|

|

|

January 5th, 2024 at 03:02 pm

We are back from our New Year's trip to Pasadena.

The trip was mixed. MM(20) was too busy and basically only had five minutes for us. We had brought him some stuff from home, and so we met him at his hotel, just as he was taking off. He did invited us to lunch with him and the group of students he was driving back to the college, but some of them had COVID and others were sick with whatever else. We declined lunch with the sick people.

We didn't do the parade, but we went to the float showcase afterwards. The downside is that for the most part there weren't any animations (the float operators were long gone). But we did see one of the floats operating. The plus side is you can get up so close and see the floats from all sides.

I have lots of pictures to share, but will just start with a few.

MH and I had a nice dinner in a pub on New Year's eve. We had found a free charger for the car and so just took our time. As we thought ahead to the New Year, all I could figure was that it's going to suck. That's my take on 2024. Mostly thinking to health issues of various loved ones. 😔

I can see the theme is that it will be a challenging year on the health front. This is the most obvious. But I also think it's going to be a crazy bucket list year. Some mix of low lows and high highs, probably. The Pasadena New Year's thing was a magical 'once in a lifetime' way to start out the year. Next month MH should be getting his movie made. Those are the biggies. But if we have any time and money left after that, we had been planning to make it to the Grand Canyon this year. I think it's ridiculous we still have not made that work after 2013 canceled trip. & it may very likely get pushed to the side *again*.

On the challenging side... GMIL's health is starting to slide. Both our parents with cognitive decline seem to be worsening significanly in recent months. & I am probably the most beside myself about the girlfriend. She's so young. It sounds pretty unlikely that she can return to school this month. The pandemic really slowed down our parents' cognitive declines. So I have been bracing myself for some obviously rougher years, but I think this is it. 2024 is obviously going to be rough. My BIL is also still battling some mystery illness.

Posted in

Just Thinking,

Picture Project,

Vacation Lifestyle

|

1 Comments »

December 23rd, 2023 at 04:42 pm

Our net worth was up $75K for the year, last I looked. Anything can happen... I only track/document on the last day of every year, so will see where we end up.

I delight in these years when spending seems a little crazy but net worth surges ahead anyway. We've probably had more years like this since our investment gains have outpaced our contributions. Once we hit that tipping point.

Looking closer, it is just retirement fund gains. Everything else has been pretty stagnant. Retirement is up $75K. We contributed $25K and the gains were $50K.

Otherwise, didn't make much progress re: massive expenses this year.

Posted in

Just Thinking,

Financial Independence by 50

|

1 Comments »

December 18th, 2023 at 12:37 am

**Retirement balance is back up to $500K+, or where it was 2 years prior.

New retirement goal is still on pause. Should probably circle back now that we have college sorted out. Still feeling somewhat "meh" about it re: too many future unknowns.

**I noticed last week that our net worth was up $60K for the year. This was before stock market spike this week. (Now up $70K). ~$50K is my general goal and I am happy with where we are at, but very much at the whim of the stock market. Will see how it all lands on 12/31.

Edited to add: I just noticed that our net worth today is at the same place it was end of 2021.

**We paid a large chunk to the mortgage down end of 2022 and I knew we were cutting it a little close on cash. After that, it was a crazy expensive year! Had a lot of home repairs and car repairs, in addition to funding MH's movie, etc.

I just calculated and I kid you not I have exactly a 6 month emergency fund left at 12/31. What??? How the heck did that happen? I am estimating MH's income for the month (will all go to savings), but looks like we will squeak by.

I was wise to give up on investing MH's income. I think I invested $0 of his income in 2024, after setting a goal to invest everything above $1K per month?

We actually have a little bit of cash buffer. DL's college owes me $2,000. So technically we have $2K cash in addition to emergency reserves.

**I did ask for a bigger raise and received a bigger raise. Was going to be a 3% COLA raise year. After bumping my pay up 20% from prior job, I would not expect anything more in the future. (Topped out very early on at prior job and came in 'at the top' to this job.) But... Had a crazy health insurance increase year. A 12% increase this year. Have certainly had many years of worse % increases, but our health insurance is so high the dollar amount is insane. In the "it never hurts to ask" vein, I got 6% just for asking. (I most definitely played up the '2 in college' thing also, when I asked.)

I probably won't work out 2024 goals until January. A big chunk of the raise will be going to taxes. Taxes and health insurance. So I need to dial in taxes before I work on the budget. I have in mind what I am hoping to work out, after taxes. Hopefully I can add $100/month to short term savings. I will have to decrease investments (re: losing temp ortho tax break).

I am hitting a crazy tax cliff and it could all go to taxes. I might err on putting my bonus to 401K next year. Things to figure out...

If I do lower investment goal (from my salary) then I may commit some of MH's income to taxable investments. But I might wait and see how the movie stuff sorts out first. Expecting it to be a big travel year re: movie production and film festivals. At least the weeks he is planning to go to Ohio, that will be early in the year. We can see how we are feeling re: cash after that and what else pops up. & of course, we can always pull money from investments if I over-invest. But my preference is to view investments as "untouchable." In addition to it just being silly to invest money that we need in 2024. But if I can't hit X dollars with my salary (because of taxes) then I will commit some portion of MH's income to investments. Probably even just $100/month would make me happy.

**DL(18) had his last final on Thursday. We are both in disbelief that he's aready done with his first college semester. It was over in a blink. I expected a more rough adjustment for DL, but it's all gone as well as could be. & he's more of the personality of my relatives who didn't attend college, so I don't have any expectations. As of right now, I think he might actually do this college thing? I just wasn't so sure before, but he seems very happy. He'd also admit this semester was over in a blink so he can probably suck it up for 4 years.

**MM(20) is off working 24/7 on the Rose parade float in LA. He refused to fly down for Christmas and wants to spend days on the road. 🙄 That gives him one day? to be home? I think he's aiming to be home for 2 days. Then he's going off camping (after New Years) and won't come home again during the winter break. Or more of what I expected during these college years. One nice thing about not having campus housing is he can go back on his own time, and is probably a lot of why he doesn't have to come home.

I don't know how the girlfriend is doing. Will hear more during Christmas break. Talked to MM last weekend and she seemed to be doing better. Clearly he isn't that concerned.

Posted in

Just Thinking,

Work

|

0 Comments »

December 14th, 2023 at 02:19 pm

Bonus ended up being smaller than last year. No complaints. I received OT (paid out as a lump sum every year) at my last job. Was usually $5K+. Have settled into $5K+ annual bonus at current job too. (Usually $5K but sometimes higher.) The nice thing is that I don't have to work any OT but still continue to get a lump sum annually. I like the end of the year bonus re: taxes. For now, my tax withholding is mostly non-existent and I use the bonus to settle up my taxes for the year (re: unpredictable bonus and MH's income, etc.). But in the future when I don't have dependents and taxes are significantly higher, any bonus over-withholding will be refunded quickly when we file our taxes.

I came up with owing $1,300 tax, when revising tax projections for the year. Which means we probably did a good job estimating taxes, and this is what I was left owing on the bonus. (I think only $300 would have been taken out otherwise, if I didn't adjust. Like I said, my tax withholding is mostly non-existent.) After taxes and 401K (minimum for match) I was left with $3,000 net.

We usually never spend windfalls or bonuses. I don't like the rule of thumb to spend X percent. I don't need to spend money just because I receive it. Historically we always throw at the mortgage, savings, etc. But of course, doesn't mean we never splurge and enjoy. We just like to divorce the unexpected money rolling in from the decision to spend it. If the cash is piling up then we think about spending it.

But this year I spent money. I counted my eggs before they hatched. Was expecting some birthday/christmas money in addition. I bought a luxurious winter jacket (love it!) and some clothes and shoes and a new electric skillet. I don't know what else we bought (off the top of my head) but I put $570 of my bonus towards spending. These were mostly November purchases.

Not necessarily a good thing. I think at the end of the day I just felt too pushed to the side re: MH's movie and paying for college x2, etc., etc. I over compensated in November (by going a little crazy on the spending), but all the extra money worked out and all is well. & I have to admit I enjoyed it. The prior year we paid a big chunk to the mortgage. The year before that my entire bonus went to MM(20)'s wisdom teeth surgery. I expect this magnified my feelings and I was delighted to do something a little more fun with some of the bonus money this year.

The rest of my bonus went to planned mortgage paydown of $2,430. This payment shaved off 4 months and will save $1,145 interest.

Need to come up with average of $1,500 per year to pay off mortgage in 30 years. Still have another 18 months to shave off.

My primary goal is to reduce mortgage principal by $10K every year (going forward), but my secondary goal is to not have a mortgage (on this house) for longer than 30 years.

I have other stretch goals in mind. We had a mortgage on our first home for 2 years and so eventually I'd like to knock down another 2 years off and not have a mortgage at all for more than 30 years. & of course, we'd really just like to knock the mortgage out once the kids are done with college.

While I have two kids in college, the goal is just the extra ~$1,500 per year to continue to pay down the balance by $10K every year. (I think technically we need to come up with $2,000 next year but then only $1,500 the year after that. The amount is dropping down rapidly).

Current mortgage balance: $89,999 🎉🎈

Posted in

Just Thinking,

Home Ownership

|

4 Comments »

December 9th, 2023 at 03:11 am

MOVIES:

--------

$100 Fandango

$ 20 Regal

RESTAURANTS:

------------

$50 Cracker Barrel (small balance left)

$25 IHOP

$50 Seasons 52

$ 25 x 1 Jamba Juice (small balance left)

$ 15 x 1 Jamba Juice

$ 10 x 1 Jamba Juice

RETAIL:

---------

REGIFT:

---------

$25 Dutch Bros

$25 Door Dash

$10 Starbucks

Note: Edited over time to remove used gift cards. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I had a big gift card haul at work Holiday party.

Pretty much everything is new (from work), except for the cards with the small balance left.

I am going to regift the Dutch Bros gift card to DL(18) for Christmas. He's the only coffee drinker in my family.

Door dash is just not our thing. We very rarely eat out and we don't do food delivery at all. In addition to that, Door Dash costs $$$$$$$. (Seriously, just paid $14 for a pizza I usually pay $8 for. I did a double take when my work ordered pizza for lunch on Friday, from a place I frequent personally. The extra $6 was before the Door Dash fees and tip. We could have walked to pick up the pizza, it was ridiculous.) Like the coffee, it's just going to always be a regift thing. I will give the Door Dash gift card to my employee.

Edited to add: I received a Starbucks gift card later and gifted it to my other employee.

Posted in

Just Thinking,

Credit Card & Bank Rewards

|

0 Comments »

December 3rd, 2023 at 05:52 pm

Yes, the state wants to give us $11,000 for college this year. MM(20)'s fall quarter refund finally showed up. I wanted to pay his winter tuition that week, so the timing worked out perfectly.

I believe it now. It's real.

Here's an update of MM's expected college costs, with the 5th year. He did officially get his double major approved and so 5 years is the plan.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$10,000 5th Year Tuition/Fees

-10,000 Tax credits

-13,000 CA middle class grants

- 6,000 Scholarship

---------

$23,000 Net cost

**I added in MM's $1K summer school class

Of course, nothing is easy. *sigh*

The girlfriend is still very ill. I just looked back at texts and it's been 6 weeks since MM(20) first took her to the hospital and she was hospitalized. She's been in and out of the hospital this whole time and they don't know what is wrong with her. This became more apparent during Thanksgiving week when MM(20) was home and he filled us in more on what was going on (and he was probably more in the loop; the girlfriend has moved back home in our city for the meantime). I presumed she was on the upswing but I texted her about something or the other yesterday and she told me she was having a bad day and was being put on heart meds. Very short term, I am sure that they are starting to wonder if she can feasibly go back to school in January. Longer term, lord knows. 😟

Posted in

Just Thinking,

College

|

3 Comments »

November 29th, 2023 at 04:07 am

Can you login now?

My login/SA problems are all fixed now.

Posted in

Just Thinking

|

1 Comments »

November 12th, 2023 at 05:56 pm

We picked up Hulu as a cable replacement when we cut the cable cord in 2012.

It was a nice alternative because at the time Hulu had current shows and we paid the premium for no commercials. We were paying $8.55/month.

For the most part, money is no object when it comes to streaming services. It's MH's thing. It's the one thing he will want to spend money on (TV and movies). But on the flip side of the coin, we have always been wary of signing up for contracts, we limit ongoing monthly costs of any kind, etc.

I probably just presumed if MH was paying for something, that he was using it. But I mentioned to him that I noticed that Hulu just jumped up from $14.99/month to $17.99/month. In the "If you're cool with it" vein... It still beats cable. But just wanted to be sure he was aware.

MH's response: "Oh yeah, I got an email about that. We should probably re-evaluate what we have and what we are using."

The cost was enough to get his attention. I told MH, "I don't think I am watching anything on Hulu." We went through and there wasn't anything I personally would want to keep track of. Most of the shows I had been more into, they wrapped up and had their series finale in the last year or so.

We quickly decided that we just weren't using Hulu and that the price was steep even if there was just one or two shows we would be into. So MH 'paused' the subscription for 12 weeks. That was the longest he could pause it. Our overall plan is to maybe pause Hulu for 6 months and then pause Netflix for 6 months. But if it was just me, I could probably do without Hulu.

I put it on my calendar. We will evaluate in another 12 weeks. I expect we will just pause Hulu again.

Netflix, we pretty much always had. It replaced Blockbuster at some point (we were mailed rentals, in the old days). I never coded this as a 'cable' expense because it was an entertainment expense that MH had always paid for.

I do watch a lot of stuff on Netflix and want to just keep it. But I am totally fine with the 6 months on and 6 months off plan. The shows will still be there.

MH bought a 1-year Peacock deal at some point. I mentioned it to him when it renewed. Wasn't sure if anyone was really using it, at the time. I think it just fell off his radar. But as we hashed it out this week, I decided I've actually been using Peacock a fair amount. It only comes out to $5/month. I think we should keep it.

I guess the only other streaming service we are paying for is Shudder. It's $5.99/month. I have been coding that to MH's allowance. I didn't realize it was a monthly subscription thing. I just moved it over to 'Cable TV', now that I realize. He's pondering starting and stopping that too, periodically.

For reference, old cable was $100/month.

I guess technically we are only paying $10.99/month now. For Shudder & Peacock.

Still have Netflix, but that literally had replaced our movie rental service. In the old old days, we had both cable and movie rentals. But if you want to split hairs, that's another $20/month.

So I look it up, for the apples to apples. We used to pay $30/month for both Blockbuster and Netflix. I don't remember why. Maybe like current streaming days, they had different offerings? Did we stream Netflix before we left cable?

Okay, so old cable and video rentals was $130/month.

Today, all the streaming costs $30/month. Which was how much it cost 12 years ago when we first cut cable.

Happy to say that it hasn't gotten all wild and out of control. I doubt we've had any discussions about this in a very long time. It looks like we just got lax about Hulu, and probably both presumed the other was using it.

Edited to add: We've always paid for the premium Netflix so that the kids could log in, so that we could log in when we travel or when we visit our parents, so that everyone in my household can stream at the same time, etc. If they get weird and stingy about that, we are happy to drop down our subscription to a cheaper offering. So far, it hasn't been an issue.

Second edit: MH corrected me and said we were paying more for Netflix? for the 4K streaming. I am sure there was an element of using all over the place. But the primary draw for choosing more expensive streaming was the video quality.

Posted in

Just Thinking

|

4 Comments »

November 12th, 2023 at 03:50 pm

The last few weeks have been crazy.

Thankfully, there has been some good crazy! It's a nice change. A mix of good and bad. It beats just constant bad news.

The worst news is that MM(20)'s girlfriend has been very ill and she dropped out for the rest of this quarter. The quarters go so fast and missing 2-3 weeks was just too much for her to catch up. I feel so bad for her parents. They've been going through this with her sister the last 2 years. So when the GF ended up in the ER (out of network) I thought, "I guess they know the drill." Been there and done that. I expect this is also why she quickly decided to drop her classes. It was an easier decision, being already familiar with the logistics.

The really good news is that MH's movie funded! Woohoo!

But I suppose this means I am just signing up for more CRAZY! Lord knows what we have gotten ourselves into.

This is just the best and the worst news. Other things off the top of my head...

There was a brush fire (arson) just blocks from MM(20)'s apartment. This was a few days after the GF left, so that was a dramatic week.

Everyone at work has been sick, and so I have been covering for everyone (per usual). But I suppose this time it was all the departments and everyone was sick. That was a little extra. (It's been a bad sick year, in general.) My employees are *always* sick or out with some personal drama. I still have no idea what it's like to have well employees that show up for work. Stress apparently works well for me because I've never been healthier. But I am vaccinated and I don't have small kids at home. To be fair, I was much more sickly when I had younger kids. (I work in a young office, most have young kids.) As I type this out, lord knows what DL(18) will be bringing home from the college.

We had a large bank fraud at work. Due to several factors, the bank refunded us six figures after 2 days. Phew! (It sounds most likely it was post office fraud. Very similar to when one of my clients had a check washing fraud incident about 15 years ago.)

On the plus side, I did have my 5-Year work anniversary dinner. My employer and his wife took out both MH and I. It was probably the best and most expensive meal I have ever had. Giving me a taste for the finer things in life.

Posted in

Just Thinking

|

0 Comments »

November 6th, 2023 at 02:19 pm

Received $98 bank interest

Received $208 I Bond interest

Snowflakes to Investments:

--Redeemed $40 credit card rewards (cash back) from our grocery card

--Redeemed $128 cash back on Citi card

--Redeemed $10 cash back on dining out/gas card

Other Snowflakes to Investments:

+ $8 Savings from Target Red Card (grocery purchases)

TOTAL: $186 Snowflakes to Investments

401k Contributions/Match:

+$1,035

Snowball to Savings/Investments:

+$1,300 MH Income

Savings (from my paycheck):

+$ 450 to investments

+$1,000 to cash (mid-term savings)

Pulled from mid-term savings:

-$2,000 Investment in MH movie project

-$ 505 Medical Bills (DL ER)

-$ 657 LA Hotel (re: movie project fundraising)

-$ 400 Tucson Airfare

-$ 265 College Travel

-$ 107 DL College Expenses

Short-Term Savings (for non-monthly expenses within the year):

+$1,500 to cash

-$ 952 Auto Insurance

-$ 78 Pest Control

TOTAL: $813 Deposited to Cash & Investments

Note: Also pulled $850 November rent from 'college savings'

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Hybrid Miles Driven: 762

Electric (EV) Miles Driven: 1,534

Note: 150 Free EV miles this month re: college trip and parking downtown

We drove the EV 735 miles re: college town trip & MH met up with a friend in the Bay Area. That's all I remember off the top of my head, but was probably about 1,000 of the EV miles.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note: I am always lagging a month behind because any bills charged in September will be paid off October 1 and reflected in my October numbers. I charge in one month and the next month I figure out how to pay for everything (if I need to pull anything from savings). So this update reflects September spending & October savings.

Interest is going to start dropping down significantly. Bank interest is down re: lots of expenses (and more to come). I Bond interest will drop significantly after November. The mega interest is expiring on those bonds.

Movie project update: It funded! Woohoo! We put in $2,000 towards the end of the campaign but then it was extended for 30? days? Because it was a Horror movie and Halloween and all that. Not planned at all, so that was a nice surprise. By the skin of our teeth... As of right now, it's raised about $2K more than the minimum. So our $2K was completely unnecessary? But it's nice to whole thing won't get canceled if someone cancels their $500 or $1,000 contribution or whatever. The buffer is nice.

Most definitely have not ruled out contributing more. But I am relieved that at least that can wait for December windfalls to sort out. (Including college financial aid, which is again delayed to December.) In the short run, our obvious financial contribution will be travel expenses early next year, re: filming of movie in another state. That's what we need to plan and save for. & MH was just telling me he expects a lot more travel next year, re: this movie.

But it's nice that we aren't scrambling to do a bigger contribution right now.

Edited to add: I think it might be happening? Saw that both schools are disbursing state grants this week? Fingers crossed! Still in 'will believe it when I see it' mode. I'd just be happy if financial aid gets sorted out before I start paying for the next quarter/semester. In both cases, should owe nothing for the next quarter/semester. If financial aid is applied to the next quarter/semester and we received refunds from the first quarter/semester.

Second edit: The $7,000 state grant is showing up in MM(20)'s financial aid today. I mean, at his college. I will still believe it when I see it. But that's a pretty good indication that the school has received updated numbers. I had already heard that people were receiving refunds. Hoping his shows up in the next couple of days. Though really I just need it to show up Wednesday. He told me he is registering for classes Wednesday. So I could literally apply the refund to his tuition on Wednesday. Will put the remainder back in his college fund.

Posted in

Just Thinking,

Budgeting & Goals,

Investing,

Credit Card & Bank Rewards

|

0 Comments »

October 30th, 2023 at 02:26 pm

I presumed that we'd hit our 6% grocery reward cap about now. Usually we switch to another credit card the last quarter of the year. But apparently our grocery spending is down. That is probably because MM(20) was gone most of the summer and DL(18) was paid for room/board at his summer job.

I am just wrapping up the month and noticed that we got a full 6% last weekend, on grocery run. Doing the math, and it looks like we can probably squeeze out one more grocery run at 6%. Have about $150 left to earn 6% cash back.

After that, will switch to another card that gives us 3% back on groceries.

Posted in

Just Thinking,

Credit Card & Bank Rewards

|

1 Comments »

October 24th, 2023 at 02:48 pm

Received $111 bank interest

Received $240 I Bond interest

Snowflakes to Investments:

--Redeemed $40 credit card rewards (cash back) from our grocery card

--Redeemed $138 cash back on Citi card

--Redeemed $26 cash back on dining out/gas card

Other Snowflakes to Investments:

+ $16 Savings from Target Red Card (grocery purchases usually, plus college apartment purchases this month)

TOTAL: $0 Snowflakes to Investments

Note: Was a high snowflake month re: big spending, but I also chose to skip putting all these snowflakes to investments. I usually skip one month per year. There's always some month that's just too crazy and could use the extra cash.

401k Contributions/Match:

+$905

Snowball to Savings/Investments:

+$550 MH Income

Savings (from my paycheck):

+$ 450 to investments

+$1,000 to cash (mid-term savings)

Pulled from mid-term savings:

-$1,200 Vacation Expenses (LA/Central Coast)

-$1,050 Hybrid Tires & new door handle kids' car

-$ 185 DL College Expenses (parking)

Short-Term Savings (for non-monthly expenses within the year):

+$1,500 to cash

-$ 450 Dentist (x3)

TOTAL: $1,520 Deposited to Cash & Investments

Note: Also pulled $850 October rent from 'college savings' and $500 (new mattress) from 'college savings'.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Hybrid Miles Driven: 1,411 (811 electric + 600 gas miles)

Electric (EV) Miles Driven: 1,131

Note: I decided it was useful to track total miles driven in my blog. I expect to just track total miles driven, for my own personal records. Will eventually get recorded in my financial software and this number will help me to calculate fuel costs.

I don't expect much commentary in the future, but it was a very high miles month. I did drive the hybrid 600 miles re: MM(20) college drop off. We chose the faster gas option for the quick one-day trip. We drove the EV To LA in August and MH drove to the Bay Area 3? times in September. So we also figured we'd give the EV a break and put some miles on my car.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note: I am always lagging a month behind because any bills charged in August will be paid off September 1 and reflected in my September numbers. I charge in one month and the next month I figure out how to pay for everything (if I need to pull anything from savings). So this update reflects August spending & September savings.

I was so confused about that dining out/gas reward. I was sure it was a mistake or some mystery $10 had been added to the reward. But today I took the time to calculate and it was correct. Had a lot of vacation expenses on September statement that were August expenses I already paid. I was thinking, "How does $450 x 3% = $26?!"

Thankfully, MH is back at work.

It was an extremely spendy months (details that will sort out in my October update). Ugh.

Not feeling confident re: sidebar savings goal. Spending more than we are saving, re: mid-term expenses (the last couple of months). I am not deducting any college expenses re: this goal (in my sidebar). The point of this goal is to cover college expenses. So if I save $10K this year and spend $10K on college expenses, I'd consider that a goal met. What's interesting is I got DL's college expenses dialed in ($1,500 per year) and am just pulling MM's college expenses from other savings/investment buckets. But I will continue to keep this $10K goal. There's the 'crap happens' factor. Still saving up for MM's next round of ortho and surgery. Still saving up for the college stuff that isn't nailed down yet. & feeling behind on home maintenance reserves, while all this money is earmarked for college. Oh yeah, and medical bills. That is the other reason we need to save so much cash. Always the medical bills.

August was *very* spendy re: college bills. (Paid ahead because financial aid hasn't sorted out yet. Meaning that I am expecting substantial refunds that should cover next semester/quarter.) I accidentally deleted my August summary and so I don't know if I will circle back to it. Life would have to slow down a bit. & unfortunately it was a monster update. This month was kind of ho hum, but things seemed to have taken a turn for the crazy re: September spending (that will sort out in October).

I wrote the 'not feeling confident about sidebar goal' comment at the beginning of September when I already had 90% of this information and started this pot. (I just wait for credit card rewards and MH's income to sort out, to finalize monthly summaries. I pay the bills the first of every month so have everything else nailed down at the beginning of every month.) MH hadn't had a paycheck in months and I was feeling the stress in that. Things have taken a turn and I expect we will be spending down savings more aggressively than planned, this year. But it all feels a little *shrugs* now that MH is back at work and we have extra money coming in. 30 days later I am probably thinking, "Oh, we are going to be spending the money!" I probably entirely give up on sidebar goal at this point. But I definitely feel more *shrugs* about it while MH has some good income months on the horizon.

Posted in

Just Thinking,

Budgeting & Goals,

Investing,

Credit Card & Bank Rewards

|

0 Comments »

October 23rd, 2023 at 03:49 pm

Just wanted to update that it looks like MH's movie will be funded!

🤯

I feel like this is just the first battle in a very long war.

They reached 90% yesterday. We have been willing to contribute the last $5K and talked about it a long time ago. If $5K is the difference between grabbing hold of this opportunity and getting this movie made... The difference between that and giving up. It's a no brainer. (Talking about less than 0.5% of our assets, going to a risky investment.)

We hit 90% on Saturday. & then someone donated $1,000 later that same day?

For now, I think we are mostly in the "in shock" phase.

There's another 10 days left on the crowd funding campaign. Will see if we even have to contribute anything at all. (MH has a few acquaintances who are very excited about the project and promising to contribute more than they already have. Everyone is also telling MH that they will get a surge at the end. Will see...)

If we squeak by without having to donate at this point, we will still probably talk about investing. Outside of the crowd funding, which we both prefer. Would not be subjected to all of the fees. Plus could invest versus doing a straight gift. Increasing our odds from 0% re: getting any of this money back. The odds might be low, but we like the 'better than 0%' odds.

(We are reaching the minimum crowd funding goal. The very bare minimum to get this done. The movie will need more money.)

Also, I'd much rather make this decision about how much we are willing to invest, in another couple of months. After year-end gifts and bonuses shake out. It would also be nice to know if the state of CA is really giving us $11,000 for college this year. (Have received $0, to-date.)

I do believe that if they hit their crowdfunding goal, that they will be able to leave the campaign up indefinitely. That will help as to reaching more than just the bare minimum.

Posted in

Just Thinking

|

5 Comments »

October 22nd, 2023 at 03:30 pm

DL(18) is my far more balanced child.

Of course, he wasn't spending anything at all re: summer camp job. Was just the nature of the job.

But then he came back home and started college. His first (college) credit card bill is a gnarly $400. I need to go through it with him and figure out what charges are for books. We want to cover college books and supplies (as long as he doesn't have a job and is just living at home). Can revisit if circumstances change. I think about $115 of this is books for school.

The rest:

$130 Car Gas

$ 85 Clothing

$ 35 Eating Out (Student Union)

$ 27 Haircut

I did end up buying him new running shoes, when his extreme cheapskate genetics had a moment. 🙄

Spending this month:

$133 Car Gas (will probably be one more fill up this credit card cycle)

$ 28 Meals Out

He planned a brunch with his new college friends. & last weekend he had some plans with his best high school friend. They did some kind of movie marathon and went out for coffee (to help stay awake). I know at other times he has been taking advantage of school amenities. When we go over that $400 bill and how much I owe him, will get a better sense if he's just eating meals in the student union or how much of that is paying for other services. I know he sometimes play pool between classes, stuff like that.

Reminds me, he got a free 'home cooked' meal at school one night and has done other free nights out. Like MM(20), doesn't mean he is sitting at home the rest of the time, just because he is not spending money.

He's been at college for 2 months? He just went to the college gym for the first time, last week. I am glad he is taking advantage of that perk. He loves going to the gym, in general. (Briefly joined a gym in early 2020, and then that went to heck. In the meantime, has just been making do at home. He mostly uses weights and a pull up bar. In addition to running and biking. But he is crazy fit. The gym will be really nice for him.)

I am shocked how much he is spending on gas. His commute is only 15 miles each way, but he's chosen to stick to the city streets and back roads. I presume that he's taking a massive hit on his mpg, not just taking the freeway.

It sounds like he is spending $1,600 just on gas, for his 9 months of commuting. Not counting summer driving or a work commute or anything beyond his college commute. I had to double check and triple check because that sounds so absurd. (My commute is 10 miles longer each way. His fuel costs 7x what I am paying for electric fuel.) Gas sticker shock.

The economics are very different re: the car-centric college choice.

Edited to add: I pinned DL(18) down. He said he had a few food purchases (just shows up as 'The Store @UU') but that a $6 charge was for scan trons. So I guess I owe him $121 (for college books and supplies). I revised #s above.

More eating out the first weeks of school. He's since switched to packing lunches. Which is interesting because he mostly refused to pack lunch during high school years. It's different I guess when your parents aren't paying for it. But I expect that 'having a lot more time to plan ahead' is also a factor.

Posted in

Just Thinking

|

0 Comments »

October 22nd, 2023 at 03:10 am

MM(20)'s mega I Bond interest expires the end of November. Will cash out and move to his high interest savings account. It used to be 'mega interest', but is below average these days. & the cap is $5K (on what used to be mega interest). I just put it on my calendar to have him open a high yield cash account when he is home for Thanksgiving break.

This reminds me, I've seen that Chevy is starting to release Bolts that they bought back during the recall. Put in new batteries and these cars have brand new 8-year warranties. They've been flooding the market, similar to how it was when we bought the car (we bought when they were coming off lease and flooding the market.) The pricing is similar, at $15,000. The kicker is that today there is a $4,000 used EV tax credit. This could be a $11,000 car purchase, plus tax on the larger sticker price. It's a little early and I know that it's more than MM(20) wants to spend. But I thought he might be enticed by the very inexpensive fuel (which would probably mostly be free.)

I wouldn't buy one of these cars before 2024, and we'd maybe miss the boat. Why 2024? Because dealerships will be able to advance the tax credit. So no more wondering if uncooperative dealerships are going to figure out their crap. $4K off the top or we walk. & also, the new rules will be much more lax. Many instances where you can take the credit up front and not have to pay back if you are not eligible. I'd have to do homework on that. There is a 20-page IRS FAQ that I have not looked at in any great detail. But I get the jist that all is this is going to be much easier and more favorable in 2024. I still expect dealerships to be uncooperative and mostly clueless. But the up front tax credit will be make or break the deal for the 20yo. Who most definitely does not want to spend $15K on a car.

I brought it up, but MM(20) told me he doesn't want a car next school year. That's news to me! The only thing of note that has changed is that he has a bike this year. He may be finding that is more than enough, for transportation.

The other big financial update is that MM(20) has committed to a 5th college year. He was a little wishy washy about his major and changed it a couple of times. Finally decided he just wants to double major. So that will take 5 years. There's some non-academic reasons also for him wanting to take 5 years.

I can very much relate. Very different reasons, but I also had several reasons I took 5 years to finish college. So I asked MM(20) early this calendar year if he thought he would finish in 4 years. I was surprised when he said yes. At that time we told him we had both taken 5 years to finish college. I am glad we had this discussion because I want him to do it right the first time. I think he felt like he had to finish in 4 years. & so he started considering this other major when he had more time (I think he'd need 4.5 years to switch?) & then after getting two major changes approved, he just got approval to just double major in both of those majors.

Of course, I think this would have been around when he would be deciding if he wanted to do a 5th year Masters program. (Another reason I didn't just presume he'd be done in 4 years). Some of this decision is that he doesn't want to do a Masters program at all. I am surprised, but makes it an easier sell. If he's really going to be done with all his schooling in 5 years, this is a pretty good deal.

The tuition part is easy. He's got just about enough cash left in his gifted college fund to cover Years 4 & 5 (when he won't be eligible for grants any longer; no tax credit that 5th year). This is exactly what the gifted college fund is for. To give him more options.

As to housing, I have no idea. It's years away and so we will keep saving. It could be that we expect him to contribute more during that 5th year. I just don't know how that will shake out. It also could likely be moot. I have two years of rent saved up for DL(18) already. It's how it's always been with my kids. MM(20) was the one who always wanted to do 2 or 3 extra-curriculars while DL(18) wanted to do zero. MM wanted to go on all the big trips while DL didn't want any part of that. MM wants to go to school 300 miles away. DL needs a slower transition into adulthood. It might just be the ying/yang it always is. I've always been able to afford all this for MM because his brother is uninterested. & so it might just be how college shakes out too. I've got rent money saved that DL(18) might not end up using.

In the meantime, I just keep saving for these college years.

Posted in

Just Thinking,

College

|

0 Comments »

October 22nd, 2023 at 12:10 am

It looks like most of our mega interest will expire the end of November.

We've accumulated $4,000 I Bond interest that will have to pay taxes on when we cash out. I was thinking that maybe I'd cash out half this year (December) and half next year (January). But that if taxes were already covered and no crazy tax cliffs, might be easier to just sell this year. But then I realized it's moot because I forgot about 1 year holding period for latest bond purchase. & the other one (mega interest) expires in January. So max I'd only want to cash out half in 2023 anyway.

I presumed the "tax free if used for college" part was useless (for our personal situation) and never dove much deeper than that. But I looked at the calculations today and yeah, that is not going to help us. All I could come up was ~$350 college expenses this year (for tuition; not covered by grants or applied to federal tax credits). Which would be the interest on my newest bond. That apparently I can't cash out until 1/1/24. But anyway, as I thought it might be, both the pricipal and the interest needs to be applied for college expenses. It's too high of a bar to make this tax-free on any meaningful level. If I sell half the bonds, then about 1.6% of the interest will be tax-free. (Because 1.6% of the proceeds will go to college expenses).

The only reason I have even that much in college expenses is because MM(20) took a $1,000 summer course.

I presumed we'd get these state grant refunds (for MM's first 2 junior quarters) when coming up with these numbers. Last I heard, we should get funds (for fall quarter) the end of next week? Not holding my breath. Still in "will believe it when I see it" mode and am in disbelief about the dollar amount. Until then, for all I know it was just a typo.

I was bummed that I Bond rates dropped so low because it was nice when it was just a separate bucket I didn't have to keep track of. But duh, I remembered I used to have all this money in cash at our brokerage. The brokerage is paying 5%+ on cash right now. Will just move the money back there. I just forgot that is where I had it before. No separate tracking to worry about, it will be in its own bucket.

While all this money has been tied up in I Bonds, I've just been tapping our cash reserves for MM(20)'s rent. Our cash reserves don't amount to much at this point. I will be reimbursing myself $6,000 (from I Bonds) to cover 2023 rent (July through January) and a $500 mattress purchase. It will be nice to use 'money saved a long time ago' to start paying for some of these expenses. The balance of this one bond (principal + mega interest) will cover MM's rent the rest of this school year. There will be some money left over. Especially if that money continues to earn 5%+ interest. I suppose the interest on this money (while it's 5%+) may cover utilities. I may be able to squeak by and have all his 2023-2024 housing covered under this one bond. This sounds like a miracle at this point, his housing was so up in the air just 6 months ago. But the interest was piling up so fast, I did decide to use some of this money for the mattress.

Edited to add: I suppose there is the benefit of state tax-free income re: I Bonds. Is not on my radar re: very low (progressive) tax rate.

Posted in

Just Thinking

|

0 Comments »

October 10th, 2023 at 02:14 am

Fingers crossed, but I think I am out of the medical loop. It's all been 'abundance of caution' that has never turned out to be anything. But I had my first mammogram (ever) that was all clear the first round. Phew! I am shocked. I was sure I'd have to go back this week. Because I always do.

It was crazy for a while in 2018-2019 with all the medical appointments. It has definitely been a step down from that. But it's nice to take it down a step further and have the "all clear" re: everything medical. I might have acheived this once in recent years but it did not last very long. Fingers crossed.

This weekend was perfect and magical. I really viewed it as more of a chore weekend, going into it. Mostly driving down to the college to deliver a few things to MM(20).

We drove 735 miles. The first car charge was free, but apparently it was just a fluke. We thought we were going to get free charging all weekend. (Electrify America is often free on Holiday weekends.)

We spent $234 on the hotel and tickets. I am guessing $400 with food and fuel and everything. Probably not quite that much. We didn't do any big meals. But I am guessing $400-ish for the weekend. Will tally it all up later.

It was fleet week and we saw some jets doing a show. Could see from the freeway on the drive down.

I guess with DL(18) having a driver license and being more independent. We are actually getting through some of these things we thought we would do while MM(20) was living on the central coast.

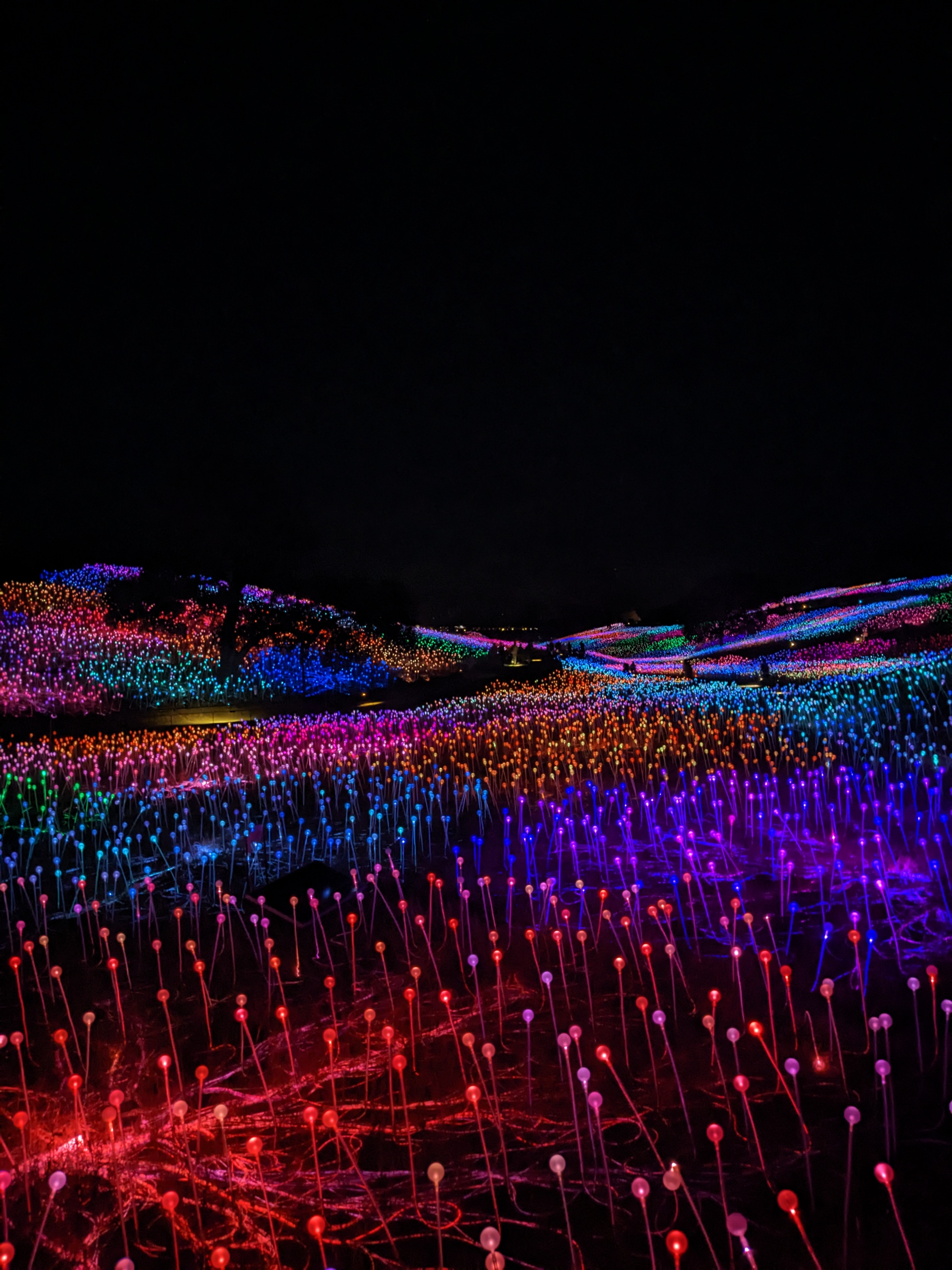

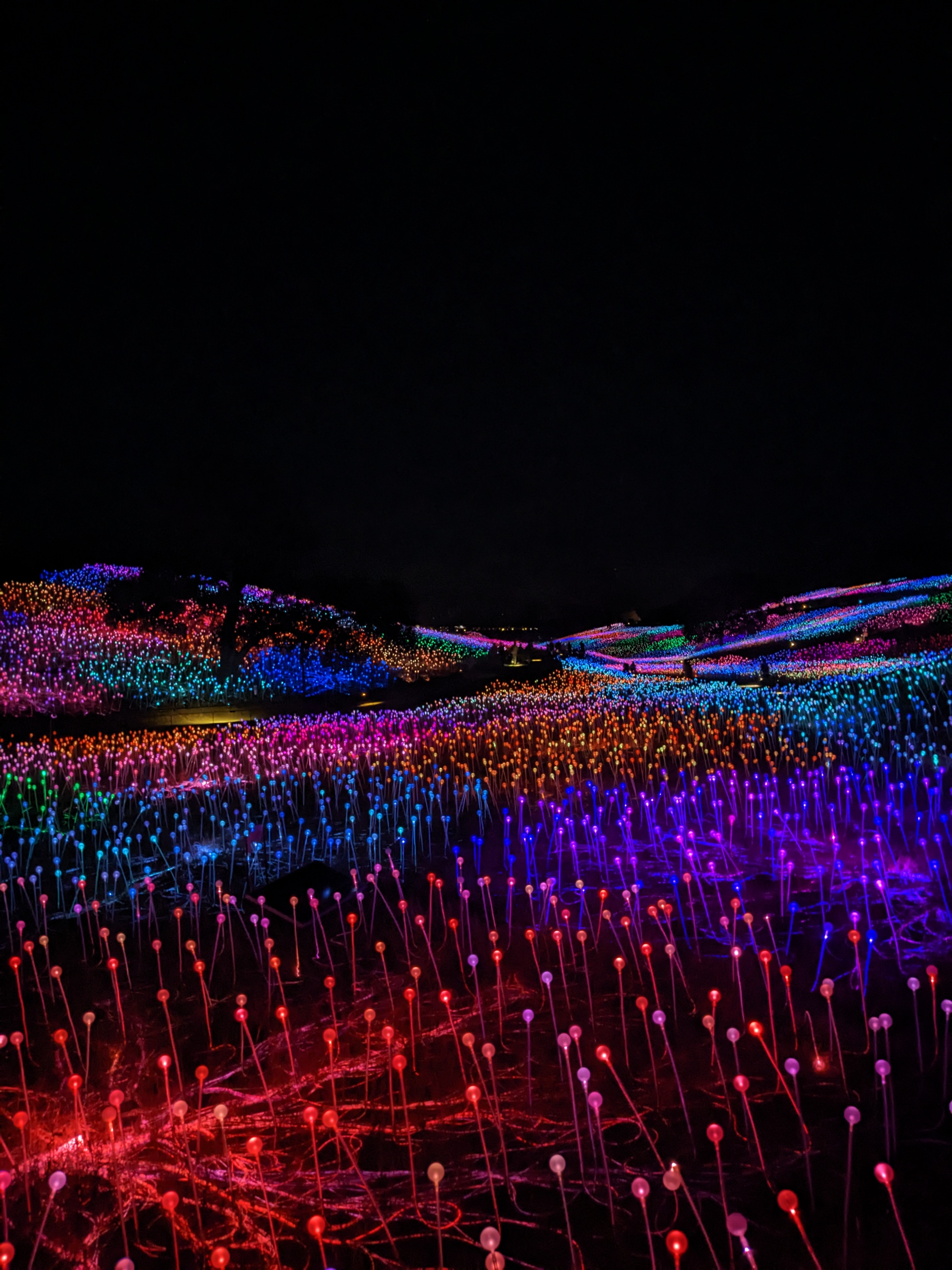

We went to this art installation. Wasn't sure if it was going to be over hyped or what. It was beautiful. & we picked the perfect day to go. The weather was absolutely perfect. The sky was so dark (no moon) that the stars were amazing. I saw a shooting star!

I thought it would be nice to get there before sunset. This ended up being perfect. It was gorgeous in the light too. We walked the property during (a great) sunset and then we went inside to eat dinner. Then we came out and walked more thoroughly through the lights. We stopped a couple of times just to sit and enjoy, the view and the stars.

The next morning we headed to the beach. There's still chatter of whales online, though clearly that all peaked the last time we were there. (It was a day trip, I didn't know until we left, and we wouldn't have had time anyway). So we tried, but no whales. But we did see lots of dolphins.

& we saw a very fast and good foil surfer. I mean, I could watch the surfers all day. But I barely noticed the surfers on this trip. The dolphins stole the show. & then MH and MM pointed out this foil surfer. Just google it, it's the craziest thing. It's hard to describe. Even most the videos I found were "meh" compared to the guy we were watching. He was just flying all over the place. It took us a while to figure out what the heck we were even seeing.

We took MM(20) with us to the beach and his girlfriend met us for lunch.

MM(20) has some leadership position re: the rose float this year. He was really eyeing these flowers at the restaurant. I guess he has been trying to track them down. So we learned a lot about that whole process. I guess the school grows a lot of the flowers. & I am sure they just have to buy some of what they need. But this particular flower is the perfect shade for what they need and more difficult to find. (Would take more than a season to grow). & I guess that dyeing flowers is frowned upon. The GF has these same flowers outside her on campus house, so they were in deep negotiations about how much MM could get away with "borrowing" flowers from her house.

Of course, the down side to this is I don't know when we will see MM(20) the rest of this year. I actually gave him a camping mattress when we initially thought his bed would arrive some nights after he moved into his apartment. It's only because of this that I know he has camping plans after New Years. 🙄 He mentioned it to me re: the camping mattress. We will have to get him a round trip flight from LA for Christmas (he will only have a couple of days off). & then I guess technically he should be free January 1st or 2nd? But if he goes camping, we aren't going to see him much.

I really need to buckle down and make Pasadena plans. I am very mellow about it because MM(20) stayed at the timeshare by Disneyland last year. That was rather last minute. I know we can find some lodging. & I am sure we have missed the boat as to anything very convenient. But I am committing to figuring things out this weekend. Ideally, we want to see all the floats before or after the parade. I just don't want to deal with the peak crowd. We briefly discussed and MM(20) insisted it's all free the night before, to see the floats up close. I am not 100% sure if that's true, if he has access we won't have, etc. But it's only $20 to go see all the floats afterwards. (I just figured this out). I will be buying tickets soon, to have that insurance.

Side note: MM(20) will have free lodging near Pasadena. Because he is staying and working until the parade, he will have free lodging. Last year he left early and just went back to watch the parade.

Other than that, I am exhausted and would be happy to go *nowhere* the rest of this year. But I have been really looking forward to the behind-the-scenes rose parade experience. Financially, will probably be a 2024 expense. Heck, even if I charge any of that in December, won't be paying for it until January. Definitely a 2024 expense. Except for these $20 tickets that I want to buy now.

Posted in

Just Thinking,

Picture Project,

Vacation Lifestyle

|

6 Comments »

September 27th, 2023 at 04:32 am

Our 'last minute reasonable college move-in hotel' from last year was not so reasonable this year. & we have stayed there a few times but I wasn't really excited about the hotel cost this September. It would have worked in a pinch (far more reasonable than anything else). But other than that... Meh.

MH keeps insisting this is a one-day trip and I keep insisting that we aren't 20 any more. I gave in for this one time and I mostly regret it.

All else being equal, would leave it at, "Well that sucked, but glad to save the money." But as we were driving home I saw in the college parent group that the whales were putting on quite a show at the beach where we usually stay at our forever hotel. Which is significant because we went on the most amazing whale watching (trip of a lifetime) some years ago and... I wouldn't know because I puked the entire time on the boat. So I am super bummed we didn't just spend that $200. I could have watched whales. From land!

Probably not as relevant, but then later (during the week?) I saw that the ocean was glowing with bioluminescence. I didn't even know that was a thing that far north. I later saw that it is also a Bay Area thing. Never heard of it when we lived there. I presume it's a little extra spectacular right now, and probably more common down south. But I don't know, this is what I presume based on pictures, social media chatter, and literally never hearing of this before.

As to the biolumiescence, they call it the red tide. Well that's going to the top of my bucket list. The pictures are magical.

Anyway, the week before move-in was chaos. MM(20) had disappeared the weekend prior, and then disappeared all day Monday. We cornered him Monday night and figured things out (whatever he needed to buy). It was more useful to ship things here and then move them in the car, but we were running out of time. We scrambled and we got it done. Move-in went as well as it could have. At least we didn't hit any traffic.

The short money summary: MM spent about $450 on the bed tax, bike supplies (lock, helmet), a microwave, a wifi router, and some misc, items. Used his $1K annual college gift, so has about $550 extra spending money for the rest of the year. MH and I chipped in $500 for a mattress. (If we didn't, he would have slept on the floor.) It seemed most prudent just to order from a furniture store and have that delivered, but then the mattress arrived several days early. As did several other things we shipped. But we got it all figured out, and it was nice his bed was already there when he moved in.

While MH was on the phone with the mattress store for what felt like hours... (While I bought up everything else). MH found out he got into the Tucson film festival. So he is going this weekend. & had to scramble to figure all that out too. The airfare was very reasonable (even though this ended up being very last minute) and so it was a no brainer. But all the hotels were booked up that weekend (don't know what else is going on) and the hotel ended up being quite expensive. We even tried to get a free timeshare stay but the place we stayed last time was booked up. So this is going to be a $1,000+ trip. But this was by far the best film festival we went to and I still think it was worth it. I am just relieved I didn't plan to go. Would have been another $400 for me to fly.

Then we started making plans to visit MM(20). Time to find another reasonable hotel that we can book last minute. Thinking maybe we could try something more "on the way" versus the "30 miles south" gem we found, that keeps raising their rates. Back to the drawing board. But I finally figured it out. They have a very nice Motel 6 near the college. It was $100+ cheaper than any other option, and it's in the college town (very convenient). We are also going to an art installation while we are there. Missed all the nature stuff so will go see the fake plastic stuff instead. All that came up to about $200 (hotel + excursion). We got a $300 cash gift for our anniversary (and because MIL felt bad about the Tucson timeshare). I wasn't necessarily planning to use that money for this trip, but it should cover most of our expenses.

Oh yeah, MM(20) left behind one piece of furniture (wouldn't fit with everything else) and forgot some minor things. I don't even know if he will want the furniture re: small apartment. But we just figured we'd do another trip and would be happy to go back on a less busy weekend. I believe we abandoned this plan last year due to Tucson.

It's nice to get to some of these things we thought we'd be able to do while MM(20) went to college in the area.

I was thinking the other day that we succeeded this year re: vacation lifestyle. It's my preference to do a lot of smaller trips and staycaytions, versus saving up big dollars for just one big trip. My personality just wants to spread it out. So I was pondering our success on this front in 2023 (after some years of failure on this front). And duh... DL(18) got his driver license. So we can go and do whatever the heck we want. That is the very obvious change that set things in motion. We certainly took advantage of this freedom this year. In the past, we probably just did more things with the kids. & some of these awkward in-between (kid) years just coincided with a lot of other crap.

Note: It's been a busy year and there's a lot I did not blog about. We did some big concert weeks (that I never said much about) and things like that.

Edited to add: Probably could have just done AirBnb in Tucson because it is a lower cost region. MH realized too late. (An Uber driver was telling him he had an inexpensive AirBnb. Which was my "duh" moment.) It's not top of mind because none of these vacation rentals have ever been reasonable in our state. Making a note so that maybe this jogs my memory in the future.

Posted in

Just Thinking,

Vacation Lifestyle

|

2 Comments »

September 27th, 2023 at 03:36 am

Nesting tapered off, presumably with the hot summer weather.

I then moved on to office nesting.

Side note: It's so funny different personalities. A woman in our office was upgraded to her own office about a year ago? She immediately threw a bajillion dollars on the company credit card and filled her office to the brim. Just looking at her office stresses me out. (Personally, she is in debt up to her eyeballs. Probably more than anyone I have known.) It's just fascinating to me how her entire being just screams spending money. Not in a luxury kind of way but just in an excess kind of way. There's been other instances where it has been extreme.

She's very nice. We just have polar opposite personalities, on this front.

In contrast, I just crossed my 5-year anniversary and I had never bought a single thing for my office. It's a little complicated. My prior job was more of an art museum for the owners and I was mostly forbidden from peronalizing. (So I had never accumulated any office belongings.) There's that, and there's also, "Who the heck has the time to go shopping?" Maybe especially my first year there. But for the most part... Who has time for that?

I ended up seeing an advertisement for a pretty sea scape canvas print. I had some Kohls gift cards left from end of last year. I usually ask for these gift cards to use to buy the kids shoes, stuff like that. I decided I no longer have these kinds of expenses and I have these gift cards just sitting here. So I bought myself the print. Once I had it, I decided it would probably work better in my empty office. I don't really have any where to put it, at home.

Then that nesting mode kicked in, and I just got it done. I have a couple of other larger prints arriving tomorrow. & then I shopped around for some fake plants.

I am digging this one Etsy shop so much, I might take some inspiration from my "lots of stuff" coworker. I could probably get some kind of plant stand and just bide my time and order things that strike a chord with me. I can buy one plant stand (as opposed to ten plant stands).

It will be nice once I get all the pictures hung on the wall.

For my 5-year anniversary, my employer is taking me out for an extravagant dinner.

& yes, I could have gotten this all ordered for my office 5 years ago. But I guess it will just be an extra 5-year treat. I put everything on the company credit card and was delighted not to care about the cost.

Side note: My employer is a bajillionaire that needs tax write-offs more than anything. In a different situation I would still care about the cost. (In most any other situation?)

Posted in

Just Thinking

|

1 Comments »

September 14th, 2023 at 04:58 am

MH just told me that his sick pay was bumped up to 80 hours annually. Which is pretty nice for a job that is only ~20 hours per week.

The timing is good because he wants to take two weeks off to work on this movie. They always let him use his sick time for any time off because part-time employees don't have any vacation time.

He was just telling me they don't have any COVID policies at this point but I guess his location is being conservative. & just instituting the sick pay (probably company wide) so that people can just stay home when they are sick. Which applies to more than just COVID. No one wants your germs.

I just wanted to jot this down because I know that I will never remember.

Posted in

Just Thinking,

Work

|

1 Comments »

September 9th, 2023 at 04:55 am

Success!

Not only did I have a peaceful week. But was able to finally redo jinxed LA trip. Third time was the charm. Had planned this trip originally in 2019. Was initially supposed to be Hearst Castle, Solvang, LA. (We skipped Solvang this time, but we made it at some point.)

If money were no object, the central CA coast is where I would live. It has always been my favorite place. It's more complicated than that. Living close to family is more important, among other things. I don't foresee ever moving to the central coast. But maybe some extended (weeks long) vacations during early retirement, is probably how it would realistically translate.

Writing down before I forget: Ventura was beautiful. Never noticed it before, but it was stunning when we drove though last week.

This was the view from our hotel room. It's our 'forever hotel' near the college. The price was has quintupled on the weekends, in recent years. But weeknights can still be reasonable.

This part of the trip was particularly magical. The sky was so clear and the moonlight was so pretty. As we were wrapping up packing the next morning, I looked outside and just happened to spot 2 dolphins swimming by!

My niece is working at the college this summer. She's pre-vet, and stayed there to take care of the animals. After Hearst castle, we met up with her. We got to meet the kittens she was fostering (OMG) and the baby goats she is taking care of.

Not much to say about the rest of the trip. I holed up in the LA hotel for 3 days while MH attended the film festival. It was over in a blink. I guess that's how time is any more. But I did relax and enjoyed the peace.

We were not able to charge at the hotel and I thought that would be more challenging. But we ended up in so much LA traffic that it added a lot of range to the car. (Braking generates electricity.) Because of that, we drove about 60 miles (from last charger) and ended up with 20 more miles (range) than we started with. Got the battery up to 85%?

I still thought we'd do a quick stop on the way out (once the battery drained enough; charging is much faster on an emptier battery). But once we guaged the traffic (hit more on the way out of LA) and re-assessed once we got out of the madness, it was an easy 2-stop drive home. I think last time our second stop had been much shorter. That was probably the difference with being able to start out with a full charge.

I think the trip will end up being about $1,750. Most of that is hotels. About $400 for food and $70 at chargers. 1,000 miles driven. I am not used to paying for hotels. So, ugh. The trip feels quite extravagant in that regard. But we better get used to it. MIL has been flip flopping about her timeshare (that we just want to get rid of). So it initially sounded like maybe we could use the rest of the year. But last MH brought it up, he said they had gone back to getting rid of it ASAP. Which is really all good and for the best. I want to go back to LA for New Year's (rose parade) and so it's just going to be one of those years. I think we spent our vacation budget on the last LA trip.

I am earmarking future gift/bonus money to offset the whole 'loss of free timeshare' thing. I am also not interested in traveling with my kids in the future. (Those timeshares were the best for bigger family trips.) Just winging it for now. Will be able to plan better with the heads up in future years. & I just expect a completely revamped budget at some point in the future. But with two kids in college, it's not in our plans to actually increase our vacation budget. It's all been far more extravagant than anything I envisioned during these college years. I really thought we'd just be more homebodies, but there's just been so many opportunities and we have the cash to take advantage. This is the only year I can realistically get to the rose parade (re: work schedule). While MM(20) is building rose floats. So it's at least a 3x LA year.

Thankfully, MH went back to work Tuesday. & he was actually busy. (It usually starts out pretty slow, after summer break). & the LA hotel was slow to show up on the credit card. So I am probably going to kick that can down the road a month and let MH's income cover that. It's all the same in the end (as MH would roll his eyes and tell me) but I personally like slowing the money drain. I am looking at August and I've just got the new tires and $1,000 of vacation expenses to pay off in September. Was able to kick off medical bills and the LA hotel to be paid for in October (charged in September). & MH's October income might cover those extras.

Spending will slow, as everyone settles back to school and work.

Posted in

Just Thinking,

Picture Project,

Vacation Lifestyle

|

2 Comments »

September 6th, 2023 at 03:16 pm

I discussed with MM(20) and we are just going to send him a $1K monthly allowance for rent and groceries. Just for simplicity, as we switch to monthly housing costs. I was just paying quarterly (with tuition) when he lived in the dorms.

MM(20) only spent ~$80/month on food last school year. 🙄 & he looks starved. So I am leaning on him to spend more. I don't know that he will spend more, but I am trying. I will be sending him a flat $150/month for groceries.

Why $150? Because it makes it an even $1,000 per month, with rent. & I presume that about doubling his grocery budget should be more than ample.

I saw a conversation in the parent group recently, about what to expect to pay for food (for kids living in apartments with kitchens). $400 - $600 was pretty much all that anyone recommended. 😲 I just presumed that included eating out costs, but there were comments about how "this can be done if you meal plan" and stuff like that. Still, clearly has to be some eating out costs. MM(20) never eats out, and I expect that is most of why he keeps food costs down so low.

There was even a comment how if you don't give your kids at least $500/month, it's not fair to roommates because obviously your kid would have to steal their roommates' food.

I often feel like I live on a different planet, and this is one of those moments. The only relateable comment was someone who has a $250/budget for their kid who shops at Costco. If I can get MM(20) to actually spend $150. & I know a lot of it is that he gets a lot of free food from the girlfriend, and some free food from clubs and so one. I expect $250/month would be a decent grocery budget for MM(20) if he didn't have the 'free food' factor. (They aren't eating ramen. They are eating 4-course meals. The girlfriend is quite a chef.) Not only that, but they also take turns cooking for 2 (or more), which clearly helps to reduce their food costs.

It will be interesting to see how this year goes. With less roommates and me pushing him to spend more on groceries, he may spend a little more. He doesn't have to share a kitchen and fridge with 4 other people. That should allow for more cooking and leftovers. More room for leftovers, if nothing else.

The question mark this year is utilities and other expenses. Moving from an "absolutely everything is covered with rent" situation to a "nothing is covered with rent" situation. But the utilities should be so minimal that I think I may just reimburse him twice during the school year. & once I have a year of utility data, might just roll that into a flat monthly allowance for future years.

The school had even covered cleaning supplies, so that will be a new expense this year. I don't know how much MM(20) will pay for laundry this year and how much he will just do laundry at the girlfriend's house. (Laundry was always free in the dorms). I am sure there's things we have not thought of.

I did give MM(20) his $1K college gift this year, to use towards furnishing his apartment. Seemed the best use of this money for this school year. In the end, he's found everything for free. He even had a free bed/mattress at some point (that fell through). & he found a free bike. As of this moment, he still needs a mattress. & he might need some kitchen stuff, depending on what the roommate brings.

Posted in

Just Thinking,

College

|

5 Comments »

September 6th, 2023 at 03:46 am

MM(20) had an estimated $4K state (middle class) grant per his college. I mentioned in a prior post that $4K was my "pulled out of my butt" estimate and didn't know what to make of it. His grant had been $2K his first year, then $3K. Well, it sounds like the school basically used my estimate method. Figured he might get another $1K this year.

In the meantime, MM(20) was out of town for the long weekend. I cornered him when I got home from work and had him log in to check his grant. The dollar amount went up by $4,000 this year. What the heck!?

I had read somewhere over the summer that "the dollar amount depends on the specific school." But I was second guessing this when DL(18) wound up with the $4K amount. I just presumed both the kids would get the same $4K amount. I was stunned when MM's grant came in at $7K!

MM's expected net college costs:

$42,000 Tuition/fees**

-10,000 tax credits

-13,000 CA middle class grants

- 6,000 Scholarship

---------

$13,000 Net cost

**I added in MM's $1K summer school class, so brings the grand total tuition to $42,000.

The one thing that is really unclear is if MM(20) will get any further middle class grants. The state is treating MM(20) like a senior because he started with so many AP/IB credits. For planning purposes, I presume this is all the financial aid he will get.

I suppose you never know how things will sort out with future scholarships and everything. Lord knows I was surprised this year.

At the end of the day, this grant is an extra $3,000 in MM(20)'s pocket. I was paying his tuition from his gifted college fund. With this news, he should end his junior year with $20K cash (gifted college fund), same as he has now. I think technically will be pulling out ~$800 for tuition this junior year, but he will be able to make that back (in 12 months) with higher interest rates on cash account. If there's anything left after college, this money is for him.

Edite to add: Have been told that the college will sort out grants end of October. Hopefully before we pay the next quarter. It will be hard to believe until the college deducts it from MM's tuition.

Posted in

Just Thinking,

College

|

5 Comments »

September 3rd, 2023 at 04:04 pm

Enjoying a nice bout of cooler weather. & the clouds/sunsets that come with the cooler weather.

I got some more firm college numbers for DL(18). Woohoo!

I've been following actual CSU college numbers (over the decades) and planning for $30K (sticker price) degrees for my kids.

Actual cost = $30,400 at DL's specific college. It looks like it will be closer to $32K with parking permits (over 4 years). I am considering that as part of tuition/fees, since the parking is kind of necessary to be able to commute to the college.

Up until this afternoon, that's all the info I had. $32,000 degree minus $10,000 college tax credits = $22K max I expect to pay for this degree.

It sounded likely the kids would have similar state middle class grants, but I was second guessing because I recently read it depend on the college. & for all I know, DL(18) didn't get the paperwork in. I don't know! I had this number in April? when MM applied to college, but I didn't know if I'd get this number (for DL) until after I paid for DL's first year of college. Or like 9 months later. 🙄

But I saw the topic come up in the college parent group (MM's college) today and it looked people had real numbers. What!?

DL(18) got a $4K grant! (I was able to log into his state grant account). I am so relieved that everything went through.

The best part is these grants are increasing every year. Was more like $2K MM's first year. Then $3K. Then $4K.

DL's expected net college costs:

$32,000 Tuition/fees

-10,000 tax credits

-16,000 CA middle class grants

---------

$6,000 Net cost

Probably minus some increased middle class grants in the future, which could easily net out this cost to $0.

Of course, it's not quite so simple. The tax credit thing gets complicated. If middle class grants increase any further, then the tax credits will decrease. & I mean, we won't even get the full $2,500 tax credit this first year. But I feel pretty confident saying that DL will probably pay no more than $5K for his degree (if he can finish in 4 years).

It sounds like most likely I won't get any refunds from DL's school until next year. His tuition (full sticker price) and parking permit will be $4,000 for the spring semester. Due end of December maybe? Early January? But the school will owe me this $4,000 (grant) refund, so that should be a wash. Because of this, I've checked off DL's freshman year as done and paid for. In my sidebar. The $4K cash already paid should be all I need to come up with for the next 11 months. Phew! Feeling relieved because the money drain was pretty crazy in August/September. Paid college x2, medical bills, last minute vacation and so on.

The planner in me is very happy. We plan to just cash flow DL's college expenses (with income). I didn't think it would amount to much more than $1,500 per year. But it's nice to have firm numbers and a more firm plan.

DL(18) is just living at home, so no other college expenses to figure out. I mean, he's got a bigger commute now, but he is covering those expenses.

Posted in

Just Thinking,

Picture Project,

College

|

2 Comments »

August 26th, 2023 at 06:33 pm

MH is working on a very low budget horror film.

I have to back up and say that I don't think we saw a low budget movie short (at the festivals) made for less than $50K. For a 10 minute movie. For a full length movie with a lot of effects, this movie needs a $50K minimum budget. This is extremely low budget in the grand scheme of things. The stretch goal is a $90K budget. Which would mean bigger actors and more effects.

MH met the producer online. This project is the producer's baby. He has already had success with a low budget horror film. What's extra interesting is that the guy lives in Ohio, near my sister. So it makes it easy to participate more with the "kill two birds with one stone" aspect. The movie will be filmed there. Heck, MH has never been to Ohio the ~20 years that my sister has lived there.

This is the first project that MH has ever been offered any pay for. I am not holding my breath on that. He's also doing very little on this project.

Right now they are doing the crowdfunding. The producer has experience on this front and is doing very well. They raised $25K in a week, and maybe this thing might actually happen.

In the meantime, the producer hadn't told MH that he had entered the script into a LA festival. It got in, so we are planning to go to LA. This could have been a very frugal trip for just MH. But I am tagging along. We added some days at our forever hotel (by the college). I was surprised how short the drive was from college to LA (last time) and it was a somewhat relaxing 3-day weekend. With a stop to visit MM(20). This is a much more luxurious trip where we will stop by the beach for 2 nights and then hop on over to LA for 3 days.

MH is worried that I will be bored. I don't actually think that I will be bored. (Will have the roku for all my TV shows, library books on my Kindle, the gym and the pool. I am good.) But... I told him even if I am bored, is exactly what I need. I look forward to the three days of peace and literally nothing on my plate. Not holding my breath (there is always some emergency) but I am trying. I told MH, "Being bored would drive me crazy, but I think it's what I need right now." He's not looking forward to all the schmoozing, but that will also be good for him.

We are also going to Hearst Castle. Trying. (I am so not optimistic that trips I have tried to plan many times, that have been canceled many times, that they will happen.) That was one trip we did cancel twice already. & then we figured we'd get there while MM(20) was going to school in the area. But we never have. So now we are just doing a completely separate trip.

{I don't even know if we are helping MM move in this school year. But if we do, it will just be a quick weekend thing. Logistically. MH goes back to work when we get back from LA.}

I had a question about the writer strike (in my last post)? Yes, the professionals are striking. This is a small independent film. It's a hobby project. Making any profit sounds about as likely as winning the lottery.

Edited to add: Apparently SAG is giving their actors exemptions for Indie films. One of the actors for this movie is SAG. But I expect that most working on this film do not belong to any unions.

Posted in

Just Thinking

|

0 Comments »

August 19th, 2023 at 02:48 pm

Received $122 bank interest

Received $240 I Bond interest

Snowflakes to Investments:

--Redeemed $30 credit card rewards (cash back) from our grocery card

--Redeemed $75 cash back on Citi card

--Redeemed $7 cash back on dining out/gas card

Other Snowflakes to Investments:

+ $8 Savings from Target Red Card (grocery purchases)

TOTAL: $120 Snowflakes to Investments

401k Contributions/Match:

+$795

Snowball to Savings/Investments:

-$0-

Savings (from my paycheck):

+$ 450 to investments

+$1,000 to cash (mid-term savings)

Pulled from mid-term savings:

-$165 Garage Door Repair

Short-Term Savings (for non-monthly expenses within the year):

+$1,500 to cash

-$130 Graduation & Birthday

-$100 Travel (college trip EV charging & multiple gas trips to camp)

-$100 DL supplies for summer at camp

-$ 78 Pest Control

-$ 70 Concerts

TOTAL: $3,584 Deposited to Cash & Investments