH had the free ride but he also just lived at home during college years. He told me he is not interested in saving MM(19)'s college fund while we pay for completely unnecessary luxury costs like housing 300 miles away. The "Far away college" was not necessary to get him the same quality degree. I am 100% on the same page.

For MM(19)'s freshman year I did not agree this was entirely fair, because MM received a (one-time) scholarship at this other college. It would have cost him the same to live at home the first year. But for this school year, I do appreciate the load off my shoulders. Phew!

We both want to leave some of this money for the kids, as long as they are choosing affordable degrees. But for MM(19), it's just not going to be *all* of it.

We've been kicking the can down the road as much as possible. Wanting to rely more on saved money when we have two kids in college at the same time. & then all this financial aid delay during this school year. Have been waiting for that to sort out.

But now it is time. We agreed to cash flow MM(19)'s rent this year. Food costs are just being carved out of our grocery budget (no new spending.) & we will pull tuition from MM's college funds.

The Gifted College Fund

This is a $1K annual gift from the in-laws, since birth. MM(19) has probably received ~$20,000. (I think one or two years might have been forgotten/skipped). This gift has grown to $30,000 over time.

I did give him the $1K gift for spending money this college year, but he just put this money in I Bonds (along with his earnings last year).

In 2020 MM(19) had a big earnings year and we put $5K of this gift into a ROTH IRA.

This leaves him with $24,300 today, that is just sitting in cash.

We paid $0 tuition last year and so we did not pull any money out from college funds.

We will pay $4,300 tuition this school year. This works out pretty well. I will draw this account down to $20,000, reimbursing ourselves for the $4,300 tuition.

I want to remember that with the ROTH IRA and the I Bond money, he technically still has $26,000 of this gift money left. & he might receive another $2,000 from the in-laws during his college years ($1,000 x 2 years).

Next Year

DL(17) will most likely live at home and go to the local State college. We will not touch his college fund. I expect to pay ~$2,000 tuition in August and ~$2,000 tuition in January.

Note: Will also get a $2,000 college tax credit; net cost is ~$2,000 for the year.

We will pull MM(19)'s tuition from his college fund. It will be $2,000 tuition in August, $2,000 tuition in November, and $2,000 tuition in February.

Note: Will also get a $2,500 college tax credit back; net cost is $3,500 for the year.

I will cash flow the tax break, and so will pull ~$1,200 from MM's college fund every quarter. I'd like to just reimburse ourselves every quarter, but will need more timely financial aid information in order to do that. With two in college at the same time, I might err on just reimbursing what we actually pay and then putting back any financial aid refunds. If it's anything like this school year was.

The above numbers presume $0 scholarships.

Unknowns

There's still a lot of unknowns re: next school year.

DL(17)'s situation is very cut and dry with the whole living at home thing.

MM(19).... Where to begin!

There is a lot that has to sort out re: housing. He's trying to get free room/board or deeply discounted room/board re: RA position or other on-campus jobs. He's trying to get on campus housing (as a backup plan.)

Financial aid is supposed to be favorable with two in college. This means nothing for DL(17) if he lives at home. For MM... I don't fully understand what this means. If our "need" is $15,000, do they give us $15,000 next year? I was going to say they've only offered us loans for negligible amounts of "need" in prior years. But I guess to be fair, the school also knew that they were giving us scholarships and they knew the state was giving us aid. In reality, "need" has been covered in past years.

MM(19) might fare better with scholarships if he does demonstrate need.

I am just preparing financially re: what I do know, and any reduction in expenses will just be gravy.

Update: I transferred the $4,300 to our checking account and paid rent for the rest of the year. I really enjoyed paying this expense with someone else's money. 😁 The rent bill just happened to match the $4,300 figure and I can pay it now. I can't pay tuition until MM(19) registers for classes.

Posted in

Just Thinking,

College

|

2 Comments »

February 20th, 2023 at 03:41 pm

Both our EVs should be extraordinarily low maintenance. But my expectations are pretty low because of the dealership factor. With the more specialized cars and the long warranties, we are at the mercy of the dealership. (Might need less repairs, but the repairs will cost a lot more than we've paid to our trusted independent mechanics in the past). It is on my list to find a trusted EV mechanic at some point. I just thought we would have more time.

We've saved $1,200 this past year by not trusting the dealership. I don't know much about cars, but I can recognize complete made up bull crap when there is nothing wrong with the car. This hasn't left me feeling warm and fuzzy about the "if anything goes wrong with our cars" factor.

In the end, I've seen several people complaining about this dealership in my online EV groups. It is the worst of the worst. For whatever reason, MH liked this dealership more than the others and had been digging in his heels a little bit. But... I do think they royally pissed MH off in recent months.

We drove the hybrid to San Francisco last weekend. We stopped at the gas station by our house, on the way home, and the engine light came on. Got an error to "service high voltage charging system", something like that, and the car would not charge.

I was relieved when I checked my online EV group. A - the car was perfectly fine to drive. (A very helpful Chevy EV tech had told many people this.) B - It was most likely something very simple, like low coolant or just needing a software update.

I was surprised when MH just booked the appointment with the other dealership in our city. Phew!

I quickly looked up this other dealership and saw absolutely glowing reviews in my online group. We quickly found out why. The service manager has the same car. I am relieved that the service manager has the same car, because otherwise I would have questioned if they knew what they were doing. Because the repair bill ended up being far below average for the work done. (Which in many cases in other states or regions is because they don't have EV techs or have no idea what they are doing. But in this case... I have to trust they did all of the maintenance and knew what they were doing.)

I am not ready to give my full praise to this dealership. We paid $200 for the diagnostic. Which made this repair at least 70% more than it would have been with our independent mechanic. We've *never* paid a diagnostic fee before. Not to the shop that is going to do the work we asked them to diagnose.

But overall I am happy that we found a dealership that we could trust a wee bit more, and that it did end up being the simple fix.

There is only one line item basically re: maintenance for our EV. Change out the (battery and other) coolant every 150K miles. It's the same on my hybrid but maybe a few more line items of maintenance with the hybrid. The cars are very similar.

My first impression of this dealership was not good when they immediately started pushing "recommended maintenance." But I quickly deduced from my online group that this is a thing and that it is in the manual. It was also universally agreed that this was useful maintenance. So I did pull up the car manual later. There is a footnote that you do this every 5 years or 150K miles. I had literally never heard this before. & this does not redeem the scammy dealership. Never in a million years would I have thought they would sell us bullcrap while completely ignoring the actual recommended maintenance. But the scammy dealership did exactly that.

In the end, it was just low coolant. The maintenance was the fix.

Moral of the story: We could have saved $200 (diagnostic fee) if we had realized this. My car is 6 years old, so should have flushed out the coolant a year ago.

{To be *very* clear, scammy dealership had both our cars in the past year and failed to mention the one line item of maintenance that is recommended after 5 years. This put both our cars at risk (of damage) and left me with a separate trip back to the dealership for repairs. I guess MH too. Will be a separate trip for maintenance they should have done when they last had his car.}

Instead of oil changes, the EV is going to need a $300 coolant flush every 5 years. I can live with that. It's the 'oil change' equivalent I guess.

This means that our EV is also due for this service. & that we realize we want to of course be proactive because the EV would be far less useful if we couldn't charge it. But the EV is about 15,000 miles behind the hybrid and the battery coolant (probably the most important part) was changed out already with the battery recall. So we are just going to wait for a more convenient time. Will get it done this spring or summer.

Oh yeah, and the dealership told us that the brakes on the hybrid are at 95%. No surprise. The traditional brakes are used very little on these cars (only for hard/fast stops). It was just the first time we had any feedback on our personal cars. My car has 70,000 miles, for reference. We've always heard the brakes will last the life of these cars.

I guess it was a big car repair week for SA.

Edited to add: I've never joined an online car group before and don't know that I would have thought to do so. But our EV friend added me to some Volt group when we bought the Volt. It does help to soften the blow of not having our forever trusted (gas car) advisors to turn to. & is helpful when you completely miss the fine print.

Second edit: To clarify, all maintenance quotes were given without even looking our cars. This was the stuff they were trying to sell us when we dropped off the cars. None of this stuff is actually recommended maintenance, except this hybrid maintenance that we agreed to.

Posted in

Just Thinking,

Electric Vehicle (EV)

|

2 Comments »

February 19th, 2023 at 07:05 pm

The in-laws continue to be wishy washy. But MH was going to meet them today (presumably) to buy a Bolt. They had already been very wishy washy and changed their mind last minute twice, so wasn't holding my breath.

It's maybe kind of sort of done...

In the end, MH had swayed them to just buy used. But they were being very picky (re: color) and so there was really only one good candidate today. I feel like when we buy cars we usually go out with multiple options, so I didn't expect much. Last time he had found 3 cars within their parameters, so that was probably more what they expected. But I thought maybe they'd just go look at new cars if this one car was a bust.

{Reminds me, I saw a MSRP tracker, if anyone is interested. Just some google sheet type thing where people share dealer feedback and how much they are charging over MSRP. You can sort by city and car make/model. I will track it down if anyone wants it.}

Found: 2020 Bolt (fully loaded) $25,000. Net price $20,000 after federal tax credit and utility rebate. Mileage 10,000.

Because of the battery recall *and* very little change between 2017 and 2023 model, it seemed pointless to go new. & mileage was kind of moot. But for the same price range, of course "way less miles" is a plus.

When discussing, the only thing the in-laws seemed really intrigued by (re: newer models) was the wireless charging (for cell phone/devices). I perused the car details today and the only other thing I can find is that this 2020 has a power liftgate. It's basically our car, a lot less miles, and these two features.

In the end, they made the purchase but they don't have the car yet. Very long story. We could end up with a Round 4, but for the sake of MH's time, I hope this purchase works out.

This was a non-Chevy dealership and they didn't know about the battery recall. So... The in-laws want to get a charger ordered. They need to have their garage wired to accomodate the charger (have already consulted with an electrician). & it's plausible they may need to take the car to a Chevy dealership for the battery replacement. They've got a few steps to go through. I don't know where they are with the 2020 recalls. They could be done, but I just don't know and it's something they should double check.

It's a process, but I think they will be very happy in the end.

Edited to add: This is by far the most expensive EV that anyone I know has purchased. I've had some very frugal and broke friends buying EVs over the years. For more early adopters, they cost pennies on the used market or could lease for $100/month. Found out recently my bff picked up a Bolt. It's a $100/month lease deal.

Posted in

Just Thinking,

Electric Vehicle (EV)

|

1 Comments »

February 19th, 2023 at 04:38 pm

Post re: MM(19) Freshman college year:

Last year MM spent $500. This was everything during the school year that wasn't tuition/room/board/medical. Off the top of my head, his spending would have included school books/supplies, transportation, club dues, haircuts, clothing, dining out, entertainment, gifts, toiletries, ATM withdrawals, etc. I did spend about $250 on bigger purchases for him, when his very liquid funds were getting low. So I think $750 was a fair annual number ($500 + $250) and he will be very comfortable with the $1,000 next school year. ($111 per month).

I had given MM(19) his annual $1,000 "college money" gift from in-laws. Not really any reason to save more for his college years and felt that money would be better suited to giving him spending money during the college year.

The school year is half way over and so I was just looking at where we were at with things. MM(19) has spent a whole whopping $350. I have less details because I am not on his new credit card. But would be for all of the same categories I mentioned above. This puts his spending very on track with the prior year.

I expect that his spending the first quarter was somewhat reduced by his very busy schedule. But... With going to LA almost every weekend, I would expect more eating out and gas expenses. It could just be he had no time for anything else. He also had a job that quarter. & this quarter he has been sick.

MM ended up testing negative just 5 days after his first COVID positive. Phew! Glad that he got out of COVID jail quickly and is not impacting his classes. He was sick for a few days and then he had asymptomatic COVID after, which meant maybe two weeks where he wasn't leaving his apartment much. The weekend he tested positive, both his girlfriend's parents and the in-laws were visiting. He said they brought him 6 bags of food and things. He is very well taken care of. & the girlfriend was bringing him several meals (might have been included in the 6 bag count). She likes to cook.

I guess it's been a weird quarter. There were some days that they just had to shelter in place re: flooding. At this point he's maybe spent half the quarter just stuck in his apartment.

The new thing this year is groceries. I gave MM $400 for groceries & $100 for the week he was in LA, to cover food costs. That's for 4 months, so we are averaging $125/month food spending. MM(19) is being *very* cheap with his food shopping, but also gets the benefit of a lot of food from his girlfriend.

{I hadn't thought about it but he clearly spent nothing on groceries during the past few weeks? If several people brought him food.}

This school year MM(19) received $1,100 net wages, received $201 in credit card rewards, and has received $140 interest. The I Bond interest is just starting to kick in (9.62%).

Edited to add: Talked to MM(19) this weekend. He went beach camping this weekend and will be spending next weekend in LA. Just to be clear that his spending does not reflect a miserly existence.

MM's spending this year is notably more "hoarding electronics". With the private bedroom and more personal space, he is clearly starting a hoard. He's always been a bit of a trash hoarder and did find a (broken) drone on the beach end of last year. That would be very typical MM. But with a little personal space and money he is starting to buy old electronics off the internet and buy a lot of stuff "because it was cheap." The electronics is old, but for some purpose or project. The "because it was cheap" purchases are anything you can imagine.

I just saw that our credit union is doing a 5% CD for 12 months. I will ask MM(19) if he is interested. He is starting to pile up more cash.

Posted in

Just Thinking

|

4 Comments »

February 15th, 2023 at 01:44 am

Received $94 bank interest for the month of January.

Received $246 I Bond interest for the month of January.

Snowflakes to Investments:

--Redeemed $36 credit card rewards (cash back) from our grocery card

--Redeemed $96 cash back on Citi card

--Redeemed $21 cash back on dining out/gas card (& grocery rewards from Q4 2022)

Other Snowflakes to Investments:

+ $7 Savings from Target Red Card (grocery purchases)

TOTAL: $160 Snowflakes to Investments

Snowball to Savings:

+$1,300 MH Income

+$ 250 MH Award Money (Script Contest)

+$1,130 College Refund

+$1,050 State Inflation Relief

-$ 700 Stereo System + backup camera (kids' car)

401k Contributions/Match:

+$563

Savings (from my paycheck):

+$ 250 to investments

+$1,000 to cash (mid-term savings)

Short-Term Savings (for non-monthly expenses within the year):

+$1,500 to cash

-$1,200 Home Insurance

-$ 360 Auto Repairs (kids' gas car)

-$ 210 Annual Movie Pass (Regal)

-$ 175 Museum Membership

TOTAL: $4,898 Deposited to Cash and Investments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Hybrid Miles Driven: 605

Fuel Costs: $16 Electricity

(assumed 50 miles & 14 KwH per full charge)

Electric (EV) Miles Driven: 1,516

Fuel Costs: $21 (home) + $46 (out)

(assumed 300 miles & 60 KwH per full charge)

Most charging (both cars) was done at home or at free chargers.

Lots of driving this month. One college trip (round trip ~650 miles), one Bay Area trip (~250 miles) and then MH traveled about 140 miles roundtrip for a San Francisco trip. He drove 70 miles and then took the train the rest of the way.

The hotel charging was expensive, $23 for a full charge. Is more in line with gas prices. But was worth it and very convenient to just charge up the car all the way, overnight. The rest of the charging expenses will decrease substantially in the future, with warmer temps and more efficient EV tires.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note: I am always lagging a month behind because any bills charged in December will be paid off January 1 and reflected in my January numbers. I charge in one month and the next month I figure out how to pay for everything (if I need to pull anything from savings). So this update reflects December spending & January savings.

I chickened out about sweeping MH's income (above $1,000) to investments. I am struggling with feeling a little "cash poor" after that big mortgage paydown. We just bought a second set of new tires (when the first were a bust). We will have fence replacement expenses soon. & while in storm/fence/tree mode, will get our trees trimmed. There's college expenses in February, and $12,000 I need to send to IRA for 2022.

MH did unexpectedly receive some Holiday pay (for the week after Christmas). I suppose some of this is moot because I didn't expect that MH would bring home much in January. That was just a nice surprise, but we are also trying to get these tires covered. With unexpected money, ideally.

It should just be a short term stress. Will add back some buffer quickly, these months that MH is working. & college expenses should be pretty minimal until August. I am going to pull some money out of college funds, for the first time. Tuition for the whole (academic) year, which will offset MM's last rent bill for the school year. & the two refunds I just received from the college will be all I need to cover tuition. Just parking the refunds until it goes back out again.

I had written off our inflation relief check as lost/stolen. Tried to call three weeks ago. Was told I had to wait until January 31st to get a replacement card. The original showed up in the mail on January 30th. Phew! That would have been so irritating to cancel/replace and then just have it show up the next day. I applied to the car stereo purchase, which was the original plan. (I don't remember if that was the original original plan, but was easy to justify the stereo upgrade knowing that this money was coming.) I suppose that works out pretty well. The rest, and MH's unexpected Holiday pay, should cover most of the tire purchase.

January was clearly a big cash boost, and I do appreciate it. MH also finally got that $250 he won a while back.

I was just updating sidebar. I am just going to call it. MM(19)'s first two years of college paid for in cash. I won't send the final 2022-2023 payments over for another few weeks, but clearly we have the cash to cover it. Extra so, if I am just applying recent college refunds and pulling from college funds. I put this *goal* more in my sidebar as a clarification. The feeling of it is *shrugs*. It's less of a goal and more just how we roll. It's also fairly official that DL(17) will be the 4th person in our household to take advantage of CSU (CA State University). This is just solidifying my *shrugs* feelings about the cost of college.

Posted in

Just Thinking,

Budgeting & Goals,

Investing,

Credit Card & Bank Rewards,

College,

Electric Vehicle (EV)

|

2 Comments »

February 11th, 2023 at 04:36 pm

I got my first shocking bill re: inflation.

I presumed that utilities would take about a year, because we do budget billing (just pay a flat amount each month.)

So I just got an email that our budget billing was going up 33% for the gas bill.

We've also been much more relaxed with heating over the past year or so. So I didn't know how much was that we were using more gas, that prices went up, that the balanced billing is just catching up with reality.

In the end, our gas usage was down (compared to last year). Could be somewhat due to weather. It hasn't been sunny or warm at all. In that regard, is colder than I ever remember it being. But we've been getting less freezing temps. The crazy storms kept temperatures a little warmer over night.

In the end, the per unit pricing had gone up dramatically on this bill. Saw other neighbors complaining and talking about gas prices soaring.

For now, it's an extra $25/month. I will take it out of the 'breathing room' which is still very significant compared to what we are used to. I had added initially an extra $200/month of breathing room. I can live with an extra $175/month.

{Some some neigbors complaining about bills doubling and tripling! Same people also said they keep their heat at 72F 24/7. I don't feel like we have been particularly energy frugal in recent years, but I guess it's relative. We have never run the heat at night.}

In other random news... DL(17) got his ears pierced. So random! MH and the kids are (were) all kind of, "Like hell I'd ever make any permanent change to my body." Which is just how they are wired. & so this was really out of left field.

What I learned in the last 48 hours is that everything about my own ear piercings were wrong. The first thing DL(17) tells me is that he is not going to Claire's to get his ears pierced. Then I learn that you aren't supposed to use rubbing alcohol to clean the ears as they heal. You aren't supposed to turn the earrings. Etc., etc. It's a wonder us older people survived our piercings. 😁

Other than that, work has been crazed. & we went to San Francisco last weekend. Went to the first comedy Sketchfest in 4 years. Well, we skipped 2020 for whatever reason. Then the last 2 years were postponed/canceled. They did just reschedule everything for the same days/times, and so we went to the 5 shows we had paid for over a year ago. We ate very well and had a nice time. Might be the last time we use the free timeshare. We paid ~$250 for the weekend.

That reminds me, MM(19) ended up getting COVID. After living in dorms for 1.5 years, I am surprised it took this long. He was sick a couple of weeks ago? Then took a test for some other reason. I presume he is just asymptomatic and COVID wasn't what he had when he felt sick. I am sure he tested when he was sick, just because his girlfriend's sister is immunocompromised and so he has been very cautious. (His school would only require a COVID test if he knew he was exposed. They don't ask the kids to test every time they have the sniffles.) I guess in this case, he took a test because MIL was going to be in town visiting. But he told me he was probably going to take a test anyway because his roommate had COVID. I hope he continues to feel fine.

Note re: Inflation: Rent and (car)gas are most of what I hear people complaining about locally re: inflation. There is a reason that we do not have these two expenses.

Posted in

Just Thinking

|

2 Comments »

January 28th, 2023 at 02:59 pm

Received $79 bank interest for the month of December.

Received $220 I Bond interest for the month of December.

Snowflakes to Investments:

--Redeemed $2 credit card rewards (cash back) from our grocery card

--Redeemed $113 cash back on Citi card

--Redeemed $25 on dining out/gas card (+ groceries during Q4)

Other Snowflakes to Investments:

+ $5 Savings from Target Red Card (grocery purchases)

+ $141 Dividends

+ $100 MH income (to meet 2022 goal)

TOTAL: $386 Snowflakes to Investments

Snowball to Savings:

+$1,132 College Refund

+$4,000 Bonus

401k Contributions/Match:

+$1,800

Savings (from my paycheck):

+$950 to cash (mid-term savings)

-$1,000 Auto Repairs (Kids' gas car)

-$ 600 Play Station 5

-$ 530 Flood Insurance

-$ 270 AAA

-$ 150 Holiday Break College Travel (Train + Plane)

-$ 150 Gas (Rental + Kids' Car)

Short-Term Savings (for non-monthly expenses within the year):

+$1,500 to cash

TOTAL: $7,367 Deposited to Cash and Investments

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

For Comparison:

Gas Rental Miles Driven: 220

Fuel Costs: $17

Ended up being 16 cents per mile for the rental. Cost was 7x what I pay for electric fuel. I am glad it ended up being such a short rental. I thought we would be paying hundreds of dollars for gas. I only drove the rental about half as much as I drive my car usually. Paid for most of the gas last month.

Hybrid Miles Driven: 347

Fuel Costs: $9 Electricity

(assumed 50 miles & 14 KwH per full charge)

Electric (EV) Miles Driven: 1,071

Fuel Costs: $17 (home) + $17 (out)

(assumed 300 miles & 60 KwH per full charge)

Most charging (both cars) was done at home or at free chargers.

2 Bay Area trips (Holidays)

We've mostly been using Electrify America for charging. But I found a AAA deal for EVGo, which made the cost more comparable. We were able to set it up so that EVGo recognizes the car. You just plug in and it charges your credit card. MH also wanted to try it out because his parents are buying an EV. Wants to make it as simple as possible for them. This time we just got it all set up. Next time we see if it's really that easy.

It was under 50F degrees when we drove home, so the battery range took a hit. (50F is when I really notice it on the hybrid.) Between that and using the heat/defrost (a big energy drain) we stopped for a 100 mile charge. Most of the time we shouldn't have to stop at all on this drive. The range has also taken a big hit with the new tires (less efficient) but last time I only stopped to charge for 5 minutes. & that was probably unnecessary. Just to show what a difference winter makes. It easily could have been over 50F degrees, and so it's not a big impact for us. Christmas and New Years long drives might be the only time we really notice the cold impact on the EV battery. It was a rare time that we stopped just to charge (without running errands, eating a meal, going to a movie, taking a rest on a big drive, etc.)

Christmas Day was same, with far below average temps.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note: I am always lagging a month behind because any bills charged in November will be paid off December and reflected in my November numbers. I charge in one month and the next month I figure out how to pay for everything (if I need to pull anything from savings). So this update reflects November spending & December savings.

I failed at saving MH's income this month. If I had any time or energy I'd break it down, but it just doesn't matter to me at this point. I did add $100 of his paycheck to investments, to top off 2022 investment goal. I only needed $50, but rounded up. This goal was otherwise met with credit card rewards and dividends.

Things were made worse by a last minute auto repair. Their credit card machine wasn't working and so MH took a check to pay. A series of random events which led to a very rare last minute cash purchase. This is messing up my accounting! But all else being equal it would have been a January expense (charged in December, cash sorted out in January). So that is how I will treat it. If I account for it now, I have to pull from mid-term savings. Short-term savings has been $0 for a while. In January I will be able to reset the short-term savings clock and will have cash to cover a random auto repair. (Will reimburse the checkbook.) I was already planning to use this last few hundred dollars to reimburse MM(19), mostly for groceries. All these cash expenses are just throwing me off. But it will work out if I just reimburse the checkbook, and then will have the cash to reimburse MM(19) what I owe him. Having two ~$300 cash expenses to sort out is incredibly rare.

It took me a minute to figure out why 401K/match was so high. The flip side of the coin is that I will only receive one paycheck in January. (I received 3 paychecks in December. January 1 paycheck was paid a couple of days early.)

I received two refunds from the college. Finally. (That only took 5 months for the State and the college to sort out.) That said, the State of CA is being very slow to pay us our inflation relief check. So now that is dragging on. (At this point it's clearly lost/stolen, but I can not request a replacement check for another week.)

I Bond interest will bump up in future months. I have $10K cash set aside. Have just been waiting for January so that I can add this last $10K to the I Bonds. I also have some 2022 I Bonds that are bumping up to a higher rate soon. So these I Bond interest numbers will continue to increase. I will get the $10K cash moved over ASAP so that I can get interest for the full year. But I will take my time pondering if I want to do more. For another $10K or $20K, I might wait closer to the last minute and see what the new interest rate will be. (I'd park some of the kids' gifted college money in I Bonds. This is the only reason I have so much cash for I Bonds, in the first place. Just piling all this college cash into the I Bonds.)

January is also done for us, financially. Paid bills January 1, and all paychecks have been received for January. Will end the month up ~$2,700.

Posted in

Just Thinking,

Budgeting & Goals,

Investing,

Credit Card & Bank Rewards,

Electric Vehicle (EV)

|

0 Comments »

January 22nd, 2023 at 05:04 pm

MH's parents told him last month that they are going to buy an EV in 2023. They are eyeing the Bolt, same car we have.

They've probably never spent more than $15K on a car. They prefer to buy new and will probably end up in the $25K range.

I am 1000% in the "they should splurge and get what they want" head space and am happy to see them buying something a little nicer than they usually would. But... I don't see the point in going new for a Bolt. They replaced all the batteries with the recall. So the barely used ones will have just as long warranties as the new ones. There's no improvement in range, charging speed, in anything. It's the same car. If anything, they are shipping them without features because of the chip shortage. All the more reason to just buy used.

Anyway, they told MH that they would want his help buying the car.

Shortly after that, the IRS announced that they are still sorting through new EV tax credit rules and that in the meantime, the Bolt gets the full $7,500 credit. For a few months, while they sort out all the new rules. We told the in-laws and they wanted to go car shopping January 1, given this new development.

Since then, they've been wishy washy. MH and I pounce on a deal when we car shop, so we were ready to pounce (and was doing homework the last week of December). This apparently freaked out the in-laws and they changed their mind. They've since been wishy washy, with everything financial. To the point maybe we should discourage them and they need to just take some more time before making any big financial decisions. But I guess MH was with his parents yesterday and they said they are ready now. So he may make the trip again next weekend, to help them buy a car.

It will be a really nice perk for us, when we can just charge at their house. I suppose some of the last minute change of mind is they just talked to someone with a Bolt who said they can charge 30 miles overnight without a fast charger. If they can just plug into a regular outlet in the interim, they are feeling more confident about it. They have an older house and it will take some time and money to get a Level 2 charger installed.

{They think they are only going to drive this car around town. 🙄 They have *no idea*. I know they need time to warm up to it and get used to it but they aren't making any sense. They should be able to make the roundtrip to our house without any stops. Getting free electricity at our house would just be gravy. When they visit the grandkids at college, they can just charge overnight at a hotel. Or while they stop for a meal. It would never make any sense to take their loud and 'expensive to fuel' gas cars. I expect that they will realize this quickly, once they have the car.}

When we were talking about the January 1 buy date, I told MH I thought they should get the ball rolling. I'd expect a stampede on January 1.

But... I forget we live in California and the rest of the country is weird. 😁 I swear, just about everything is different. Have been seeing in my Bolt group people complaing about it taking months to get cars. & how some were taking advantage of car sales year-end quotas and being able to haggle, while taking delivery in 2023 (and getting tax credit) because it takes time.