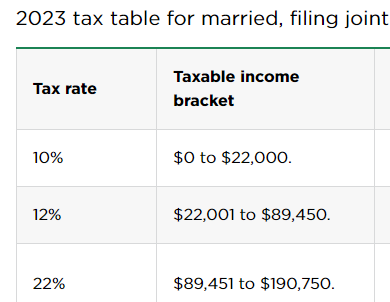

I was so pleasantly surprised how low overall our taxes were last year (with MH working full year, with my raise and bonus, etc.) that I never noticed that we had graduated out of the 12% tax rate. 😵 Which also means... No more 0% tax on investments.

Which means... I need some time wrap my brain around that and actually think about taxes when it comes to investments. We've been spoiled for so long.

I went back and looked more closely because I thought maybe it was just the investments (I sold a lot of investments last year). In the end, taxable income was $89K and that only included about $3K of investment income. The rest is pretty simple. Mostly just salaries and the standard deduction. (Though we will obviously have a lot more bank interest in 2023.) With our (more than 3%) raises this year, we are clearly in a new tax bracket. 22%.

It's going to get nasty with the I Bonds. Tax-free if used for "college tuition". Not going to be tax-free re: our very low tuition costs. So that's one more tax thing I will have to think about and plan around. I had wanted to use the I Bond money for college rent. But it might make the most sense to just consider the I Bonds our emergency fund, so that we can then tap more accessible cash (without any tax consequences).

I will also have to reconsider utilizing my work 401K. If we are really close re: hitting the next tax bracket and losing 0%-tax investment space. It might be worth throwing a few thousand dollars into a 401K if it gets us back to tax-free investments. Will just have to see how the year shakes out.

Another note to self:

First ~$13K of earned income is tax-free for the kids. Have been having them claim exempt. In the end, MM(19) made $6,000 in 2022. What I didn't think about was that only $5,200 of CA wages are exempt (single standard deduction). MM(19) ended up owing $3 to California. I suppose he can continue to claim exempt for Federal. (Can do so if prior year and current year are both $0 tax years). But technically is no longer able to claim exempt (California) because he paid $3 tax for 2022. Will have to keep an eye on that. DL(17) is more likely to just work something like 15 hours per week year round, so he will probably start piling up the dough pretty quickly. Will have to have him submit a separate California W4.

I appreciated that we realized this without a big tax bill to pay!

April 18th, 2023 at 01:40 am 1681782003

April 18th, 2023 at 01:53 pm 1681826005

April 18th, 2023 at 11:14 pm 1681859684

April 19th, 2023 at 11:11 am 1681902672

April 19th, 2023 at 03:14 pm 1681917294