|

|

|

October 5th, 2024 at 03:00 pm

October 3

$9 Groceries

$6 Fast Food

$0 Movies

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I didn't see where the weather landed today (101 or 102 probably), but the forecast just keeps adding more 100F+ days. Last I saw, through Monday.

Okay, so I guess it was 103F again, and that was an all-time October record. Thank you Google.

Today it was sick spending. I felt like crap and was feeling very particular about food. So I grabbed some groceries in the morning (for breakfast) and got a fast food burger for lunch. I had planned ahead black bean wraps for the week, but the thought of those makes me want to puke. So I told DL(19) to please eat those. I thought of that after he ate all the rest of the food I bought within a couple of hours of me getting home this morning. So much for that.

I will probably buy breakfast on the way to work tomorrow, unless I wake up feeling 100%.

MH went to the movies after work. He used his unlimited movie pass.

Oh yeah, and I taught DL(19) how to address an envelope today. He did not have a clue. His employer requested some paperwork. Which is a whole thing because it's a state job and everything about this is weird and tedious. Thankfully he was able to update his address online. They had a typo in the street name, but the mail was still making its way here. He's just never had any reason to mail anything before.

Posted in

Just Thinking

|

3 Comments »

October 4th, 2024 at 02:49 am

October 2

NSD

**103F Degrees**

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

MM(21) was really dragging his feet transferring money from his savings to his checking account. But I saw today that he transferred $1,800 over. Probably leaves him with $1,000-ish that he will insist can last him through the school year (after he pays for that engagement ring). I need to check in with him about getting his rental deposit back. I haven't seen that show up in his account yet.

I looked up MM's college town weather out of curiosity and it is just as hot. Ugh! His region largely doesn't have A/C. He's always lived on upper levels without A/C, but school starts in late September and the region is not that hot (close to the coast). He's having a rough week, I am sure.

MH went to a free advance movie screening. I attempted to attend one with him some months ago. Maybe the first time since 2020? It's gone very far downhill. They were just sticking to the smaller theaters which only leaves the first couple of rows. Maybe 20? seats and you have to get there many hours early to snag that. The rest is reserved for press. But MH got his first press pass today! Re: his producer "job" that does not pay. He would be happily paid in press tickets. So this was a nice treat. I don't think it was anything particularly exciting, but he will always say yes if it means more press tickets in the future.

Posted in

Just Thinking

|

5 Comments »

October 2nd, 2024 at 12:07 am

October 1

$ 7 Patreon (MH)

$105 Groceries

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Ugh! The other shoe dropped. Had major work drama in May. I think that some of my coworkers thought I was being overly dramatic but I knew my assistant would likely quit after that. She gave her very short notice today. (What is up with these very short notices??) At least when awesome admin left (her spouse gave no notice; they moved out of state for his new job) at least she stayed on and worked as much as possible. She's a people pleaser and probably helped smooth the transition more than she should have. In this case, I was too shocked to really process that I will have to train someone from zero. What a mess. The way she told me, it just really threw me for a loop. Though otherwise not completely surprised.

A very rare work break (in addition to plans to pass off a lot of my work to this employee) just became a big mountain to climb. Which would be less of a big deal if it wasn't constant mountains.

Blogging relaxes me, and is appreciated today. But I am also now more skeptical about my badwith this month. I realized today when I looked for an old "expenses tracking" post (to copy and paste) that I gave up the last October tracking I tried because MH's grandfather passed away. I just gave up mid-month. That doesn't make me feel too warm and fuzzy.

In other news, we put away the grocery credit card for the year. We maxed out our rewards on that card.

The weather is absurd. 102F degrees forecasted for tomorrow. The plus side is that we are done with summer rates. Instead of paying $0.35 per kWh during peak peak times (which we mostly try to avoid) we get to pay just $0.16 for non-summer peak hours. Which will probably still equate to an absurd electric bill because we aren't usually running the A/C in October. But it will be a little more reasonable and less sweltering in the house.

I did buy some ice cream (Saturday?) when I saw the weather forecast. I am going to go turn off my brain and eat some ice cream.

Note: Labeling this as 'Daily Expense Challenge so that it's easy to find in the future, but I am not considering this a 'challenge' and don't have a goal to limit spending. Just sharing more minutiae about where we are at these days.

Posted in

Just Thinking,

Daily Expense Challenge

|

9 Comments »

October 1st, 2024 at 02:32 pm

I was thinking about detailing daily expenses in October. It's always a good way to dive back into blogging. I looked back and I guess it's a common month for my to share more expense details.

Last week I would have said that where my head is at is that we are relaxing more financially and trying to find a new balance.

Then I paid all the October bills. *Sigh* & was informed of another massive health insurance increase for 2025. No idea how we survived 1000% health insurance increase early on during one-income years. (Roundabout financing with our mortgage; is the obvious reason we still have a mortgage.) But the plan this time around is to just hold on for another few years. At least we will be dropping from 4-person coverage to 2-person coverage. Just need to hang on in the meantime.

On the flip side of that coin, our net worth is up $100K for the year. I find it hard to sweat the small stuff during recent stock market years. It's 5 years in a row of $100K gains. (Health insurance is not "small stuff" but pretty much everything else is small.)

I am also concerned about the long term future and the inevitable "what goes up must come down." But like the health insurance, if we can just hang on for a couple of more years, our expenses should overall reduce drastically after that. Re: kids grown, mortgage paid off, etc. I think it's just so close that we can taste it. & is a lot of our relaxing.

Anyway, I can delve into my feelings and how all over the place they are, as I share daily tracking. I do think it would be wise to rein things in a bit for October.

I pay all the bills the first of every month. I've got everything paid except the *big* credit card bill. Waiting for my paycheck to hit today. Then I will get that paid off. (The rest of our paychecks during the month generally go to savings/investments. My second paycheck and all of MH's paychecks.) It's a rare 3-paycheck month for MH. Rare, because of all the months he usually has off of work (re: seasonal job). But we have some home maintenance planned this month, paid for in cash. His extra paycheck will cover that. (That bill is not paid yet because the work has not happened yet.)

I don't have any plans to spend money today. I think MH is going grocery shopping.

I don't know if I have the bandwith to track all month in my blog. Will see how it goes.

Posted in

Just Thinking

|

1 Comments »

September 24th, 2024 at 01:10 am

I was just double checking MM's bank account before sending him rent money for October. There was a random $500 deposit from his college that confused me for a beat, but I eventually realized that it must be a scholarship. What!? I figured maybe MM(21) didn't know about it. But he did know and just never bothered to tell me. It's a $1,500 scholarship for the year ($500 per quarter).

Talk about a nice surprise! It's all money in MM(21)'s pocket. I am depositing the $500 back into his 'gifted college fund'.

MM(21) Year 4 'Gifted College Fund': $16,750 (+$5K ROTH IRA ~ unknown current value)

Still no idea how MM(21)'s grant will sort out this year. I should have some answers in November and then I will know what net tuition costs will actually be this school year. & at that point I should have a pretty good idea about our 5-year tuition cost. I'll do an update at that time.

It was a big money day. DL(19) also got his first paycheck for first more steady job. It's the first job my kids have had that isn't just a summer or a temp job. DL(19) received a $750 check for 2 weeks of pay. & I think he's worked another 4 weeks already (the State pays monthly).

I don't know that DL(19) has ever made a big purchase. At the moment he owes me $400 for some car maintenance. Not that he borrowed the money from me. But we went in 50/50 with the cost and I was just being nice and waiting for his payday before I asked for his 50%. He told me that he wants to buy a used bike for $500-ish. This is probably his first big purchase, ever.

I guess now it will be all the things. He will need a high yield savings account (first priority is to save up for a car), I want him to apply for a credit card in his own name (now that he has income), and we will talk about saving for retirement. His employer is taking 7.5% for retirement (mandatory). DL(19) was playing with stock market type simulators when he was 10, maybe younger. I wouldn't necessarily prioritize taxable investing for a 19yo but I think he will like making his money work for him. One thing at a time, but it all needs to be addressed as the money starts to pile up.

Posted in

Just Thinking,

College

|

6 Comments »

August 24th, 2024 at 02:21 pm

MM(21) cash: I think he's down to about $11,000 cash. $1,750 in his checking account, but $1,200 of that is earmarked for an engagement ring.

The engagement topic has come up more. It sounds like the engagement is planned for any day now. But the wedding will be an 'after college' thing.

MM(21) has been insisting that he doesn't need any money. & has been pinching his pennies. Never ended up pulling any money from savings (last school year). But we will have to sit down before school starts and make sure he has enough cash for the next school year. Or at least the first half of the school year. On the flip side of the coin, he is much more spendy during summer months. He did a big trip a few weeks ago. This week he has been going out almost every night, socializing with college friends. Restaurants, bars, that kind of thing. He's very, "Like hell I would spend money," at school, so it's good to see him relaxing and enjoying a little more.

The past school year MM(21) received a $1,000 gift from the in-laws (annual college gift) and $500 interest. Expenses were $680. This means that he was able to save $820, which is about what he will be spending on an engagement ring. (They are going 50/50 on the ring, so he only has to come up with half the cost.)

Note: I cover tuition/fees, rent, utilities, medical/dental and a grocery allowance. The $680 he spent was for everything else. It included $250 automobile expenses. Just had him pay towards some of the car repairs during summer months when he was using the car more. I no longer have access to his credit card, so I don't know how much he has spent on fuel (probably some) or what else he spends his money on.

I've been giving him his 'gifted college money' (during college years) for 'college spending'. But MIL has been inconsistent. Ideally he should be getting a check any day and it might last him for the next school year. But if MIL forgets for a while, MM(21) will need to transfer some funds out of his savings account.

Engagement ring side note: The topic came up at work because a co worker's young sister just got engaged and we were talking about MM(21)'s engagement plans. My employer has a 8 figure net worth (family money) and married very young. He mentioned that a couple of our employees (who don't work in the office) he felt were delaying engagements re: cost of ring. & we joked about the diamond industry recommendation to spend X months of salary on a ring. 🙄 I don't remember the number, but my boss revealed (to everyone) that he spent a whole whopping $300? on an engagement ring. He had bought it at a pawn shop. (He's a decade younger than I, so this was around 2005. For reference). I chimed in that my ring didn't cost any more than that.

It's funny because my inclination is to say that we were 18/19 and weren't going to spend any more on a ring. But that's not true at all. If I actually stop to think about it. MH had the free college ride and was working his butt off to save up for a Bay Area home (he started saving in high school). He had thousands of dollars, in addition to no immediate expenses. I would have considered it a red flag if he spent any more on a ring. I am sure everyone else just wrote it off that both my boss and my husband were "very young and broke" but the truth is the both of them could have bought much more expensive rings (with cash) if that was something they actually valued. & of course, we are talking about people who don't do debt. Clearly people justify spending a lot more, putting engagement rings on credit.

Edited to add: MM(21) bought the ring this week. I don't know if he plans to propose this week in town or if he plans to propose at college town. He's moving back next weekend.

Posted in

Just Thinking

|

6 Comments »

August 15th, 2024 at 02:11 pm

MIL was trying to outlast my kids, but she gave up. We took over the camp account and I put down a $100 deposit for next summer. We did let one cabin go. It's now freed up for a younger family.

It was 55F degrees on the beach day. I tried to talk some of the kids out of it (we needed two cars to get them all to the beach), but they wouldn't hear of it. They had grand sand castle plans (pictured above). I thought the picture was a good symbol of my kids' unwillingness to outgrow family camp.

MH and I had been planning a day trip to Napa. At some point MH mentioned it would be fun to take MM wine tasting for his 21st birthday. We went wine tasting at a castle and then did a hike through the redwood forest behind the castle. & we had an extravagant dinner.

The original plan was to go to the culinary school for lunch or dinner. I didn't get the reservations in time. It's on our list this year to go back at some point (just MH and I).

Other goings on...

MH went to Indiana for a film convention. He had a blast. He just told me that he is pretty certain he won't go back to Ohio in the Fall (as originally planned). It sounds like more of this movie stuff is getting pushed into next year. It's a relief financially, but it's more money next year just being tied up for this movie stuff.

MH got a job as a producer for a local cable show. As it always is, he's not getting paid for this. But it sounds like there will be some money making opportunities and they do want to pay him in the future if they can. Not holding my breath, but it's a good opportunity re: networking and experience.

MH's movie is coming along nicely. Slowly but surely.

DL(19) got a job! He's been looking for 3 years... He's had a couple of sketchy temp jobs, but has wanted something more year round and permanent. I think considering that he gave up and just applied to anything and everything (was willing to work full-time hours this summer to get his foot in the door, though he has no need or desire to work that much). Considering the more desperate and wide net he cast, I think this job could work out pretty well. It is a state job and he will be making $$$$$. I will share more details if it works out.

It's been absurdly hot and so I have just been in survival mode. There is nothing productive happening in this heat.

Work/school is ramping back up during the next two weeks. With both MH and DL(19) returning to work. MM(21) doesn't start school for a while but I think he is moving back to college in a couple of weeks.

Posted in

Just Thinking

|

0 Comments »

July 29th, 2024 at 03:19 am

I hadn't realize that these middle class college grants were on the chopping block for this next school year. I was just looking up something else completely different and came across news that there was a push to cut these benefits by 90%. (Which I think is fair. I think 'very low cost and great colleges' is more than good enough.) By the time I saw this, the state budget had already passed. Nothing was cut and the benefits will again be increased this next school year. (Which I also think is fair. Talk about last minute, making it impossible to plan if you have no idea what your actual cost will be.)

I *think* this means my last tuition estimates were spot on. But I will hold off until it's official. Until all the red tape is sorted and the money starts to show up in my bank account.

I went through MM(20)'s rental application some weeks ago. Fingers crossed! I hadn't really thought about it before, but as I thought to rent logistics, I can see it's going to be a pain making sure that 3 roommates get their rent in time. He's already largely moved his stuff over but will technically have no lease for 10 days. He is using the same property management company as last time, so this whole process is much smoother than last year. He's planning to move into a much nicer townhome (moving up from a small apartment). It's very close to campus (closer than the "on campus" apartments were) and so MM(20) is intent on living without a car for another year or two.

I will do an update on where we are at with those costs, but will wait until it is official. Because he sorted out a couple of big rental messes last year, I am just letting it go and letting MM(20) figure it out. But I think it's incredibly stressful he doesn't have the lease signed yet. He just told me the new lease should be for August 2nd.

Edited to add: I am still waiting for that to be finalized, so that I can do an update on his rent for the last 2 years. So that I can at least do a projection. In the short run, not even sure if the 3rd roommate will work out or if they will just split everything 3 ways.

Second edit: Never got around to posting this. Some of it was because I expected an update any day. But MM(21) hasn't been home most of the month. So I have not seen him for more than 5 minutes. & I don't know any other details other than the lease is signed, re: original plan. (I have no idea where things landed re: drama). I am going to roll with the info I have and do some projections re: where we are at with college money.

MM(21) has $20K in his gifted college fund. Tuition is roughly $20K for the last 2 years. But we will get $4,500 in tax breaks and he will likely get another $7K+ grant this year. (Still not certain if that will be $0 or $7K.) It's plausible that MM(21) will still have ~$11K left in his college fund, at the end of Year 5. Note: I've only touch this fund to pay for his tuition.

It's Year 5 rent that I didn't have much of a plan for, and left it with MM(21) - last year - to circle back later. For now, I think we will cover the Year 5 rent. A lot of it of course depended on where he ended up for the last 2 years. I've got $13,000 set aside for MM's rent specifically. In addition, will presume another $2K of interest (over 2 years). This will cover 18 months of rent.

I've got 6 months of rent to figure out how to cover. Roughly $5,000. Because of the grant, I am eyeing MM(21)'s gifted college fund. It's precisely what that money is there for. $5K will buy him the difference that I don't have 'already saved' for his 5th year of rent. If I pull $5K out for rent, he may still end college with $6,000 (gifted funds).

If the math went another way, I'd have no problem telling MM(21) he needs to start chipping in towards expenses, etc. But it sounds like he might be able to squeak by.

I am so very close to crossing off MM(21)'s college as 'done and paid for'. But I won't be certain until this final year state grant sorts out. I am hesitating because it was initially supposed to be $0. I won't fully believe it until the money hits my bank account.

Another Edit: I know, I know. But I didn't feel it was worth a new blog entry. MM(21) just told me his new deposit amount on the townhouse ($750). I decided to just pull that from his 'gifted college fund'. Making a note about it because I don't care for his blase attitude about picking up his despot check from the old rental. If he ever gets that money back, I will put it back in his college fund. Trying to shift the financial pressure to him.

I can see it's more interesting to just update the kids' college fund balances when I do these posts. Will start to see MM(21)'s balance dwindling down more these last couple of years.

MM(21) Year 4 'Gifted College Fund': $16,150 (+$5K ROTH IRA ~ unknown current value)

Note: We have pulled $11,865 from these funds to cover first 3 years of tuition, one summer class, one expensive class fee, and a rental deposit. I am also probably due a $2,500 financial aid refund (will deposit back into this fund, when received). MM(21) will likely end his senior year with the $20K he started with. Financial aid is just incredibly slow to sort out. I will probably pay for the first two quarters before I start to get final numbers or refunds. So this account will be a yo yo in the meantime.

Clarification: It was $20K when I started this post, but then I paid Fall tuition & took out that $750 rental deposit. Tuition/grant/tax credit/interest will probably be a wash this school year. Rental deposit should also be returned eventually.

DL(19) Year 2 'Gifted College Fund': $28,700

Note: No plans to touch DL(19)'s college fund, as long as he is living at home and receiving significant state grants.

Posted in

Just Thinking,

College

|

0 Comments »

June 23rd, 2024 at 03:37 am

I am finally setting my next bigger picture retirement goal. It's been 3 years since we hit our $500K retirement goal. I drafted this post in January (have been slow to publish) and so I'd say we took a 2.5 year breather re: retirement goals. Wanted to let the stock market rebound, let college sort out, etc. Real estate is still a mess. I suppose we've decided that part is moot until we decide where we want to settle.

A lot of my "meh" feelings about it has been the markets. At current, the smaller homes in our neighborhood are selling for the same price as our larger home. (This renders downsizing completely useless. In addition to this, our property taxes and utilities would increase. I would have been okay with that to pocket $200K, but makes no financial sense in the moment.) I think that doubling our last retirement goal in 5 years was doable, but it was just kind of depressing while the market was down. & of course, the housing thing was a compounding factor because if we can't cash out $200K to throw at retirement then that's $200K more we need to come up with.

In the meantime, we mostly figured out college for both our kids. Still some financial unknowns but I think it's about 90% more clear than it was 2 years ago.

Ideally, I'd like to put less emphasis on retirement savings. But the reality is it's just not efficient to lower retirement contributions. After pondering for a couple of years and going more with the flow, I can see we won't change much. Will continue to contribute to work retirement plans up to the match and will continue to max out IRAs. Not sure how successful we will be with increasing IRA limits and two in college, but will keep trying.

That said, our $500K retirement goal (by 45) was a big stretch goal. We are going to continue to hit things pretty hard, but... I am no longer interested in the stretch goal being the priority.

Note: Age 45 goal was 6x salary

So our new goal will be more realistic:

$1 Mil in retirement accounts by age 52.

This presumes 6 years and a 7% rate of return.

I do think that 'thinking it' is 90% of the battle, and I think is some of why I wrestled with setting a more conservative goal. In the end, I am just setting both the realistic goal and the stretch goal. The stretch goal is to hit $1 Mil by age 50. The stretch goal is a stretch goal, but I do think it is possible. I am doing my part to write it down and believe in it. Mostly, I have other priorities and don't want to sacrifice too much for the stretch goal.

Along the same lines, I don't know how I will feel about catch up contributions when we turn 50. My gut feeling is "meh". The whole point of making retirement *the* priority in our 20s/30s is that we don't want to spend our 50s catching up. But if I really think about it, I am less of a fan of our retirement work plans and have no plans to ever max out. I do prefer self directed IRAs and I can see taking advantage of catch up space. Which is just another $1K per year, each. Once our kids fly the nest, I am sure that will be fine.

Other than that, our bigger plan is just to work less. Our expenses should drop considerably when our kids fly the nest. & so that may be a situation where we could max out everything (and do all the catch up contributions). But the bigger plan in our 50s is to work less. Not to save more. More likely will be cutting back work hours and lowering retirement contributions.

We turn 50 in 2026. That will probably be a bit of a transition year where we pay the last of the college expenses.

Posted in

Just Thinking,

Investing,

Financial Independence by 50

|

0 Comments »

June 8th, 2024 at 03:35 pm

I just happened to notice (very randomly) that DL(18)'s tuition was due this month. What!? We paid in August last year but I guess that was a special freshman due date.

What a pain. I paid the entire tuition for the school year, basically. Will get a financial aid refund in November. (Tempted to cross off the year as done and paid for, but will wait for financial aid to sort out.)

Feeling cash poor in the short run. Was feeling very balanced and then suddenly feel out of balance. I will have to ponder.

I had been meaning to share a food stamp update but wanted to wait and see if MM(20) was truly eligible. He's been dragging his feet but he finally got through the red tape.

My conclusion is that the only reason he is eligible for the food stamps is because we are uber frugal. But I will start at the beginning and then get to how it ended up.

In MM(20)'s college county, some majors are eligible for food stamps. The main criteria is that you can't live with your parents, you must have a kitchen (he would have been ineligible freshman year) and you need to cook most of your meals. MM(20) fit all these parameters.

They've been doing a big marketing push this year. It would be hard not to know about this, at this point. Was totally clueless last school year and then only found out mid-year this year.

MM(20) had told me at some point that his girlfriend was getting "food financial aid." So finding this out was a big lightbulb moment. This explains why she refuses to accept any grocery money. Obviously she knew about the food stamps. This is also probably the only reason we perservered with the red tape. Her parents clearly have a higher household income. If not for knowing she was eligible for full benefits, it would have been easier to write off that clearly MM(20) would never be eligible for food stamps.

Now that he is approved and he has his benefit amount, I'd say the truth is somewhere in the middle. They don't ask anything about assets, so that is not a factor. MM(20) will become ineligible any month he makes something like more than $2,800 (more than full-time minimum wage). They asked MM(20) for financial aid information, so they probably extrapolated our income/assets (at least a rough estimate) from that information.

I am still a little confused why the girlfriend is receiving the full food stamp benefit of $300/month. I don't know if it's because it's more 'all or nothing' if you have no parental support. Or if she was just being paid room/board at her on campus job (considered to have $0 income?).

The final answer is that MM(20)'s benefit is being pro-rated based on the support we provide him. It sounds like he will be getting $150/month food stamp benefits. This just happens to be the amount we were giving him for groceries. We reported to the state that we were "gifting" him $1,400/month (half minimum wage) for tuition/room/board/support. It sounds like if he is being gifted half minimum wage, then he gets half the food stamp benefit.

Of course, I will no longer be giving him food money (due to this benefit) and his rent is decreasing next year. So technically he will be eligible for a little more.

I already mentioned in the past that MM(20) is in the extreme minority re: low grocery spending. & MM(20)'s rent is also easily half of what it could be. It quickly became clear that he is only getting this benefit because A - he is uber frugal, and B - we give him very little support outside of tuition/rent. & C - he's also living off of his girlfriend's food stamps. It sounds like it's fairly typical for parents (at this college) to give students $2,000/month for just rent and food. That's not counting utilities, allowances for spending money, or any other financial support. Oh yeah, and that does not even count tuition! I was right to be skeptical about being eligible for food stamps. We just squeaked by because our personal situation just happened to fit inside the box.

How random is that, that the government wants to give him the amount I was giving him for food allowance? Technically, MM and his girlfriend are sharing $450/month. Even with her fancy menus, it's more than they can figure out how to spend.

MM(20) already bought up groceries for this school year (before he got the benefits), so this won't change my budget until next school year. But this will be a nice benefit for next school year. Fingers crossed, however many months he can get this benefit. (Ideally, for last 2 school years.)

Posted in

Just Thinking,

College

|

3 Comments »

May 30th, 2024 at 01:23 pm

🤪

This pretty much sums up life right now. There's an element of "no idea where to begin," every time I have some peace and inclination to blog.

I have mixed feelings about work. At least I am not juggling craziness on top of the busy season. But I don't know why everything has to implode every May 1. It feels like I can never catch a break on the work front.

We had to reschedule a few times, but finally circled back to that last hike we did. I wanted to try it out with hiking boots. With stretching and proper shoes, it was easy peasy.

We left home on 8am Saturday and we were shocked how crowded it was already. But because it was cooler and early enough, we did get the river bank to ourselves. We hiked down to a swimming hole that had been more crowded on our last afternoon hike.

This last one just happens to be called a monkey flower.

I wanted to note the time. We might try 7:30 next time. Just to play it safe. I don't know if the holiday weekend was a factor.

When trying to figure out the archaic payment system last time, I saw that the library had stake (lol) state park passes to borrow. I couldn't really find details about that either (like how long we could borrow the pass) and so I just reserved a park pass and tried it out. It probably took about 10 days to get a pass. We can borrow for 3 weeks, same as books. I will just plan to keep a pass checked out all summer because the kids will also use.

Money stuff has been pretty quiet but won't be quiet for long. Just got a $2,000 MRI bill. College expenses are just a 'second half of the year' thing. At this point I guess, while most of MM(20)'s college savings are being pulled from other savings buckets. & I think for DL(18) the timing worked out that I get a refund of first semester financial aid around the time the second semester is due.

I expect MH and I have been way too relaxed and spending way too much money. We have both been frittering money away on smaller things, which has never been our thing. But that MRI bill is stressing me out and now I am realizing that college will be a big money outflow the second half of the year. I've already told MH we will have to rein it in this summer when he is off work. He is well aware of excess spending. He seems kind of down on movie travel plans this year and has already seemed to decide he rather relax more and enjoy some smaller spending, and is willing to let go of some of the larger spending plans. It's different, but it's interesting we both subconscionsly seem to have ended up in the same place.

It just so happens that we have not had any 'big' expenses the first 4 months of the year. (Other than travel plans, paid for with gift money). I pulled money from savings the first time (this year) in May, when I purchased a new cell phone. I expect this is why MH and I have been more relaxed about money.

I need to add taxes to our expense tracking. I have not bothered during these ~$0 tax years with kids. But even just the payroll taxes, we are probably making $40K more than when I first took this job in 2018. It's now $950/month payroll taxes. & our income taxes will be about the same when kids are done with college (though we aren't paying much in the interim). Payroll and income taxes will suddenly become our two largest expenses.

When looking how much we are in the black the past few months, I can see it's exaggerated without the taxes reducing income. It's time to start tracking taxes and mentally preparing for when that is our #1 expense. I may have also just left these off (payroll taxes specifically) so that I didn't have a heart attack during lowest one-income years. But it's 22 years later now and things change.

Posted in

Just Thinking,

Picture Project

|

2 Comments »

April 21st, 2024 at 03:16 pm

I guess this is largely a MM(20) money update.

I thought we would go over MM's cash during winter break, but he ended up not having much of a break. I am surprised he still has any cash available, but he's been in extreme low spend mode and just stretching that $1K annual gift (using for spending money during college years). We touched base during his spring break. I think he had maybe ~$1,200 easily accessible cash. He was very *shrugs* about it, just needs it to last 3 months.

MM(20) did decide that he was probably going to cash out some or all of his I Bonds. But we decided to just wait and see what the next interest rate would be. & we left it that he will need to open a new bank account this summer (to park extra cash).

I just happened to notice two things last week:

1 - I Bond rate set for 2.97% inflation rate next round.

2 - One of our CUs is paying 5.5% interest.

The CU account is a mega interest account that was paying 4% when the average high yield interest rate was 1%. It's fallen behind in recent months, but that 5.5% is perfect for MM(20) to park his I Bond funds. The catch on this 'mega interest' account was that the cap was $5K for the mega interest.

I can't even tell you why I checked, but maybe it's just because it's been so long since either of us has kept a full $5K in these accounts... I figured I'd double check (if my memory was correct) and... The 5.50% is on the first $10K!

Note: We've already moved our own money over to take advantage of $10K @ 5.5%.

I let MM(20) know. He is cashing out his I Bond and moving most of that to his CU account. When all is said and done, he will have $10K earning 5.5%, $500 earning 7% (another CU), and $1,500 left in his checking account. Maybe only $1,000 left after a few more months of college spending. He will want to figure out a higher-balance high yield savings account at some point, but won't be necessary until he gets a job and starts piling up more money.

In other news, MM(20) has had his rental figured out for next year, for a while, but was still negotiating the cost of the bedroom he will be renting. I guess he got that sorted out and he told me it will be $808/month. He will be saving $42/month, for a much bigger room and nicer neighborhood.

Somewhat related, we need to cash out the rest of our I Bonds. I have been dragging my feet because I got used to the easy separate buckets of money. But I think I've only really been allocating this money to the kids 50/50 (in my mind) while it was doled out 50/50 into separate I Bonds. The truth is that this is a '2 in college at the same time' fund. I just needed a little time to wrap my brain around it. I am thinking about loosely earmarking $20K for future DL(18) rent expenses. & then earmarking the rest to MM(20). I would earmark all of the mega I Bond interest to MM(20). & also all future interest to MM(20), who is currently paying rent. This is very simplistic and easy to keep track of. I really only care about keeping the $20K for DL(18) if he is moving out this summer/fall (and if we are paying two years of rent for two college kids at the same time). So if we end up falling a little short, this $20K is money we can probably tap if MM(20) needs it. (At current, DL has no plans to move out.)

I wasn't sure if we would pay for MM(20)'s 5th year of college rent. We left it as a bridge to cross later. I wanted to give him ample notice if we expected him to chip in. But at the same time, wanted to give it some more time to see how things sorted out. He did his part. He's done a good job keeping rent costs down. I suppose when I tell him we are going to pay for the rent, will have to clarify that we can cover rent 'at this rent level'. (We also found out his 5th year of tuition will be free, because adding the 5th year is giving him a 4th year grant. I could just pull the 5th year of rent from his gifted college fund, if I wanted or needed to. Now that we expect he might have anything left in there).

MM(20)'s current lease ends in July and I think the new lease starts August 1? But he will be able to store his stuff there in the meantime. MM(20) expects to stay at this house his last 2 years of college. With everyone I know who rents being constantly kicked out by selling landlords... I would never presume he could actually stay there 2 years. But it would be nice if it works out. Just my past experience re: sky high real estate. It doesn't help that home sales just went from 0 to 100 overnight. But I would have laughed at the idea of counting on this rental for 2 years, regardless. We can only hope that it is that easy.

Posted in

Just Thinking,

College

|

1 Comments »

April 19th, 2024 at 03:26 pm

We did the traditional ‘after busy season time off and hike’. But this time was a little different. For the first time in 7? years I didn’t just look up the easiest hike I could find. I mean, the hike was labeled “easy”, I guess because of not a *lot* of elevation gain. But after about a mile uphill, it did kick my butt. MH’s job is way more physical and he seemed less bothered by it. But he very heartily disagreed with the “easy” assessment. It was a 4 mile hike with a lot of uphill. And… It was just perfect. It is exactly what I needed. I like that it was a bit more of a challenge, while being relatively easy. & I probably would not have been up to that during several years of recent ‘survival mode'.

This morning I bought some hiking shoes, which should help. I’d like to go back and redo with some better footwear. & I am over this “once per year” hike schedule. I’ve decided that at a minimum we need to be doing a hike at least once every month.

We do really need to take more advantage while our fuel costs pennies. Not sure how long that will last. Thinking to hitting more Bay Area and Tahoe hikes. Last year I realized that we had extra freedom with MH done with the whole 'driving the kids to school' thing. In addition to that, I do work from home one day per week. I'd like to maybe once or twice a month hit an afternoon hike. If it's easier for me to leave at 2 or 3. I think we left closer to 3:00 for this hike and I was surprised how empty the parking lot was (both before and after our hike). I expected more of an 'after work' crowd.

Here are some pictures from our hike yesterday. This is only 30 minutes from our house.

I’ve done a good mix of relaxing and crossing things off my to do list, this week off work. I feel I have both the physical and the mental energy to get things done. While my time has skewed maybe 80% - 90% towards just relaxing. It’s been a good balance.

In other news... I was not supposed to know this but MM(20) is engagement ring shopping. MH and I got engaged when we were both 19, which was weird in our day. Have got a lot of questions why we bothered to get engaged if we didn't plan to get married until after college. (& it was just plain weird to get married in our early 20s). I presumed that MM(20) and his girlfriend are not in any rush. They are certainly taking their sweet time. I am not surprised at all that they plan to eventually get married. But it is a big surprise that they are ring shopping.

The only reason I know is because the GF is going halvsies on the ring and she gave a chunk of money to MM(20). I thought it was rent/utility related. I am just trying to figure out how much I owe the kid for utilities. So I asked him about it. He got really uncomfortable and I thought, "Ugh, I don't want to know." So I started to tell him, nevermind. But by the time I changed course, he had already admitted it was for an engagement ring.

What!?

Kudos to the girlfriend for getting MM to buy a $1,200 ring! (This is what I presume, re: her $600 contribution). She thinks it's cute that he is an extreme cheapskate. It is not cute, and it will get old. So I am relieved he can at least spend money on important things. Not that I think a ring is important. But you know, people first. Then money, then things. It's the "people first" part that I think he's wise to oblige.

Admittedly, there could be a YOLO aspect re: girlfriend's recent health problems. I presume they won't get married until after college, but who knows. The girlfriend is *amazing* and a very welcome addition to the family.

Posted in

Just Thinking,

Picture Project,

Vacation Lifestyle

|

2 Comments »

March 30th, 2024 at 03:03 am

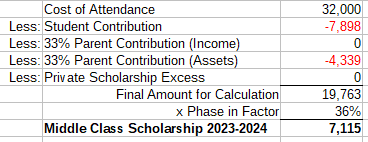

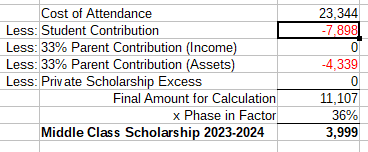

My kids both received substantial middle class grants from our State this year, re: attending in-state public Universities.

I've tried to look this up (how to ballpark or estimate) in the past, but it's so complicated and depends on so many factors. Primarily, how many students are eligible. Because then funds are divided among eligible students.

So my mind was just blown when I figured it out. 🤯 I just had to dig a little deeper.

Side note: It appears that the kids' assets are not being counted in this formula.

There's other parts to the formula, but calculations below are just what was applicable for our personal situation.

This is how the calculation went for the 2023-2024 school year.

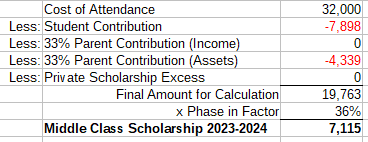

MM(20)

Note: The cost of attendance is a ridiculous number that we do not pay. $20K is a more accurate number. $10K for tuition, $12K for housing, and maybe save $2K here at home re: less utilities and food costs. Eating is not a college expense. In this case, MM(20) spends way less on food at college than at home, so that is a cost savings for us. (& utility savings might be a few pennies on top of that.)

& all students are expected to be able to contribute the $7,898 re: part-time or summer work.

DL(18)

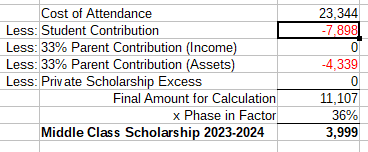

Note: The cost of attendance is a ridiculous number that we do not pay. We paid $8,000 tuition and DL(18) has some increased transportation costs with the daily commute to the college. The rest is food/housing allocated to 'students who live with parents', plus $3,000 misc. personal spending (nope).

I guess the key is the 'Phase In Factor' and is decided every year based on the budget. For now, the best I can presume is that the phase in factor will remain the same for 2024-2025. There is a lower 24% factor being used to estimate financial aid for 2024-2025. So that is the number the kids will get from their colleges. & then they eventually finalize this % later in the year. I am going to use 36% (same as this year) as a rough estimate of the actual dollar amount. It does not sound like the State has the budget to bump up this grant again next year. Which is completely fine with me. We are getting to a tipping point where more grant money means less college tax credits. So it's all kind of the same in the end, for us.

In the end, it looks like grant numbers will likely be the same next school year, unless CA budget numbers radically change that %. & of course, MM(20)'s grant might be a big fat $0 (if the decide he is already a senior, based on their methodology). I do not count on anything, but it's just nice to have a better idea how all of this is calculated.

I now understand that DL(18)'s grant is smaller because he is living at home. (& also because his college tacks on less fees). & I now know that it doesn't matter if either kid starts piling up assets (re: working or gifts). & I confirmed that there is no '2 in college at the same time' adjustment for this particular grant (re: our personal situation).

I also had no idea how much assets were penalizing us. I knew we were on the lower end of this income scale, so the $0 income adjustment makes sense. For the assets, we are penalized $140 for every $10K we add. I guess technically $280 (x2) while we have two kids in college. It would clearly be pointless to have less assets. That's less assets generating interest and stock market gains. & of course, if we didn't have the assets, then we'd be tapping retirement funds or taking higher interest loans, etc., to pay for college. Clearly we are better off just having *more* assets.

I keep distinguishing the middle class grants because we knew it was pointless to plan for any (need-based) financial aid re: middle middle class income and in-state public colleges (very low cost). That has gone as expected, but the middle class grants have gotten a big boost in the years since MM(20) started college. It could end up being a $40K windfall (roughly $20K per kid). & that is a really nice surprise.

Side note: MM(20) did get a nice one-year merit scholarship from his college. I've since been told that is not a thing. It was apparently a bit of a unicorn. Just to add to the, "Well that was unexpected," which sums up all of my kids' financial aid.

The next chapter: If I ever get to blogging about it. I found out in the Fall that MM(20) is probably eligible for food stamps. $300 per month! We are going to apply this weekend. Obviously should have applied sooner, but we are both in disbelief about it. Not 100% sure, but will just have to apply and see what happens. (Would have applied sooner if I knew 100% for sure that he was eligible.) These are also benefits being extended to the middle class.

Edited to add: Note to self: The new FASFA form does not ask if a student plans to live with parents. Just read somewhere it's up to the school to get that information and report it for our middle class grant? Something I will need to keep on top of when DL(18) moves out. Will want to make sure we get the extra grant dollars if we are paying for rent.

Posted in

Just Thinking,

College

|

1 Comments »

March 23rd, 2024 at 01:51 pm

I wanted to repost this because have had a lot of questions in recent years about things addressed in the past.

Our Big Picture feelings about college, per 2017 post:

https://monkeymama.savingadvice.com/2017/03/29/college_211895/

Of course, I could see how it would be interesting to update how things have shaped up, 7 years later.

We both agree that we expect the kids to work significantly during high school and college, that our own financial health comes first, and that we don't want to borrow a penny for college. We don't want them to graduate with any student loan debt. We are willing to help our kids in any way we can as long as we are within these parameters.

2024 Update: Tried to be open minded, but couldn't ignore the 'cost pennies colleges that everyone recruits from'. Both our kids ended up different State colleges, but are basically the third generation in our family to take advantage.

Our kids aren't working as much as we envisioned. One thing I don't think I said in this particular blog post was that our city has generally always been terrible on the employment front, and I of course recognize that an engineering degree might take more commitment than our business degrees did. That said, I think the pandemic is mostly what torpedoed my kids teenage working years. MH and I were very much, "You don't need a teen job around crowds of people." But also, there is an element of the kids not needing to work. MM(20) had a couple of strong working summers and has $10K+ saved up. With his grandparents helping, I feel very *shrugs* about him not working at all in 2023. DL(18) is a little further behind the curve and probably more impacted by the pandemic.

I think the point of my original post is we expected our kids to work and contribute. (Wasn't planning to buy them cars and pay for all their college expenses). But with grandparents giving them this gifted college fund and helping them, has bought them a lot of freedom not to work. I personally don't have any problem with it. I wouldn't personally just do all the work and pay for everything, but if the grandparents want to do that, more power to them.

Both my kids announced this winter that they were bored and they intended to work this school year. MM(20) wants to do all the things and so it took him 2+ years to get settled and figure out his priorities. But he knew he would have a lot of time in winter and spring quarter. I forwarded him an internship opportunity (for this summer) that pays $40/hour. If he could land that, he could make $10K in 6 weeks. Something like that. I am all for "working smarter, not harder". DL(18), I strongly encouraged to not work in the fall, to ease into college. He has thrived his first semester of college and he announced towards the end of fall semester that he was bored and could definitely work. He might not be able to find a low hours job (like an on campus job) until next fall. He did find a temp job and made about $1,300 this year already. I will feel a lot better about DL(18) once he finds a steady job and has enough savings to buy a car.

We personally have not tied up this money (re: gifted college funds) in college type funds because we don't have any incentive to. We would rather have free use of the money. We don't have a big enough income, but I do have enough tax knowledge, to not bother with 529 plans or other college savings options. To be clear, we are not paying any taxes on these investment gains. So we don't need the trade-off of extra hoops to jump through for tax breaks that we don't need.

Along the same lines, MH and I both used our "college money" for a home down payment instead. In a state where college cost pennies and housing costs are sky high, I think it seems very likely our kids will experience the same. So I don't want to be penalized for tying up their gift money for college when they more likely will use it for post-college housing. Ideally, we'd actually really like to pay it forward and save this in-law money to give them as a lump sum *after* college. I don't know if we will be able to swing it, but this is what we would like to do. & if we can't, we definitely want to do something like this for our grandkids. (I think if it was not for the in-law money, this would just be a "pay it forward to grandkids" goal).

2024 Update: DL(18) is currently on the 'living at home' plan and on track to use 100% of this college money after college. As of today, I think MM(20) might have $5K or $10K left after getting a 5-year degree. Very likely $0. He chose a much more extravagant college experience (5 hours away, in paradise). & even DL(18), who knows. The kid I thought maybe would never get more than a AA degree, he told me the other day he might want a PhD. He might find a way to use his $30K for college. I do have their gifted college funds parked in cash, while we expect to use all of the funds (MM) and while DL's plans are still so up in the air. We can talk about longer term plans for this money as longer term plans crystalize.

In 2014 we were in a position to start putting money away into taxable investment accounts again (in addition to fully funding IRAs). I guess college is the only goal at this point, besides retirement. Though I don't consider this *all* to be college money, it is certainly accessible if we need it for college. We are putting away about $7,500 per year. I think matching the in-law college money is a good place to start. It probably works out too that we will probably get there in another couple of years. At that point we may just back off and figure that $40,000/each is a phenomenal start. I think we'd probably most likely just focus on cash flowing the rest (if there is anything left to cash flow).

2024 Update: For MM(20), we've had a lot of windfalls to help with his rent. Pandemic funds and unemployment covered his first year of rent. & the in-laws have been giving us some gift money after they received an inheritance.

Our investments ended up getting to $40K and we have earmarked all of this money for college. Won't necessarily use it all, but have it earmarked for now ($20K per kid, to cover rent). I lost my job in 2018 and took a big pay cut, but also gained a work retirement plan. So we stopped adding to taxable investments (and was not able to match the gifted funds, which ended up being $30K per kid). I only added snowflakes (credit card rewards) 2018-2022. The money did get a big boost when I put it in I Bonds for much of 2022-2023. We turned $40K into $45K (while keeping the principal safe). I don't know if anything has ever come that financially easy to us. It seems there's always some obstacle or headwind, so I am really delighting being in the right place at the right time, just having this wad of cash for I Bonds when interest rates were nearing 10%.

I was able to resume (more significant) taxable investing in 2023. Our investment account just hit $10K. After saving for college, I wanted to save up $10K for MM(20)'s jaw surgery and related round of ortho. I didn't feel comfortable crossing off his college as 'done and paid for' until we had this covered. Not that it is a college expense, but it's a final expense we wanted to cover for him before he flies the nest. So I am eyeing this $10K and wondering if I should just call it. But I will wait for MM's grant to sort out his senior year (still not sure about that) and will wait for his lease to be finalized and to have real numbers. By the end of the year I should have a plan and/or be able to call it.

Edit: With the I Bond gains, the kids ended up with about $53K/each. Which yes, was a phenomenal start. That's $30K gifted funds ($1K per year, built up up over time), and $23K (our investments 2014 -2018 --> cash --> I Bonds --> back to cash). DL's money is completey untouched, as mentioned. But I have started to spend down MM's money from this $53K peak.

& to be clear, the investment account is up to $10K after completely starting over. (I can see that wasn't clear when I typed that out). 'College' money is all in cash. But we have been able to resume adding to taxable investments (more than just snowflakes) in the past year.

Since I worked my way through college, I think the idea of MH working + kids working seems easiest on some level (would be a LOT of cash that we could put towards college). But, I think the "saving ahead" is important just because you never know. Relying on future income streams is a little outside of my comfort zone. So while some part of me thinks that "cash flowing with several jobs" is really the most obvious and the easiest, we always have a Plan A + Plan B + Plan C, etc.

2024 Update: Plan A is working out pretty nicely. I mean, I am happy to have the "saved ahead" I Bond money too. But also, we are hitting some of our highest income years while our kids are in college, and so that is going pretty well. I stand by my decision not to divert large amounts of assets to college savings (or anything at all when my kids were very young). We started saving when we had the money and are mostly cash flowing with higher income during these college years.

Note: We are mostly using 'saved ahead' money to pay for MM's tuition/room/board (the more expensive college) while we have two in college at the same time.

We did also park extra money in ROTHs that we have never touched (starting when the kids were babies). I never would have put that much money in retirement otherwise, but was okay with it knowing we could use this money for college. I would have also been fine lowering retirement savings during these college years. Plan B was always, "We don't have to mega save for retirement".

Final thought: I've already said this many times before, but is worth mentioning. We planned for full sticker price (roughly $30K) for the State colleges. These college tax credits and middle class grants did not exist when I went to college and I never counted on any of this money. The grants and credits will bring the net cost of MM(20)'s degree down to about $15K and DL's degree will cost $5K (or maybe $15K if he takes 5 years). This is just a nice surprise that we did not plan for.

Also, I don't expect to be saving any more money for college after 2024. I think we will move on to other financial goals because we will be DONE.

Posted in

Just Thinking,

College

|

2 Comments »

March 11th, 2024 at 03:45 am

I've revised MM's estimated college costs, below. I also kept the old numbers (to the right), for reference.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$10,000 5th Year Tuition/Fees

-12,000 Tax credits (-10,000)

-21,000 CA middle class grants (-13,000)

- 6,000 Scholarship

---------

$13,000 Net cost ($23,000)

**I added in MM's $1K summer school class

I won't believe it until I see it, but I now believe that MM's 5th year will be entirely paid for with state funds and tax credits.

So, I just completed the kids' FASFAs for next school year (was delayed this year due to major revisions; I waited for all the kinks to work out before I bothered with it.) I logged into DL's account to make sure his GPA was reported by his high school.

I am still so confused because MM(20)'s state grant changed from '3 years' to '4 years' at some point. It was expected he would only get 3 years of grants re: college credits he went into college yet. He was already considered a sophomore when he started college (per state grant measures, but he would need a minimum of 4 college years to complete an engineering degree).

So I asked MM(20) to double check today while we had a video call. (He set up his own account; I don't have access). I also needed his college tax form, so was just taking care of business. It is still very clearly showing that he will get a middle class grant next year (Year 4). He told me that he is pretty sure that changed when he made his double major official (end of last school year). Which is *why* he is taking a 5th college year. So, wait. This means his 5th year will cost $0! If that's the reason and this is true, that is pretty sweet. I mean, he's getting a whole free year out of the deal of adding one more year of college.

I am still skeptical and will believe it when the money hits our account.

I also (at some point) crunched the numbers on a Year 5 college tax credit and it was a lot more than I expected. A full $2,000. & so I also added that to my estimate, and that will bring the net Year 5 cost down to $0.

In the end, net tuition/fees will be the same difference, if it takes 4 or 5 years.

I will have to check if MM(20) anticipates taking any more summer classes.

Posted in

Just Thinking,

College

|

0 Comments »

March 10th, 2024 at 05:39 pm

It's a fun weekend of taxes and FASFA. It would feel good to get these things done, but just cleaning up my own stuff before tackling everyone else's taxes. The calendar is pretty empty this month and so wanted to get these chores done, but I don't have any of the in-laws' tax stuff. So that will spill into April and be a little hectic.

MM(20) has his "Martha Stewart" girlfriend back. She has way too much time on her hands (without school and work) and this was the menu for last week: egg salad, vegetable sandwiches with hummus and tapenade & fries, mashed white beans with chili fried eggs and toast, french onion soup, rigatoni with red wine sauce & focaccia bread, California rolls, tofu cutlets with rice and veggies. That's what she shared. She has been cooking 2-3 meals every day. She is just delighting in feeling 1,000 times better. She could barely stand (too weak) when I saw her two weeks ago. I think she is blessed to have another 3 weeks to build up muscle/strenght before school starts up again, but not sure she even needs that at this point. She is planning to come home the next two weeks (all her friends will be busy with finals) and we will very likely be the recipient of some of her cooking/baking.

DL(18) asked me last night if we could invite his friend to camp again, this summer. MH and I were kind of *shrugs* though we'd probably have to ask the in-laws to drive up our sleeping bags. I thought maybe the last time we took this friend was the last year we had the van, but DL(18) said it was 2019 and I confirmed. We are small car people and I couldn't even tell you why we had a van. We mostly did not use it (too much of a gas guzzler). I mean, we usually chose our small car (the gas sipper) for road trips. & this means a lot of people were bugging me how we would ever survive without the van (we live in SUV land). I felt very *shrugs* about it, because we always drove as little as possible. (I can probably count on one or two hands how many times we actually found it useful to have a minivan). So it's funny to think back the one time we packed 5 people in our vehicle for camp, it was just one of our small cars. But the kids were a little smaller. In contrast, I guess we didn't have to drive DL(18) last year and I was delighting in being able to bring a mattress. It's a little tiny thing but it's not going to fit with the 5 of us. I will 1000% send that ahead with the in-laws.

The girlfriend has been asking to go to camp too (for 1 or 2 years) but we said no. My niece didn't want the competition for time with her cousins. But I think we will let it go this year. This is the "final" year that my in-laws are paying for the trip. My MIL is just about 80. I give her one big gold star. I don't know that I will be offering to rough it in the woods when I am 80. 😁 I think it's more than fair that their time is done. I am happy to take over paying for these trips if the kids still want to go. Or if not, I'd like to rent a house in the woods every summer, something like that. Pay it forward to our kids in some manner. In addition to recognizing the value in the annual tradition.

I did have a small hesitation about bringing the one friend, re: cost. I feel about 90% "this is important and cost doesn't matter." But there's that 10% "Ugh" if we are going to save any money this year. For some reason I thought it would be $2,000 to bring two guests. ??? Which would be no big deal except for you know, the roughly $2,000 we just spent on Pasadena & Sketchfest, and the $3,000 we just spent getting MH's movie made, and so on.

I looked it up today and it is $329 to add one person to the trip. $1,000 was roughly the cost of the whole family, when kids were smaller. Which felt like a bajillion dollars when my kids were small, but feels very, "That's it?" today. But that's why I had $1,000 stuck in my head.

DL(18) reminded me it was 2019 the last year we took his friend. I think that explains the Ugh feelings I had about it. x1 it was a no brainer and we paid for his friend. But that was when I took that big pay cut. I literally make 40% more today (salary). That one year was just a particularly tight year. $329 x2 we can easily handle, and won't be a big drain on MH's income or savings goals this year. Phew!

Inviting the girlfriend also gives us more car room. I don't know where we could park a second car though, so will have to check ahead of time. I mean, I am sure we can figure something out.

It's going to be a fun camp year, & it's also fun looking forward to new traditions.

Posted in

Just Thinking

|

0 Comments »

March 8th, 2024 at 02:41 pm

This is a Part 2 re: my last post. Realized I should have mentioned this with that post.

I am enjoying actually making interest on our cash. The 'Gifted College Fund' interest covered all of MM's college expenses during his junior year.

Interest received this school year: $950

Net Tuition Paid (after tax credits): $743

Class supplies purchased separately: $185

In the end, interest will roughly equal costs this school year.

(I actually skipped a $241 reimbursement, I think in December when I got my work bonus. So I only deducted $687 from college fund this school year.)

We didn't pull any expenses from the college fund freshman year. (We didn't intend to, but I think our net cost was $0 that year.) We pulled out $5,000 to cover Sophomore year expenses (we had less middle class grants & scholarships that year). $20,000 remains in this college fund.

I expect that MM(20) will have $0 left when he is done with college. His state grants are probably exhausted (this is still very unclear, but likely those funds will dry up). & he's added a 5th year, so will be a couple of roughly $10K years of paying full tuition. He understands that his choice to pay 5 years of rent in a high cost region, this means that he will not have any (gifted) funds left at the end. Choosing a very affordable State college still has many benefits, like MM(20) not having to work at all. Or us feeling *shrugs* about the 5th year.

Note: I have no plans to touch DL(18)'s gifted college fund, as long as he is living at home and paying roughly $1K per year tuition. If not used for college, it's his money to do whatever he wants with it.

Posted in

Just Thinking,

College

|

4 Comments »

March 6th, 2024 at 04:42 pm

The last week (er, two weeks) have been a whirlind. Mostly good things. MM(20) visited for dinner Friday night (over one week ago), we went to GMIL's 99th birthday party that Saturday, and MH got home from his trip that Sunday night. I paid off the travel credit card bill. We ended up using exactly that $3K gift money to cover the cost. (The goal was to cover a chunk of the costs. It's just gravy that it covered everything.) More details later, if I ever have any time. I had family visiting from the mid-west and MH needed to help his GMIL with a new computer, so we were in the Bay Area this past weekend.

I've got 2023-2024 college year mostly wrapped up. I mentioned (re: annual goals) that this won't be a big college expense year.

DL(20) received his state financial aid check/refund last week. So now I have a better idea the flow of things. Refunds arrive 11/1 & 3/1, roughly.

I received a $2,000 refund (spring semester) from DL's college and a $1,074 bill (spring quarter) from MM's college on the same day. I paid MM's tuition and checked off on my side bar that his third year is done and paid for.

Note: $2,000 is the net I should owe for DL's fall semester. Will just park the money in savings to cover the rest of his college expenses this calendar year. In the short run, the $2K will let me cash flow MM's tuition before I reimburse myself from various buckets. This semester thing is a lot more simple than the quarter thing.

For MM's tuition, I am cash flowing the tax credit ($833, or 1/3 tax credit). I have the benefit of reduced taxes, to pay this portion of tuition. The remaining $241 I will pull from MM's gifted college fund.

I did also cash out two of the I Bonds (end of 2023) and am able to reimburse myself monthly for MM(20)'s rent. We have never had more than a roughly 1% interest rate (or some promo deals on smaller amounts of savings) during our adulthood. I more viewed the I Bonds as an investment (that was mega interest for a while). Turned maybe $20K of savings into $22K+ for MM's college expenses (woohoo)! But now that I am cashing that out, I am really enjoying having some decent interest rates on our cash. Any incidental college expenses that MM(20) has at this point should just be covered by interest. This is also how I am funding his utilities. I am leaning towards just hiring a cleaner (with this interest money) when MM's lease ends.

In other news. Very cautiously optimistic but... It sounds like the girlfriend is bouncing back? She told me that she unexpectedly felt well for a whole 5 days and that she was traveling to visit MM(20) for a couple of days. She is doing so well that those 'couple of days' has turned into 2 weeks. MM was just telling me she extended her stay so that she could go down to LA and visit her cousin's baby or something like that. I had no idea if they found some underlying condition (had more answers), found meds that worked, or what happened. I spoke to MM(20) a couple of days ago and he told me that she is just getting better, as they said would happen. They just didn't know if it would take months or years. My recollection is that she has been down for 5 months. It sounds like she is putting this chapter behind her.

Posted in

Just Thinking,

College

|

1 Comments »

March 1st, 2024 at 12:32 am

Apparently I gave up monthly updates in November. That tracks. My employer went on a weeks-long Europe trip in December and so the 'worst deadline' (the least forgiving) was shortened by a couple of weeks. 😩 Had to get everything done by 12/15 instead of 12/31. Since then, it's just the 'tax season' flow of my job, everyone's medical dramas, and mostly being out of town.

I just wanted to jot down miles (it's easy to reference here) but didn't realize how far I would need to go back.

Hybrid Miles Driven:

Nov - 590

Dec - 1,694 (LA Trip)

Jan - 490

Feb - 218

February Note: I mostly drove the EV while MH was out of town. I prefer my car in some ways and I prefer his car in some ways. But the fuel is a heck of a lot cheaper in the EV. I use gas miles in the winter months ($$$$) when the EV range isn't quite enough (in the hybrid). I drove my car once a week while MH was gone, to avoid a dead battery or other problems.

We had some free miles on our LA trip, but I haven't been keeping track.

Electric (EV) Miles Driven:

Nov - 593

Dec - 951

Jan - 1,501

Feb - 1,045

Note: 75 Free EV miles in February.

A year or two ago MH set up 'auto charge' with EVGo. All of the chargers can be finicky, but with the 'auto charge' you can just drive up and plug in your car. It will recognize the car and charge your credit card. MH is not a big EVGo fan, so I don't know if we had ever tried it. I asked MH if he thought this would work on my account but he told me that when he set it up he could only link the car to one (his) account.

DL(18) and I went to the Bay Area for GMIL's 99th birthday last weekend. I was delighted to see that there was an EVGo right near the restaurant (on the same street) and they had 10 chargers. I always prefer the 8-10 chargers. There's just always a working charger in those cases. & maybe helps when you don't have a navigator/helper to check ahead of time what chargers are open (I didn't have MH and wasn't going to bother DL with this). The whole thing sounded pretty easy but I had a couple of other options in mind if this location didn't work out. I couldn't tell you why but *no one* was using these chargers, while other chargers were largely in-use in this tech-y city. I was pleased how easy the whole thing was.

After all that, there was a mystery $10 credit on MH's EVGo account and so the charge was free. I looked up on my account but I did not get the mystery credit. Which just made it more of a mystery. But it was a nice surprise.

Posted in

Just Thinking,

Electric Vehicle (EV)

|

0 Comments »

February 21st, 2024 at 04:31 pm

Movie production expenses = $130. Most of that was buying sympathy flowers for someone on the cast or crew. Purchases had died off for a while but a $20 purchase showed up yesterday and MH confirmed it was for props.

Eating out = $274

That's for 18 out of 22 days. Well on track with the $500 gift money we allocated for food. MH has skipped a couple of meals (due to time) and has been treated out to a few meals.

Everyone is getting tired and tensions are rising. MH is trying to smooth things over. That seems to be how his role is shaping up. But as people are venting to him, they are paying for his meals. It's not anything major but just seems to be getting worse as people are more exhausted.

Transportation: $20

Unchanged and this is probably all that he will spend.

Everything continues to be going pretty well on the movie set. 🤞🏼

Total movie investment: $6,000

We set aside $3,000 gift money to cover the hotel, airfare and all of the above. We invested $2,000 cash. & MH will lose ~$1,000 of wages re: time off.

As of today, feeling like it's very much worth it. Still don't have any expectation of making any of this money back. (Too many things would have to still go right.) To this point, things have gone as well as could possibly be and we are feeling very happy with this investment. If nothing else comes of it, it was an amazing opportunity.

Posted in

Just Thinking

|

2 Comments »

February 19th, 2024 at 02:56 pm

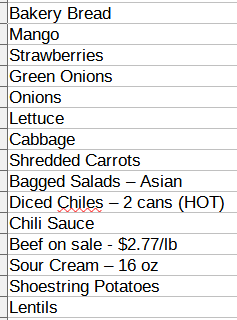

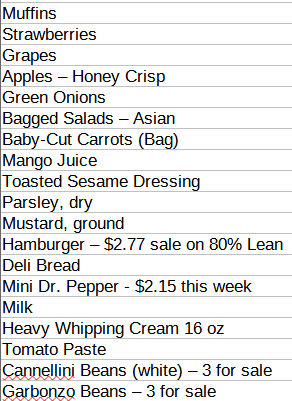

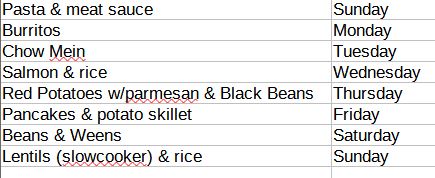

DL(18) baked potatoes Thursday night and I made black bean wraps on Friday night. I made 5 wraps. DL ate 4. I might make again on another night. Saturday I baked some parmesan red potatoes and ate the 1/8 cup or whatever of rice left. That's when I realized the black bean wraps were gone. It worked out because I wasn't that hungry and DL had Chipotle (his friend took him out). DL ate all his curry and the fridge is getting empty. I suppose his appetite is also ramping up. He just wasn't hungry at all when he was sick. As I type this out, I realize he is probably just resuming a more normal appetite. This may be the only reason I got away with not cooking anything most of last week.

DL(18) told me he is not sick of lentils, that he doesn't care for beef, and he really loves fish. So I decided to add salmon to the menu this week. I told him that kind of screws up my meatloaf plan but he said he was fine with the meatloaf. I just don't know how many leftovers of that he will eat.

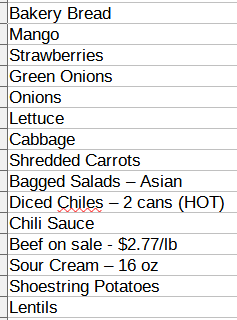

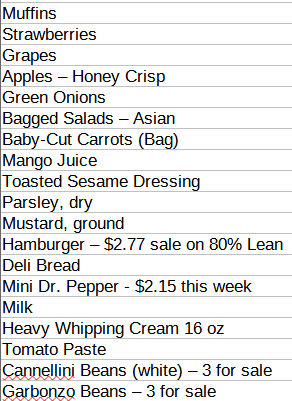

I made a grocery list. I picked two of my favorite recipes and added lentils back to the list. It was definitely a "turn off my brain" kind of week re: planning but also willing to dip my toe into recipes I have not made much.

Sunday - Mini meat loaves & mashed potatoes (with horseradish and chili sauce)

& will cook up some hambuger patties with the third pound (to the freezer)

Monday - Thai Chicken (basically a chicken noodle salad)

Wednesday - Salmon & rice (per DL request)

Friday - Indian Spiced Lentils (for MM to eat this weekend and to take home). & maybe black bean wraps, baked potatoes or baked cabbage

Saturday - baked potatoes or black bean wraps for lunch? (We all have various dinner plans/parties that night)

I've got some ideas for Sunday/Monday night. MH will be back but won't be in any shape to cook. I might just go back to the store Wednesday to pick up the salmon and some canned food (beans and corn) for our crockpot chili. Maybe I won't even need to grocery shop next weekend. I will try to get us through next Monday night and then will pass the baton back to MH.

Both my kids are leaning more vegetarian over time. I checked in with MM(20) and I was surprised he wouldn't eat the salmon. That is new. So I will try to have some vegetarian options for him. We have a lot of meatless recipes but the lentils is the only thing I can come up with (off the top of my head) that makes a lot. Enough to keep MM satiated. If he's only going to eat one meal with us, that should suffice. I was relieved when DL(18) told me he would welcome another batch of lentils, too. & that is one other thing that MH will be happy to eat when he gets home Sunday. But anyway, MM(20) will be home and grazing and constantly hungry, so will have some other filler foods if he needs. & I just love roasted cabbage so it's a good excuse to make. It would be way too much for just DL and I. But with MM here, we might get through a whole head of cabbage.

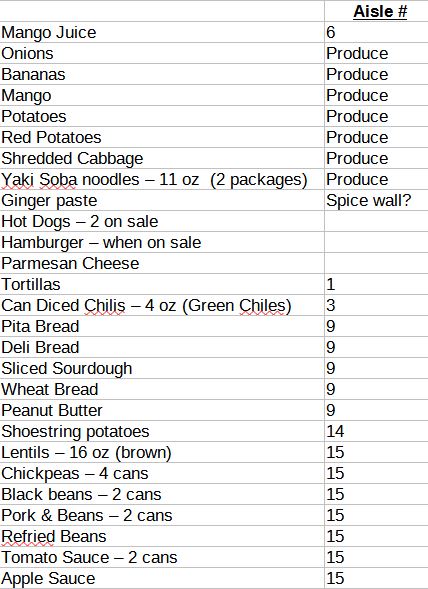

Here is my grocery list for today:

The store had no Asian salads whatsoever last week, so will try again.

I will pick up some beef if I can find the unicorn of beef on sale. Just feeling optimistic enough to put it on the list, after last week. If not, I won't worry about about it.

Update: