|

|

|

|

You are viewing: Main Page

|

|

April 21st, 2024 at 03:16 pm

I guess this is largely a MM(20) money update.

I thought we would go over MM's cash during winter break, but he ended up not having much of a break. I am surprised he still has any cash available, but he's been in extreme low spend mode and just stretching that $1K annual gift (using for spending money during college years). We touched base during his spring break. I think he had maybe ~$1,200 easily accessible cash. He was very *shrugs* about it, just needs it to last 3 months.

MM(20) did decide that he was probably going to cash out some or all of his I Bonds. But we decided to just wait and see what the next interest rate would be. & we left it that he will need to open a new bank account this summer (to park extra cash).

I just happened to notice two things last week:

1 - I Bond rate set for 2.97% inflation rate next round.

2 - One of our CUs is paying 5.5% interest.

The CU account is a mega interest account that was paying 4% when the average high yield interest rate was 1%. It's fallen behind in recent months, but that 5.5% is perfect for MM(20) to park his I Bond funds. The catch on this 'mega interest' account was that the cap was $5K for the mega interest.

I can't even tell you why I checked, but maybe it's just because it's been so long since either of us has kept a full $5K in these accounts... I figured I'd double check (if my memory was correct) and... The 5.50% is on the first $10K!

Note: We've already moved our own money over to take advantage of $10K @ 5.5%.

I let MM(20) know. He is cashing out his I Bond and moving most of that to his CU account. When all is said and done, he will have $10K earning 5.5%, $500 earning 7% (another CU), and $1,500 left in his checking account. Maybe only $1,000 left after a few more months of college spending. He will want to figure out a higher-balance high yield savings account at some point, but won't be necessary until he gets a job and starts piling up more money.

In other news, MM(20) has had his rental figured out for next year, for a while, but was still negotiating the cost of the bedroom he will be renting. I guess he got that sorted out and he told me it will be $808/month. He will be saving $42/month, for a much bigger room and nicer neighborhood.

Somewhat related, we need to cash out the rest of our I Bonds. I have been dragging my feet because I got used to the easy separate buckets of money. But I think I've only really been allocating this money to the kids 50/50 (in my mind) while it was doled out 50/50 into separate I Bonds. The truth is that this is a '2 in college at the same time' fund. I just needed a little time to wrap my brain around it. I am thinking about loosely earmarking $20K for future DL(18) rent expenses. & then earmarking the rest to MM(20). I would earmark all of the mega I Bond interest to MM(20). & also all future interest to MM(20), who is currently paying rent. This is very simplistic and easy to keep track of. I really only care about keeping the $20K for DL(18) if he is moving out this summer/fall (and if we are paying two years of rent for two college kids at the same time). So if we end up falling a little short, this $20K is money we can probably tap if MM(20) needs it. (At current, DL has no plans to move out.)

I wasn't sure if we would pay for MM(20)'s 5th year of college rent. We left it as a bridge to cross later. I wanted to give him ample notice if we expected him to chip in. But at the same time, wanted to give it some more time to see how things sorted out. He did his part. He's done a good job keeping rent costs down. I suppose when I tell him we are going to pay for the rent, will have to clarify that we can cover rent 'at this rent level'. (We also found out his 5th year of tuition will be free, because adding the 5th year is giving him a 4th year grant. I could just pull the 5th year of rent from his gifted college fund, if I wanted or needed to. Now that we expect he might have anything left in there).

MM(20)'s current lease ends in July and I think the new lease starts August 1? But he will be able to store his stuff there in the meantime. MM(20) expects to stay at this house his last 2 years of college. With everyone I know who rents being constantly kicked out by selling landlords... I would never presume he could actually stay there 2 years. But it would be nice if it works out. Just my past experience re: sky high real estate. It doesn't help that home sales just went from 0 to 100 overnight. But I would have laughed at the idea of counting on this rental for 2 years, regardless. We can only hope that it is that easy.

Posted in

Just Thinking,

College

|

1 Comments »

April 19th, 2024 at 03:26 pm

We did the traditional ‘after busy season time off and hike’. But this time was a little different. For the first time in 7? years I didn’t just look up the easiest hike I could find. I mean, the hike was labeled “easy”, I guess because of not a *lot* of elevation gain. But after about a mile uphill, it did kick my butt. MH’s job is way more physical and he seemed less bothered by it. But he very heartily disagreed with the “easy” assessment. It was a 4 mile hike with a lot of uphill. And… It was just perfect. It is exactly what I needed. I like that it was a bit more of a challenge, while being relatively easy. & I probably would not have been up to that during several years of recent ‘survival mode'.

This morning I bought some hiking shoes, which should help. I’d like to go back and redo with some better footwear. & I am over this “once per year” hike schedule. I’ve decided that at a minimum we need to be doing a hike at least once every month.

We do really need to take more advantage while our fuel costs pennies. Not sure how long that will last. Thinking to hitting more Bay Area and Tahoe hikes. Last year I realized that we had extra freedom with MH done with the whole 'driving the kids to school' thing. In addition to that, I do work from home one day per week. I'd like to maybe once or twice a month hit an afternoon hike. If it's easier for me to leave at 2 or 3. I think we left closer to 3:00 for this hike and I was surprised how empty the parking lot was (both before and after our hike). I expected more of an 'after work' crowd.

Here are some pictures from our hike yesterday. This is only 30 minutes from our house.

I’ve done a good mix of relaxing and crossing things off my to do list, this week off work. I feel I have both the physical and the mental energy to get things done. While my time has skewed maybe 80% - 90% towards just relaxing. It’s been a good balance.

In other news... I was not supposed to know this but MM(20) is engagement ring shopping. MH and I got engaged when we were both 19, which was weird in our day. Have got a lot of questions why we bothered to get engaged if we didn't plan to get married until after college. (& it was just plain weird to get married in our early 20s). I presumed that MM(20) and his girlfriend are not in any rush. They are certainly taking their sweet time. I am not surprised at all that they plan to eventually get married. But it is a big surprise that they are ring shopping.

The only reason I know is because the GF is going halvsies on the ring and she gave a chunk of money to MM(20). I thought it was rent/utility related. I am just trying to figure out how much I owe the kid for utilities. So I asked him about it. He got really uncomfortable and I thought, "Ugh, I don't want to know." So I started to tell him, nevermind. But by the time I changed course, he had already admitted it was for an engagement ring.

What!?

Kudos to the girlfriend for getting MM to buy a $1,200 ring! (This is what I presume, re: her $600 contribution). She thinks it's cute that he is an extreme cheapskate. It is not cute, and it will get old. So I am relieved he can at least spend money on important things. Not that I think a ring is important. But you know, people first. Then money, then things. It's the "people first" part that I think he's wise to oblige.

Admittedly, there could be a YOLO aspect re: girlfriend's recent health problems. I presume they won't get married until after college, but who knows. The girlfriend is *amazing* and a very welcome addition to the family.

Posted in

Just Thinking,

Picture Project,

Vacation Lifestyle

|

2 Comments »

March 30th, 2024 at 03:03 am

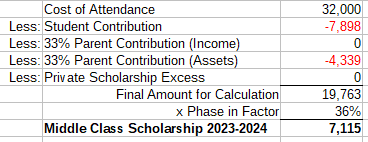

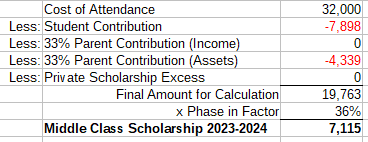

My kids both received substantial middle class grants from our State this year, re: attending in-state public Universities.

I've tried to look this up (how to ballpark or estimate) in the past, but it's so complicated and depends on so many factors. Primarily, how many students are eligible. Because then funds are divided among eligible students.

So my mind was just blown when I figured it out. 🤯 I just had to dig a little deeper.

Side note: It appears that the kids' assets are not being counted in this formula.

There's other parts to the formula, but calculations below are just what was applicable for our personal situation.

This is how the calculation went for the 2023-2024 school year.

MM(20)

Note: The cost of attendance is a ridiculous number that we do not pay. $20K is a more accurate number. $10K for tuition, $12K for housing, and maybe save $2K here at home re: less utilities and food costs. Eating is not a college expense. In this case, MM(20) spends way less on food at college than at home, so that is a cost savings for us. (& utility savings might be a few pennies on top of that.)

& all students are expected to be able to contribute the $7,898 re: part-time or summer work.

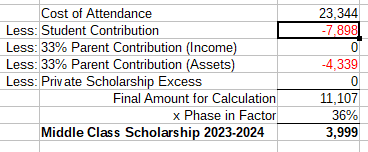

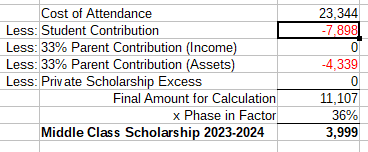

DL(18)

Note: The cost of attendance is a ridiculous number that we do not pay. We paid $8,000 tuition and DL(18) has some increased transportation costs with the daily commute to the college. The rest is food/housing allocated to 'students who live with parents', plus $3,000 misc. personal spending (nope).

I guess the key is the 'Phase In Factor' and is decided every year based on the budget. For now, the best I can presume is that the phase in factor will remain the same for 2024-2025. There is a lower 24% factor being used to estimate financial aid for 2024-2025. So that is the number the kids will get from their colleges. & then they eventually finalize this % later in the year. I am going to use 36% (same as this year) as a rough estimate of the actual dollar amount. It does not sound like the State has the budget to bump up this grant again next year. Which is completely fine with me. We are getting to a tipping point where more grant money means less college tax credits. So it's all kind of the same in the end, for us.

In the end, it looks like grant numbers will likely be the same next school year, unless CA budget numbers radically change that %. & of course, MM(20)'s grant might be a big fat $0 (if the decide he is already a senior, based on their methodology). I do not count on anything, but it's just nice to have a better idea how all of this is calculated.

I now understand that DL(18)'s grant is smaller because he is living at home. (& also because his college tacks on less fees). & I now know that it doesn't matter if either kid starts piling up assets (re: working or gifts). & I confirmed that there is no '2 in college at the same time' adjustment for this particular grant (re: our personal situation).

I also had no idea how much assets were penalizing us. I knew we were on the lower end of this income scale, so the $0 income adjustment makes sense. For the assets, we are penalized $140 for every $10K we add. I guess technically $280 (x2) while we have two kids in college. It would clearly be pointless to have less assets. That's less assets generating interest and stock market gains. & of course, if we didn't have the assets, then we'd be tapping retirement funds or taking higher interest loans, etc., to pay for college. Clearly we are better off just having *more* assets.

I keep distinguishing the middle class grants because we knew it was pointless to plan for any (need-based) financial aid re: middle middle class income and in-state public colleges (very low cost). That has gone as expected, but the middle class grants have gotten a big boost in the years since MM(20) started college. It could end up being a $40K windfall (roughly $20K per kid). & that is a really nice surprise.

Side note: MM(20) did get a nice one-year merit scholarship from his college. I've since been told that is not a thing. It was apparently a bit of a unicorn. Just to add to the, "Well that was unexpected," which sums up all of my kids' financial aid.

The next chapter: If I ever get to blogging about it. I found out in the Fall that MM(20) is probably eligible for food stamps. $300 per month! We are going to apply this weekend. Obviously should have applied sooner, but we are both in disbelief about it. Not 100% sure, but will just have to apply and see what happens. (Would have applied sooner if I knew 100% for sure that he was eligible.) These are also benefits being extended to the middle class.

Edited to add: Note to self: The new FASFA form does not ask if a student plans to live with parents. Just read somewhere it's up to the school to get that information and report it for our middle class grant? Something I will need to keep on top of when DL(18) moves out. Will want to make sure we get the extra grant dollars if we are paying for rent.

Posted in

Just Thinking,

College

|

1 Comments »

March 23rd, 2024 at 01:51 pm

I wanted to repost this because have had a lot of questions in recent years about things addressed in the past.

Our Big Picture feelings about college, per 2017 post:

https://monkeymama.savingadvice.com/2017/03/29/college_211895/

Of course, I could see how it would be interesting to update how things have shaped up, 7 years later.

We both agree that we expect the kids to work significantly during high school and college, that our own financial health comes first, and that we don't want to borrow a penny for college. We don't want them to graduate with any student loan debt. We are willing to help our kids in any way we can as long as we are within these parameters.

2024 Update: Tried to be open minded, but couldn't ignore the 'cost pennies colleges that everyone recruits from'. Both our kids ended up different State colleges, but are basically the third generation in our family to take advantage.

Our kids aren't working as much as we envisioned. One thing I don't think I said in this particular blog post was that our city has generally always been terrible on the employment front, and I of course recognize that an engineering degree might take more commitment than our business degrees did. That said, I think the pandemic is mostly what torpedoed my kids teenage working years. MH and I were very much, "You don't need a teen job around crowds of people." But also, there is an element of the kids not needing to work. MM(20) had a couple of strong working summers and has $10K+ saved up. With his grandparents helping, I feel very *shrugs* about him not working at all in 2023. DL(18) is a little further behind the curve and probably more impacted by the pandemic.

I think the point of my original post is we expected our kids to work and contribute. (Wasn't planning to buy them cars and pay for all their college expenses). But with grandparents giving them this gifted college fund and helping them, has bought them a lot of freedom not to work. I personally don't have any problem with it. I wouldn't personally just do all the work and pay for everything, but if the grandparents want to do that, more power to them.

Both my kids announced this winter that they were bored and they intended to work this school year. MM(20) wants to do all the things and so it took him 2+ years to get settled and figure out his priorities. But he knew he would have a lot of time in winter and spring quarter. I forwarded him an internship opportunity (for this summer) that pays $40/hour. If he could land that, he could make $10K in 6 weeks. Something like that. I am all for "working smarter, not harder". DL(18), I strongly encouraged to not work in the fall, to ease into college. He has thrived his first semester of college and he announced towards the end of fall semester that he was bored and could definitely work. He might not be able to find a low hours job (like an on campus job) until next fall. He did find a temp job and made about $1,300 this year already. I will feel a lot better about DL(18) once he finds a steady job and has enough savings to buy a car.

We personally have not tied up this money (re: gifted college funds) in college type funds because we don't have any incentive to. We would rather have free use of the money. We don't have a big enough income, but I do have enough tax knowledge, to not bother with 529 plans or other college savings options. To be clear, we are not paying any taxes on these investment gains. So we don't need the trade-off of extra hoops to jump through for tax breaks that we don't need.

Along the same lines, MH and I both used our "college money" for a home down payment instead. In a state where college cost pennies and housing costs are sky high, I think it seems very likely our kids will experience the same. So I don't want to be penalized for tying up their gift money for college when they more likely will use it for post-college housing. Ideally, we'd actually really like to pay it forward and save this in-law money to give them as a lump sum *after* college. I don't know if we will be able to swing it, but this is what we would like to do. & if we can't, we definitely want to do something like this for our grandkids. (I think if it was not for the in-law money, this would just be a "pay it forward to grandkids" goal).

2024 Update: DL(18) is currently on the 'living at home' plan and on track to use 100% of this college money after college. As of today, I think MM(20) might have $5K or $10K left after getting a 5-year degree. Very likely $0. He chose a much more extravagant college experience (5 hours away, in paradise). & even DL(18), who knows. The kid I thought maybe would never get more than a AA degree, he told me the other day he might want a PhD. He might find a way to use his $30K for college. I do have their gifted college funds parked in cash, while we expect to use all of the funds (MM) and while DL's plans are still so up in the air. We can talk about longer term plans for this money as longer term plans crystalize.

In 2014 we were in a position to start putting money away into taxable investment accounts again (in addition to fully funding IRAs). I guess college is the only goal at this point, besides retirement. Though I don't consider this *all* to be college money, it is certainly accessible if we need it for college. We are putting away about $7,500 per year. I think matching the in-law college money is a good place to start. It probably works out too that we will probably get there in another couple of years. At that point we may just back off and figure that $40,000/each is a phenomenal start. I think we'd probably most likely just focus on cash flowing the rest (if there is anything left to cash flow).

2024 Update: For MM(20), we've had a lot of windfalls to help with his rent. Pandemic funds and unemployment covered his first year of rent. & the in-laws have been giving us some gift money after they received an inheritance.

Our investments ended up getting to $40K and we have earmarked all of this money for college. Won't necessarily use it all, but have it earmarked for now ($20K per kid, to cover rent). I lost my job in 2018 and took a big pay cut, but also gained a work retirement plan. So we stopped adding to taxable investments (and was not able to match the gifted funds, which ended up being $30K per kid). I only added snowflakes (credit card rewards) 2018-2022. The money did get a big boost when I put it in I Bonds for much of 2022-2023. We turned $40K into $45K (while keeping the principal safe). I don't know if anything has ever come that financially easy to us. It seems there's always some obstacle or headwind, so I am really delighting being in the right place at the right time, just having this wad of cash for I Bonds when interest rates were nearing 10%.

I was able to resume (more significant) taxable investing in 2023. Our investment account just hit $10K. After saving for college, I wanted to save up $10K for MM(20)'s jaw surgery and related round of ortho. I didn't feel comfortable crossing off his college as 'done and paid for' until we had this covered. Not that it is a college expense, but it's a final expense we wanted to cover for him before he flies the nest. So I am eyeing this $10K and wondering if I should just call it. But I will wait for MM's grant to sort out his senior year (still not sure about that) and will wait for his lease to be finalized and to have real numbers. By the end of the year I should have a plan and/or be able to call it.

Edit: With the I Bond gains, the kids ended up with about $53K/each. Which yes, was a phenomenal start. That's $30K gifted funds ($1K per year, built up up over time), and $23K (our investments 2014 -2018 --> cash --> I Bonds --> back to cash). DL's money is completey untouched, as mentioned. But I have started to spend down MM's money from this $53K peak.

& to be clear, the investment account is up to $10K after completely starting over. (I can see that wasn't clear when I typed that out). 'College' money is all in cash. But we have been able to resume adding to taxable investments (more than just snowflakes) in the past year.

Since I worked my way through college, I think the idea of MH working + kids working seems easiest on some level (would be a LOT of cash that we could put towards college). But, I think the "saving ahead" is important just because you never know. Relying on future income streams is a little outside of my comfort zone. So while some part of me thinks that "cash flowing with several jobs" is really the most obvious and the easiest, we always have a Plan A + Plan B + Plan C, etc.

2024 Update: Plan A is working out pretty nicely. I mean, I am happy to have the "saved ahead" I Bond money too. But also, we are hitting some of our highest income years while our kids are in college, and so that is going pretty well. I stand by my decision not to divert large amounts of assets to college savings (or anything at all when my kids were very young). We started saving when we had the money and are mostly cash flowing with higher income during these college years.

Note: We are mostly using 'saved ahead' money to pay for MM's tuition/room/board (the more expensive college) while we have two in college at the same time.

We did also park extra money in ROTHs that we have never touched (starting when the kids were babies). I never would have put that much money in retirement otherwise, but was okay with it knowing we could use this money for college. I would have also been fine lowering retirement savings during these college years. Plan B was always, "We don't have to mega save for retirement".

Final thought: I've already said this many times before, but is worth mentioning. We planned for full sticker price (roughly $30K) for the State colleges. These college tax credits and middle class grants did not exist when I went to college and I never counted on any of this money. The grants and credits will bring the net cost of MM(20)'s degree down to about $15K and DL's degree will cost $5K (or maybe $15K if he takes 5 years). This is just a nice surprise that we did not plan for.

Also, I don't expect to be saving any more money for college after 2024. I think we will move on to other financial goals because we will be DONE.

Posted in

Just Thinking,

College

|

2 Comments »

March 11th, 2024 at 03:45 am

I've revised MM's estimated college costs, below. I also kept the old numbers (to the right), for reference.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$10,000 5th Year Tuition/Fees

-12,000 Tax credits (-10,000)

-21,000 CA middle class grants (-13,000)

- 6,000 Scholarship

---------

$13,000 Net cost ($23,000)

**I added in MM's $1K summer school class

I won't believe it until I see it, but I now believe that MM's 5th year will be entirely paid for with state funds and tax credits.

So, I just completed the kids' FASFAs for next school year (was delayed this year due to major revisions; I waited for all the kinks to work out before I bothered with it.) I logged into DL's account to make sure his GPA was reported by his high school.

I am still so confused because MM(20)'s state grant changed from '3 years' to '4 years' at some point. It was expected he would only get 3 years of grants re: college credits he went into college yet. He was already considered a sophomore when he started college (per state grant measures, but he would need a minimum of 4 college years to complete an engineering degree).

So I asked MM(20) to double check today while we had a video call. (He set up his own account; I don't have access). I also needed his college tax form, so was just taking care of business. It is still very clearly showing that he will get a middle class grant next year (Year 4). He told me that he is pretty sure that changed when he made his double major official (end of last school year). Which is *why* he is taking a 5th college year. So, wait. This means his 5th year will cost $0! If that's the reason and this is true, that is pretty sweet. I mean, he's getting a whole free year out of the deal of adding one more year of college.

I am still skeptical and will believe it when the money hits our account.

I also (at some point) crunched the numbers on a Year 5 college tax credit and it was a lot more than I expected. A full $2,000. & so I also added that to my estimate, and that will bring the net Year 5 cost down to $0.

In the end, net tuition/fees will be the same difference, if it takes 4 or 5 years.

I will have to check if MM(20) anticipates taking any more summer classes.

Posted in

Just Thinking,

College

|

0 Comments »

March 10th, 2024 at 05:39 pm

It's a fun weekend of taxes and FASFA. It would feel good to get these things done, but just cleaning up my own stuff before tackling everyone else's taxes. The calendar is pretty empty this month and so wanted to get these chores done, but I don't have any of the in-laws' tax stuff. So that will spill into April and be a little hectic.

MM(20) has his "Martha Stewart" girlfriend back. She has way too much time on her hands (without school and work) and this was the menu for last week: egg salad, vegetable sandwiches with hummus and tapenade & fries, mashed white beans with chili fried eggs and toast, french onion soup, rigatoni with red wine sauce & focaccia bread, California rolls, tofu cutlets with rice and veggies. That's what she shared. She has been cooking 2-3 meals every day. She is just delighting in feeling 1,000 times better. She could barely stand (too weak) when I saw her two weeks ago. I think she is blessed to have another 3 weeks to build up muscle/strenght before school starts up again, but not sure she even needs that at this point. She is planning to come home the next two weeks (all her friends will be busy with finals) and we will very likely be the recipient of some of her cooking/baking.

DL(18) asked me last night if we could invite his friend to camp again, this summer. MH and I were kind of *shrugs* though we'd probably have to ask the in-laws to drive up our sleeping bags. I thought maybe the last time we took this friend was the last year we had the van, but DL(18) said it was 2019 and I confirmed. We are small car people and I couldn't even tell you why we had a van. We mostly did not use it (too much of a gas guzzler). I mean, we usually chose our small car (the gas sipper) for road trips. & this means a lot of people were bugging me how we would ever survive without the van (we live in SUV land). I felt very *shrugs* about it, because we always drove as little as possible. (I can probably count on one or two hands how many times we actually found it useful to have a minivan). So it's funny to think back the one time we packed 5 people in our vehicle for camp, it was just one of our small cars. But the kids were a little smaller. In contrast, I guess we didn't have to drive DL(18) last year and I was delighting in being able to bring a mattress. It's a little tiny thing but it's not going to fit with the 5 of us. I will 1000% send that ahead with the in-laws.

The girlfriend has been asking to go to camp too (for 1 or 2 years) but we said no. My niece didn't want the competition for time with her cousins. But I think we will let it go this year. This is the "final" year that my in-laws are paying for the trip. My MIL is just about 80. I give her one big gold star. I don't know that I will be offering to rough it in the woods when I am 80. 😁 I think it's more than fair that their time is done. I am happy to take over paying for these trips if the kids still want to go. Or if not, I'd like to rent a house in the woods every summer, something like that. Pay it forward to our kids in some manner. In addition to recognizing the value in the annual tradition.

I did have a small hesitation about bringing the one friend, re: cost. I feel about 90% "this is important and cost doesn't matter." But there's that 10% "Ugh" if we are going to save any money this year. For some reason I thought it would be $2,000 to bring two guests. ??? Which would be no big deal except for you know, the roughly $2,000 we just spent on Pasadena & Sketchfest, and the $3,000 we just spent getting MH's movie made, and so on.

I looked it up today and it is $329 to add one person to the trip. $1,000 was roughly the cost of the whole family, when kids were smaller. Which felt like a bajillion dollars when my kids were small, but feels very, "That's it?" today. But that's why I had $1,000 stuck in my head.

DL(18) reminded me it was 2019 the last year we took his friend. I think that explains the Ugh feelings I had about it. x1 it was a no brainer and we paid for his friend. But that was when I took that big pay cut. I literally make 40% more today (salary). That one year was just a particularly tight year. $329 x2 we can easily handle, and won't be a big drain on MH's income or savings goals this year. Phew!

Inviting the girlfriend also gives us more car room. I don't know where we could park a second car though, so will have to check ahead of time. I mean, I am sure we can figure something out.

It's going to be a fun camp year, & it's also fun looking forward to new traditions.

Posted in

Just Thinking

|

0 Comments »

March 8th, 2024 at 02:41 pm

This is a Part 2 re: my last post. Realized I should have mentioned this with that post.

I am enjoying actually making interest on our cash. The 'Gifted College Fund' interest covered all of MM's college expenses during his junior year.

Interest received this school year: $950

Net Tuition Paid (after tax credits): $743

Class supplies purchased separately: $185

In the end, interest will roughly equal costs this school year.

(I actually skipped a $241 reimbursement, I think in December when I got my work bonus. So I only deducted $687 from college fund this school year.)

We didn't pull any expenses from the college fund freshman year. (We didn't intend to, but I think our net cost was $0 that year.) We pulled out $5,000 to cover Sophomore year expenses (we had less middle class grants & scholarships that year). $20,000 remains in this college fund.

I expect that MM(20) will have $0 left when he is done with college. His state grants are probably exhausted (this is still very unclear, but likely those funds will dry up). & he's added a 5th year, so will be a couple of roughly $10K years of paying full tuition. He understands that his choice to pay 5 years of rent in a high cost region, this means that he will not have any (gifted) funds left at the end. Choosing a very affordable State college still has many benefits, like MM(20) not having to work at all. Or us feeling *shrugs* about the 5th year.

Note: I have no plans to touch DL(18)'s gifted college fund, as long as he is living at home and paying roughly $1K per year tuition. If not used for college, it's his money to do whatever he wants with it.

Posted in

Just Thinking,

College

|

4 Comments »

March 6th, 2024 at 04:42 pm

The last week (er, two weeks) have been a whirlind. Mostly good things. MM(20) visited for dinner Friday night (over one week ago), we went to GMIL's 99th birthday party that Saturday, and MH got home from his trip that Sunday night. I paid off the travel credit card bill. We ended up using exactly that $3K gift money to cover the cost. (The goal was to cover a chunk of the costs. It's just gravy that it covered everything.) More details later, if I ever have any time. I had family visiting from the mid-west and MH needed to help his GMIL with a new computer, so we were in the Bay Area this past weekend.

I've got 2023-2024 college year mostly wrapped up. I mentioned (re: annual goals) that this won't be a big college expense year.

DL(20) received his state financial aid check/refund last week. So now I have a better idea the flow of things. Refunds arrive 11/1 & 3/1, roughly.

I received a $2,000 refund (spring semester) from DL's college and a $1,074 bill (spring quarter) from MM's college on the same day. I paid MM's tuition and checked off on my side bar that his third year is done and paid for.

Note: $2,000 is the net I should owe for DL's fall semester. Will just park the money in savings to cover the rest of his college expenses this calendar year. In the short run, the $2K will let me cash flow MM's tuition before I reimburse myself from various buckets. This semester thing is a lot more simple than the quarter thing.

For MM's tuition, I am cash flowing the tax credit ($833, or 1/3 tax credit). I have the benefit of reduced taxes, to pay this portion of tuition. The remaining $241 I will pull from MM's gifted college fund.

I did also cash out two of the I Bonds (end of 2023) and am able to reimburse myself monthly for MM(20)'s rent. We have never had more than a roughly 1% interest rate (or some promo deals on smaller amounts of savings) during our adulthood. I more viewed the I Bonds as an investment (that was mega interest for a while). Turned maybe $20K of savings into $22K+ for MM's college expenses (woohoo)! But now that I am cashing that out, I am really enjoying having some decent interest rates on our cash. Any incidental college expenses that MM(20) has at this point should just be covered by interest. This is also how I am funding his utilities. I am leaning towards just hiring a cleaner (with this interest money) when MM's lease ends.

In other news. Very cautiously optimistic but... It sounds like the girlfriend is bouncing back? She told me that she unexpectedly felt well for a whole 5 days and that she was traveling to visit MM(20) for a couple of days. She is doing so well that those 'couple of days' has turned into 2 weeks. MM was just telling me she extended her stay so that she could go down to LA and visit her cousin's baby or something like that. I had no idea if they found some underlying condition (had more answers), found meds that worked, or what happened. I spoke to MM(20) a couple of days ago and he told me that she is just getting better, as they said would happen. They just didn't know if it would take months or years. My recollection is that she has been down for 5 months. It sounds like she is putting this chapter behind her.

Posted in

Just Thinking,

College

|

1 Comments »

March 1st, 2024 at 12:32 am

Apparently I gave up monthly updates in November. That tracks. My employer went on a weeks-long Europe trip in December and so the 'worst deadline' (the least forgiving) was shortened by a couple of weeks. 😩 Had to get everything done by 12/15 instead of 12/31. Since then, it's just the 'tax season' flow of my job, everyone's medical dramas, and mostly being out of town.

I just wanted to jot down miles (it's easy to reference here) but didn't realize how far I would need to go back.

Hybrid Miles Driven:

Nov - 590

Dec - 1,694 (LA Trip)

Jan - 490

Feb - 218

February Note: I mostly drove the EV while MH was out of town. I prefer my car in some ways and I prefer his car in some ways. But the fuel is a heck of a lot cheaper in the EV. I use gas miles in the winter months ($$$$) when the EV range isn't quite enough (in the hybrid). I drove my car once a week while MH was gone, to avoid a dead battery or other problems.

We had some free miles on our LA trip, but I haven't been keeping track.

Electric (EV) Miles Driven:

Nov - 593

Dec - 951

Jan - 1,501

Feb - 1,045

Note: 75 Free EV miles in February.

A year or two ago MH set up 'auto charge' with EVGo. All of the chargers can be finicky, but with the 'auto charge' you can just drive up and plug in your car. It will recognize the car and charge your credit card. MH is not a big EVGo fan, so I don't know if we had ever tried it. I asked MH if he thought this would work on my account but he told me that when he set it up he could only link the car to one (his) account.

DL(18) and I went to the Bay Area for GMIL's 99th birthday last weekend. I was delighted to see that there was an EVGo right near the restaurant (on the same street) and they had 10 chargers. I always prefer the 8-10 chargers. There's just always a working charger in those cases. & maybe helps when you don't have a navigator/helper to check ahead of time what chargers are open (I didn't have MH and wasn't going to bother DL with this). The whole thing sounded pretty easy but I had a couple of other options in mind if this location didn't work out. I couldn't tell you why but *no one* was using these chargers, while other chargers were largely in-use in this tech-y city. I was pleased how easy the whole thing was.

After all that, there was a mystery $10 credit on MH's EVGo account and so the charge was free. I looked up on my account but I did not get the mystery credit. Which just made it more of a mystery. But it was a nice surprise.

Posted in

Just Thinking,

Electric Vehicle (EV)

|

0 Comments »

February 21st, 2024 at 04:31 pm

Movie production expenses = $130. Most of that was buying sympathy flowers for someone on the cast or crew. Purchases had died off for a while but a $20 purchase showed up yesterday and MH confirmed it was for props.

Eating out = $274

That's for 18 out of 22 days. Well on track with the $500 gift money we allocated for food. MH has skipped a couple of meals (due to time) and has been treated out to a few meals.

Everyone is getting tired and tensions are rising. MH is trying to smooth things over. That seems to be how his role is shaping up. But as people are venting to him, they are paying for his meals. It's not anything major but just seems to be getting worse as people are more exhausted.

Transportation: $20

Unchanged and this is probably all that he will spend.

Everything continues to be going pretty well on the movie set. 🤞🏼

Total movie investment: $6,000

We set aside $3,000 gift money to cover the hotel, airfare and all of the above. We invested $2,000 cash. & MH will lose ~$1,000 of wages re: time off.

As of today, feeling like it's very much worth it. Still don't have any expectation of making any of this money back. (Too many things would have to still go right.) To this point, things have gone as well as could possibly be and we are feeling very happy with this investment. If nothing else comes of it, it was an amazing opportunity.

Posted in

Just Thinking

|

3 Comments »

February 19th, 2024 at 02:56 pm

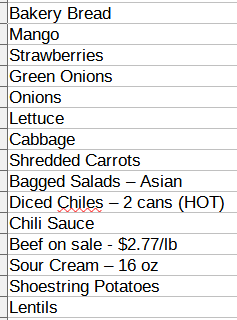

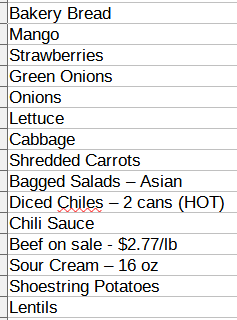

DL(18) baked potatoes Thursday night and I made black bean wraps on Friday night. I made 5 wraps. DL ate 4. I might make again on another night. Saturday I baked some parmesan red potatoes and ate the 1/8 cup or whatever of rice left. That's when I realized the black bean wraps were gone. It worked out because I wasn't that hungry and DL had Chipotle (his friend took him out). DL ate all his curry and the fridge is getting empty. I suppose his appetite is also ramping up. He just wasn't hungry at all when he was sick. As I type this out, I realize he is probably just resuming a more normal appetite. This may be the only reason I got away with not cooking anything most of last week.

DL(18) told me he is not sick of lentils, that he doesn't care for beef, and he really loves fish. So I decided to add salmon to the menu this week. I told him that kind of screws up my meatloaf plan but he said he was fine with the meatloaf. I just don't know how many leftovers of that he will eat.

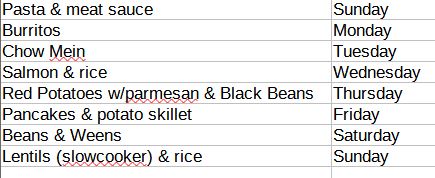

I made a grocery list. I picked two of my favorite recipes and added lentils back to the list. It was definitely a "turn off my brain" kind of week re: planning but also willing to dip my toe into recipes I have not made much.

Sunday - Mini meat loaves & mashed potatoes (with horseradish and chili sauce)

& will cook up some hambuger patties with the third pound (to the freezer)

Monday - Thai Chicken (basically a chicken noodle salad)

Wednesday - Salmon & rice (per DL request)

Friday - Indian Spiced Lentils (for MM to eat this weekend and to take home). & maybe black bean wraps, baked potatoes or baked cabbage

Saturday - baked potatoes or black bean wraps for lunch? (We all have various dinner plans/parties that night)

I've got some ideas for Sunday/Monday night. MH will be back but won't be in any shape to cook. I might just go back to the store Wednesday to pick up the salmon and some canned food (beans and corn) for our crockpot chili. Maybe I won't even need to grocery shop next weekend. I will try to get us through next Monday night and then will pass the baton back to MH.

Both my kids are leaning more vegetarian over time. I checked in with MM(20) and I was surprised he wouldn't eat the salmon. That is new. So I will try to have some vegetarian options for him. We have a lot of meatless recipes but the lentils is the only thing I can come up with (off the top of my head) that makes a lot. Enough to keep MM satiated. If he's only going to eat one meal with us, that should suffice. I was relieved when DL(18) told me he would welcome another batch of lentils, too. & that is one other thing that MH will be happy to eat when he gets home Sunday. But anyway, MM(20) will be home and grazing and constantly hungry, so will have some other filler foods if he needs. & I just love roasted cabbage so it's a good excuse to make. It would be way too much for just DL and I. But with MM here, we might get through a whole head of cabbage.

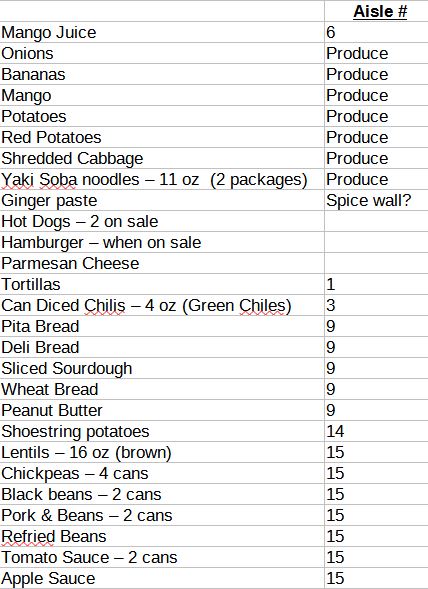

Here is my grocery list for today:

The store had no Asian salads whatsoever last week, so will try again.

I will pick up some beef if I can find the unicorn of beef on sale. Just feeling optimistic enough to put it on the list, after last week. If not, I won't worry about about it.

Update:

I spent $73 at the grocery store. It was a pretty light grocery run. But I found more beef! Salads were well stocked today so DL(18) will be happy. My one splurge was some sort of red cake balls. They were in the 50%-off Valentine section. They looked decadent and everything else was kind of "meh" (or just too over-priced, even at 50% off). I then quickly saw (the one package) was in the wrong place. They were red but I guess they weren't keen on taking 50% off of those. I decided to keep them in my cart. I will probably just end up taking them to work. It was $10 but I figured whatever, because I have one less mouth to feed this month.

Totaly grocery/household spending February: $657 out of $850 budget. (Note: includes some movie purchases that I have just absorbed in grocery budget.)

Really the only thing on my list is some canned beans and corn (for chili) and the salmon. I will presume that I have $43 to spend on Wednesday. (I don't think I will spend that much, but will see what comes up.) That leaves $150, if I want to pick up a few more things next weekend or if MH wants to do a grocery run. Even if MH picks up some groceries, I presume it would just be to get through 4 days (through March 1). But I don't know what he may find lacking, when he gets home. I can see my shopping tapering off as I am well stocked with the things that I like.

Edited to add: I just checked the chili recipe; we have everything on hand except kidney beans. I chose it because it's a simple crockpot recipe (that I've maybe made once or twice). I didn't realize it was such a 'using what we already have' recipe. (Side note: the secret ingredient in this recipe is salsa). When I checked to see if we had any kidney beans, I found a stash of granola bars. I set out a couple of boxes that DL(18) will probably appreciate. It wasn't on my radar because I can't eat crunchy/hard food right now (re: ortho treatment). DL(18) didn't care enough to add to the shopping list, but he will eat them.

Posted in

Just Thinking

|

1 Comments »

February 17th, 2024 at 04:40 pm

2024 TALLY:

$782 Capital One Venture (Moi)

------------

$782 TOTAL *ONE-TIME REWARDS*

**In addition, various monthly rewards that I will tally at 12/31

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

We hit the $4K spend on this credit card and so the bonus appeared shortly after. It took just under 2 months. I charged two months of health insurance, one airplane ticket, and one hotel week. I wasn't thinking about it and didn't realize the hotel would charge in smaller chunks. It looks like they are charging one week at a time. It just happened to be enough to hit the bonus. I was otherwise planning to charge some car insurance. We have a couple of more months but I wanted to earn the reward in time to pay for the hotel.

There is a $95 fee on the card, but we spent enough we earned other reward points (more than just the $750 bonus). The other rewards so far offset the fee. The total tally will probably be another $40, bringing the total reward closer to $800 (net) on this card.

I had applied $45 rewards to airfare. Was able to apply $800 rewards to the $800 hotel charge. Minus $95 fee = $750 Net.

One reason we are doing so well on movie budget/spending is that the original plan was that I was going to fly out too. I think it's official that I will not bother. MH might get some time off tomorrow but is otherwise working 15-hour days. He skipped dinner the other night because he needed sleep more than food. Anyway, tomorrow is his only day off and the weather took a cold turn in Ohio. It's for the best. I really need the 3-Day weekend to regroup at home.

Note: Edited to add $32 more rewards (re: final hotel charges)

Posted in

Just Thinking,

Credit Card & Bank Rewards

|

0 Comments »

February 16th, 2024 at 03:32 pm

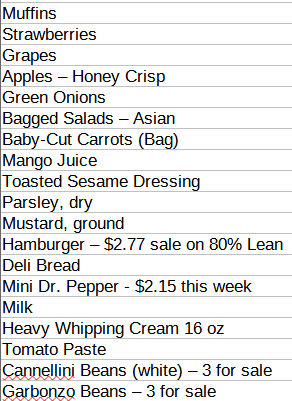

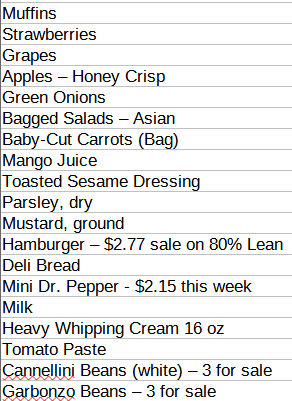

I had some time to breathe Wednesday. 🙄 Work, chores, drama. Work, chores, drama. That's how the weekend went, and so I completely gave up on any grocery shopping.

I got past a big work deadline Tuesday. & I was determined to come up with a shopping list that night.

Menu plan: Not much planned. I thought I'd be eating burritos for days (should get through that). As I wrapped up for bed Tuesday night, I saw that DL(18) ate *all* the burritos. So that's like 4 my-sized servings I don't have to get to. Anyway, before that I was just planning to make black bean wraps on Thursday. & maybe have DL(18) make baked potatoes on Friday. That is still the plan. (I ended up being too tired to do any dishes or cooking on Wednesday night.)

DL(18) is feeling a lot better, so he made a big batch of curry. He's into some rice and beans curry thing.

Shopping List:

Pretty much everything on the list is stuff we ran out of, expired, or that DL(18) requested. Just trying to break shopping out into smaller chunks.

& a cough suppressant for DL. I think I forgot to write that down, was a last minute add to the list.

I will get some muffins or something, to get us through the week. Dr. Pepper is my thing, will grab while it is on sale.

I grabbed the mail Monday and ground beef was supposed to be on sale with a digital coupon (per sales ad) but I couldn't find this sale or coupon anywhere online. Which is fine. I will ask MH about that before the weekend shop. We don't need any meat but I will buy more if it is on mega sale.

I am looking forward to the 3-day weekend. I can tell now that I am mostly going to give up and just keep it simple that last week. But would like to put some more thought into grocery/meal planning next week, more than I was able to this week.

Grocery final results: My 'smaller run' ended up being $108 (with tax).

I could have sworn that sales prices changes Monday or Tuesday, and I checked the date on the mailer. But it ended up confusing because some of the sales I was looking at had changed between menu planning and shopping. MH forwarded me the sales/coupons Wednesday morning and I saw the beef deal and confirmed he had clipped that coupon. Of course, the beef is always cleared out when it's under $3/pound. So I got lucky that they even had any.

I went to the bakery first and picked up some fresh sourdough and some garlic parmesan craft butter. This seemed extremely decadent. Because I went off list with basically my first purchase, I *felt* like I was very "off list" this shopping trip. But I looked through the receipt and I guess that was the only thing. It was a $7 splurge. It's just so funny psychologically to feel like I was splurging too much, but I had MH in my head because he would never spend $5 on craft butter. & he is wrong. O.M.G. It was so good...

Oh wait, I did also pick up some yogurt. It was on sale and it will still be on sale this weekend. But I thought DL(18) might appreciate because he has been eating through the yogurt. Okay, I feel better that there was something else (to make me feel like I was way off list). I think that was it.

I suppose next week's shop has the potential to be lighter too, because we are all stocked up through this Wednesday. Just 3 more days to run out of more stuff, and I don't have any major cooking planned. The theme next week will clearly be ground beef. Was already thinking of making a 2-pound meatloaf (that makes a lot of leftovers). Accordingly, I just put the 3 pounds of meat in the freezer. Instead of separating it into pounds like we usually do. So I guess I am committing to that. I can always make some hamburger patties and freeze for later (pound #3) if the idea of cooking more meat sounds "meh". So yeah, pretty much stocked up and have more meat than we can possibly need for the next 2 weeks. (Still have all that chicken in the freezer, plus whatever beef MH had already bought on mega sale last month). I might just focus on shopping for meals this weekend and can do a produce/snack run mid-week.

Off the top of my head, meatloaf on Sunday and am thinking of making Thai chicken on Monday. (Wanted to make at least one chicken dish; this is one of my favorites). Thursday or Friday will try to find a big vegetarian meal because MM(20) will be home this weekend. If nothing else I can make lentils again and send him home with the leftovers. (That ended up being so simple and YUM). & the next Saturday and Sunday I will try to make a couple of meals that MH likes.

I think the above is more than ample. Black bean wraps (tonight) will last us a couple of days. Will have a lot of meat and chicken leftovers for the work week. & then can start ramping up food when MM(20) is home and for when MH gets home. MM will probably just eat one meal with us (Friday night). But if I do the big batch of lentils thing, it will give him some food to take back with him. I usually don't like everything that MH cooks and am used to eating more sandwiches and scrounging for food. I will scale back next week. There's always deli sandwiches or pancakes or whatever if I do not make enough meals. We have some deli meat that we need to get through. Not that I expect to get to any of that with all these planned leftovers, but I will err on not planning any meals Tues/Wed/Thurs. Which I guess is the same as what we did this week. DL(18) ended up baking potatoes on Thursday. That can be another filler meal. That might be a good request for next Friday night (he's got some new technique that is very good). I'd need to get more potatoes because MM(20) thinks that 3 or 4 potatoes is a serving.

Posted in

Just Thinking

|

0 Comments »

February 14th, 2024 at 03:36 pm

Just going through the credit cards and seeing where we are at.

I am throwing the little convenience store type purchases into 'groceries'. A - I don't have to feed MH from grocery budget this month. B - I have no idea if these charges or for him or for production. Though it sounds like all of these purchases have been for the movie so far. Total movie expenses absorbed in grocery budget = $12.

Movie production expenses = $108. Most of that was buying sympathy flowers for someone on the cast or crew.

Eating out = $208

That's for 11 out of 22 days. Well on track with the $500 gift money we allocated for food. I'd be fine if MH went over this and we had to tap grocery budget or vacation budget. But... MH is being cheap. On the plus side, he told me that someone's mom is home cooking meals for the movie set, so he is pretty happy with that. He's getting breakfast at the hotel and some sort of food most days. I think he is very happy with the quality of food on set (he had very low expectations; doesn't care for pizza or convenience foods.) But if he is still buying a meal out every night (at midnight), I can see that he's not happy with the quantity of food.

Transportation: $20

MH's sister visited last weekend and apparently he paid for an Uber. He had a day off to go out and about. He also met my sister for dinner. I am just realizing that my sister clearly paid for that. Which sounds fair. (If MH is the one paying ~$3,000 to be in their neck of the woods.) MH won't have any time to meet them again and I am surprised my sister even showed up for the one dinner.

I think the producer insisted on picking MH up from the airport and my BIL is going to drive him back to the airport.

Hotel

MH finally got someone to take him up on the couch bed offer. He has some actor staying with him this week. Will see how that goes.

I hadn't thought about it but the hotel is charging chunks over time, re: extended hotel stay. Makes sense. This is perfect because they charged just enough for our $750 travel reward. The Hotel charged something like $800. I should be able to offset with the $750 reward, before the amount is due.

At this point, I'd say we can probably manage all of the expenses with our $3K gift money + $750 credit card reward. (Will likely pay $2K for the hotel, $500 for airfare/transportation & $500 for food). Didn't really expect that, but am happy that spending has been so minimal. I can probably absorb the movie expenses in our budget. I told MH the $5 here and there was not bothering me at all and of course we can cover that (don't want to bother to try to get reimbursed with money that doesn't exist). & I told him I was cool with the flowers if it wasn't every day. Anyway, that $108 and whatever else, can just absorb in our grocery budget probably. Or can just land in the 'MH is not home spending any money whatsoever' budget space.

Everything has been going pretty well on the movie set. 🤞🏼

Lord knows I don't have any time to spend money. It's all just work, chores, drama over here. I know I am not as efficient of a shopper/cooker and I have a lot of sick expenses for the sickie. Picking him up some cough medicine today. But also, I have not had time to spend $1 otherwise, so there is also that.

Posted in

Just Thinking

|

0 Comments »

February 11th, 2024 at 08:14 pm

Overall, no idea what to expect this month. It's going to be a weird one.

I think MH should mostly be fed on set. Though he doesn't expect to be well fed and we presumed he would buy dinner every night at the hotel restaurant.

In theory, I'd expect to spend less on food at home. But we are already up to $450 spent on groceries this month. This amount includes MM's monthly grocery allowance. & MH did a grocery shop around the last day of January. We had spent the January grocery budget and I think some of that was to stock up before he left, so that is also why it is so high already. I just pushed it to February, presuming it would be a lower spend month with only 3 people to feed.

Note: This includes $208 groceries purchased this week so far.

On Monday MH encouraged me to go to the store to pick up chicken on sale. My first reaction was, "Like hell." This was going to be a work hell week and I was scrambling to meet a deadline. In addition to adding all the cooking and dishes to my plate. But I finally decided a work break would be nice, to save a bajillion dollars. Chicken was $14 for 2.5 pounds. Bought on sale for $5. Bought 3 packages. Spent $15, saved $27.

I refused to let MH cook ahead for us. DL(18) is the more picky one who does his own thing a lot of the time. & MH always makes way too much food when he does that. But he's insisting on going through the sales and clipping the electronic coupons or whatever. I personally made my grocery list before looking at the sales, and there wasn't anything that swayed me or looked interesting. Except I noticed we were due a free cake mix, so I picked that up. & I guess MH will remind me if random one-day deals pop up. He had got some email about the chicken.

Shopping List:

Notes on shopping list: It's an unusual shopping list because I can't eat any hard food re: ortho treatment. So it's skewed to the softer side of things.

Clearly MM(20) eats most of the bread. We struggle not to waste bread, without him. But anyway, all the bread was old and stale and so I started anew.

The grocery run was $150. I ended up picking some other produce and breakfast pastries.

Menu Plan:

With the busy work week, I just turned off my brain and went with all the stuff I can make in my sleep. I might want to try new recipes or dig out stuff MH doesn't care for as much, during the next couple of weeks.

I started with burritos (old family recipe) because it makes a lot of leftovers (for lunch during the week, or if I want to skip a night of cooking.) I don't think I have ever made the crockpot lentil recipe but it makes a *lot* of leftovers.

Note: We don't generally eat out. So there is no eating out expected or planned.

Things went askew on Tuesday. DL(18) ended up sick on Tuesday and requested a bag salad from the store. I picked up a couple and I grabbed some popsicles while I was there. (He had mentioned only cold food sounded good and he had a sore throat). & I bought the smallest bottle of tylenol I could find. It will expire before anyone uses it again. I didn't expect DL(18) to want our use the tylenol, but it beats scrambling in the middle of the night because there's no meds in the house.

DL(18) didn't want chow mein, and salmon no longer sounded good. Which is fine. I usually view a weekly menu as more of a 'food we can make' list and am not that set on the days. Just didn't expect it to get so out of whack so quick. I ended up making chow mein for lunch on Wednesday (had leftovers on Thursday). & I made potatoes for dinner on Wednesday. I ended up finding some leftover meat in the fridge I had forgotten about and that only had another couple of days left. So I ate that with the potatoes. DL(18) decided not to eat potatoes after telling me they sounded good. So we had leftover potatoes on Thursday and I made a half batch of pancakes. I thought Friday would be a good leftover day (it was) and salmon was Saturday dinner.

On Wednesday I went to the CU to deposit some cash, next to the grocery store. There was already 10 people in line before they opened. Nope! I think while I was there I was going to see if I could get salmon for the weekend, or I don't remember what I was going to do. But I just turned around and didn't bother.

Thursday I asked the sickie if anything sounded good. He requested baby carrots, so it was drive #5 to the store. While there I picked up the salmon and some muffins. I usually do homemade baked goods but I am exhausted after nightly cooking and dishes, and shopping (in addition to a very busy work week.) Also, I am not going to make baked goods for just 2, and so there is also that. Too used to baking for a bigger crowd. I can revisit when I have more brain power, but for now the baked goods section is a nice treat.

Note: Tried the CU at 4pm Thursday (while there) and there was no line.

So that's how I spent $208 this week already. Today I will regroup and plan for a new week. Or maybe not. I am very behind schedule (work was too crazy) and so I may just menu plan during the week and shop on Wednesday morning. I've got one meal left to cook and 3-4 'already have stuff on hand' meals that I was thinking about. & then the planned lentils leftovers... & still haven't finished food from this past week. But I'd like to do a small grocery run on Wedneday a.m. versus a very big run next weekend. The theme this week might just be 'getting through what we have.'

I looked at the credit card. I was going to say that I thought MH was too busy to spend any money. But after radio silence for a few days, I see that he made a Walgreens and a Office Depot purchase. I am guessing the Walgreens thing was personal (who knows) but I know the Office Depot thing was props for the movie. I expect very little personal spending but he may be contributing here and there to movie props or whatever is needed. They started filming on Wednesday.

Posted in

Just Thinking

|

0 Comments »

February 2nd, 2024 at 03:09 pm

I expect it to be a bigger travel year and didn't want to exhaust the travel budget with our January 1 trip. So I decided to use MH's paycheck to cover the Pasadena trip. I looked at the total today and we spent about $1,300. Most of that was for the hotel. Hotel & food. MH should be able to cover the $1,300 with his January paychecks.

{Edited to add: So okay, this is taking me forever to post. Yes, MH's January paychecks covered the Pasadena trip.}

MH is also taking some unpaid weeks off work in February, so it will be a slow start on the savings side (for 2024).

Ideally, I'd like to carve out (some of) future in-law cash gifts to offset the loss of timeshare. (Which I guess they decided to keep? Lord knows...). Ideally. But this year is one-off with MH jetting to Ohio for 3 weeks. I set aside $3,000 of gift money to pay for the hotel and airfare. Maybe not all of it, but should cover a chunk of the expenses.

After setting aside the money, MH told me he had been offered a couple of free lodging options. But with the gift, he eventually decided to go ahead and get a suite. In the lower cost locale it was just very affordable. Fingers crossed, but it's about $100/night for the suite and he can walk to set. (I hope the plans don't change and he is able to save the money on transportation.) He then has a couch to offer up if they need more room for cast or people traveling from the west coast, which it sounds like they do.

I was initially going to support MH and would also be able to see my sister. But my sister is being extraordinarily difficult (per usual) and MH doesn't think he will have any time for me. Seriously, I may just show up and sit in a hotel alone for 3-4 days. It sounds kind of pointless. (Weather is just the icing on the cake. I would enjoy a solo trip if not for the extreme weather.) For now, still very undecided and just keeping it loose.

January we are doing the traditional San Francisco sketchfest thing but instead of one long weekend the shows were more spread out. I don't think it will save us any money. We usually just stay at a free timeshare. We easily spent $100 on dinner and the train last Thursday for show #1. MH received some birthday money to cover that, but we may do the same thing 3 more times.

We usually do more staycation-y things with our vacation money, so this is relevant re: vacation spending. I usually pull these expenses from our vacation fund.

That's all the vacation-y stuff.

2024 has been full speed into the drama, unfortunately.

MM(20)'s roommate got off the RA waitlist, so that's a whole thing. MM insists his roommate will pay rent the next 5 months but I am not as convinced. I think maybe during a transitionary period, but I don't seriously expect he will continue to pay rent for the rest of the lease.

The Girlfriend's sister got COVID and ended up in the ICU. She has a rare autoimmune disorder and was doing very poorly with that, after COVID. Their poor parents.

The girlfriend has developed a temporary heart condition, most likely brought on by severe illness last fall. Her long term health prognosis is good (shouldn't have any long term heart damage) but she is rendered disabled in the short run. Mostly bed ridden. She could be sick for months or years.

My BIL is really struggling with this bout of COVID. He has undiagnosed health issues, and also isn't handling COVID well.

My mom's health has taken a sudden bad turn.

2024 is going about as I expected, but didn't realize it would start out so dramatic.

Posted in

Just Thinking

|

3 Comments »

January 14th, 2024 at 03:03 pm

Same goals as last year, mostly. Bumped up IRA goal to new contribution limits (thanks to MH's raises). & added a dollar figure to keep mortgage moving down by $10K per year.

1 - Pay cash for college

It's not a "goal" to me so much as just how we do things. But it seems so weird to everyone else, I write it down.

This year is probably going to be very low-spend on the college front. I think technically I will be spending $2,000 for DL's fall semester and the college owes me $2,000 for his spring semester. No other expenses because he is living at home. All of MM's college expenses will come from other buckets (money already saved).

2 - $10,000 to savings

$1,000/month, plus interest. Topping off with snowballs.

Although we are saving more than $10,000 ($1,000 x 12 months = $12,000), I am leaving some buffer for bigger expenses. I will count additions and subtractions to mid-term cash savings. But I will ignore college draw downs. The main purpose of this goal is to fund college expenses.

Even though I don't expect to cash flow much in the way of college expenses this year, I am still saving for MM(20)'s 5th year of rent.

3 - $7,500 to investments

$350 per month, plus snowflakes (credit cards rewards & dividends)

Topping off with snowballs and/or excess cash saved

4 - $2,025 to mortgage

Topping off with snowballs and/or excess cash saved

Keeps us on track with $10K principal paydown per year

5 - 9% of household income to work retirement plans

This is the minimum for the match; I'd otherwise rather fund IRAs.

9% figure does include match.

6 - $14,000 to IRAs 2023 (MAX)

Will fund with MH's income

Total retirement savings rate is 20% of household income.

7 - Small Monthly Charitable Contribution

When I added breathing room to our budget, I added something like $30/month charitable contribution. We've always done the bigger contributions at the end of the year. But trying to be more mindful about how the little things add up. & wanted to add more regular gifting with the breathing room. When I look back, we did a few more donations that we probably would not have done otherwise but... Pretty much failed. At the time, MH was paying so much forward with crowd funding and everything (why I kept skipping doing even more donations). But when I look back, it's not like an extra $300 donated ($30 x 10) would have moved the needle either way. So I am doubling down and want to be more mindful of this budget item in 2024. I put it in my sidebar so that it will happen.

Even though 2023 was pretty tight and we got saved by the bell (re: in-law cash gift), I still think that these goals are doable. If we aren't spending an extra $3K here or there on medical, auto repairs, home repairs *and* vacations... & college too.

These are just preliminary goals at this point. I am just guessing on the tax side of things. I will likely have to lower some of my goals re: paying more in taxes. I just need to do a solid tax projection first. This is more what I am hoping I can cover, but I keep hitting a big tax cliff and so I don't know. Might have to reduce taxable investments (and throw more to 401K) if that is the case. I will update once I do a tax projection.

Edited to add: I squeaked by! Did a tax projection today and it came out exactly what I planned for. Phew! Pretty good for more just starting out with a number I hoped to accomplish. I just got lucky. It wasn't based in any real numbers and I didn't think I'd get to stretch my raise this far.

Posted in

Just Thinking,

Budgeting & Goals,

Investing,

Home Ownership

|

3 Comments »

January 11th, 2024 at 03:33 pm

I am memorializing goals in my sidebar.

Pay cash for college ✔

$10K to Savings ❌

Final tally was $4,742.

The plan was to use this money to pay cash for college. At the end of 2023 we had roughly -$0- cash plus emergency funds. So that's about how it sorted out. That we had just enough to cash flow college.

We most definitely failed at this goal. But I just copied the commentary from last year and it still held true. So I am happy enough to squeak by (with what we need). Failing this goal is due to several big and unexpected expenses in 2023.

(We did not fail enough to say no to anything that we said yes to. As long as we had the cash, we were fine with falling short of our goal.)

$7K to Investments ✔

Final tally: $7,781

I did cheat a little bit on this one. Included the $2K investment in MH's movie towards this goal. It wasn't what I had in mind when I made the goal. But I couldn't justify setting any more cash aside in taxable investments. We did invest the money and will just call that a win.

9% Income to Work Retirement Plans ✔

MH and I both contribute the minimum for 401k match. The 9% includes employer contributions.

$13,000 to IRAs 2023 ✔

Done. We won't fund until we do our taxes and the year is over. But we did end the year with an extra $13K set aside for IRAs. This is mostly thanks to annual cash gift from in-laws.

This year was rough but I would not have given up. Without the gift, we probably would have taken until April to save up at last $6,000 for one IRA and probably would have just used the taxable investments to fund the second IRA. I had diverted $6K last year (from my IRA) to Invisalign. So I was pretty hell bent on maxing out our IRAs this year, even if it meant failing our investment goal. I didn't want to have a retirement contribution shortfall two years in a row.

Posted in

Just Thinking,

Budgeting & Goals

|

0 Comments »

January 7th, 2024 at 05:16 pm

Our net worth increased by $85K in 2023. This works out to $25K retirement contributions & a $60K increase in stocks. I am depreciating our autos aggressively but that is offset by mortgage paydown. Home values remain steady.

Re: my sidebar big picture goal, this leaves $35K to come up with in the next 3 years.

I am looking it up and I have $32,000 of kids' gift money sitting in investments in our name (included in our net worth). In addition to $38K I have loosely earmarked for college. That's $70K we may be drawing down over the next 4 years. So it may be more realistic that we need to come up with $105K (35K + 70K) over the next 3 years, to stay on track.

Estimate Net Worth Change for 2024:

Mortgage: Paydown $10,000 <--Regular payments + $2,000

Retirement: Contribute $24,000

Investment Gains: $26,000 <---Investments doing the hard work for us

TOTAL INCREASE: $60,000

Our net worth changes never look anything like our estimate (it's rare any asset class actually has an average year). But, I go through this exercise just to make sure my goal is realistic and doable.

I am just presuming that other savings/investing and college spending will mostly be a wash. As I type this out, just wondering aloud if I should adjust this estimate downwards. But as I think it through, 2024 will likely be a wash. It's going to be a much bigger college hit in 2025 or 2026.

Posted in

Just Thinking,

Financial Independence by 50

|

0 Comments »

January 6th, 2024 at 03:19 pm

2023 TALLY:

-0-

------------

-$0- TOTAL *ONE-TIME REWARDS*

Ongoing rewards:

+$297 AmExRewards (6% cash back groceries/streaming services)

+$101 Target rewards (5% discount Target purchases; mostly groceries)

+$154 Visa Rewards (3% cash back restaurants/fuel). Ended up also using for groceries in Q4 (3% cash back)

+$1,261 Citi 2% card (2% back everywhere - health insurance/medical is the *big* expense that we charge, is more than our mortgage payments)

Grand Total = $1,813

I just want to add that historical figures below do also include bank bonuses. They just don't generally work very well for us so I do not utilize as much. (We did -0- bank bonuses in 2023).

Year 2011 = $4,164

Year 2012 = $2,782

Year 2013 = $2,623

Year 2014 = $3,128

Year 2015 = $2,585

Year 2016 = $1,906

Year 2017 = $3,578

Year 2018 = $2,096

Year 2019 = $2,266

Year 2020 = $2,107

Year 2021 = $2,377

Year 2022 = $1,803

Year 2023 = $1,813

Total 13 Years = $33,228 ***Mostly Tax-Free Income***

Note: I have been tracking since 2011 because that's when the rewards got CRAZY. We have always utilized cash back on credit cards. It's just been extra rewarding during the past decade.

***CAVEAT - I absolutely do not recommend utilizing credit card rewards in this manner, unless you are in full control of your credit card spending. We treat our credit cards like debit cards; only charging if we have the cash on hand already. We've never paid a cent of fees or interest.***

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I guess that we are consistent. Rewards were +/- $1 for both Visa and AmEx.

Somehow squeaked by with slightly more rewards this year. Even though we did no one-time bonuses. This is just an indication that it was a spendy year.

Honorable Mention to I Bond interest: ~$2,900 interest this year. I won't include it because it's not a "bonus". It's basically the equivalent to bank interest. But it was such a boost this year, and might be why I did not pursue more rewards.

I have already signed up for a $750 travel bonus for 2024 (in my name). I am hoping this will offset most of our airfare re: movie shoot. MH just booked a flight for $400. I am also considering doing a second $750 travel reward in his name.

Will see how things sort out in future years. I also think we are just less interested in these bonuses with our raises in recent years. We need less 'extra money' to fill in the gaps. But The $750 or $1,500 will be nice during a big travel year (and with two in college and everything). I also applied for a bigger cash bonus last year but was denied. I suppose that's another factor.

Posted in

Just Thinking,

Credit Card & Bank Rewards

|

1 Comments »

January 6th, 2024 at 03:10 pm

Here's a few pictures from MM's rose float.

After making it through work hell month (December) and jetting off for a few days... My plan is to sleep all day today. I have like 10 blog posts in my head (re: end of year tallies and so on) but this might be all I eke out.

At least I usually have New Years day to regroup, or a long weekend. So I am feeling really behind and off kilter.

Edited to add: All of MM(20)'s winter break lodging was covered by the college, and most of the food was covered. I think alumni take turns bringing meals to the kids, stuff like that. He drove home for Christmas with a rose float van. He was given the van and a gas card, in exchange for being in charge of a carpool.

Posted in

Just Thinking,

Picture Project

|

2 Comments »

January 5th, 2024 at 03:02 pm

We are back from our New Year's trip to Pasadena.

The trip was mixed. MM(20) was too busy and basically only had five minutes for us. We had brought him some stuff from home, and so we met him at his hotel, just as he was taking off. He did invited us to lunch with him and the group of students he was driving back to the college, but some of them had COVID and others were sick with whatever else. We declined lunch with the sick people.

We didn't do the parade, but we went to the float showcase afterwards. The downside is that for the most part there weren't any animations (the float operators were long gone). But we did see one of the floats operating. The plus side is you can get up so close and see the floats from all sides.

I have lots of pictures to share, but will just start with a few.

MH and I had a nice dinner in a pub on New Year's eve. We had found a free charger for the car and so just took our time. As we thought ahead to the New Year, all I could figure was that it's going to suck. That's my take on 2024. Mostly thinking to health issues of various loved ones. 😔