|

|

|

|

Home > Archive: March, 2024

|

|

Archive for March, 2024

March 30th, 2024 at 03:03 am

My kids both received substantial middle class grants from our State this year, re: attending in-state public Universities.

I've tried to look this up (how to ballpark or estimate) in the past, but it's so complicated and depends on so many factors. Primarily, how many students are eligible. Because then funds are divided among eligible students.

So my mind was just blown when I figured it out. 🤯 I just had to dig a little deeper.

Side note: It appears that the kids' assets are not being counted in this formula.

There's other parts to the formula, but calculations below are just what was applicable for our personal situation.

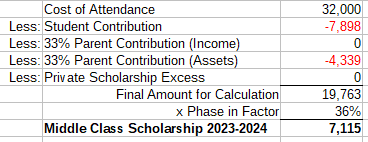

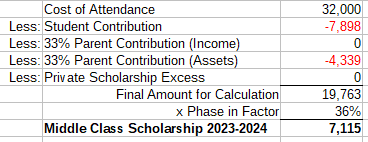

This is how the calculation went for the 2023-2024 school year.

MM(20)

Note: The cost of attendance is a ridiculous number that we do not pay. $20K is a more accurate number. $10K for tuition, $12K for housing, and maybe save $2K here at home re: less utilities and food costs. Eating is not a college expense. In this case, MM(20) spends way less on food at college than at home, so that is a cost savings for us. (& utility savings might be a few pennies on top of that.)

& all students are expected to be able to contribute the $7,898 re: part-time or summer work.

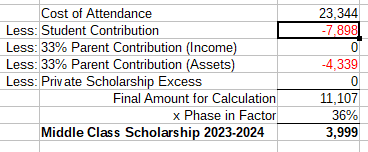

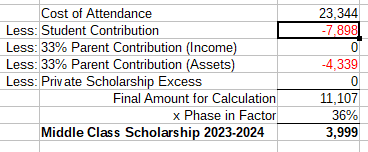

DL(18)

Note: The cost of attendance is a ridiculous number that we do not pay. We paid $8,000 tuition and DL(18) has some increased transportation costs with the daily commute to the college. The rest is food/housing allocated to 'students who live with parents', plus $3,000 misc. personal spending (nope).

I guess the key is the 'Phase In Factor' and is decided every year based on the budget. For now, the best I can presume is that the phase in factor will remain the same for 2024-2025. There is a lower 24% factor being used to estimate financial aid for 2024-2025. So that is the number the kids will get from their colleges. & then they eventually finalize this % later in the year. I am going to use 36% (same as this year) as a rough estimate of the actual dollar amount. It does not sound like the State has the budget to bump up this grant again next year. Which is completely fine with me. We are getting to a tipping point where more grant money means less college tax credits. So it's all kind of the same in the end, for us.

In the end, it looks like grant numbers will likely be the same next school year, unless CA budget numbers radically change that %. & of course, MM(20)'s grant might be a big fat $0 (if the decide he is already a senior, based on their methodology). I do not count on anything, but it's just nice to have a better idea how all of this is calculated.

I now understand that DL(18)'s grant is smaller because he is living at home. (& also because his college tacks on less fees). & I now know that it doesn't matter if either kid starts piling up assets (re: working or gifts). & I confirmed that there is no '2 in college at the same time' adjustment for this particular grant (re: our personal situation).

I also had no idea how much assets were penalizing us. I knew we were on the lower end of this income scale, so the $0 income adjustment makes sense. For the assets, we are penalized $140 for every $10K we add. I guess technically $280 (x2) while we have two kids in college. It would clearly be pointless to have less assets. That's less assets generating interest and stock market gains. & of course, if we didn't have the assets, then we'd be tapping retirement funds or taking higher interest loans, etc., to pay for college. Clearly we are better off just having *more* assets.

I keep distinguishing the middle class grants because we knew it was pointless to plan for any (need-based) financial aid re: middle middle class income and in-state public colleges (very low cost). That has gone as expected, but the middle class grants have gotten a big boost in the years since MM(20) started college. It could end up being a $40K windfall (roughly $20K per kid). & that is a really nice surprise.

Side note: MM(20) did get a nice one-year merit scholarship from his college. I've since been told that is not a thing. It was apparently a bit of a unicorn. Just to add to the, "Well that was unexpected," which sums up all of my kids' financial aid.

The next chapter: If I ever get to blogging about it. I found out in the Fall that MM(20) is probably eligible for food stamps. $300 per month! We are going to apply this weekend. Obviously should have applied sooner, but we are both in disbelief about it. Not 100% sure, but will just have to apply and see what happens. (Would have applied sooner if I knew 100% for sure that he was eligible.) These are also benefits being extended to the middle class.

Edited to add: Note to self: The new FASFA form does not ask if a student plans to live with parents. Just read somewhere it's up to the school to get that information and report it for our middle class grant? Something I will need to keep on top of when DL(18) moves out. Will want to make sure we get the extra grant dollars if we are paying for rent.

Posted in

Just Thinking,

College

|

1 Comments »

March 23rd, 2024 at 01:51 pm

I wanted to repost this because have had a lot of questions in recent years about things addressed in the past.

Our Big Picture feelings about college, per 2017 post:

https://monkeymama.savingadvice.com/2017/03/29/college_211895/

Of course, I could see how it would be interesting to update how things have shaped up, 7 years later.

We both agree that we expect the kids to work significantly during high school and college, that our own financial health comes first, and that we don't want to borrow a penny for college. We don't want them to graduate with any student loan debt. We are willing to help our kids in any way we can as long as we are within these parameters.

2024 Update: Tried to be open minded, but couldn't ignore the 'cost pennies colleges that everyone recruits from'. Both our kids ended up different State colleges, but are basically the third generation in our family to take advantage.

Our kids aren't working as much as we envisioned. One thing I don't think I said in this particular blog post was that our city has generally always been terrible on the employment front, and I of course recognize that an engineering degree might take more commitment than our business degrees did. That said, I think the pandemic is mostly what torpedoed my kids teenage working years. MH and I were very much, "You don't need a teen job around crowds of people." But also, there is an element of the kids not needing to work. MM(20) had a couple of strong working summers and has $10K+ saved up. With his grandparents helping, I feel very *shrugs* about him not working at all in 2023. DL(18) is a little further behind the curve and probably more impacted by the pandemic.

I think the point of my original post is we expected our kids to work and contribute. (Wasn't planning to buy them cars and pay for all their college expenses). But with grandparents giving them this gifted college fund and helping them, has bought them a lot of freedom not to work. I personally don't have any problem with it. I wouldn't personally just do all the work and pay for everything, but if the grandparents want to do that, more power to them.

Both my kids announced this winter that they were bored and they intended to work this school year. MM(20) wants to do all the things and so it took him 2+ years to get settled and figure out his priorities. But he knew he would have a lot of time in winter and spring quarter. I forwarded him an internship opportunity (for this summer) that pays $40/hour. If he could land that, he could make $10K in 6 weeks. Something like that. I am all for "working smarter, not harder". DL(18), I strongly encouraged to not work in the fall, to ease into college. He has thrived his first semester of college and he announced towards the end of fall semester that he was bored and could definitely work. He might not be able to find a low hours job (like an on campus job) until next fall. He did find a temp job and made about $1,300 this year already. I will feel a lot better about DL(18) once he finds a steady job and has enough savings to buy a car.

We personally have not tied up this money (re: gifted college funds) in college type funds because we don't have any incentive to. We would rather have free use of the money. We don't have a big enough income, but I do have enough tax knowledge, to not bother with 529 plans or other college savings options. To be clear, we are not paying any taxes on these investment gains. So we don't need the trade-off of extra hoops to jump through for tax breaks that we don't need.

Along the same lines, MH and I both used our "college money" for a home down payment instead. In a state where college cost pennies and housing costs are sky high, I think it seems very likely our kids will experience the same. So I don't want to be penalized for tying up their gift money for college when they more likely will use it for post-college housing. Ideally, we'd actually really like to pay it forward and save this in-law money to give them as a lump sum *after* college. I don't know if we will be able to swing it, but this is what we would like to do. & if we can't, we definitely want to do something like this for our grandkids. (I think if it was not for the in-law money, this would just be a "pay it forward to grandkids" goal).

2024 Update: DL(18) is currently on the 'living at home' plan and on track to use 100% of this college money after college. As of today, I think MM(20) might have $5K or $10K left after getting a 5-year degree. Very likely $0. He chose a much more extravagant college experience (5 hours away, in paradise). & even DL(18), who knows. The kid I thought maybe would never get more than a AA degree, he told me the other day he might want a PhD. He might find a way to use his $30K for college. I do have their gifted college funds parked in cash, while we expect to use all of the funds (MM) and while DL's plans are still so up in the air. We can talk about longer term plans for this money as longer term plans crystalize.

In 2014 we were in a position to start putting money away into taxable investment accounts again (in addition to fully funding IRAs). I guess college is the only goal at this point, besides retirement. Though I don't consider this *all* to be college money, it is certainly accessible if we need it for college. We are putting away about $7,500 per year. I think matching the in-law college money is a good place to start. It probably works out too that we will probably get there in another couple of years. At that point we may just back off and figure that $40,000/each is a phenomenal start. I think we'd probably most likely just focus on cash flowing the rest (if there is anything left to cash flow).

2024 Update: For MM(20), we've had a lot of windfalls to help with his rent. Pandemic funds and unemployment covered his first year of rent. & the in-laws have been giving us some gift money after they received an inheritance.

Our investments ended up getting to $40K and we have earmarked all of this money for college. Won't necessarily use it all, but have it earmarked for now ($20K per kid, to cover rent). I lost my job in 2018 and took a big pay cut, but also gained a work retirement plan. So we stopped adding to taxable investments (and was not able to match the gifted funds, which ended up being $30K per kid). I only added snowflakes (credit card rewards) 2018-2022. The money did get a big boost when I put it in I Bonds for much of 2022-2023. We turned $40K into $45K (while keeping the principal safe). I don't know if anything has ever come that financially easy to us. It seems there's always some obstacle or headwind, so I am really delighting being in the right place at the right time, just having this wad of cash for I Bonds when interest rates were nearing 10%.

I was able to resume (more significant) taxable investing in 2023. Our investment account just hit $10K. After saving for college, I wanted to save up $10K for MM(20)'s jaw surgery and related round of ortho. I didn't feel comfortable crossing off his college as 'done and paid for' until we had this covered. Not that it is a college expense, but it's a final expense we wanted to cover for him before he flies the nest. So I am eyeing this $10K and wondering if I should just call it. But I will wait for MM's grant to sort out his senior year (still not sure about that) and will wait for his lease to be finalized and to have real numbers. By the end of the year I should have a plan and/or be able to call it.

Edit: With the I Bond gains, the kids ended up with about $53K/each. Which yes, was a phenomenal start. That's $30K gifted funds ($1K per year, built up up over time), and $23K (our investments 2014 -2018 --> cash --> I Bonds --> back to cash). DL's money is completey untouched, as mentioned. But I have started to spend down MM's money from this $53K peak.

& to be clear, the investment account is up to $10K after completely starting over. (I can see that wasn't clear when I typed that out). 'College' money is all in cash. But we have been able to resume adding to taxable investments (more than just snowflakes) in the past year.

Since I worked my way through college, I think the idea of MH working + kids working seems easiest on some level (would be a LOT of cash that we could put towards college). But, I think the "saving ahead" is important just because you never know. Relying on future income streams is a little outside of my comfort zone. So while some part of me thinks that "cash flowing with several jobs" is really the most obvious and the easiest, we always have a Plan A + Plan B + Plan C, etc.

2024 Update: Plan A is working out pretty nicely. I mean, I am happy to have the "saved ahead" I Bond money too. But also, we are hitting some of our highest income years while our kids are in college, and so that is going pretty well. I stand by my decision not to divert large amounts of assets to college savings (or anything at all when my kids were very young). We started saving when we had the money and are mostly cash flowing with higher income during these college years.

Note: We are mostly using 'saved ahead' money to pay for MM's tuition/room/board (the more expensive college) while we have two in college at the same time.

We did also park extra money in ROTHs that we have never touched (starting when the kids were babies). I never would have put that much money in retirement otherwise, but was okay with it knowing we could use this money for college. I would have also been fine lowering retirement savings during these college years. Plan B was always, "We don't have to mega save for retirement".

Final thought: I've already said this many times before, but is worth mentioning. We planned for full sticker price (roughly $30K) for the State colleges. These college tax credits and middle class grants did not exist when I went to college and I never counted on any of this money. The grants and credits will bring the net cost of MM(20)'s degree down to about $15K and DL's degree will cost $5K (or maybe $15K if he takes 5 years). This is just a nice surprise that we did not plan for.

Also, I don't expect to be saving any more money for college after 2024. I think we will move on to other financial goals because we will be DONE.

Posted in

Just Thinking,

College

|

2 Comments »

March 11th, 2024 at 03:45 am

I've revised MM's estimated college costs, below. I also kept the old numbers (to the right), for reference.

MM's expected net college costs:

$42,000 Tuition/fees** (4 Years)

+$10,000 5th Year Tuition/Fees

-12,000 Tax credits (-10,000)

-21,000 CA middle class grants (-13,000)

- 6,000 Scholarship

---------

$13,000 Net cost ($23,000)

**I added in MM's $1K summer school class

I won't believe it until I see it, but I now believe that MM's 5th year will be entirely paid for with state funds and tax credits.

So, I just completed the kids' FASFAs for next school year (was delayed this year due to major revisions; I waited for all the kinks to work out before I bothered with it.) I logged into DL's account to make sure his GPA was reported by his high school.

I am still so confused because MM(20)'s state grant changed from '3 years' to '4 years' at some point. It was expected he would only get 3 years of grants re: college credits he went into college yet. He was already considered a sophomore when he started college (per state grant measures, but he would need a minimum of 4 college years to complete an engineering degree).

So I asked MM(20) to double check today while we had a video call. (He set up his own account; I don't have access). I also needed his college tax form, so was just taking care of business. It is still very clearly showing that he will get a middle class grant next year (Year 4). He told me that he is pretty sure that changed when he made his double major official (end of last school year). Which is *why* he is taking a 5th college year. So, wait. This means his 5th year will cost $0! If that's the reason and this is true, that is pretty sweet. I mean, he's getting a whole free year out of the deal of adding one more year of college.

I am still skeptical and will believe it when the money hits our account.

I also (at some point) crunched the numbers on a Year 5 college tax credit and it was a lot more than I expected. A full $2,000. & so I also added that to my estimate, and that will bring the net Year 5 cost down to $0.

In the end, net tuition/fees will be the same difference, if it takes 4 or 5 years.

I will have to check if MM(20) anticipates taking any more summer classes.

Posted in

Just Thinking,

College

|

0 Comments »

March 10th, 2024 at 05:39 pm

It's a fun weekend of taxes and FASFA. It would feel good to get these things done, but just cleaning up my own stuff before tackling everyone else's taxes. The calendar is pretty empty this month and so wanted to get these chores done, but I don't have any of the in-laws' tax stuff. So that will spill into April and be a little hectic.

MM(20) has his "Martha Stewart" girlfriend back. She has way too much time on her hands (without school and work) and this was the menu for last week: egg salad, vegetable sandwiches with hummus and tapenade & fries, mashed white beans with chili fried eggs and toast, french onion soup, rigatoni with red wine sauce & focaccia bread, California rolls, tofu cutlets with rice and veggies. That's what she shared. She has been cooking 2-3 meals every day. She is just delighting in feeling 1,000 times better. She could barely stand (too weak) when I saw her two weeks ago. I think she is blessed to have another 3 weeks to build up muscle/strenght before school starts up again, but not sure she even needs that at this point. She is planning to come home the next two weeks (all her friends will be busy with finals) and we will very likely be the recipient of some of her cooking/baking.

DL(18) asked me last night if we could invite his friend to camp again, this summer. MH and I were kind of *shrugs* though we'd probably have to ask the in-laws to drive up our sleeping bags. I thought maybe the last time we took this friend was the last year we had the van, but DL(18) said it was 2019 and I confirmed. We are small car people and I couldn't even tell you why we had a van. We mostly did not use it (too much of a gas guzzler). I mean, we usually chose our small car (the gas sipper) for road trips. & this means a lot of people were bugging me how we would ever survive without the van (we live in SUV land). I felt very *shrugs* about it, because we always drove as little as possible. (I can probably count on one or two hands how many times we actually found it useful to have a minivan). So it's funny to think back the one time we packed 5 people in our vehicle for camp, it was just one of our small cars. But the kids were a little smaller. In contrast, I guess we didn't have to drive DL(18) last year and I was delighting in being able to bring a mattress. It's a little tiny thing but it's not going to fit with the 5 of us. I will 1000% send that ahead with the in-laws.

The girlfriend has been asking to go to camp too (for 1 or 2 years) but we said no. My niece didn't want the competition for time with her cousins. But I think we will let it go this year. This is the "final" year that my in-laws are paying for the trip. My MIL is just about 80. I give her one big gold star. I don't know that I will be offering to rough it in the woods when I am 80. 😁 I think it's more than fair that their time is done. I am happy to take over paying for these trips if the kids still want to go. Or if not, I'd like to rent a house in the woods every summer, something like that. Pay it forward to our kids in some manner. In addition to recognizing the value in the annual tradition.

I did have a small hesitation about bringing the one friend, re: cost. I feel about 90% "this is important and cost doesn't matter." But there's that 10% "Ugh" if we are going to save any money this year. For some reason I thought it would be $2,000 to bring two guests. ??? Which would be no big deal except for you know, the roughly $2,000 we just spent on Pasadena & Sketchfest, and the $3,000 we just spent getting MH's movie made, and so on.

I looked it up today and it is $329 to add one person to the trip. $1,000 was roughly the cost of the whole family, when kids were smaller. Which felt like a bajillion dollars when my kids were small, but feels very, "That's it?" today. But that's why I had $1,000 stuck in my head.

DL(18) reminded me it was 2019 the last year we took his friend. I think that explains the Ugh feelings I had about it. x1 it was a no brainer and we paid for his friend. But that was when I took that big pay cut. I literally make 40% more today (salary). That one year was just a particularly tight year. $329 x2 we can easily handle, and won't be a big drain on MH's income or savings goals this year. Phew!

Inviting the girlfriend also gives us more car room. I don't know where we could park a second car though, so will have to check ahead of time. I mean, I am sure we can figure something out.

It's going to be a fun camp year, & it's also fun looking forward to new traditions.

Posted in

Just Thinking

|

0 Comments »

March 8th, 2024 at 02:41 pm

This is a Part 2 re: my last post. Realized I should have mentioned this with that post.

I am enjoying actually making interest on our cash. The 'Gifted College Fund' interest covered all of MM's college expenses during his junior year.

Interest received this school year: $950

Net Tuition Paid (after tax credits): $743

Class supplies purchased separately: $185

In the end, interest will roughly equal costs this school year.

(I actually skipped a $241 reimbursement, I think in December when I got my work bonus. So I only deducted $687 from college fund this school year.)

We didn't pull any expenses from the college fund freshman year. (We didn't intend to, but I think our net cost was $0 that year.) We pulled out $5,000 to cover Sophomore year expenses (we had less middle class grants & scholarships that year). $20,000 remains in this college fund.

I expect that MM(20) will have $0 left when he is done with college. His state grants are probably exhausted (this is still very unclear, but likely those funds will dry up). & he's added a 5th year, so will be a couple of roughly $10K years of paying full tuition. He understands that his choice to pay 5 years of rent in a high cost region, this means that he will not have any (gifted) funds left at the end. Choosing a very affordable State college still has many benefits, like MM(20) not having to work at all. Or us feeling *shrugs* about the 5th year.

Note: I have no plans to touch DL(18)'s gifted college fund, as long as he is living at home and paying roughly $1K per year tuition. If not used for college, it's his money to do whatever he wants with it.

Posted in

Just Thinking,

College

|

4 Comments »

March 6th, 2024 at 04:42 pm

The last week (er, two weeks) have been a whirlind. Mostly good things. MM(20) visited for dinner Friday night (over one week ago), we went to GMIL's 99th birthday party that Saturday, and MH got home from his trip that Sunday night. I paid off the travel credit card bill. We ended up using exactly that $3K gift money to cover the cost. (The goal was to cover a chunk of the costs. It's just gravy that it covered everything.) More details later, if I ever have any time. I had family visiting from the mid-west and MH needed to help his GMIL with a new computer, so we were in the Bay Area this past weekend.

I've got 2023-2024 college year mostly wrapped up. I mentioned (re: annual goals) that this won't be a big college expense year.

DL(20) received his state financial aid check/refund last week. So now I have a better idea the flow of things. Refunds arrive 11/1 & 3/1, roughly.

I received a $2,000 refund (spring semester) from DL's college and a $1,074 bill (spring quarter) from MM's college on the same day. I paid MM's tuition and checked off on my side bar that his third year is done and paid for.

Note: $2,000 is the net I should owe for DL's fall semester. Will just park the money in savings to cover the rest of his college expenses this calendar year. In the short run, the $2K will let me cash flow MM's tuition before I reimburse myself from various buckets. This semester thing is a lot more simple than the quarter thing.

For MM's tuition, I am cash flowing the tax credit ($833, or 1/3 tax credit). I have the benefit of reduced taxes, to pay this portion of tuition. The remaining $241 I will pull from MM's gifted college fund.

I did also cash out two of the I Bonds (end of 2023) and am able to reimburse myself monthly for MM(20)'s rent. We have never had more than a roughly 1% interest rate (or some promo deals on smaller amounts of savings) during our adulthood. I more viewed the I Bonds as an investment (that was mega interest for a while). Turned maybe $20K of savings into $22K+ for MM's college expenses (woohoo)! But now that I am cashing that out, I am really enjoying having some decent interest rates on our cash. Any incidental college expenses that MM(20) has at this point should just be covered by interest. This is also how I am funding his utilities. I am leaning towards just hiring a cleaner (with this interest money) when MM's lease ends.

In other news. Very cautiously optimistic but... It sounds like the girlfriend is bouncing back? She told me that she unexpectedly felt well for a whole 5 days and that she was traveling to visit MM(20) for a couple of days. She is doing so well that those 'couple of days' has turned into 2 weeks. MM was just telling me she extended her stay so that she could go down to LA and visit her cousin's baby or something like that. I had no idea if they found some underlying condition (had more answers), found meds that worked, or what happened. I spoke to MM(20) a couple of days ago and he told me that she is just getting better, as they said would happen. They just didn't know if it would take months or years. My recollection is that she has been down for 5 months. It sounds like she is putting this chapter behind her.

Posted in

Just Thinking,

College

|

1 Comments »

|